SteadyOptions is an options trading forum where you can find solutions from top options traders. Join Us!

We’ve all been there… researching options strategies and unable to find the answers we’re looking for. SteadyOptions has your solution.

equus

Mem_C-

Posts

302 -

Joined

-

Last visited

-

Days Won

3

Content Type

Profiles

SteadyOptions Trading Blog

Forums

Everything posted by equus

-

I do play around with limit orders but the numbers they give are way above what I imagined I was doing. Yes, they seem to be mixing the two terms in the very same email. Customer support didn't have much of a clue, I spoke with two different agents.

-

Update: it looks like the three ruling coalition parties have agreed to change the above tax law retrospectively. It seems quite a number of traders in Germany were landed with six figure capital gains tax bills on negative net profits trading options. Best blog I found covering the issue: As reported by the Germany Editorial Network (RND), citing coalition groups, the traffic light parties have agreed to lift the loss offsetting limit for forward transactions, retrospectively until their introduction in 2020. The abolition of the screwed-up loss offsetting should be included in the new annual tax law, which regularly regulates a large number of detailed questions and about which the loss offsetting limit had only come into tax law at the time. https://stock3.com/news/neue-steuerregeln-ab-2021-fuer-derivate-kommt-alles-ganz-anders-8478516

-

Yes, I believe constantly moving limit orders in that way would contribute to the count. According to IB, the following counts as "a single order": A complex order of 8 or fewer option legs; Each option leg of a complex order of 9 or more option legs" It took a bit of digging, but it seems the number of contracts does not change the count. Nasdaq gives an example here: A customer enters an order to buy 10 XYZ6Dec100.0C at 1.00. The customer cancels and replaces the order three times. In this case, the count of orders is four (the original order plus 3 cancel/replace orders). https://www.nasdaqtrader.com/Content/NewsAlerts/ISERics/ISE-RIC-2016-007$Professional_Customer$20160930.pdf

-

Very good free stock screener: https://www.tradingview.com/screener/

-

@MarcoGreat resource, thank you Marco.

-

Just got the following notice from IB. Does anyone know what the consequences are of passing over the threshold for "Professional Customer designation"? Does it mean being on the hook for Professional data subscription fees? This notice is intended to assist with monitoring your U.S. option orders for purposes of the Professional Customer designation. As background, the option exchanges require any retail customer who submits over 390 listed option orders on an average daily basis for a given month to be designated as a Professional. Professionals are then treated the same as broker dealers for purposes of execution priority and transaction fees in the following quarter. Based upon a review of your activity in U******* and any related accounts for the month of Oct 2024, you’ve submitted orders totaling 7078 contracts, representing a daily average of 373 contracts through 25 Oct 2024. Based upon this data, we project that you will meet the Professional classification if your total orders for the remainder of this month exceed 1892.

-

Oops, yes thank you.

- 1061 replies

-

- rv chart

- volatilityhq.com

-

(and 1 more)

Tagged with:

