SteadyOptions is an options trading forum where you can find solutions from top options traders. Join Us!

We’ve all been there… researching options strategies and unable to find the answers we’re looking for. SteadyOptions has your solution.

dwilliams8649

Mem_C-

Posts

13 -

Joined

-

Last visited

-

Days Won

1

Content Type

Profiles

SteadyOptions Trading Blog

Forums

Everything posted by dwilliams8649

-

Well, the reason for that is IBs SMART algorithm for routing orders is a bit SMARTer than TOS's... However, for complex orders, more than 2 legs, I seem to get better fills in TOS. Not sure if anyone else has such an experience. .

-

I think if you can get TOS to around 1.00 with no ticket, it's worth it to leave IB. After all is said and done, IB will be more expensive. If you use IB, most likely you have to go out and buy charting software and a good option's analytics / backtesting package. And most charting software (there are some exceptions) require separate exchange agreements. Plus the money you might lose trying to modify and adjust complicated trades.

-

Well... As of June, I paid 57k in commissions, I spread my account across multiple brokers since then, and my commissions rate has increased. I am currently at .70c with no ticket.

-

If we are trading this on the S&P during a time period filled with 2-3 one-day standard deviation moves and market gap ups/downs of 3-4%, we probably wouldn't experience the ideal result. In such a backdrop, we might need to change the underlying or wait for a better market environment. AAPL during that time, would've been a much safer bet (and would've been profitable). There is no real mechanic strategy that is going to work every time, we must be willing to make adjustments based on the current backdrop/environment. For every 10 trades, if it fails once, well... let's assume that average profit is 40% and every loss is 70%, that's still 29% (non compounded). And from backtesting, it's more better than 10:1... So I think there is still hope. Also I don't think Augen would feed us all the information, but rather, give us a starting point.

-

Thanks Kim... the problem with backtesting is that we will include days that, under normal circumstances, we would skip. Augen mentioned that in his webinar. "If there is some large economic event pending, then enter the trade on Friday." I am curious what would happen if you entered the trade on a Friday morning, instead of Thursday, on the trade(s) that you faced a major loss,.

-

Well, TOS OnDemand uses an algorithm based on actual fill prices at that particular point in history, so for less liquid stocks, it's near impossible to get a fill at the mid, even while backtesting... However, for AAPL, the majority of the fills were at the mid, some were executed right away, some took a minute or so to get filled.

-

Also, from what I know, OptionVue gives 30m historical data. TOS OnDemand is supposed to be tick-level data... So I will check by 30m intervals on TOS OnDemand and compare to your results. If they line-up, as I mentioned there were price spikes of 30%, it would valid some of this backtesting.

-

I think for some strategies, like the one he mentions above, it's the result of the market makers trying to get rid of another inefficiency (the large amount of time-decay that happens over the weekend). So for this strategy not to work, it would imply the existence of another inefficiency. I think that's why Augen likes this strategy. Also, your correct, commissions could be a big issue. I think TOS is negotiable down to .50 with no ticket (you would have to have a large account and trade a lot of volume to get this). IB has a standard .75, tradestation 1.00 with no ticket (but is also negotiable down to about .75).

-

I just used it for Thursday (and in the final 2 hours), just to show how the trade would be done... but you're correct, it should be done on Friday, expiration day (and in the final 3 hours).

-

@chadk, first of all, I just wanted to say thank you... Yes, it was the one with SMB Option's Tribe that was held a few days ago. However, although the live webinar was free, the recorded session is not free2play. And it's supposed to be a time strategy, but not in the tradition sense. The point of it is to bank on the forced price adjustments of market makers to incorporate weekend time decay into the option's price by end of day. Depending on how efficient this was, this trade could be a big FAIL by Monday. For the second strategy, you do the reverse trade at 1pm EST and you're hoping that the stock moves in the final 3hours before close. Gamma is very high, so a slight move in the stock can be very profitable. I've experienced 70-80% returns while backtesting this strategy. Augen seemed to have a fancy on AAPL, and referred to it as a index in its own right. I also don't think slippage would be a problem with an ATM butterfly on AAPL as its highly liquid. During the webinar, Augen used 5 point spaced strikes. The point of the trade is for the middle strike to lose as much value as possible by EOD Friday as the MMs price in weekend time decay. So, it would seem that the 10 point wings would be more profitable generally?? During my backtesting with TOS OnDemand, I would have profit spikes during the day of over 30% on AAPL. As I only used AAPL, I can't really speak on the results of GOOG and AMZN, but I will do more testing on these stocks and on SPY and RUT.

