SteadyOptions is an options trading forum where you can find solutions from top options traders. Join Us!

We’ve all been there… researching options strategies and unable to find the answers we’re looking for. SteadyOptions has your solution.

dwilliams8649

Mem_C-

Posts

13 -

Joined

-

Last visited

-

Days Won

1

Content Type

Profiles

SteadyOptions Trading Blog

Forums

Everything posted by dwilliams8649

-

Well Well, this does put a bit of a turn on things. For the GOOG fly I would've used a 5 point strike spacing though.

-

Trading and getting fills with Interactive Brokers

dwilliams8649 replied to cwerdna's topic in General Board

Well... I see two solutions: 1. Connect your iPhone to your laptop and use the hotspot feature. 2. Buy an iPad and download a remote control app, such as crazyremote. This will let you control your home computer and you don't have to worry about the mobile TWS, which sucks. Crazyremote is the fastest out of the others that I've tested. Works great on 3G as well. Crazyremote let's you look at your home computer's desktop and control it like a "remote". You can even watch movies... -

For In Augen's webinar he did mention that he would hold some positions until close Tuesday. I really think that we are giving up on this strategy too soon. Another thing that I think we're forgetting is that the "perfect" condition would be a decline in IV rather than a dormant price (although it helps). For example, I was able to close out AAPL long butterfly (660/665/670) today (live trade) at .52, I went in at .42, even though the stock jumped $17 from Friday's close. Next time I will most likely do a 10 point strike spacing, as too much is taken up in commissions with a 5 point spacing.

-

Actually I was able to get out at .52 this morning... went in at .42.

-

Well... As I was explaining in previous posts... the strategy makes money off of IV collapse from the market makers efforts to price in the weekend time decay into the option prices. Market makers do not want to hold onto a position that's going to loss value my Monday morning (all else held equal). Let's say the long butterfly is trading for $1.40 (about 4 hours before market close on Friday) and the weekend time decay is worth .50c. Then by market close on Friday (and all else held equal) the option should be priced at $1.90 or greater.

-

When you said you did such a trade on AAPL, do you mean you opened up an iron condor that expires next week? or was it expiring today?

-

Basically he's saying that sellers are not compensated for the amount of risk that they must take upon themselves during that one week period. Part of the reason for this is because weekly options are not used when calculating the VIX. So actually volatility might be higher than the number the VIX states. The higher the VIX the higher the price of options. So normally you want to buy cheap sell high. But people who sell time decay on weekly expiring options are selling "cheap". So Augen says that we should take the other side of the trade and buy from the "foolish" sellers who are trying to sell time decay through weekly expiring options.

-

An iron condor on weeklies (weekly options that expire in 8 days) would be a "foolish" trade according to Augen.

-

Good point, I am sure the MMs do some gamma or reverse gamma scalping to compensate for their possible weekend losses. But then I suppose that would imply that there would be no change in the spread's value (barring a large movement in the underlying and all else held equal) from Thursday to Monday afternoon. If that was consistently the case, then no one (figure of speech) would want to buy/sell these options on Thursday or Friday, they would wait until late Monday or Tuesday morning. This decrease in demand (bringing down IV), would of course decrease the price of the long options and increase the price of the short options, and thus increase the value of the long butterfly. So I think that over the long run, this strategy has to work. The main problem is that will the profit from this trade be enough to compensate us once we include commissions.

-

Both PCLN and SPY are doing quite well. Especially my PCLN butterfly.

-

The bright side is that if this doesn't happen, meaning that the markets were not efficient, then time decay would have to take hold over the weekend. If this is the case, then we would simply hold the trade over the weekend (and hopefully close it out Monday morning[?] for a profit [hopefully]).

-

This is my understanding of the trade.... The point of the trade is to take advantage of decreasing IV towards market close on Friday. This usually starts to happen from 1pm, but can start to happen earlier. For example if theta on AAPL for a 10 contract butterfly spread is at $25 a day, then IV would have to decrease (i.e. through a forced decrease in demand [by MMs]) towards the end of the session to cover the 2.7 days that the market is going to be closed for the weekend. So basically all else equal, this trade should make a profit of at least $67 (hopefully more). The best strategy to take advantage of this is the long butterfly as it's well hedged on both sides and tends to have a very low delta.

-

I am not sure if that would be a fair test, as the mid did go down to .33/.32 at some points, but for maybe a few seconds, and would jump back up to .45 to .50.

-

10:08:56 PM

-

I went below the mid and started moving up until I got a fill... the mid tends to jump a lot in the morning...

-

I have a GTC at .65... I think we're on the same page here.

-

Well... I think that was the point Augen was trying to make^^, the trade is pretty well hedged against small movements.

-

I got in on the same trade... but at a .42 debit. I went in at the 5 point strike as well. During backtesting I got "quicker" results with the 5 point strike... quicker, as in I was able to close out the trader faster at my predefined T/P. But I intend to do a longer testing time period to get a better/more valid comparison.

-

Jeff Augen's webinar was upload... here is the linke.. If it's something that's not allowed, my apologies KIm [ you can delete it ] http://optionstribe.com/2012/08/recording-of-how-to-capitalize-on-price-distortions-in-weekly-options-jeff-augen/

-

That's what I tried to say in my previous post. It might not be a good strat for low IV stocks. High IV stocks will have a wide range of profitability that extends beyond the outer strikes, so don't need to worry too much in that regard. The goal is to find stocks that have medium to high (but not crazy high) vol.

-

Using it on EOD data takes away the pricing inefficiencies that occur as the market makers try to compensate for emending time decay. And Kim tested it on SPY using tick/min data and it had great results (except for the one major loss, which could have been avoided).

