SteadyOptions is an options trading forum where you can find solutions from top options traders. Join Us!

We’ve all been there… researching options strategies and unable to find the answers we’re looking for. SteadyOptions has your solution.

Arthur

Mem_C-

Posts

122 -

Joined

-

Last visited

-

Days Won

3

Content Type

Profiles

SteadyOptions Trading Blog

Forums

Everything posted by Arthur

-

May jobs report: The US unemployment rate unexpectedly FALLS to 13.3% (vs. expected rise to 20%). Wow.

-

Here is a real world example: around March 15 I got an info "from the future" that SPX would fall below 2000 by the end of April. So, I bought a bunch of APR and MAY puts. That didn't go well

-

@Christof+ @urfiend @mustafaoe @equus @rigulator @Bernie @Daniel S @nitsuj Any thoughts?

-

Dear German option traders, we have to talk about 2021. Changes to the German income tax law, which go into effect in January 2021, make options trading basically unprofitable/pointless (at least for private traders). The main change is that, while gains are still fully taxed, losses can be deducted only up to 10,000 EUR per year in total (!). Example: you've made a calendar trade which ended up with 0% profit (one leg gained 30,000 EUR and the other lost 30,000 EUR). Since losses are deductible only up to 10,000, you will have to pay taxes on a 30,000-10,000=20,000 EUR gain! Oh, and you've already used all your annual “loss pool”, so with your next spread trade you won't be able to deduct any loss... What are the solutions? a) Founding a trading company (GmbH or UG)? b) Founding a family foundation (Familienstiftung)? c) Emigration? Any thoughts/suggestions? I am lost... https://boerse.ard.de/anlagestrategie/steuern/verlustverrechnung-fuer-termingeschaefte-wird-erschwert100.html

-

@mccoyb53 Have you tried Tradier? They do accept come European countries (not sure about Ireland).

-

Tradier experienced some technical issues today which made it impossible to close trades. What a mess!

-

@DjtuxLooks like you've added 2 new columns to the Scanner: Call Calendar Current Price and Put Callendar Current Price, correct?

- 1061 replies

-

- rv chart

- volatilityhq.com

-

(and 1 more)

Tagged with:

-

@Christof+ Thanks a lot, much appreciated. Just one more question: in my flex report I don't have the columns "Open/Close" and "FX rate" (I think IB doesn't know if a trade is opened or closed anyway, right?). So, do you add those two columns manually? It should be doable to manually add the EUR/USD exchange rate for each day, but deciding for each trade whether it's an "open" or "close" sounds like an impossible task - my 2018 table has thousands of rows...

-

@Christof+ If you don't mind, can you attach an excel spreadsheet with an example? I am not sure if I got the correct IB flex report and if my calculations in the last column are correct...

-

@Djtux Would it be possible to add a new column to the Scanner: Average Max Move from the last 4 cycles? For the background: I sometimes hold straddles through earnings hoping for a large stock move. Being able to compare the current straddle RV to the average max move from the last 4 cycles would make it much easier for me to find suitable through-earnings-candidates. Currently I have to do the calculations manually for each stock using the Straddle Table.

- 1061 replies

-

- rv chart

- volatilityhq.com

-

(and 1 more)

Tagged with:

-

I completed the paperwork 10 days ago and haven't heard from Tradier since. Sent them an e-mail 2 days ago, but haven't received any response yet.

-

I just tried to open an account using the link and the promo code and received the following error message "We are unable to open accounts for non-US residents". That was even before I could specify my country of residence, so apparently it applies to all countries outside the US. I've contacted Tradier via e-mail, hope they can help.

