We’ve all been there… researching options strategies and unable to find the answers we’re looking for. SteadyOptions has your solution.

BlackBat

Mem_C-

Posts

210 -

Joined

-

Last visited

-

Days Won

1

BlackBat last won the day on June 17 2018

BlackBat had the most liked content!

Recent Profile Visitors

BlackBat's Achievements

Advanced Member (4/5)

66

Reputation

-

BlackBat started following FrankTheTank

-

Bid and ask TWS IB - Own order not showing up

BlackBat replied to Bull3t007's topic in General Board

I noticed the exact same thing, in case my buying order does change the bid, the bid size is less than my actual order quantity. -

Bid and ask TWS IB - Own order not showing up

BlackBat replied to Bull3t007's topic in General Board

I also noticed this behavior in TWS lately, no idea what causes it. As of today, I still see combos which show bid/ask prices that are tighter than the bid/ask calculated using each leg's bid/ask, so the combo mid seems to be still affected by the combo limit orders. I'm totally confused. And during the past few weeks it happened to me several times that my order not only did not seem to alter combo bid/ask but also was shown in blue (Your order is being held and monitored) and not in green (Active on SMART). I had some doubts at that time that my order is really being taken into account. But then things got to normal after a few hours. Before that, I only noticed this behavior as I was playing with some OCA orders (they were shown in blue and their limit price did not alter combo's bid/ask even though they were clearly active => one of those OCA orders filled at some point while being shown in blue, but I had some doubts that it was a fill as good as it would have been if the order were shown in green - maybe I'm biased here). Then I stopped using OCA orders and reverted to regular ones. I added this in the hope that others can confirm whether it happened to them, too. -

Speaking about attempting to enter trades ASAP after receiving the alert vs. patiently waiting for them to drop in price , @krisbee, you said a couple of days ago on the recent AXP topic that you didn't hurry to enter the official trades as they were posted but instead you just waited for them to drop significantly in price before entering, and it is true that during the last few months with elevated volatility many of them did have big drawdowns before showing any significant profit, so your approach seems definitely interesting. For the AXP trade you said you entered at $0.94 while the official entry price was $1.27, so you got it at more than 25% discount, and you were showing 46% profit, which is awesome! A few questions / remarks: 1. What I understand from your message is that for all these trades which had large drawdowns you waited and entered the official entries later for a big discount. Even though at the time you entered you probably could have bought the ATM RIC strikes even cheaper than the official strikes which were not ATM any more. Or in case of RICs you actually entered the ATM-centered strikes? This question might sound naive but I just wanna make sure I got it right. 2. How do you determine your target entry price for all those trades? Do you just subtract 25% of the maximum risk from the official price or is it a more complex process? 3. Is your position in dollar terms proportionally smaller than the official one, because of the discount you got for the entry price? Or do you buy more contracts to aim for the same allocation in dollar terms? For example, did you still buy 4 AXP RIC contracts like in the trade alert (of course, multiplied by how much larger your portfolio size is comparing to the official $10k portfolio) or did you buy 5 or 6 of them to make up for the 25% discount that you got? 4. Waiting to get all the trades for a significant discount guarantees that we enter ALL of the losing trades, including those with 100% loss, since we don't really have a stop loss on the trades, while we inevitably miss the (not so many) trades that were showing little to no losses before reaching the profit target. This seems to lower the profit potential of this strategy. 5. I also thought on the idea of averaging down, so scaling into the position in several steps, aiming for an even lower entry price at each step (but without exceeding the targeted position). While this might give us a better entry price for most of the trades it will also cause us to miss trades that are winners from the beginning (or to book those profits only on a much lower allocation than the targeted one) and, on the other hand, we will book losses on the full targeted allocation and these two points might obliterate the advantage of getting better average entry prices on the rest of the trades. So I am pretty confused on which approach would be better. 6. Waiting to get (much) better prices for the official trades that hedge one another seems risky business and I speak from my own experience: roughly one month ago when I had a 15% allocation on the three VXX ratio spreads that we had open at that time but was still trying unsuccessfully to enter the official SPX butterfly trade that kept increasing in value right from the beginning as it was opened while SPX was dropping and hasn't recovered sufficiently to get the butterfly's price low enough for entering, so I ended up with three losing VXX ratio spreads but missed the 36% gain SPX butterfly trade which should have covered those losses. Maybe in this case I should have probably opened the fly at lower strikes but I was not confident enough that those strikes would have been well positioned for the trade to be successful, so I kept hoping that I could enter the official SPX butterfly at some point, which did not happen. Anyway, since SPX flies that reach 36% gain without showing any significant loss in between are pretty rare, maybe in the long run it is worth waiting to buy official SPX flies at a 25% discount. So, to me, waiting to enter at much lower prices seems to be a potentially successful approach to the extent that a sufficient percentage of the total trades have big drawdowns before showing decent profits, and the discount you get on entry is big enough to make up for the few 100% loss trades that you will inevitably have and for the winning trades that you will miss because their price did not ever drop to your expected entry price. Would love to hear other opinions about waiting to get better prices in this high-volatility environment.