-

Well... the differences arose because the first trade was entered at 1pm CST (2pm EST) and used an Iron Butterfly and when AAPL was 645 (giving a higher credit). The second trade was entered at 1pm EST and used either a call or put butterfly when apple was at 644.20. Augen... well, I am not sure if he was talking about EST or CST... as they were running short on time, he said he would continue his explanation in his next webinar. He started out by explaining the long butterfly in detail... but he seemed equally excited about the prospects of the short butterfly.

-

In my previous post, I called SPY, AAPL & SPY... Actually, I wanted to do AAPL again, even though Chris has it, just to compare entry points and exits.... Because, Augen said you could hold the position until Tuesday... So I think for unprofitable Friday trades, I will hold until Tuesday or until profitable and then compare with Chris.

-

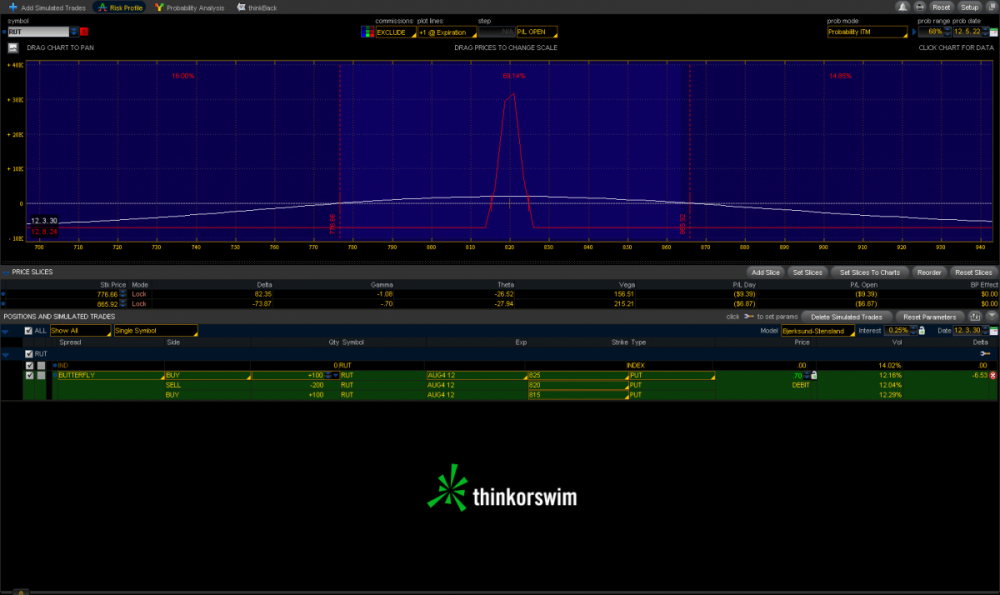

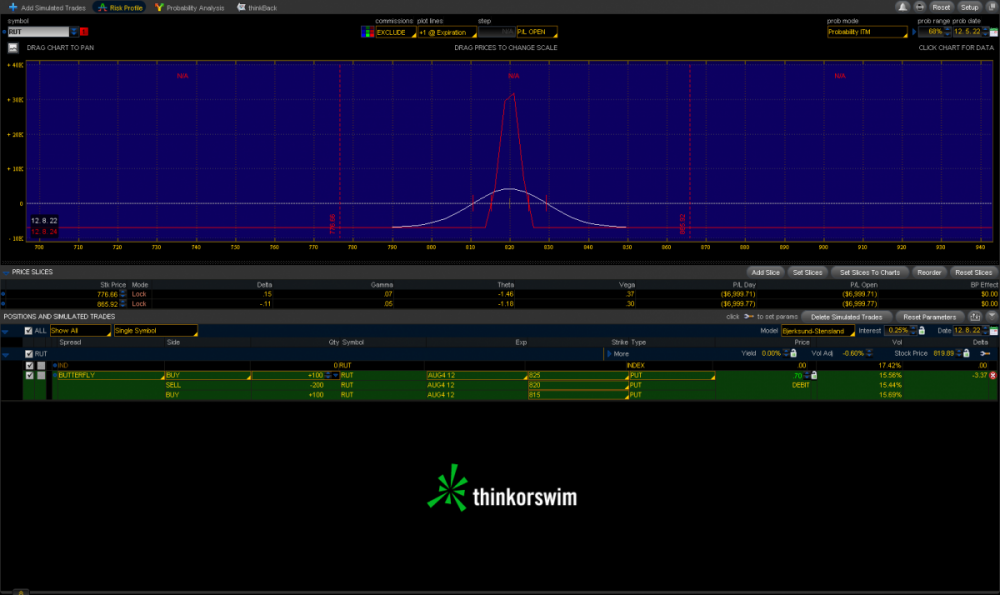

Well... I just wanted to chime in Well...once the trade is opened, the profit zone is not just going to between the two outer strikes, but actually much further for stocks like APPL.... I have attached two images (using RUT as an example), the first is what the trade should look like on Friday if successful. For stocks like AAPL this range would be wider. The second image is what happens once time decay takes over. This usually comes around by Wednesday. So the profitability range has been greatly decreased. The MMs can no longer compensate for the rapid time decay. So the trade is fine, once the stock doesn't do something crazy. I am not sure if a low volatility stock such as MSFT could be considered a better candidate. But I guess that's what backtesting is for.

-

I will do SPY, AAPL, PCLN.... Also, strike price spacing is very important.... we should backtest to find the ideal strike price separation. For AAPL it seems the most profitable are at 5 points wide. That's also the point with the best fills btw...