-

@Christof+ @urfiend @mustafaoe @Marco and others Hallo zusammen In this topic I would like to discuss the peculiarities of paying taxes in Germany. The German tax system is different from the US as in GER only the realized gains are taxed – and there is no Wash-Sale Rule, as far as I know. Gain from options trading are taxed at 26.375% (plus "church tax"). Gain from stocks are also taxed at 26.375%, but are treated separately from options, so it's not possible to offset gains from options with losses from stocks. I haven't traded stocks in my account, however I still have stocks gains due to an assignment. Forex gains are taxed at the personal tax rate, if I am not mistaken. I currently use IB, but I am thinking about switching over to Tradier. So here are some thoughts/questions I have: 1) IB offers a "realized gains" report which shows the gains grouped into 3 categories: stocks / options / forex. Do you use this report for your tax declaration? 2) What is your experience with forex gains? My base currency in IB is EUR, but I trade options in USD. Apparently, every time I buy or sell an options, I realize forex gains/ losses. So, in my case IB shows realized forex gains (over EUR 1000 in 2018), even though I haven't actively traded EUR/USD. The forex gains will be taxed at my personal tax rate, correct? 3) Does Tradier offer a similar "realized gains" report? You can also answer in German, if others don't mind

-

@krisbee @SBatch Do you guys have experience with Tradier margin calls?

-

Does anyone know how Tradier handles margin breaches (e.g. after an assignment)? Do they issue a margin call and let you add cash to your account, or do they just auto-liquidate after 10 minutes like IB? I am currently with IB and their forced liquidation policy makes me nervous. Every time the short leg of my spread moves ITM I have the feeling that I am playing with fire.

-

These are legitimate questions for a beginner. So, after 20 days your call option is "in the money", having an intrinsic value of $100. Yes, you could exercise your call option and buy the underlying shares for $100 each thus making a profit of $200-$100=$100 per share (minus the initial price of the option). Please note that you would need to have $10,000 to be able to pay for 100 shares. However, in general, in a liquid market, it never makes sense to exercise an option - because you could just SELL the option at a higher price than $100. Let's assume that after 20 days the price of your call option is $120 ($100 intrinsic value + $20 time value). If all other factors (price of the underlying stock, implied volatility, interest rate...) remain constant, then the time value will decrease as the option gets closer to its expiry date. On the last day before expiration, the time value will get close to zero and the price of the option will be very close to its intrinsic value ($100).

-

Your mistake was not selecting wrong strike price - but choosing a wrong (too risky) strategy by buying a call and thus making a directional bet on rising stock prices. The NTNX stock lost around 30% in the last 4 weeks, so your call would have lost value regardless of the strike price. In general, if you expect the stock price to move significantly, then a suitable strategy would be to buy a straddle (a call AND a put with the same strike price and expiration). Regarding your current situation: like krisbee wrote, your next steps depend on your risk appetite and your assessment of the future NTNX stock price.

-

Hey guys, This topic deals with trading options on European exchanges, like ICE Futures Europe (UK) or EUREX (Germany/Switzerland). I do understand that most SO user are based in North America and thus have no particular interest in trading options in Europe – due to different time zones and reluctance to have foreign currency exposure. However, some members (including myself) are based in Europe, and for them expanding the stocks universe to include large European companies (which are not traded in the US) might offer additional opportunities. The biggest problem for me personally is that there are currently no good tools/databases I know of allowing to look at historical RVs and do backtesting of European companies. Which can also mean that there are still many 'hidden gems' there. Also, it should be noted that the standard lot size on the ICE is 1000 shares (not 100) – which makes most straddles too expensive, but might be an advantage when trading cheap calendars. What is your experience with trading options on European exchanges? Any backtesting tools you can recommend? Do you hedge your currency exposure?

-

@clipsnation183 Thanks for sharing this sad story which will be a lesson for all of us. Like others have noted, it takes a lot of courage to be so open and honest about it! Cheer up and good luck to you in the future! I have a general question to the community about the risk of assignment and why it can be so devastating. We never trade naked short options, so if you have an ITM short call it always means that you have an ITM long call as well (different strike or expiration). So, if you get assigned on your ITM short calls, why can't the broker just exercise the long calls to balance the position?

-

@Djtux Thanks for adding the calendar features to the scanner, it was very useful! You've asked which additional columns we would like to have, so here is my input: As far as I understood, the current setup of the scanner allows to scan 'standard' calendars only (number of weeks: 'Auto' and earnings type: 'After'). I think it would be nice to be able to scan all possible calendars (weeks 1-5, earnings 'Before' and 'After'). Thus it would make sense to add two more columns to the scanner: 'Number of weeks between the calendar legs' and 'Short leg expiry before or after earnings'.

