SteadyOptions is an options trading forum where you can find solutions from top options traders. Join Us!

We’ve all been there… researching options strategies and unable to find the answers we’re looking for. SteadyOptions has your solution.

Maji

Mem_C-

Posts

713 -

Joined

-

Last visited

-

Days Won

7

Content Type

Profiles

SteadyOptions Trading Blog

Forums

Everything posted by Maji

-

Thank you @Djtux for the table. I have a general observation/comment that I would like some input from you and the other members. In general, the CML trades appear to be over optimized, imo. It is like choosing the RSI period and overbought/oversold levels that show large profits but for a very small zone. Your table does help to identify the plateaus of profit zone, which too me is a better entry area. Looks like T-5 or T-4 is a better entry with exit around T-2. Do you feel the same way, or you rather go with the backtest results from CML?

- 1716 replies

-

- pre-earnings

- trade machine

-

(and 1 more)

Tagged with:

-

EXPE Post Earnings Straddle - http://www.cmlviz.com/cmld3b/index.php?number=11933&app=news&cml_article_id=20180208_the-option-trade-after-earnings-in-expedia-inc&source=TM_insights Here is the output from Optionslam for the post earnings move for EXPE EARNINGS DATE PRE-EARNINGS CLOSE POST-EARNINGS OPEN PERCENTAGES REPRESENT PRICE CHANGE RELATIVE TO PRE-EARNINGS CLOSE FOR SPECIFIED NUMBER OF CALENDAR DAYS PRICE PERC% 1 DAY 3 DAYS 5 DAYS 8 DAYS 13 DAYS 21 DAYS 34 DAYS 55 DAYS Thu 10/26/2017 AC $147.35 $123.10 -16.45% -15.98% -15.98% -15.39% -16.49% -19.53% -17.17% -17.19% -18.55% Thu 07/27/2017 AC $154.25 $154.44 0.12% 3.4% 3.4% -1.01% -1.88% -4.11% -6.55% -7.0% -7.28% Thu 04/27/2017 AC $136.19 $133.86 -1.71% -1.82% -1.82% 2.04% 3.06% 2.66% 3.71% 5.56% 9.73% Thu 02/09/2017 AC $123.25 $125.01 1.42% -0.48% -0.48% -2.9% -3.11% -2.18% -3.51% 5.05% 1.39% Thu 10/27/2016 AC $126.42 $128.85 1.92% 4.12% 4.12% -0.34% -0.95% -1.32% 0.12% -1.87% -9.14% Thu 07/28/2016 AC $119.27 $113.74 -4.63% -2.19% -2.19% -4.79% -5.06% -4.09% -3.21% -8.51% -9.43% Thu 04/28/2016 AC $106.99 $116.84 9.2% 8.2% 8.2% 8.39% 5.76% 5.29% 1.46% 3.37% 0.92% Wed 02/10/2016 AC $94.35 $100.10 6.09% 9.56% 8.37% 8.37% 13.9% 10.39% 13.12% 23.23% 10.28% Thu 10/29/2015 AC $127.06 $136.16 7.16% 7.27% 7.27% 7.34% 4.92% 1.32% 0.81% -3.1% -0.61% Thu 07/30/2015 AC $107.61 $116.36 8.13% 12.85% 12.85% 15.75% 12.48% 12.23% 10.3% 5.36% 13.5% The last EA lead to a movement of about 16% in 3 days, but before that the movements were much subdued. The current RC of the ATM Straddle for Feb 16 is 11% approx. The IV is 46% and the collapse is to around 26% average. So, my question is... what is an attractive RV or IV that one should look at near the close tomorrow for the EXPE ATM straddle to enter this recommended trade?

- 1716 replies

-

- pre-earnings

- trade machine

-

(and 1 more)

Tagged with:

-

@ykotowitz You are right... my calculations are indeed messed up. Thank you for pointing it out!!! Goes to show how careful I need to be and check over and over again... @NikTam Thanks for posting... my calculations were faulty.

