SteadyOptions is an options trading forum where you can find solutions from top options traders. Join Us!

We’ve all been there… researching options strategies and unable to find the answers we’re looking for. SteadyOptions has your solution.

-

Posts

20 -

Joined

-

Last visited

Recent Profile Visitors

The recent visitors block is disabled and is not being shown to other users.

Dave W's Achievements

Jr.Member (2/5)

2

Reputation

-

Dave W started following 2017 Year End Performance by Trade Type

-

@Djtux, Yes, I think you captured the issue - I was referring to knowing the historical date when the announcement date was confirmed. As you said, the cycle is reasonably predictable. But I think we still have cases with large equities where we don't know if an announcement will fall in week X or week Y. I realize you have other concerns (a number of which you listed earlier in the thread). That said, I'll just be a voice of caution on this topic. I'd prefer to have as little "unknowable" knowledge as possible when we backtest. Knowing the actual date of an earnings announcement 30 days prior to earnings when we wouldn't have really known the date until 20 days prior to earnings could allow someone to come up with misleading backtest results. Hopefully you'll have the data to handle this at some point in the future. You'll have to indulge me a bit on this particular topic; I was a partner in a firm that evaluated backtests, and the process is fraught with danger without adding peering into the future into the mix. I have no doubt the tools will be useful despite what I've brought up. Appreciate you making them available.

- 1061 replies

-

- rv chart

- volatilityhq.com

-

(and 1 more)

Tagged with:

-

@Djtux, The service looks interesting. I signed up to try it out. Getting some scenario-based written training or videos on how to use each chart and table would be very helpful. Ping me via email if you might want help with something like that. One question -- are you concerned that using T-30 days to expiration charts might be allowing you to 'peek' into the future on your backtests? In other words, let's say earnings are not confirmed until 20 trading days, or roughly 1 month, prior to the earnings event. If you show a chart using T-30, you would be peeking into the future by 10 trading days to have knowledge of the right expiration to use to display in the chart. I'm guessing this is why Dustin only used T-10 days -- because the vast majority of tradable options have announced the earnings date by then. Or do you have a source of data so that you would only show T-30 when you know that earnings were confirmed prior to that date? In a perfect world, you would only show T- x days, where X = the number of days prior to earnings when earnings was confirmed. Hopefully the point I'm trying to make is clear; if not, let me know and I'll try to clarify.

- 1061 replies

-

- rv chart

- volatilityhq.com

-

(and 1 more)

Tagged with:

-

@SBatch - Very interested in hearing about your results. Tradier doesn't allow certain transactions I trade so it isn't ideal, but it may still be worthwhile if all I'm paying is $480 a year in commissions.

-

.thumb.jpg.3eca0eee4dc6e9859db7a437c48bcc91.jpg)

Hold-Through Earnings Calendar Trades and Closure Issues

Dave W replied to Dave W's topic in General Board

@Yowster, Thanks for the detailed answer. Very helpful. To clarify one point, ... The point you made, and I agree, is that I am covered by the long leg so I can't incur huge losses. But implicit in what you said, and was really what I was getting at with the quote immediately above, is that any time value in the long option is 'at risk', so the changes in the total value of the long option will not "dollar for dollar" offset the changes in the short stock position. Agreed, with one week to expiration this might not be a huge deal (although $0.10 for 1 week of time could represent a significant part of the potential profit), but I also typically use a 2 - 4 week difference in time between the front and back option when I HTE (the example above was an exception). For me, this is a risk that needs to be considered when I determine whether to do an HTE calendar that I hadn't previously considered (and another risk that typically doesn't come into play in the standard SO pre-earnings calendars). Again, thanks for the detailed answer. Much appreciated. -

@Yowster or others, I'm hoping to get some advice. I occasionally trade unofficial hold through earnings (HTE) calendars and have run into a recurring issue. After earnings, sometimes the price jump in the stock results in my calendar becoming deep in the money. When I try to close out the deep ITM calendar, the market makes it very difficult or impossible for me to close out at a reasonable price. For example, this recently happened to me on RHT. I had an 82C calendar spread March 31 short / April 7 long and at the close before earnings on March 27 the stock price was $82.32. About an hour after the open on March 28, RHT stock was at $86.93. So my 82C were $4.93 ITM. But the mid-price to close out the spread was in a kind-of 'backwardation' (yes, I know that isn't the exact right term, but the situation seems similar). The mid for the short leg was $5.00 and the mid for the long leg was $4.90, so a debit of $0.10 to close the spread. Paying a $0.10 debit to close the spread (or even closing at $0.00) seemed unreasonable given that if I held the short leg through expiration, any premium to close the short options would be gone and hopefully the long option would recover some premium ($0.10 to $0.15 based on my review of other RHT options in different time periods). So I held the spread through expiration and got assigned. I closed out the position the following day using a combo stock / option order on TOS. I'd like someone who has done a number of these HTE trades to help me understand: 1. Has this ever happened to you? How would you recommend closing the trade when the price to close out the calendar spread is "way off" from what seems reasonable (e.g., having to pay a debit to close)? 2. If I do hold through expiration and get assigned, am I still 100% covered by the long option? In other words, will the changes in the long option prices offset changes in the short stock position exactly? I'm guessing the answer is no, but I haven't really looked at this yet and am not sure the best way to model it. I appreciate the advice. Thank you!

-

I'm interested, but based on some answers Kim posted from Tradier, they don't allow calendars on indexes. I do a lot of these trades in low IV. If they address that issue, I'd consider moving.

-

@ocr008 et al, Well, I'm pleasantly surprised. I contacted Kenny Griffin at TDA (Kim mentioned him in another thread). He's in a different position now, but he referred me to two other people and I was able to get the following deal. - $7 ticket charge per trade - $0.65 per contract The new deal will probably save me hundreds of dollars per year. They also gave me the option of a flat $1.00 per trade with no ticket charge, but for me the deal above will be better. Thanks for your help and suggestions!

-

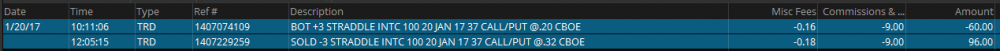

Hi @ocr008 and thanks for the response. Unless I'm misreading my statements, though, $1.50 for me appears to be $1.50 per side - not round-trip. See the attached screen shot showing an example INTC straddle trade. I opened the trade with 3 contracts. Since each straddle includes 2 options (6 total), the commission is $9.00 -- $1.50 per option. When I read what you wrote, I thought maybe TOS/TDA only charges to open and not to close the position, but you can see with the INTC trade it also cost me $9.00 in commission to exit -- another $1.50 per option. (As a related aside, I realize no matter what commissions will eat a huge percentage of low cost trades like this one unless I move to Tradier or something similar.) I'd love to get $0.75 per side (or the deal you have), which would make it more feasible for me to stay with TOS/TDA. TDA offers some IRA account options (i.e., Individual 401k) that IB doesn't offer so it would be easier for me to stay with TDA for at least some of my trading. Any suggestions on getting your deal? (Or from anyone else who gets less than $1.50 per side at TDA?) You didn't say you were getting institutional pricing, so I'm guessing it isn't institutional pricing? Thanks for your help.

-

Dave W changed their profile photo

-

Can you tell me what you did to get this rate? I just spoke with TOS and they said $1.50 per contract with no flat fee was the best they could do. They didn't discuss any structures that included a flat fee. Do you know if you getting institutional pricing?