SteadyOptions is an options trading forum where you can find solutions from top options traders. Join Us!

We’ve all been there… researching options strategies and unable to find the answers we’re looking for. SteadyOptions has your solution.

Search the Community

Showing results for tags 'straddle'.

-

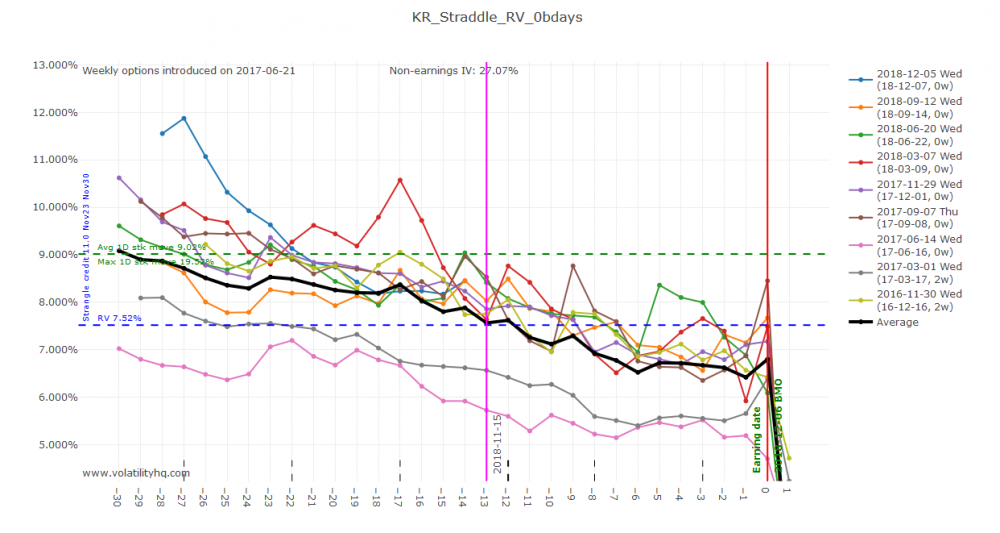

Hey Everyone, I just signed up for Volatility HQ to run some data on something I've been doing on my own and the reason I came to this service. I will use the stock KR to explain what I'm saying (by the way it also seems to be the best fit for my theory based on a quick search). What I understand the theory of the hedged straddle to be is to set a long straddle on the lowest possible RV decliners to get the cheapest possible chance at gamma gains. I have been trading something similar for a while now but using longer term options that have less time decay as well as less IV % bump. Now that I've signed up for Vol HQ I can compare both options directly. Here is a chart for the straddle RV with the first expiration after earnings as well as a chart with a long straddle with the expiration 100+ days after earnings. The first chart with the short term options has the RV decline from 9.1% to 6.8%, thus needing a gamma move or a strong hedge to counter this decline if the stock stays put. But the second chart with the long term options of 100+ days starts at 17.8% RV and ends in 30 days at 18.3% RV. Is this not free exposure to gamma? (NOTE: being new to Volatility HQ I could not figure out how to turn off the short strangle hedge in the Advanced Options area so they may be skewing results, but when I adjusted the short strangle % nothing changed)

-

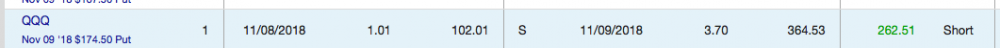

I wanted to share yesterday's trade... especially for other newbies looking to try a few low value trades. I've been buying Thursday straddles for the following day expiration. I also bought an HD yesterday. I think recent options are underpricing how much this crazy market has been moving on many Fridays. If you want to try it, I suggest you buy a tight straddle. I've lost on most of my thursday directional bets. FYI. The corresponding call is about to expire worthless, a loss of about $80. It's approximately 100% return on a one day trade. I should have gone big!

-

Dear community! I would like to get an opinion about the following video. I posted the link below. After making some research, I made the following assumptions and conclusions. - Options are probability-based financial instruments. The premium paid for buying a straddle is supposed to include all risks related to the potential change of IV, theta, gamma. - The chances of gain are 50/50 similarly to any short time predictions of the market price. Besides, you lose the spread and pay commissions. - Options pricing already includes any potential increase in IV and time decay is more likely to kill the potential trade. - As the markets are very efficient, Options pricing already includes information about historical volatility. Even if we find stocks with high historical volatility during previous earnings, the greeks are always balanced between each other to make your chances of win to 50/50 minus spreads & commissions. So, what you think? As options are

-

Saw this on Zerohedge (leading economics blog), a nice straddle strategy similar to Steadyoptions earnings trade, buy a straddle with low IV and ride it out. There's a list of 50 stocks to choose from. Any way we could narrow this down further or use this? http://www.zerohedge.com/news/2015-06-08/50-most-illiquid-stocks#comment-6175893 As a result one possible trade idea would be to put on a long-term straddle (preferably while VIX is still cheap) on some of the above names, and hope for a volatility shake out, either to the up, or downside.

-

I was wondering if anyone looked at trading straddles around economic indicators like the employment reports, retail sales, manufacturing index, construction spending, etc. Theoretically there would be stocks that are correlated with these indicators. We have mentioned one recently, the fed meeting and GLD. I do know it would be possibly to write software to check for correlation, but that is a reasonably complex project needing multiple sources of data. Does anyone no of a site or report that lists stocks correlated with events or reports OR has anyone tried this strategy before and have an opinion on it? Thank you! Richard

.thumb.png.440f90466c759fe6e5931b02f6bf3eff.png)