-

-

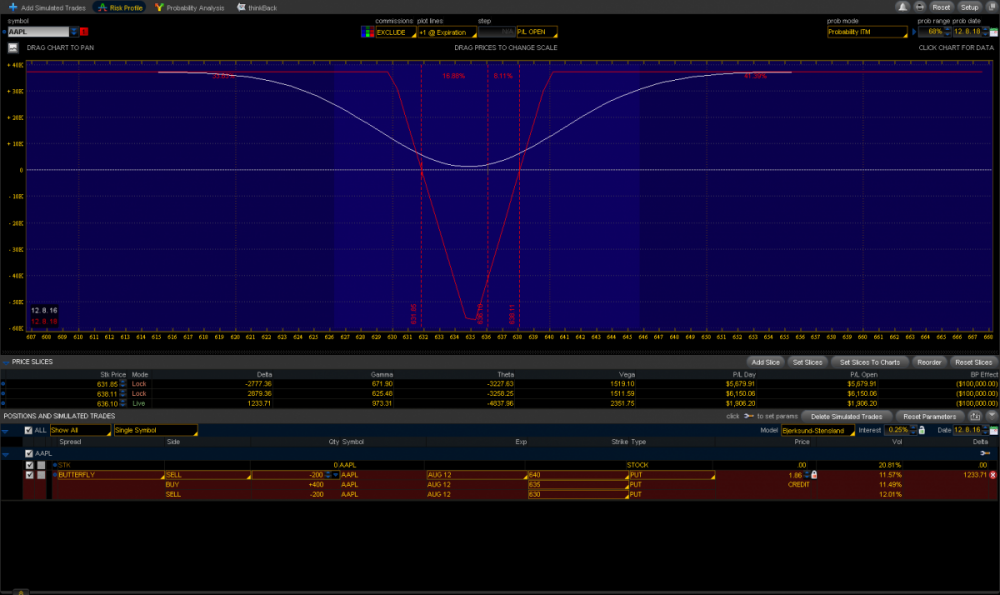

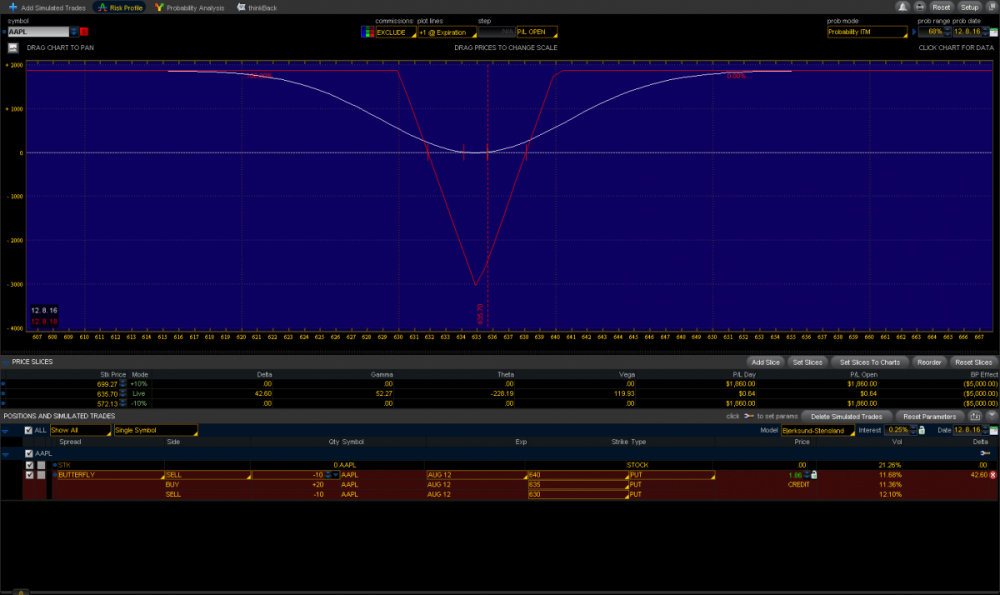

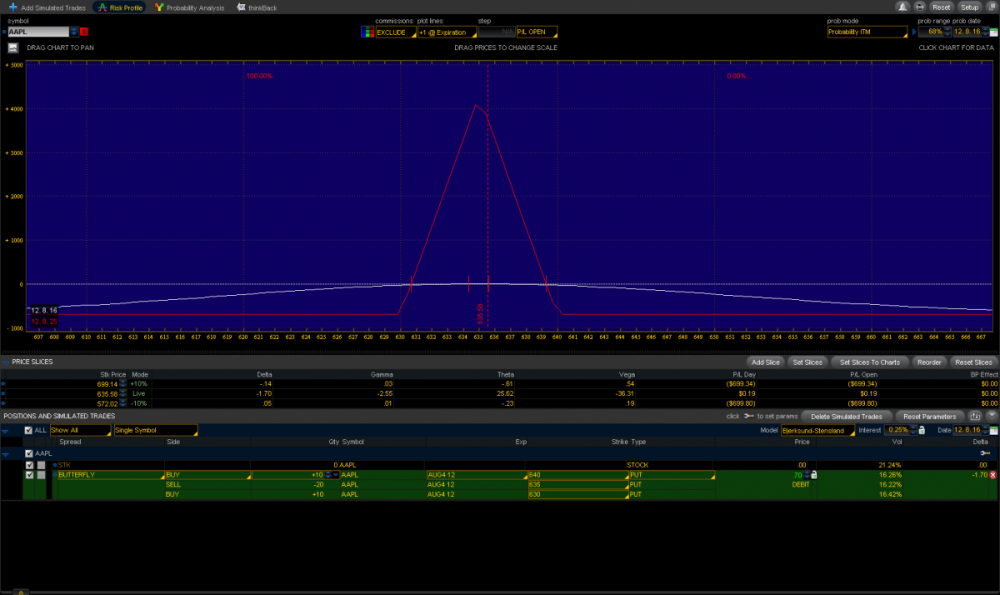

You can clearly see on the second image, on the short butterfly trade, if you look at the white line, for current P&L, you want the stock to move... and you have three hours to get there.... it's a gamma trade. Jeff's point is that time decay holds up better than expected in the last three hours... so any decent move in the stock should be able to offset theta... and on high flyers, such as apple, there is a good chance the the trade could go ITM. A final note, Jeff, said even if the trade goes into the money, it's better to close it out before market close.

-

Hey, Check out the images that I attached... Since it's a net debit trade, and the middle strike (the sold strike) is at the money, you don't want it to move too much.

-

Yes, but I think you have to pay for membership to access the archived video.

-

-

Just one more clarification, neither trade was an iron butterfly. They were strictly CALL or PUTs. Someone in the webinar had a similar question on whether it was an iron or not. and Jeff said, no. This would be the long butterfly that I am talking about. The white line, representing the current profit loss, tends to move up the following day, making the trade profitable even when the stock moves a large distance from the center strike.

-

He did it with with all calls or all puts... and yes, when I say long I mean debit, and when I say short I mean credit. So for the first strat a sample trade would be: BUY TO OPEN +10 AAPL 100 SEP 12 640/635/630 PUT @.30 LMT The second trade would involve taking the oppose trade, a SELL TO OPEN

-

Well, I listened to Jeff Augen's webinar. He toted a weekly strategy that he claims has a 90% and above success rate. His reasons on why this trade is so successful are: Increased market (makers) efficiency in regards to pricing options to encapsulate weekend time decay. According to Jeff, two years ago, it was around 50%. However, within the last year, over 90% of weekend time decay is priced into the options my market close on Friday. The foolish retail investor who tries to sell time decay on weeklies in order to make the quick buck. High index like liquidity of some stocks, such as AAPL. He gave an example using AAPL and AMZN, however, he says these strats will also work on indices. So without further delay... The two strategies that me mentions in order to take advantage of the above are: A long butterfly & A short butterfly Well, sounds simple enough. But like with everything else, timing is key. For the Long butterfly trade, Augen sets the following conditions. Entry Day: Thursday, when new weeklies enter the market. If a market moving event is expected on Friday (the next day), such as a jobs report, then wait until it's