-

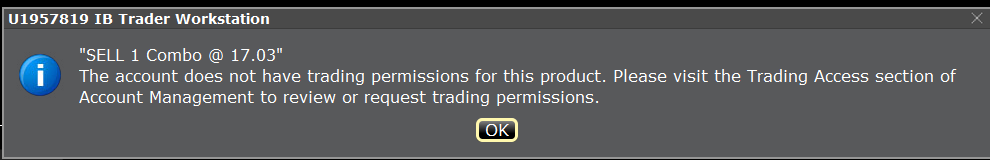

Trading and getting fills with Interactive Brokers

BlackBat replied to cwerdna's topic in General Board

I am unable to submit an order for closing a 7:2 hedged straddle (as one order), I get the following error: The weird thing is that I can issue such orders with no problems for hedged straddles with less legs, for example 6:2 or 5:2. I'm not aware of a "Trading Access" section in the Account Management. There is one called "Trading Permissions", but I couldn't find any setting there such as "maximum number of legs per combo". There is such a limit but not in the Account Management. It is in TWS's settings under Presets / Combos / Precautionary Settings / Size Limit but I've upped and also disabled that and nothing changes, I get the same error when trying to close the 7:2 hedged straddle. Any hint would be highly appreciated. -

I think it would be nice to have the non-earnings (base) IV at the fingertips, right on the straddle/calendar RV chart, in the upper-left corner, for example.

- 1061 replies

-

- 1

-

-

- rv chart

- volatilityhq.com

-

(and 1 more)

Tagged with:

-

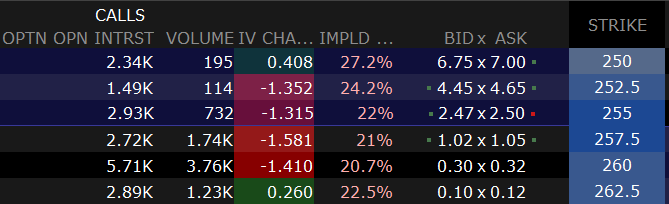

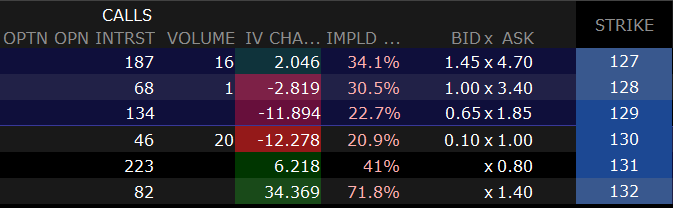

I'm looking at the "Option Open Interest" and "Volume" columns in the option chains and the difference is obvious between PLCE and NVDA, for instance. I would be interested in knowing some thresholds to make it easier for me to categorize a stock as "good liquidity", "average liquidity" and "poor liquidity". Something like we have with "low IV stocks" meaning IV=12..18%, "mid IV stocks" meaning IV=18..25% and "high IV stocks" IV>25% If this has already been discussed, I would be grateful to anyone who can point me to the relevant topic. PLCE: NVDA:

- 1716 replies

-

- pre-earnings

- trade machine

-

(and 1 more)

Tagged with:

-

Ok, so the strangle credit is implicitly assumed to be per unit of straddle, then everything is ok, thank you! One more question: why is the average one day stock move depicted as a level in the chart (the green dashed horizontal line)? Should we somehow compare this level to the current straddle RV level and draw some conclusions?

- 1061 replies

-

- rv chart

- volatilityhq.com

-

(and 1 more)

Tagged with:

-

@Djtux, I was trying to understand how the adjusted straddle RV (dashed blue horizontal line) is calculated in your charts. It looks like the strangle credit obtained from the remaining strangle iterations (displayed on the left side by the vertical Strangle credit text) is being subtracted from yesterday's straddle RV and that's it. I have verified this on several different underlyings and turned out to be true every time. To my understanding, the correct way of calculating the adjusted straddle RV level would be to subtract (from yesterday's straddle RV) the strangle credit divided by the number of straddles that we have for each short strangle. Am I missing anything? Later edit: It then occurred to my mind that maybe the correct way of using the Advanced options form would be that in the Credit received per short strangle (in %) field we enter an amount which is already divided by the number of straddles we have for each short strangle. Please confirm whether that is the case.

