SteadyOptions is an options trading forum where you can find solutions from top options traders. Join Us!

We’ve all been there… researching options strategies and unable to find the answers we’re looking for. SteadyOptions has your solution.

Alan

Mem_SO-

Posts

321 -

Joined

-

Last visited

-

Days Won

2

Content Type

Profiles

SteadyOptions Trading Blog

Forums

Everything posted by Alan

-

@Kim and other users of Tradier/TradeHawk. I just viewed the recent webinar that Lex provided for Steady Options. He went through things very quickly, so I am viewing it a second time. Although I understand that I can have a one-on-one personal session, I would prefer to try and figure out more of the platform first so that I don't waste the personal session. Do any of you know of other recent webinars or videos that I could access?

-

I am also interested in knowing how scalable the strategy is.

-

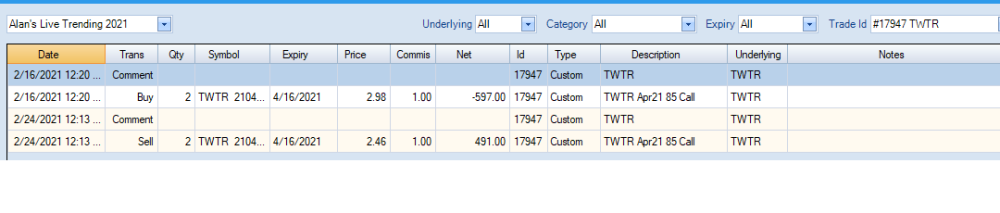

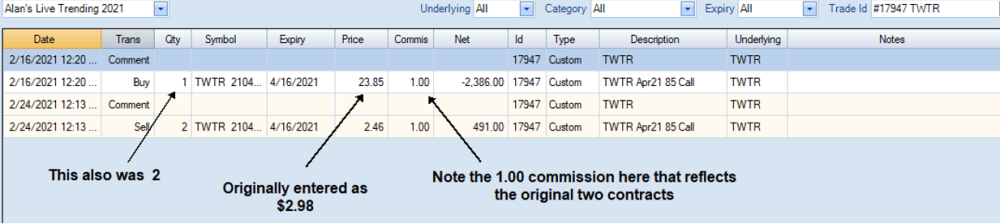

@FrankTheTank, thank you for responding. Since you have not been experiencing this problem and since nobody else has responded that they have been having issues, I surmise that it is something unique to my ONE account. Anyway, here is a directional trade I made on TWTR back on 2/16/21. The first screen shot below shows the correct pricing for my entry & exit after I reloaded the correct pricing and number of contracts: Now, here is the incorrect pricing that showed up when I went back to re-examine the trade. What you are seeing is the copy I had made and showed to ONE support: The pricing was radically changed as was the QTY on the Buy. It has been happening on multiple trades, and I have no idea why. As you might imagine, it is a nuisance. Alan

-

I have done an extremely large amount of backtesting in Option Net Explorer over the years with remarkably very few problems using the software. Invariably, any problem that I have run into is because I did something incorrectly. Over the last couple of months, however, I have noticed (while going back to review old backtested trades) that several trades in the Trade Log (and on the Reports page) were showing entry prices and number of contracts markedly different from the prices showing on the option chain. Although not as frequent, I have noticed the same with the exit prices. From what I can tell the trades involved cover the period from November 2020 to July 2021. Note that this only a fraction of the trades but enough to make it quite bothersome having to reenter the correct prices and number of contracts. I have reached out to ONE support showing them the crazy prices, but they are claiming that it is impossible. They also say that nobody else has reported this. Therefore, I am reaching out to the community here to see if anyone else has experienced the same thing with some of their trades (either live or backtested trades).

-

Has anyone had any experience with or an opinion about Motley Fool Stock Advisor? A review by Wall Street Survivor (can we trust them?) claims that they invested in the Stock Advisor's recommendations from January 2016 to the present and markedly outdid the S&P 500. Here is their review: https://www.wallstreetsurvivor.com/motley-fool-review/

-

Chartaffair.com - RV Charts & Backtesting for Steady Options

Alan replied to Christof+'s topic in Promotions and Tools

@Christof On the bottom of the Earnings Chart page, I can see Historical Straddle Performance. However, I cannot find Historical Calendar Performance. Is this available, and if so, how do I access the chart? -

Assuming one trades within a retirement account, since 2007 the 1x SWP appears to have grown close to 340% (about 11% annualized) with the indicated maximum drawdown of -10.1%. Do you have backtested gain and drawdown stats for the 3x portfolio over the same period?