over before entering the trade. Entry Time: Thursday by 10:00 Trade criteria: ATM (or close to it) butterfly. Highly liquid stock, well, such as AAPL or GOOG. Exit: He suggests, exiting by Friday close, however, the position could be held until Tuesday (morning?). After which the rapid effects of time decay will begin to take hold of the trade. Well, on my backtesting, I had a very high success rate. I used OnDemand in TOS. I would like to double check the results using another service like OptionVue. But I found it quite hard to lose money. I guess if the stock had a really high open (in the case of AAPL it if the stock gaped up 15 dollars), then we would have to take one for the team. Another thing that I noticed, is that usually I could take the trade off the table by around 10-11 on Friday, with profits. And only on a rare occasion did I have to hold it over the weekend (once, out of over 20 trials). For the second strategy, the Short butterfly Augen suggests the following. Entry Day: Friday expiration day on Weeklies (day 0). Entry Time: Approx 1pm. Trade criteria: A reasonably volatile stock, such as, you guessed it, AAPL. Exit: Well, basically he assumed that within those three hours, that most likely the stock would be ITM or close to it. He didn't give many details, but promised to come back and go into the trade further in another session. Again, using TOS OnDemand, I found that the trade did work as advertised. For my purposes, however, if the trade wasn't profitable after 1 hour, I would do an adjustment by selling another butterfly in the strike right below (upward trending market) or right above (downward trending market) the middle strike of the currently held short butterfly. This reduced my overall exposure and made it easier to profit in the currently trending direction. Well, that's it... The whole process seemed to good to be true, so I am not sure if there is something wrong with the way TOS OnDemand works in these cases, or if the strategy is really this profitable. However, according to Augen, it's supposed to be. Kim (and forum members) please give your commentary, and test this out as well if you can. The only thing that troubled me slightly during the webinar is that when Augen said that he completely gave up on trying to predict the direction of the market and that doing so is a fools game. He would much prefer to hold cash, and trade such strategies (anomalies) when they appear. However, he did talk briefly at one point about some of his indicators (I am assuming the ones that he built) that his subscribers use to predict the bottoms and tops (basically, the direction) of the market or a particular stock. -DW [update] They upload the video to their site... http://optionstribe.com/2012/08/recording-of-how-to-capitalize-on-price-distortions-in-weekly-options-jeff-augen/