- 1061 replies

-

- rv chart

- volatilityhq.com

-

(and 1 more)

Tagged with:

-

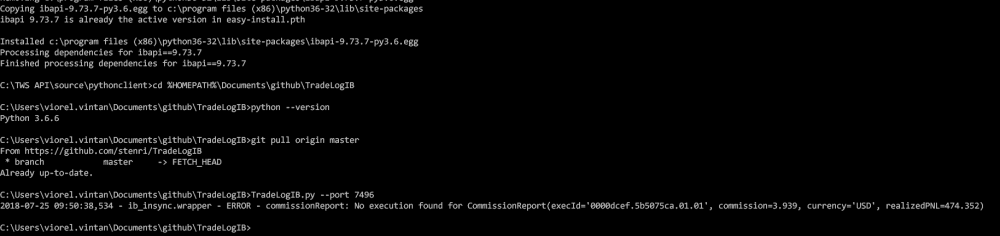

TradeLogIB: Importing Interactive Brokers trades into ONE

BlackBat replied to Stanislav's topic in General Board

No, all transactions more recent than July 19 were processed flawlessly. So, if only older entries are impacted by this error, then having your script running as a daemon should ensure timely entry processing, so we should never run into this issue again. -

TradeLogIB: Importing Interactive Brokers trades into ONE

BlackBat replied to Stanislav's topic in General Board

Got the latest copy, the csv is now generated with non-zero commissions as it should be, good job! However, if I include the transactions from July 19, I run into the following error (I also included some extra info to show the software versions): The transaction causing the error seems to be this one: Have you ever encountered similar issues for some of the entries? Thanks again for the updated version. -

TradeLogIB: Importing Interactive Brokers trades into ONE

BlackBat replied to Stanislav's topic in General Board

Thanks, I will. In the mean time I configured TWS to export the trade log automatically every day and I am working on a script that parses the exported csv and groups trades by the underlying. The target is to have a clear view of the PnL for more complex trades where some of the legs are already closed and therefore TWS doesn't give us an accurate indication of the trade's PnL, for example straddles with multiple strangle iterations. Interesting experiment so far, but I still have more work to do in order to get it into an awesome shape. -

@TrustyJules If you plan for very active multi-legged option trading, with frequent adjustments, it should be noted that on the PureVolatility forums, where such trading is done, they recommend one of Tradier, TastyWorks, EOption OR RobinHood rather than Interactive Brokers, it looks like IB's commissions are still too high for very active option trading. Unfortunately, as far as I can see, only TastyWorks out of these four accepts customers from Belgium. You might be interested in their capped commissions program, too: https://tastyworks.desk.com/customer/en/portal/articles/2802397-international-accounts https://tastyworks.com/pricing.html#capComm I personally have an IB account and am pleased with their service so far.

-

TradeLogIB: Importing Interactive Brokers trades into ONE

BlackBat replied to Stanislav's topic in General Board

Yup, I did that. Later edit: Thanks for the zip, but AFAICT this does not have anything to do with the version of the software components. The fill objects for more recent trades (approximately the last 24 hours) have the commissionReport field properly initialized: commissionReport=CommissionReport(execId='000126e2.5b30f0f5.03.01', commission=0.6678, currency='USD'), whereas older trades have it empty: commissionReport=CommissionReport() I will keep monitoring the situation during the next days. Another question: have you tried to use ib_insync for building other tools, like accessing historical data for automated backtesting, instead of manually simulating certain strategies on previous earnings cycles in ONE? -

TradeLogIB: Importing Interactive Brokers trades into ONE

BlackBat replied to Stanislav's topic in General Board

Hi @Stanislav, thanks a lot for your script, so far it works great for me, too, I was able to successfully import into ONE the csv exported by your script. There is one exception, though: all commissions are being listed as "0". I use: - Python 3.6.6 - TWS API 973.07 for Linux - the latest commit `2b04a67b270513077c6990197fecdf4933e34a91` of ib_insync - the latest commit `77ab5c422849d5101caef12ace76fcd33b2709d9` of TradeLogIB I'm wondering if it's just me or something has changed in some of the components which does affect other people, too. This test in your code returns true for me: if hasattr(fill, 'commissionReport'): so the `fill` object does have this `commissionReport` attribute and it is of type `ib_insync.objects.CommissionReport`. I listed the properties and values of these `fill.commissionReport` objects for each of the `fill` objects returned by `ib.fills()`, they all look uninitialized: fill.commissionReport.commission = 0.0 fill.commissionReport.currency = '' fill.commissionReport.defaults = {'execId': '', 'commission': 0.0, 'currency': '', 'realizedPNL': 0.0, 'yield_': 0.0, 'yieldRedemptionDate': 0} fill.commissionReport.execId = '' fill.commissionReport.realizedPNL = 0.0 fill.commissionReport.yieldRedemptionDate = 0 fill.commissionReport.yield_ = 0.0 I also searched for the word `commission` in the log file generated with --logLevel=10 (DEBUG), but no match. Are you able to get the commissions from IB at this moment? If affirmative, do you use different versions for some of the components? Any hints where I should look next? Thank you!

.thumb.png.e41473ec65d848b8bb05ec415cb90c31.png)