SteadyOptions is an options trading forum where you can find solutions from top options traders. Join Us!

We’ve all been there… researching options strategies and unable to find the answers we’re looking for. SteadyOptions has your solution.

-

Posts

407 -

Joined

-

Last visited

Content Type

Profiles

SteadyOptions Trading Blog

Forums

Everything posted by ex3y7s

-

Site is having connectivity issues again. This seems to happen biweekly; any thought to upgrading/changing your host?

-

Anyone having issues logging into/using Tradier this morning?

-

I called Tradier and they confirmed that the email went out a day early because of the holiday.

-

Did anyone else get an email from Tradier notifying them they have options positions expiring today? I have many April 18th positions, but no Wednesday options. I know Friday is a market holiday, but the April 18th equity options trade until the close tomorrow, Thursday, April 18th, correct?

-

Two options: first, you can go to "Documents" after logging in on the Tradier dashboard and download PDFs for each day. The other (better, IMO) option is to sign up at Apex and then you'll be able to log in and search/view records by date and type, as well as export to CSV.

-

Paper trades at mid price in my experience paints a very skewed result. I know any of us would kill to be able to fill at the midpoint even half the time, and over 13 years those pennies (or, more likely nickels and even dimes) absolutely will add up to inflated returns, particularly if they are compounding the account. It's true that SO alerts are often 10-15 minutes delayed so you can't necessarily get the actual fill in the alert at that moment in time, but they are based on real fills that you can see in the order books, which at least to me makes a world of difference and proves that the strategies and alerts work in real market conditions. Over time and with patience, an SO subscriber's fills will converge to the actual service--sometimes the delay working against and sometimes in favor of the entry--whereas with a service based on paper trading at mid price you will virtually always be drifting farther and farther away.

-

Trading and getting fills with Interactive Brokers

ex3y7s replied to cwerdna's topic in General Board

Forgive me if this is the wrong topic. Does anyone know if it's possible to set the defaults this setting refers to: https://www.interactivebrokers.com/en/software/tws/usersguidebook/configuretws/charts_settings.htm#XREF_83067_What_to_show_when by contract type? When I have a chart for an option or spread, I'd like to show the midpoint automatically without having to go into "Chart Parameters" > "What to show" > "Midpoint" each time, but without actually selecting "Retain Current" in the link I posted (so that I see trades if I select a stock for that chart, etc.). -

Wow some great new features in there--especially the market-centered advanced orders. We just need to get Tradier to offer futures now!

-

IB passes along the exchange fees and to my knowledge does not negotiate commission rate. You can see the volume tiers on their websites. Lower rates start above 10k contracts per month, so quite large volume for a retail trader.

-

Same--I responded to the affirmative.

-

Tradier support emailed me and this issue has been fixed!

-

@Kim @SBatch I got an email today from Tradier saying: We are reaching out today in regards to your TradeHawk/Tradier Brokerage subscription through TLT Elephant/Creating Alpha. It appears that you have not subscribed with TLT Elephant/Creating Alpha and are therefore not eligible for that promotion at this time. If you wish to continue your subscription, please sign up with Creating Alpha here:https://steadyoptions.com/subscribe/ I am subscribed to CA through the SO bundle. My Tradier account email is the same as my SO email. Is there something I need to do such that they can see it? Thanks!

-

Selected remove because the picks are typically just the same 4 links repeated with each email. I read and enjoyed Kim's recent blog posts very much--I don't need to see links to them again with every email.

-

I heard back from Tradier that they will be fixing this (correct BWB margin calculation). They don't have a timeframe for it, but suggested 2-3 weeks.

-

Following up here it looks like the margin was corrected overnight, so as of now for trading broken wing butterflies at Tradier you will need enough margin to cover the widest wing with no offset from the other wing when opening, but the correct margin starting the next trading day.

-

Check under "E-documents" on the Tradier dasbhoard: it has daily PDF reports from Apex with the fees. They become available the next day after trades are made.

