.thumb.jpg.ab622b3574791e39df58d3c87b4b58ca.jpg)

There is a bullish momentum pattern in Apple Inc (NASDAQ:AAPL) stock 2 calendar days after earnings, if and only if the stock showed a large gap up after the actual earnings announcement.

This is a conditional entry -- the company reports earnings and if the stock move off of that report is a 3% gain or larger, then a bullish position is back-tested looking for continuing momentum. The event is rare, but when it has occurred, the back-test results are noteworthy.

Apple Inc (NASDAQ:AAPL) Earnings

In Apple Inc, if the stock move immediately following an earnings result was large (3% or more to the upside), if we test waiting two-days after that earnings announcement and then bought a three-week at the money (50 delta) call, the results were quite strong. This back-test opens two-days after earnings were announced to try to find a stock that continues an upward trajectory after an earnings rally.

Simply owning options after earnings, blindly, is likely not a good trade, but hand-picking the times and the stocks to do it in can be useful. We can test this approach without bias with a custom option back-test. Here is the timing set-up around earnings:

- Condition: Wait for the one-day stock move off of earnings, and if it shows a 3% gain or more in the underlying, then, follow these rules:

- Open the long at-the-money call two-calendar days after earnings.

- Close the long call 14 calendar days after earnings.

- Use the options closest to 21 days from expiration (but more than 14 days).

This is a straight down the middle direction trade -- this trade wins if the stock is continues on an upward trajectory after a large earnings move the two-weeks following earnings and it will stand to lose if the stock does not rise. This is not a silver bullet -- it's a trade that needs to be carefully examined.

But, this is a conditional back-test, which is to say, it only triggers if an event before it occurs.

RISK CONTROL

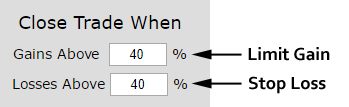

Since blindly owning calls can be a quick way to lose in the option market, we will apply a tight risk control to this analysis as well. We will add a 40% stop loss and a 40% limit gain.

In English, at the close of every trading day, if the call is up 40% from the price at the start of the trade, it gets sold for a profit. If it is down 40%, it gets sold for a loss. This also has the benefit of taking profits if there is a stock rally early in the two-week period rather than waiting to close 14-days later.

Another risk reducing move we made was to use 21-day options and only hold them for 14-days so the trade doesn't suffer from total premium decay.

RESULTS

If we bought the at-the-money call in Apple Inc (NASDAQ:AAPL) over the last three-years but only held it after earnings and after an earnings pop higher, we get these results:

|

AAPL Long 50 Delta Call |

|||

| % Wins: | 80% | ||

| Wins: 4 | Losses: 1 | ||

| % Return: | 151.9% | ||

Tap Here to See the Back-test

The mechanics of the TradeMachine® are that it uses end of day prices for every back-test entry and exit (every trigger).

Looking at Averages

The overall return was 151.9%; but the trade statistics tell us more with average trade results:

➡ The average return per trade was 46.54% over each 12-day period.

➡ The average return per winning trade was 76.92% over each 12-day period.

➡ The average return per losing trade was -75% over each 12-day period.

WHAT HAPPENED

Bullish momentum and sentiment after of earnings can be quite powerful with the tailwind of an earnings beat. This is just one example of what has become a tradable phenomenon in Apple. To identify patterns that have repeated over and over again, empirically, we welcome you to watch this quick demonstration video:

Tap Here to See the Tools at Work

Risk Disclosure

You should read the Characteristics and Risks of Standardized Options.

Ophir Gottlieb is the CEO & Co-founder of Capital Market Laboratories. Mr Gottlieb’s learning background stems from his graduate work in mathematics and measure theory at Stanford University and his time as an option market maker on the NYSE and CBOE exchange floors. He has been cited by Yahoo! Finance, CNNMoney, MarketWatch, Business Insider, Reuters, Bloomberg, Wall St. Journal, Dow Jones Newswire, Barron’s, Forbes, SF Chronicle, Chicago Tribune and Miami Herald and is often seen on financial television. He created and authored what was believed to be the most heavily followed option trading blog in the world for three-years.This article is used here with permission and originally appeared here.

There are no comments to display.

Join the conversation

You can post now and register later. If you have an account, sign in now to post with your account.

Note: Your post will require moderator approval before it will be visible.