With binary options, you either double your money or lose it all: the roulette table of options trading. Some traders like the simplicity of 100% return versus 100% loss; but it’s not for everyone. Beating the 50-50 consistently is a challenging idea.

It might be possible if you believe in technical analysis and use signals to time a trade in binary options. For example, if the underlying price moves above the upper Bollinger Band or below the lower band, retracement is more likely than any other time. An even safer timing move is when the Bollinger default of two standard deviations is changed to three standard deviations. A move outside of the bands is as close to certain to retrace very quickly. If you’re not sure about this, set up the 3-Sigma default and check as many stocks as you want. You will see that price never remains in that status for very long; even two to three days outside of the 3-Sigma is rare.

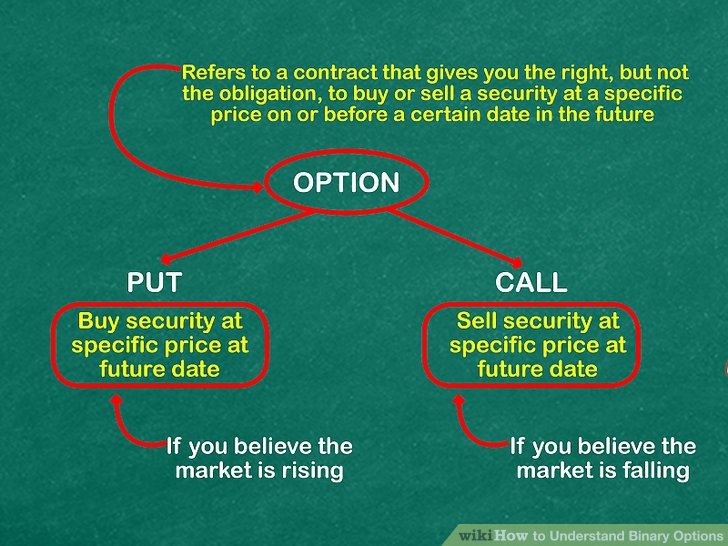

Most traders know all about swing trading and the timing of buying calls or puts. The shorter the time to expiration, the cheaper the options but the more rapid the time decay. The farther away, the more expensive the option but the more beneficial the timed element. It’s a dilemma of proximity, timing and volatility, all working for (or against) you.

Enter a solution (or a speculative flaw), the binary option.

Without expert timing based on technical signals (like Bollinger Bands, double tops and bottoms, momentum oscillators like RSI, volume spikes, t-line crossover or large price gaps associated with earnings surprises), binary options are pure gambles. This does not mean they don’t have a place in a trading program, at least not for everyone.

The binary sets up a strike. If the underlying price is above a call’s strike before an identified deadline, you make a 100% profit. If the price is below the put’s strike by that deadline, it is profitable. Otherwise, the binary is a 100% loss.

These tend to be extremely short-term, usually the same day. By the end of the day, the binary call or put will be totally profitable or a total loss. For example, you buy a 50 binary call, hoping the ending price today will be higher than $50 per share. Subtracting trading costs, you stand to earn about $45 on your $50 risk; or to lose the entire balance. If you think the price will be below that 50 strike, buy a binary put.

The many sites offering binary options can be found easily with a Google search. But be wary of the promises made by many. For example, some sites promise you a 50% to 75% return every hour by trading binary options. This could happen (about half the time), but it is unlikely that you can get that level of return consistently.

Many traders believe they have superior ability at chart reading and technical signal interpretation. But it is gambling and consistently calling the right direction – even with an array of convincing signals – is not all that easy. We have all met gamblers who will follow the roulette table and, upon seeing ‘red’ hit five time in a row, will place a bet on ‘black,’ ignoring the facts: Every roll is independent. But they insist it’s a surefire way to get rich. Maybe so, maybe not; but betting on a binary option is a gamble, and the quirks of the moment as the market comes to a daily close often defy even the strongest technical signals.

The rationale that you cannot lose more than the entire amount you bet is appealing to some, but it is still a 100% loss. Perhaps the most sensible use of the binary contract is to use it occasionally when the signals are so convincing that you think your chances are close to 100%. For example, an underlying price moves below the lower band with a 3-Sigma set, and you are certain a retreat is imminent. But you wait until the second day. If price is still below that lower band, you buy a binary call expiring by the end of the day. In this case, you have a better than average chance of profiting, but it is still a form of gambling. But it is based on a technical signal and not just a hunch.

Binary options could have a place in your swing trading program but keep the entire field in view. Be aware of overall market volatility. Time the binary trade and limit your exposure. In other words, be aware that it is a gamble and not a sure thing. You will win sometimes, you will lose sometimes.

The important thing is to use gambling with options very selectively. Be analytical and avoid being a binary thinker.

Michael C. Thomsett is a widely published author with over 80 business and investing books, including the best-selling Getting Started in Options, coming out in its 10th edition later this year. He also wrote the recently released The Mathematics of Options. Thomsett is a frequent speaker at trade shows and blogs on his website at Thomsett Guide as well as on Seeking Alpha, LinkedIn, Twitter and Facebook.

There are no comments to display.

Join the conversation

You can post now and register later. If you have an account, sign in now to post with your account.

Note: Your post will require moderator approval before it will be visible.