-

Just got the following response from Tradier's Director of Operations: That is not the way in which our system does the calculation at the current time. It only looks at the maximum requirement on each of the spreads and based the total requirement on that. There is the possibility that our clearing firm looks at it the way that you are expecting and if so, you will get back some of the requirements overnight tonight. That makes it sound like a Tradier issue rather than an Apex one. I'll update if my buying power is updated overnight.

-

Awesome--I just sent them an email so I will update when I hear back. Their support has been wonderfully responsive in the past.

-

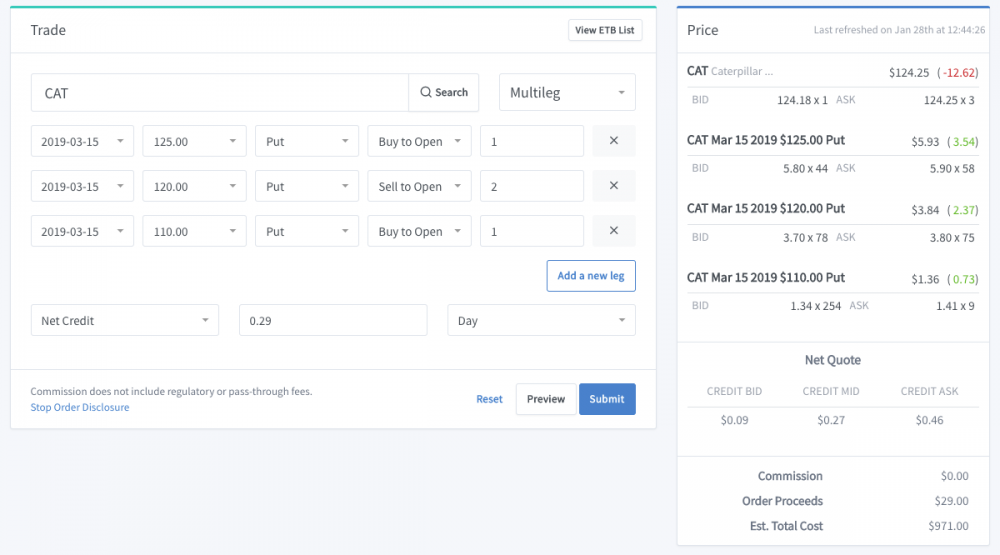

Just discovered today that Tradier doesn't offset one wing of a BWB against the other when calculating margin requirements. In the position below the max loss is $500 minus the credit received but Tradier is showing a margin requirement of $1000 minus the credit.

-

That's really great to know, and makes me more excited for the TradeHawk announcement. I've been submitting orders programmatically using Tradier's API and then managing them in their web UI. The submission works well but their web dashboard makes order management a bit cumbersome, so it would be great to have a real trading platform to manage the orders. Thanks guys.

-

Interesting--I haven't been dissatisfied with the fills on Tradier but my experience has actually been the opposite: fills on IB are usually slightly better. It certainly doesn't offset their commissions, though!

-

Will existing customers using the SO offer be able to switch?

-

Following up and answering my own question here, it turns out you can actually just open a url with some appropriate query parameters in it and it will prepopulate the order fields in their UI: https://developer.tradier.com/documentation/overview/trade-link. Not bad!

-

To those who have played with the Tradier API: can I create an order using it but not place it until I've verified it in Tradier's web UI? One of the things I love about IB is that I can programmatically submit an order using their API with "transmit: false" and the order shows up in TWS but isn't live yet. I can then verify the strikes/price looks correct and place and adjust the price using the TWS UI. Is this an option with Tradier? I notice their docs mention preview order functionality, but it's unclear to me if that will actually show up in their UI or not. I could potentially implement a hack where I submit orders with prices that won't allow them to fill (e.g. buy for nothing or sell for a very large amount), but even that makes me pretty nervous in the event I've gotten the strikes wrong. Thanks for any insight!