- 1061 replies

-

- 1

-

-

- rv chart

- volatilityhq.com

-

(and 1 more)

Tagged with:

-

@Djtux Maybe the best would be to keep the current scanner as it is (and rename it "Straddle Scanner") - and create a separate "Calendar Scanner"?

- 1061 replies

-

- rv chart

- volatilityhq.com

-

(and 1 more)

Tagged with:

-

Hey @Djtux! Thanks for creating this powerful tool, it's amazing. I really like the scanner – I use it e.g. to find straddles with the lowest RV decay. (Unfortunately, there is no "sort by" function, so I just download the data into Excel and then sort it there by RV decay and other attributes). Now my question is: would it be possible to create a similar scanner – for calendars? With columns like "RV rise", "Number of weeks between the calendar legs", "Short leg expiry before or after earnings", etc. It would help me to find suitable calendars much easier - I would just look for calendars with the highest RV rise (%) and then apply further restrictions. Do you think it would be possible to create such a calendars scanner? PS: just saw that Anderson317 had a similar request.

- 1061 replies

-

- 1

-

-

- rv chart

- volatilityhq.com

-

(and 1 more)

Tagged with:

-

More tools to analyze the earnings trades: www.art-of.trading

Arthur replied to Christof+'s topic in General Board

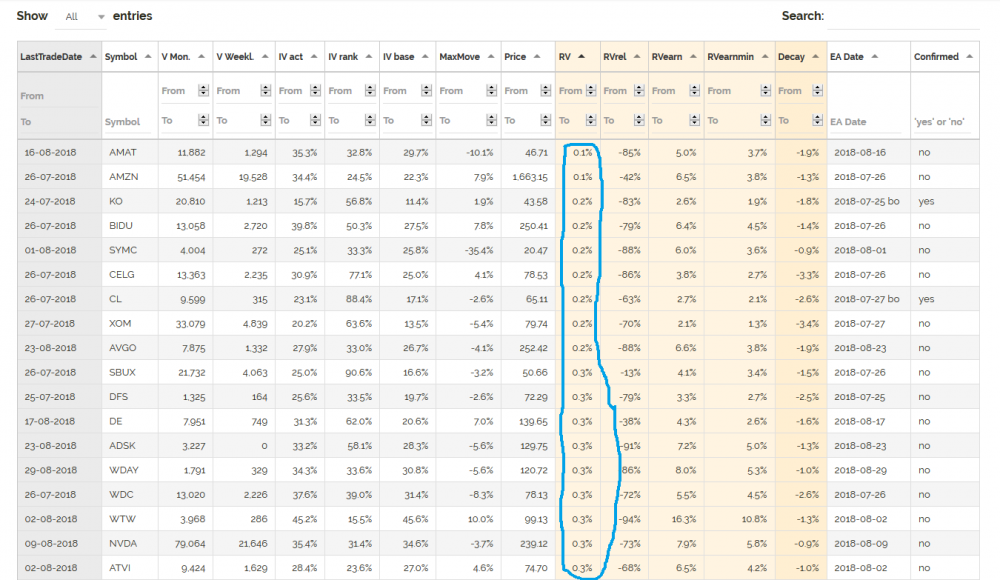

@Christof+ I've sorted the Upcoming Earnings by the RV and got a bunch of impossibly cheap straddles (please see screenshot attached). Too good to be true Anyway, enjoy your vacation! -

More tools to analyze the earnings trades: www.art-of.trading

Arthur replied to Christof+'s topic in General Board

@Christof+ Thanks for creating such a great tool! I am currently looking at the Upcoming Earnings section, and I noticed that the RV column shows the RV of the shortest to expiry straddle. However, we are usually interested not in the options expiring next, but in the options expiring after the next earnings. Would it be possible instead to show the RV of the straddle expiring after the next earnings date (regardless of whether confirmed or not)? It would make the search for "cheap" straddles much easier...