If you think your risk tolerance places you among the conservative trading class, but you trade like a speculator, it means one thing: You are a speculator. The culture of options trading favors swing trading and speculation, over and above the strategically more effective ideal of hedging. Contrarians hedge, but they might also speculate. But a contrarian should be acting based on rational analysis, while the rest of the market moves in unison. Making decisions emotionally. This is why crowd thinking and speculation are so difficult, and why true hedging (based on contrarian principles) works.

A reality check is in order for many options traders. This is especially true because of the tendency to settle in with a favorite set of strategies and forget to change with market conditions. Not every strategy works well in every market. Being able and willing to reconsider the nature of a strategy and of risk itself helps clarify your true risk profile.

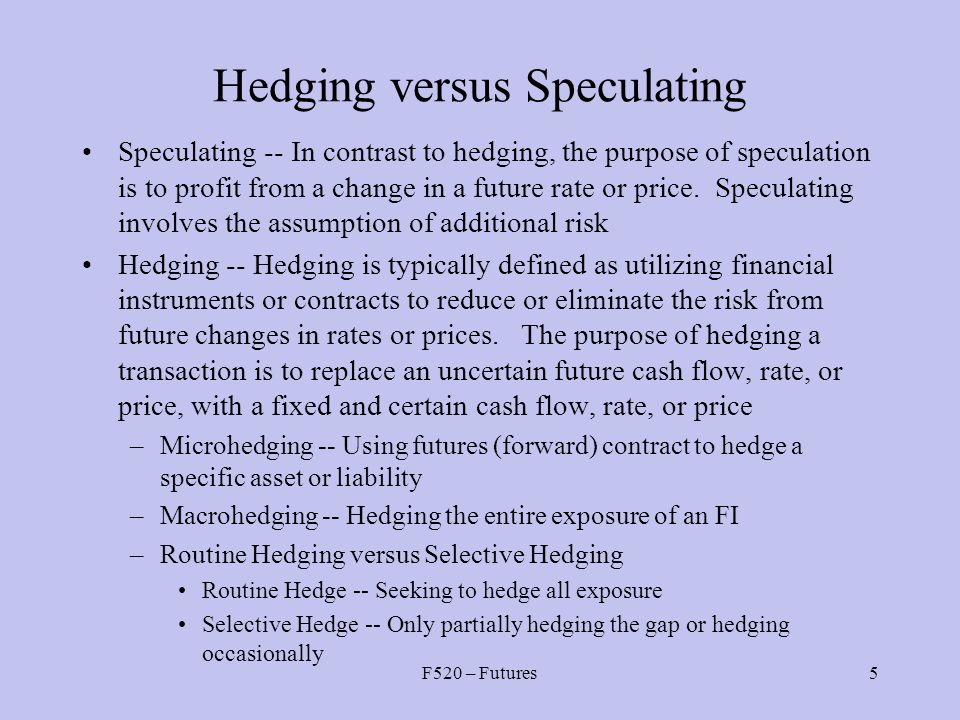

Speculators are willing to take higher than average risks, in the belief that bigger profits are just around the corner. Most traders know that most speculators lose more than they gain. In the options market, the risk of acting contrary to your risk profile is ever present. But it is not just that self-described hedgers are really speculators. A greater danger lies in the unwillingness of some to step back and take an honest look at actions.

If you are making speculative trades, you’re a speculator – no matter what definition you place on yourself – and that is something to be confronted. If, in fact, you are a speculator and want to continue with high-risk trades, then embrace the role. But if you do think you’re conservative and want to use options to hedge market risk, it is time to evaluate not only which strategies you employ, but your underlying rationale for entering and exiting trades.

As part of this self-analysis, it also makes sense to move beyond the tendency to see yourself as “knowing better” than the average trader. Options traders tend to have a high level of self-esteem, and deservedly so. To trade in this market demands a level of knowledge, experience and plain old guts, more than most traders. At the same time, this self-esteem may prevent you from stepping back and taking an honest look and how, why, and what you trade.

The threat to continued success is not limited to which strategies you execute, or even to whether you are a contrarian or a crowd follower. The great threat is in the blind spot all traders develop once they reach a plateau of confidence. Knowing how the market works and applying that knowledge to selecting the best options and stocks, can lead to an over-confident blind spot, and that’s where the real threat lies.

An action as simple as interpreting a stock chart, applying technical signals to evaluate a trend, and then picking an option based on recognized reversal signals and confirmation, is not really all that simple. The ability to skillfully go through this process is the result of a long learning curve. It points out, however, that possessing the skills and knowledge only opens the door. Once you “arrive” as a successful and knowledgeable options expert, the danger appears. The inability to recognize our own blind spots can exert a subtle but dangerous change in your risk profile, intended or not.

Question your actions considering what you believe to be your true risk profile. If you think you’re a hedger, but you act as a speculator, this self-evaluation is a wise step to take.

There are no comments to display.

Create an account or sign in to comment

You need to be a member in order to leave a comment

Create an account

Sign up for a new account. It's easy and free!

Register a new account

Sign in

Already have an account? Sign in here.

Sign In Now