-

Chartaffair.com - RV Charts & Backtesting for Steady Options

Alan replied to Christof+'s topic in Promotions and Tools

@Christof+ DKNG, which is currently being discussed in SO Trade discussions, does not load up. The message I get is Symbol not active. -

Maybe he his referring to the fact that there will be an inversion of the delta difference (DD) between the long and short. When the trade starts out, the DD is +30 (50 Delta - 30 Delta). Since the short is closer to expiration and is on the steeper part of its gamma curve (since it is OTM its gamma increases faster until it gets to ATM whereas the ATM long which will show a slower gamma increase as it is moving ITM), the short option will see its Delta increasing faster than that of the long option. At some point the short's Delta will exceed that of the long option, and there will be a negative DD. At that point further up movement of the stock causes the trade to start losing. It is conceivable on a very big move prior to the expiration of the short, the trade will lose just due to this DD inversion.

-

@rasar I am with tos and have used them for years. There have been a few hiccups, but, by and large, I have no complaints. That said, as being discussed, it might be good to start using another a broker as a backup just in case. So, since you mentioned having used TastyWorks and recently Tradier, I am curious as to why you are planning to migrate to Trade Hawk.

-

Like many of you I spend hours and hours here on SO & working on my trading, and even though I have yet to really make my mark, I really love the journey. However, when I can pull myself away from charts and reading Kim's & Yowster's posts (and those of the rest of you), I have found myself lately really wanting to indulge in something I used to do a lot - reading great fiction novels. Years ago I read all the Robert Ludlum novels. A few years later I read everything by Wilbur Smith, and I really enjoyed the Harry Potter series. But for the past several years, except for a couple of science fiction novels, I have not been reading. Since I really cannot trust the recommendations of online sites, I thought I would ask my fellow travelers on the trading journey whether they have any good authors that they can recommend. Basically, I am looking for great fiction novels - you know, the ones that are hard to put down. So, any recommendation will be welcome.

-

@rasar, I take it your desktop version came back up. The market just closed. Mine never came back up. I finally was able to get access. Lucky that I had no major action to take. In the meantime I have been attempting to learn how to use the web-based platform.

-

Chartaffair.com - RV Charts & Backtesting for Steady Options

Alan replied to Christof+'s topic in Promotions and Tools

@Christof+ Is there a way to see HV(30) & IV (30) on the same chart? -

@Yowster & @Kim One of the reasons Yowster gave above was that, "Options became very expensive, so it became difficult for many trade to fit into a 1K allocation". If one were able to trade much larger allocations than 1K, are you saying that one would be able to take on more trades and potentially have even better results? If so, is there any chance that these larger allocation trades could be included more in the official discussions? I realize that we have an "Unofficial Trade Ideas" section, and occasionally these larger allocation trades are discussed there - but it is only occasionally. Therefore, is there any chance that the official 10K starting account could be increased to a larger amount to accommodate these larger trades as part of the official discussion? I, for one, would be definitely interested in seeing a larger official account.

-

I used OptionNET Explorer (ONE)

-

I can see how Taleb, by either using far OTM SPX puts close to expiration or VXX calls in a similar way, could have generated 3600%. I backtested SPX using -4 Delta 2-4 DTE puts from 2/21 to 2/28, rolling 30 minutes before the market close each day back into -4 Delta/2-4 DTE puts and trying to limit the trade to no more than 10% of the available open interest (therefore, requiring multiple strikes near 4 Delta & different expirations). Doing so generated 4,000%. However, if left on until the next trading day, the return dropped all the way down to 83%. So, getting in and out at the right time was critical. However, I have no idea how Ackman went from $27 million to $2.6 billion. In the article link it says: Pershing Square used credit protection on investment-grade and high-yield bond indexes to land the massive profits. The assets rise in value as the odds of corporate defaults increase. What could he have used that jumped about 10,000% that had enough volume to accommodate such large amounts of capital? By the way, in case you might be interested, that one week backtest if rolled each time the -4 Delta put reached -10 Delta intraday would have generated over 12,000% (but ending up at -13% if left on until the next trading day).

