SteadyOptions is an options trading forum where you can find solutions from top options traders. Join Us!

We’ve all been there… researching options strategies and unable to find the answers we’re looking for. SteadyOptions has your solution.

-

Posts

115 -

Joined

-

Last visited

Content Type

Profiles

SteadyOptions Trading Blog

Forums

Everything posted by SureTrader

-

Reducing the mistakes I make when trading Calendars

SureTrader replied to zxcv64's topic in General Board

@zxcv64 Thanks for detailed explanations. I will post in the above link in the future about indices. I agree that RV has been an invaluable metric for pre-eps trades. I wish there is some tool like that for indices as well Appreciate it much. -

Reducing the mistakes I make when trading Calendars

SureTrader replied to zxcv64's topic in General Board

Thank you for sharing your experience. The last paragraph is the vital part. Can you share a bit more of your experiences regarding trading rules and psychology. SO mostly trades Pre-earnings calendars which are a different category due to high gamma resistance than regular calendars. I trade weekly double calendars with indices (SPX, NDX) with IV backwardation in front and back dated options. I feel this is the pre-defined "edge" in these calendars. 1. Rules to follow- Can you please share your trading rules. Do you scale up gradually or enter all at once. What if IV drops after you enter. My biggest obstacle has been timing the entries. As you hinted above the calendars drop in value as the day goes by, which means it better to sell at the beginning of the day (esp on T-0). Do you have any suggestions on entry times. 2. Do you have (hard) stop loss? If so, whats your criteria- gamma (price moved away from the profit tent) or IV drop or time left in the trade (waiting till T-X) 3. Hedging- Since calendars are short gamma, how do you hedge?- add another calendar (more short gamma) with the direction of the price movement? if so when? or add long gamma to counter short gamma such as call/ put or a vertical or a ratio trade 4. Do you follow 10% rule like SO does for allocation per trade. I have personally been starting with 10% and go up to 20% if I have to add capital to hedge. 5. Is it a good idea to scale up when the IV is dropping like the environment that we are in now. IV has been held up last 3 months due to market volatility which is now deflating like a balloon. Thank you so much for starting this conversation. Always helps when experienced traders share their personal views and experiences. -

@Djtux Is there a tutorial on your website on how to use the scanner and charts. On the earnings scanner, I came across the following table. can you please let me know why the calendar (Double/put/ call) RV % is green and red? Thanks

- 1061 replies

-

- rv chart

- volatilityhq.com

-

(and 1 more)

Tagged with:

-

Appreciate your help.

-

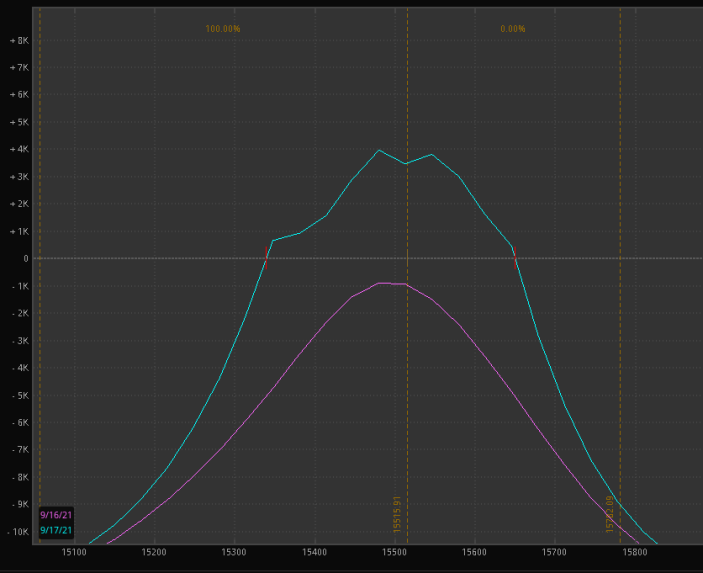

@Kim @YowsterI had a position in NDX like the risk analysis chart shown below last night. This is a NDX triple calendar position with shorts expiring this AM and longs on Monday. I was debating whether to let the shorts expire or close before last night. Since it's a cash settled index there is no assignment risk and I have capital to cover the longs. What would be the wise thing to do since the price is fairly centered and have ~350 point range. I bailed out since I wasn't sure if the longs premium would collapse and would create more significant loss than what's shown. My expectation is that the index price would open with in the range of the tent and I would close the longs on Friday morning. Appreciate your comments. Yesterday the IV before closing was as below

-

They are nonsense, IMO. Beware. Most people trade against themselves too by not following a plan or not even having one when they begin. SO fixed that for me and I am very grateful for that. These courses are similar to online colleges. You'll get a degree but that's about it.