-

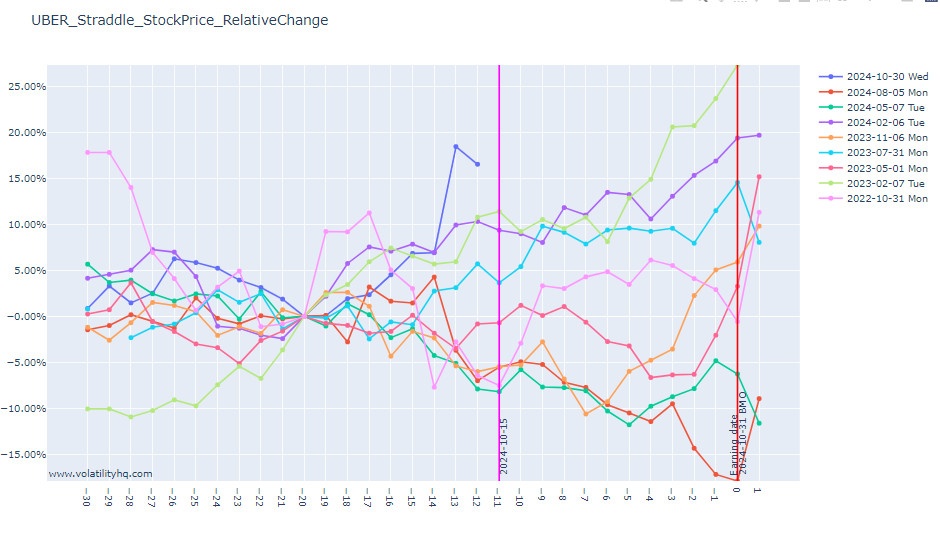

Yes, I did try. But it doesn't seem to change the way the chart is presented. For example, UBER is T-11 right now but with the T-20 setting it still shows the same chart stuck at T-11:

- 1061 replies

-

- rv chart

- volatilityhq.com

-

(and 1 more)

Tagged with:

-

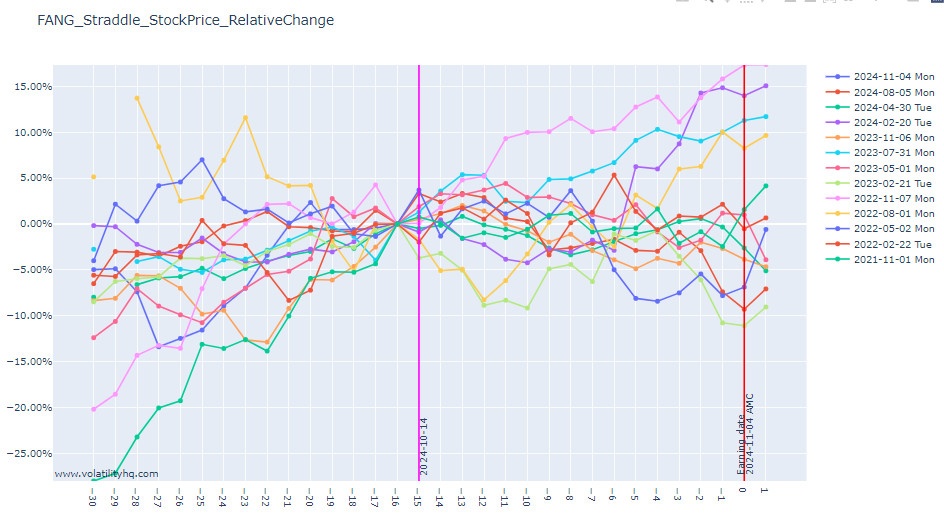

@Djtux Is there any way to shift or offset the vertical pink line to the left or right in the chart? Today is T-15 for this symbol which is great for looking at potential Double Diagonal candidates, but usually this is not the case.

- 1061 replies

-

- rv chart

- volatilityhq.com

-

(and 1 more)

Tagged with:

-

A little cautionary tale to those who might at some point be considering to move to another country and continue trading options - be sure to check the tax rules for options trading before you make the move, even if the country is well regarded. Last year I made the move to Germany and became officially resident, only to find out that the tax laws had been changed a couple of years earlier to make options trading ruinously expensive. When it came time this January to file my taxes here, I discovered that I'm facing a tax bill of some several hundred percent on my trading profits from 2022, which fortunately were only modest. If it had been a good year this could have been ruinous but even so the tax is bill is still going to hurt quite a lot. My tax advisor here (Steuerberater in German) advised me to leave the country. Another possibility apparently is to consider setting up a limited liability company (GmbH) as a vehicle through which to trade, since these regressive tax laws only apply to individuals and not companies. There is a Steadyoptions thread where these tax laws were discussed here. Here is a link to the accountants KPMG on the subject.

-

At the moment SteadyOptions is offering 5 different services. If one has previously subscribed to one of the services but is interested to subscribe to a different service for the first time, is one free to choose a monthly subscription? Am interested in one or two of the other services at this time. Monthly subscriptions are available to new members only. Returning members should select Quarterly or Yearly term. The trial can only be used one time per household per service.