- 1716 replies

-

- pre-earnings

- trade machine

-

(and 1 more)

Tagged with:

-

I am looking at some trades in K that reported by the CML backtester... Nov 2, 2017 Open 2DaysAfterEarnings Short Calls -5 K Dec15`17 65 Calls $0.48 z- $62.38 17.4 23.5 Nov 2, 2017 Open 2DaysAfterEarnings Short Puts -5 K Dec15`17 60 Puts $0.82 z- $62.38 19.3 -30.2 Nov 2, 2017 Open 2DaysAfterEarnings Long Calls +5 K Dec15`17 67.5 Calls $0.15 z- $62.38 17.9 8.9 Nov 2, 2017 Open 2DaysAfterEarnings Long Puts +5 K Dec15`17 57.5 Puts $0.3 z- $62.38 20.2 -13.3 So, you are collecting (0.34 + 0.15 =) $0.49 and risking (67.5 - 57.5 - 0.49 =) $9.51. That is just an absurd risk /reward ratio, imo. There are many more examples like this in the test results. I am not sure if it is really a feasible trade.

- 1716 replies

-

- pre-earnings

- trade machine

-

(and 1 more)

Tagged with:

-

A big thank you to @LloydC247 for helping me out. I wrote to tastyworks regarding fills. Here is what TT wrote back... I am posting it here so that other members can read it and hopefully it will help. I will highlight/bold the takeaway...

- 92 replies

-

- 1

-

-

- tastytrade

- tastyworks

-

(and 1 more)

Tagged with:

-

Thank you guys for your insights... very much appreciated.

- 1716 replies

-

- pre-earnings

- trade machine

-

(and 1 more)

Tagged with:

-

I would like some feedback from SO members who have been using CML trademachine. After I looked at the latest after earnings AAPL trade this morning, I am thinking of canceling my CML subscription. Risk 2.50 to make 0.50 is the premise. Also, I feel these trades CML is recommending are almost cherry picked (read over optimized) by looking back at an established bull market. I am sure they had a few great recommendations but those were mostly directional trades except a couple of ICs. I think I may better spend this money on ONE, if I am looking to do backtesting. Their much hyped squeeze and momentum systems don't seem to be really functional, and they are tinkering with it all the time. It looks like over optimization to me. I am on the fence and would like to know what you all think?

- 1716 replies

-

- pre-earnings

- trade machine

-

(and 1 more)

Tagged with:

-

that is true... I was looking at the Feb 16 straddle.

- 1716 replies

-

- pre-earnings

- trade machine

-

(and 1 more)

Tagged with:

-

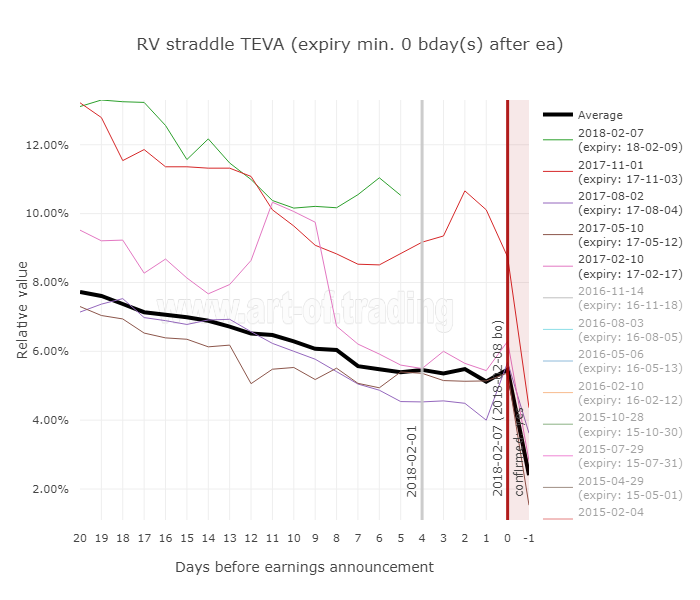

I have a small buy order for the Feb 16 ATM straddle for 2.20, which is at 10% approximately. The mid is around 2.50, so I am not sure if I will be filled. The mean of the one day max move is around 8%, so the 10% is already an overpriced proposition in my mind. Does not look that great in terms of value from the chart attached below.