-

Weekly double calendars on Indices (SPX, NDX, DJX)

SureTrader replied to SureTrader's topic in General Board

I don't have ONE. Here is a trade that I am in now. I will exit this tomorrow or early Friday. I will try a PnL of 10%. -

Weekly double calendars on Indices (SPX, NDX, DJX)

SureTrader replied to SureTrader's topic in General Board

@zxcv64 Yes. I agree with you about the vega being the main play. I do Friday short strikes and the following Monday options for the long strikes. So, 7 DTE for short strikes and 10DTE for the longs. As you said the Friday options have higher IV vs the foll Monday options which helps. I use 20 to 30 deltas for the strikes depending on the environment. I must also add that I hedge the calendars with long call verticals in case the short strike price is breached. I only add the hedge if the price closes over the short call by the EOD. This limits losses toward IV collapse and price movement. It's a short and long gamma combo play. I use SPX and NDX as underlyings. I manage these very actively which is good and bad in some instances but that's me. 10% PnL is my exit point. The last 2 weeks due to elections have been very profitable as you see in the graph. -

I have been trading Weekly Double calendars (WDC) since April with good success. I know they are gamma and Vol plays along with Theta (but only at/ on expiration days). I have been targeting ~10% PnL exits. My question is how to time the entries and exits more precisely. @Kim and @Yowster are awesome at this. The reason why I am asking is after I enter 50% of the time the price of the calendar drops by 5-7%. It's very random and unpredictable but puts the trade in a major disadvantage. I tried entering the trades in the early hours of the day in the noon and sometimes before the end of the day. But the time of the day is not very helpful. I typically enter on the next week Fridays and exit on Thursdays or early Fridays. @Volatilityhq doesn't provide data on non-EPS underlyings. Here are my results. Not complaining about the results at all but just being a bit more greedy like everybody.😀

-

FYI. Etrade sent this message today. Maybe the same with the brokers too. " Because the market is currently pricing in heightened uncertainty, E*TRADE will be increasing our base margin maintenance requirement (house margin requirement) from 25% to 30%, beginning Monday, October 19, 2020. "

-

Do they? Can you show where they say that. I am not @Kim or @yowster's minion to blindly support them but this is outright disrespectful to a great service and this community. Why do you have the need to compare your results with SO or any other member's. Do you feel good if you beat others but not the market? Yeah, last month was a small loss but I can attest to the fact that I made good money this year.

-

@borgia A lot of services hide losses by rolling and say that the position is still open. They won't publish that to even know. Well, your account/ brokerage doesnt care about whats not a realized loss (even though it is, once you roll). SO is very comprehensive and most importantly adapting to dynamic markets. And SO looks at a portfolio as a whole while managing the positions individually too. How is buying straight up calls and puts not gambling. Most often it's day trading too and not to mention it leads to PDT in margin accounts less than 25K. I have seen most traders who are constantly nervous about whether to hold or close or go work out in the gym with such services (I was one like that before). If you have a busy job then it will kill you.

-

I have been with SO for only 3 mo now and am 90% close to their results. You have to know how not to try ditto them. Ditto should not be the goal. I am here for ideas only. Execution (entry and exit) is upto me. I some times get better fill and some times not. The goal should not be to beat SO performance. I often make changes to the original idea.

-

I came across two brokerages 1. Firstrade and 2. Hrtrader. Both have mobile apps and $0 commissions. Hrtrader needs a minimum of $30K to open and monthly $25 flat fee OR total free if you have 50K daily margin and EOD free cash plus 50 trades mo. Anyone has experience with them? The reviews on both are average but want to know if someone has real experience.

-

I came across two brokerages 1. Firstrade and 2. Hrtrader. Both have mobile apps and $0 commissions. Hrtrader needs a minimum of $30K to open and monthly $25 flat fee OR total free if you have 50K daily margin and EOD free cash plus 50 trades mo. Anyone has experience with them? The reviews on both are average but want to know if someone has real experience.

-

I am already using TW. They do provide options on futures and some commodities but charting is bad. Mobile app is alright.

-

Hmmm... that's disappointing. So, Tradier's all much ado about nothing.

-

Hey Guys, New to SO here. What is the best mobile platform connected thru Tradier? Trade Hawk and Trend don't have mobile apps. Could you let me know the platform price as well with SO? Also, can we trade futures options in that platform? Thanks

-

Hey Guys, New to SO here. What is the best mobile platform connected thru Tradier? Trade Hawk and Trend don't have mobile apps. Could you let me know the platform price as well with SO? Also, can we trade futures options in that platform? Thanks

-

Summary of SteadyOptions Discounted Offers

SureTrader replied to Kim's topic in Promotions and Tools

How does Tradier work? I like the flat fee option but seems I need to connect with another platform/ broker. There are 20 options for that. I don't know which one is good. Any suggestions based on your subscribers. My objective is to save on commissions & fees and have a reasonable platform for trading options (incl futures) even on a mobile. Please share your thoughts. Thanks