SteadyOptions is an options trading forum where you can find solutions from top options traders. Join Us!

We’ve all been there… researching options strategies and unable to find the answers we’re looking for. SteadyOptions has your solution.

Search the Community

Showing results for tags 'qqq'.

-

@Kim, @akito, @Paul, @NJ_KenRob I did pretty well on trading the midterms... 87% for a one day trade, 187% for an 8 day trade by buying VXX puts. I'm going to try some trades on the G20. Would love to have some more experienced company to discuss it with. My thesis... * The China Trade war is one of the most influential effects on the current market... especially the Chinese, but even QQQ. * As an example, look at what the market did last friday (Nov 2nd) when Trump tweeted that he wanted his staff to put a China trade deal on paper to consider... many of the china stocks jumped 10%. A couple hour later the white house clarified that the tweet was optimistic. All gains plus some were immediately given up. * Expectations for the Trump/XI meeting at the G20 (Nov 30-Dec 1) are all over the place. * I think the G20 will meeting will function like an earnings call as if all of china were reporting in the same 3 days... volatility and options related to QQQ, BABA, BIDU will go up substantially in the days leading up to the meeting. * I'm planning to do small straddles, strangles and a couple long call positions on BIDU, BABA, QQQ 7 days out and 3 days out (Nov 23rd and 27th). All of these are extremely efficient in terms of bid/ask as well as volume. I'll also likely try a VXX trade. * I haven't decided if I will sell on Thurs Nov 29th, Friday Nov 30th, or hold through the weekend. * I really don't have much of an opinion on whether to use expiration dates of Dec 7, 14 or 21. I may try small trades in all three just to watch. * While no one can predict the direction of Trump, the market reaction should be pretty extreme. If there great progress, the market will soar. If there's no progress or a step back, the market is going to take a big hit... especially China. * If you have ideas, I'd greatly appreciate you sharing them. Even if you don't want to do the trade or have an opinion, let me know if you'd like to see the results.

-

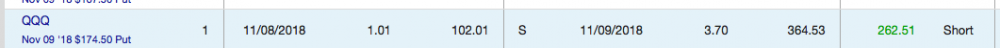

I wanted to share yesterday's trade... especially for other newbies looking to try a few low value trades. I've been buying Thursday straddles for the following day expiration. I also bought an HD yesterday. I think recent options are underpricing how much this crazy market has been moving on many Fridays. If you want to try it, I suggest you buy a tight straddle. I've lost on most of my thursday directional bets. FYI. The corresponding call is about to expire worthless, a loss of about $80. It's approximately 100% return on a one day trade. I should have gone big!