- 1716 replies

-

- pre-earnings

- trade machine

-

(and 1 more)

Tagged with:

-

What does not kill us, makes us stronger... that is what comes to my mind. I seriously doubt if he is a lawyer based on his writing skills. Usually lawyers need to write briefs and they write pretty well.

-

More tools to analyze the earnings trades: www.art-of.trading

Maji replied to Christof+'s topic in General Board

@Christof+ Thank you for fixing the issue promptly. -

I set up the profit target of the hedged position in its entirety. However, sometimes I have to split them if they are not filled even when the mid is beyond it and it is sitting there.

-

I think trading is about probabilities... if you go through the closed trades, then I think the average straddle/hedged straddle have produced a 10-12% gain on the average. So, a 15% gain is above average and I will be happy to take it. The SO system is based on making small but consistent profits and not home runs. I usually put a GTC of 10% for straddles and 30-40% on calendars, depending on where I entered. Sometimes, I will lower it to 25%, if the trade does not seem to be moving. You can set alerts if your broker/quote system allows that. Other than that, imo, GTC is the way to go if you can't monitor your positions. Good luck.

-

@Djtux Thank you.

-

@anand331 Thank you for the heads up!!

-

Thank you for the clarification. Very much appreciated.

-

During the last three or four months that I have been with SO, I found that most of the time when calendar trades suffer, it is mostly due to stock movement. That is expected. However, what are the drawbacks if we add a second calendar in the direction of the move. This second calendar will be a call calendar if the initial was put calendar and vice versa. For example, we entered CSX 55 put calendars when CSX was at 55. Now, as CSX moved up to say 58, why not add a 58 call calendar to it, provided that the RVs are not too high compared to historical averages? I would like some input from the community here. Thank you.

-

Is anyone here trading on Robinhood? If yes, how are the fills you are getting compared to your previous brokers? Thank you.

-

@zxcv64 I am worried that my overall portfolio is too much biased towards long positions. The SVXY trades added to that bias. Now, if I add those calls, the bias will further increase. The whole purpose of why I try these options trades is to try to be delta neutral. Combine it with my IRA/401-K, I am always net long, but now I am worried about these long side momentum plays. Just trying to see what others think about this matter.

- 1716 replies

-

- pre-earnings

- trade machine

-

(and 1 more)

Tagged with:

-

You nailed it on the head!!! I have an account with Tasty but I don't trade that big of an account to matter. However, this cap is a good thing for traders. Robinhood with their free trades are definitely making the discount option brokers try to do something different.

-

Happy New Year everyone. I hope it brings blessings and good fortunes to everyone of us and to everyone on earth. We really need evil to be banished and I hope it happens this new years. If anyone is in San Diego and/or Southern California and wants to get together sometime, please let me know. All the best.

-

@Yowster Thank you for the great breakdown and analysis.

-

It looks like almost buying a long call... Financials have been on an uptrend, so if I test with long calls, I think I will get similar results. It might be cherry picking, but I will check this idea and see. I have sent a number of reports, especially about CML's squeeze setups, to the help desk and got emails back that they were looking into it but never a resolution. They now changed the squeeze set up significantly. I am starting to think that this thing is over optimized and maybe working in a bull market. We have to remain vigilant while taking these trades.

- 1716 replies

-

- pre-earnings

- trade machine

-

(and 1 more)

Tagged with:

-

I have read that the brokers sell our orders to the exchanges and that is where they make money. That means we are not getting the best possible price in lieu of low commissions/no commissions. However, with limit orders with options we are ready to accept the prices but it hurts if the trades are not executed because of this.

-

Thank you for the pointer.