-

Trading and getting fills with Interactive Brokers

dwilliams8649 replied to cwerdna's topic in General Board

@Xfanman, I've heard of people using the Tradestation platform to route orders to IB, using the Ninja Trader platform as an intermediary. But that could just be making things unnecessarily complex. -

Trading and getting fills with Interactive Brokers

dwilliams8649 replied to cwerdna's topic in General Board

That's how it's supposed to work.. it relates to the +(BUY)/-(SELL) quirks of the TWS platform. However, you did it correctly. -

Trading and getting fills with Interactive Brokers

dwilliams8649 replied to cwerdna's topic in General Board

@kowski06, I use Advanced Order Management... I actually think that the Mosaic view is harder to use. -

Trading and getting fills with Interactive Brokers

dwilliams8649 replied to cwerdna's topic in General Board

@RobertB, I know what you mean. However, for options trading, the TOS platform is much more efficient, especially for spreads. I would have to equate efficiency with money here. The commissions for IB are lower, however, you have to pay for the datafeed and all exchange fees are passed through (on a per-trade basis). So it's hard to predict how much a particular trade will cost in commissions. TOS, if you are an active trader, allows you to negotiate the commissions. Depending on how much volume you put out, it can be halved. One of the reasons why TOS is more expensive is because the dafafeed costs have to be distributed to everyone. To get a similar feed with IB I am paying around $400-500 a month. If you're a newbie - intermediate trader, paying that much might not seem reasonable. -

Trading and getting fills with Interactive Brokers

dwilliams8649 replied to cwerdna's topic in General Board

For closing out orders in IB the best way I found was to go into Option Trader, then go to the combo tab...click on clear chains, then click on load my chains. TWS will then load only the chains that you have positions in. You're basically doing a buy/sell to close from there on (the opposite of what you did to open the position). I would recommend setting up your profit targets and putting in a limit order before hand (best down immediately after placing your order to open). You can always go to the orders tab, and easily modify and update the order from there, to reflect updated market conditions. You don't want to be doing this from scratch in a fast moving market. -

Trading and getting fills with Interactive Brokers

dwilliams8649 replied to cwerdna's topic in General Board

You should check out the Hoadley Excel add-in. If you combine that with the Interactive Brokers DDE interface for Excel for quotes and order entry, you can have yourself a really nice system. To make good option analytic tools, it would take at least a year of serious coding. I think the Hoadley add-in is a good compromise. If you take a good 2-3 weeks, you can have a combined analytics, quoting, and order entry system. You can check out the Hoadley addin at http://www.hoadley.net/options/optionstools.htm -

Trading and getting fills with Interactive Brokers

dwilliams8649 replied to cwerdna's topic in General Board

I've used all three and a few others... If you are mainly a stock trader, I think all or fine. If you are looking for the most versatile I would say NinjaTrader followed by Multicharts...Multicharts is more powerful especially if you do a lot of backtesting/strategies. Esignal has the best charts IMHO and a pretty good datafeed. TWS for trading options just sucks... especially if you trade a lot of spreads. When it comes to managing/modifying/closing spreads, most of the time you have to do it leg-by-leg or buy/sell to close... TOS is by far the best platform of trading options... I've tried most of them, if not all. Tradestation is decent, and is improving, it's scanners or top notch. And I am currently leasing the platform. However TOS's option analytic tools and entry system has no competition.