-

More tools to analyze the earnings trades: www.art-of.trading

equus replied to Christof+'s topic in General Board

Wonderful @Christof+ Thank you for listening and responding. -

More tools to analyze the earnings trades: www.art-of.trading

equus replied to Christof+'s topic in General Board

The second decimal place feels quite blunt when looking at symbols with low RVs, for example 0.25%. Having that extra decimal place and therefore resolution might be helpful in such charts. Perhaps an option to switch on and off? -

More tools to analyze the earnings trades: www.art-of.trading

equus replied to Christof+'s topic in General Board

Great work @Christof+ Would love to see the RV percentages in the charts expressed to 3 decimal places. -

I second SeanM - thanks Yowster for the thoughtful analysis..

-

Yowster, to follow up on this what would be the smart play if you found yourself in either situation? Would it be to flatten the shares (selling the shares in the case of the put calendar or buying back the shares in the case of the call calendar) and immediately close the remaining long leg of the calendar? Would it matter whether this was done on the Monday following assignment or later in the week? Thanks

-

Good to have you back Vancouver...

-

Kim, I have question: suppose you enter one of these 2 month VIX 16 PUT calendars and there is no bump in VIX, so you roll the short leg (like you did twice in 2013) and end up with a 1 month calendar. Suppose then that the SPX relentlessly continues to make new highs and VIX stays persistently low. You are approaching the expiry of the already rolled short leg and paper losses are very high. What course of action might you then take?

-

I have backtested the VIX Put Calendar back to September 2006, which is the beginning of the data in ONE/IB. When we have traded it in the past we have typically aimed for an entry price of -0.50 (credit) or better (i.e. more credit). There are 1929 trading days. The table below shows how many of those days showed a particular price, or better, for the 2 month 16 PUT VIX CALENDAR. For example, the calendar showed a price of -1.00 or lower (i.e. even more negative) for 5.7% of the 1929 trading days. CALENDAR PRICE / NUMBER OF TRADING DAYS / EXPRESSED AS A PCNT OF TOTAL TRADING DAYS -0.50 / 335 / 17.4% -0.75 / 217 / 11.2% -1.00 / 109 / 5.7% -1.25 / 44 / 2.3% -1.50 / 20 / 1.0% -1.75 / 5 / 0.26% -2.00 / 3 / 0.16% -2.25 / 1 / 0.05% What is very interesting to emerge are the results for the 7 month period where VIX is extremely and persistently low, from start of Aug 2006 to end of Feb 2007, averaging around 11.00. While the strategy performs well in other years, the backtesting shows that it is a real minefield to trade in this environment in 2006/07, and quite hard to avoid sustaining 50% & 75% losses. During that low-volatility period the SPX was making all-time new highs. As I write the VIX Aug16/Oct18 16 PUT calendar is trading for around -1.80 and the SPX is making all time new highs.

-

If the IB Check Margin facility is misreporting the margin, it raises an interesting question about the margin needed for rolling. If there's no bump in VIX in the next 8 trading days i will need to roll the short leg back a month. When Kim did his roll in May 2013, it was a net DEBIT which INCREASED the overall margin. But now Check Margin is showing such a roll will DECREASE margin by $109! Guess one should assume it will increase rather than decrease margin.

-

Oh well done getting that good price. Guess we'll see how long the low VIX lasts.

-

Thanks for the link Greenspan76. How did you check to see it calculated correctly? I am also in a VIX put calendar and the IB Account Window seems to report a different Current Initial Margin each day as the spread value changes, so it's hard for me to tell what it reported on the day of entry.

-

Kim, with VIX low again (around 12), the mid on the Sep20/Nov15 VIX 16 Put Calendar is around -0.50. In previous trades you wrote (for IB) "Please note that this trade requires $150 margin per spread", which means margin for this trade should be around $150-50=$100. When I use the check margin feature in TWS it shows Initial Margin $52, Maintenance Margin $52 and it is independent of the limit price used! How did you find this figure or information, $150 per spread?

-

Thanks for the possible lead, that will definitely be worth testing out. Kim, i wonder how do you manage to keep track of so many symbols and when they announce the dates?