SteadyOptions is an options trading forum where you can find solutions from top options traders. Join Us!

We’ve all been there… researching options strategies and unable to find the answers we’re looking for. SteadyOptions has your solution.

Search the Community

Showing results for tags 'newbie'.

-

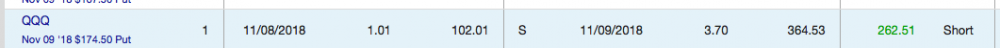

I wanted to share yesterday's trade... especially for other newbies looking to try a few low value trades. I've been buying Thursday straddles for the following day expiration. I also bought an HD yesterday. I think recent options are underpricing how much this crazy market has been moving on many Fridays. If you want to try it, I suggest you buy a tight straddle. I've lost on most of my thursday directional bets. FYI. The corresponding call is about to expire worthless, a loss of about $80. It's approximately 100% return on a one day trade. I should have gone big!

-

For what it's worth, thought I'd share my experiences for both the amusement and education of others. There should be nothing quite like hearing from another newcomer what it was like to jump headlong into trading the Steady Options strategy. So far, I have done (or messed up doing) the following: Went directly to trading with real money, although at the minimum allocation on every trade I have never been able to paper trade, it just doesn't simulate investing real money or hold my attention and everything that goes with it (but be prepared that you can and will probably lose money if you start this way) Have so far placed 31 trades, of which I closed 28 and made a profit of 2.7% overall I wasn't new to trading, which I think saved me, because I wouldn't have been able to deal with the ups and downs on zero experience My results would have been much better, except that I made the following mistakes Chased fills on calendars, particularly on Netflix, feeling desperate to get into the trade after it was posted (way too excited on the first few days) Later saw Kim's warning not to chase fills (woops) My losses on these trades were higher due to overpaying for the position in the first place Accidentally entered an Iron Condor or Iron Butterfly backwards on more than one occasion (I think this is easier to do than people might think) Accidentally had an expiring option assigned to me, noticing that all of the sudden I was short 100 shares of Starbucks in my account, and then I was unable to cover it for a few days, which cost me money - Track your expirations carefully, I thought I would never make this mistake and then wham! Decided to switch to Interactive Brokers from Fidelity, had my account locked up for three days, missed the exit on the QCOM trade, which cost me a big loss (I didn't realize the transaction of money to IB would happen immediately upon my request, then lock up my account) The entire transfer of money to Interactive Brokers failed because of this mistake - make sure you don't have expiring options that are less than 2 weeks out when you make a switch like this! Developed two trades on my own, based upon forum content - a BABA calendar trade and Disney hedged straddle, of which the BABA trade was a loser due to a big surge in the share price and the Disney was a nice winner And perhaps my biggest mistake, on the very first day with SO I saw we were doing a Netflix calendar with puts, so I thought we must be bearish on the stock and so I sold my regular stock position in Netflix, then later read the detailed description of calendar trades and realized it was all about capturing the decay of the shorter option against the longer one. I should have held on to my Netflix position! But as Jesse Livermore said, this is like a tuition fee for learning a lesson. I'm trading on top of an intense full time job, and I have found that I make mistakes when work is going crazy, even though I think I'm on top of things. So I guess the message is don't underestimate how confusing this can get when you have 10+ trades open at once and you are stealing 5 minutes out of your day to manage the trades. In the future, I will keep much more precise records and also probably limit the number of trades that I have open. So hey, bottom line, I have had a blast, learned a ton, and I didn't lose money! But now I realize this will take years to learn. I hope this is informative and/or amusing to someone. This is a great community. Thanks.

-

Hello all - I am new here and trying to set up a new option trading account so I can reduce the commission and fee which seems to be crucial to maximize your gain when trading with the SO strategy. Currently, after reading a few posts, I'm looking at either Tradier + ONE or + tradehawk. Now, I would be grateful if someone can share with me what would be the average number of contracts do you get to really transact on average (per month) for a 100k portfolio size so I can sign up with the right plan. Tradehawk has a current plan that if I trade more than 300 contracts per month, it would refund the $59 fee. Hence, I am wondering if I would be able to reach this threshold. I saw that the official SO trade are about 10-12 trades per months but the number of contracts is a big variable depending on the stock price and fill rate. I am also aware that bigger lot size could have a hard time getting order filled if blindly following the official trade. Can anyone share his/her experience? It would be great if you can give me a rough ratio of how much do you actually follow the official trades as well i.e. 500 contracts/month and about 50% of the time...