-

Chartaffair.com - RV Charts & Backtesting for Steady Options

Alan replied to Christof+'s topic in Promotions and Tools

@Christof+ Any chance that the decay rate could be recalculated after removing cycles in 'Exclude individuals EAs from graph'? -

1620% over 13 years is only about 24% per year if the account is compounded.. 24% is very nice but much less than the average at SO. If the 1620% was not a compounded number, then, yes, a very high return - 124% per year.

-

A couple of questions regarding IB: 1) Does IB charge an exchange fee of 0.35 - 0.45 in addition to the commission fee when trading SPX options? 2) Assuming one is trading a large volume, how low can one get the commission rate on equity options (either with an associated ticket fee or without one)?

-

@Kim How many members are there currently?

-

I just called them. The guy told me that there is no monthly fee. I asked him how the firm makes money. He said they have other corporate ways but wasn't able to divulge them.

-

I pay the 0.01-0.02 "Misc Fees" also. I should have mentioned it earlier.

-

@Kim Unfortunately (or maybe not), when you tried to get lower rates at TOS, they were incalcitrant. I tried too for many years. Remember, I was stuck at 1.50. Then all of sudden, probably because of a global change in the competition, they were willing to lower the rates. It was crazy how many of us were able to get down to 0.75 (& some lower). The other thing is the rates under 0.50. If one is trading large volumes, it might be worth going for these lower rates in non-index options. Of course, if IB offers the same, and if the fills, as being discussed here, are better at IB, then it wouldn't make sense to switch. That said, in your recent article about brokerages where you showed a study comparing them all, TOS & IB were exactly the same in all aspects except the commissions. Per the information I seem to be getting, the commissions might be better at TOS if trading very large volumes.

-

@YowsterTherefore, if one is trading a wide variety of options (both equity and index), TOS & IB are more a less a wash as far commissions/fees are concerned for most moderate volume traders. The advantage, if true, is the better fills at IB. What would be interesting is a test. Several of us enter the same exact trade at exactly the same time at IB, TOS, Tastyworks, Tradier, etc., and see who gets filled first & who gets the best fill. Of course, some here have probably already done this. If, indeed, the fills are better at IB, trade index options on TOS & the rest either at IB or the other brokerages if the latters' lower commission structure overcomes any fill disadvantages.

-

@Kim & @sakuraIf the fills are definitely better with IB, that is important to know. Also, the absence of assignment and exercise fees is definitely a bonus. I called IB today to ask a few questions. They told me the following. Please let me know if your experience is different. 1) If one has a 0.70 contract rate at IB & one closes out a short option position between 0.05 - 0.10, the commission drops to 0.50. If the short option is below 0.05, the commission drops to 0.25. I asked if the commission ever goes to zero, and the person I talked to said "no". However, I do believe I have heard IB traders here say that below a certain level they are not charged a commission. For comparison, at TOS there is no reduction in commission between 0.05 & 0.10, but at 0.05 & under there is no commission charged at all. 2) If one is trading index options, IB adds the 0.44 exchange fee per contract to the 0.70 commission. Therefore, the roundtrip cost is 2.28 per contract. I asked if it is possible to negotiate a waiver of the exchange fees if trading large volumes and was told that any negotiation of this would have to be directly with the exchange. I cannot imagine the exchange waiving the fee, but who knows. The person I talked to at IB said that IB would not absorb the fee. This is where TOS appears to be more appealing. If one is at a commission rate greater 0.50, TOS will absorb the exchange fees. If one is under 0.50, they will add the exchange fees. Note that it is possible to get commission rates much lower than 0.75 (i.e. under 0.50) at TOS, but one will have to trade very large volumes. I imagine the same is available at IB. If the fills, indeed, are much better at IB, that argues strongly for the SO strategies where it seems that any advantage in fills can make a significant difference is returns. One of the things that I like to take into consideration when assessing a strategy is scalability. Can the strategy be traded with a large account? It is quite possible that Chris' experience with the fund is a model for trading the SO strategies in large amounts. Hopefully, that is working out well, and he is getting results similar to the SO performance results. It would be nice to know that if I am successful with the SO trades, I would be able to ramp up the account. That said, with the exception of a few equity options with very large open interest, I generally have looked to index options as the way to potentially trade a large account. Of course, that requires finding a strategy that works - I am still looking. However, if one is fortunate to find such a strategy, the large open interest of index options plus their generally higher prices means that that one can conceivably trade a 5 or 6 figure account. That IB does not absorb exchange fess puts a damper on using them for any such index option strategy. For those of you with IB accounts, have any of you been able to get a fee structure without the added exchange fee for index options?