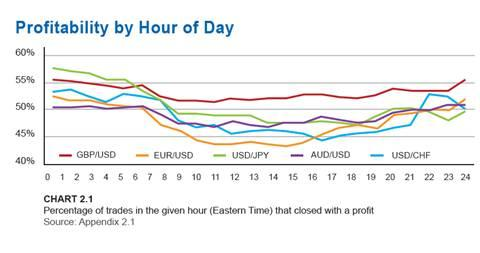

It also depends on the currency you’re trading with: profitability is higher with certain currencies at certain times of the day, but the same currencies yield losing trades at different times.

Why do many traders fail at forex trading? Very often we find that common trading strategies have limitations that few understand.

There is more to profitability than timing. Here are 4 patterns related to forex profitability. These are all based on hard facts accumulated by FXCM for its US clients.

FXCM is a large US forex broker with significant global operations, so the data here is significant.

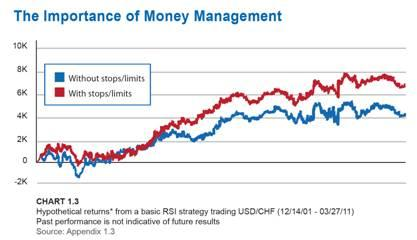

● Forex Traders with FXCM were right on their trades more than 50% of the time. Anyone would say that is a great statistic. Does that mean they were profitable on their account? No, traders lose more money on losing trades than they win on winning traders. A simple fix to that is traders should be using stops and limits to enforce a risk/reward ratio of 1:1 or higher.

● Most forex traders are range traders – that means that they don’t wait for a breakout. The more success in range trading was done during Asian trading hours, when movements are more limited to ranges. It’s important to remember that the opening session of the week is more volatile than all the rest that follow.

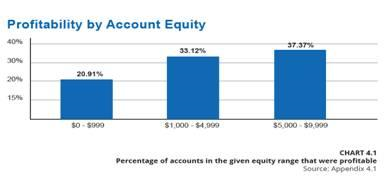

● The third most common mistake traders made is trading with too much leverage. Traders should take their account equity and multiple it by the effective leverage target and they will know their maximum account exposure before entering a trade. High volatility + high leverage are usually a recipe for wiping out the account.

● European and North American Trading Hours tend to have the most volatility. We’ve seen that trading on trade breakouts tend to be more successful trades during that time. If you’re stalking on breakouts, then these volatile sessions (and especially the overlap) are the best times for you.

This is a guest post from FXStreet, a leading provider of data, real time analysis and actionable tools for Forex traders.

There are no comments to display.

Create an account or sign in to comment

You need to be a member in order to leave a comment

Create an account

Sign up for a new account. It's easy and free!

Register a new account

Sign in

Already have an account? Sign in here.

Sign In Now