SteadyOptions is an options trading forum where you can find solutions from top options traders. Join Us!

We’ve all been there… researching options strategies and unable to find the answers we’re looking for. SteadyOptions has your solution.

Amos

Mem_C-

Posts

65 -

Joined

-

Last visited

-

Days Won

1

Content Type

Profiles

SteadyOptions Trading Blog

Forums

Everything posted by Amos

-

@Ordos @Yowster Thanks guys for the replies. You both make interesting points. Yowster I do see what you mean by the higher priced stock as the spreads can be wider for higher priced underlyings. Ordos thats a good point as I didn't think about 1 market maker. Thank you fellas for the replies.

-

I see a lot on this site and others where people talking about a certain criteria for OI(open Interest) and volume for strikes. My question is why even worry about those 2 metrics if the bid/ask is tight? Now I have seen OI and volume on the low side but with a tight bid/ask spread less than 5 cents. If there is low volume and OI according to those 2 metrics why would the spread be less than 5 cents? Wouldn't that indicate a liquid market?

-

Thanks Kim.

-

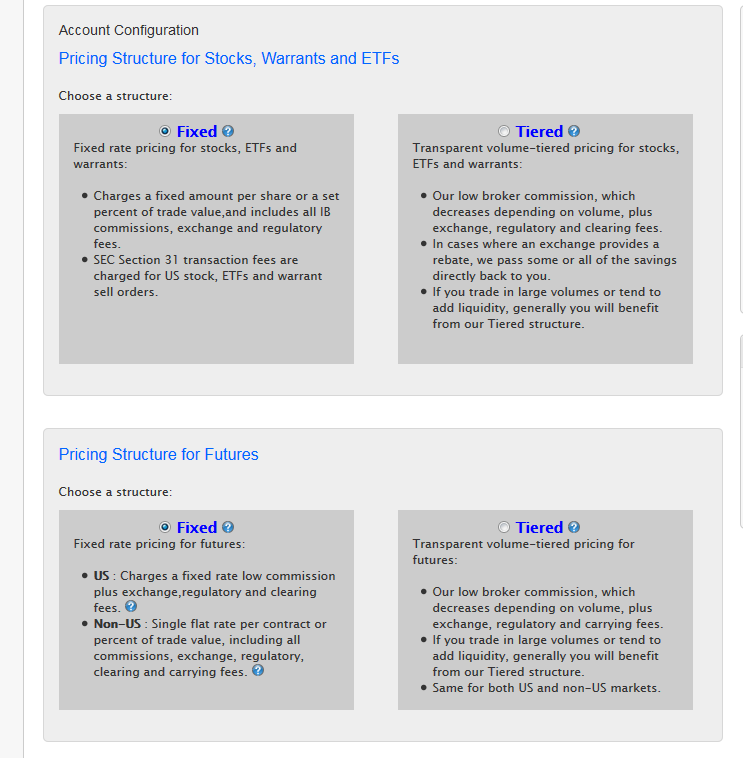

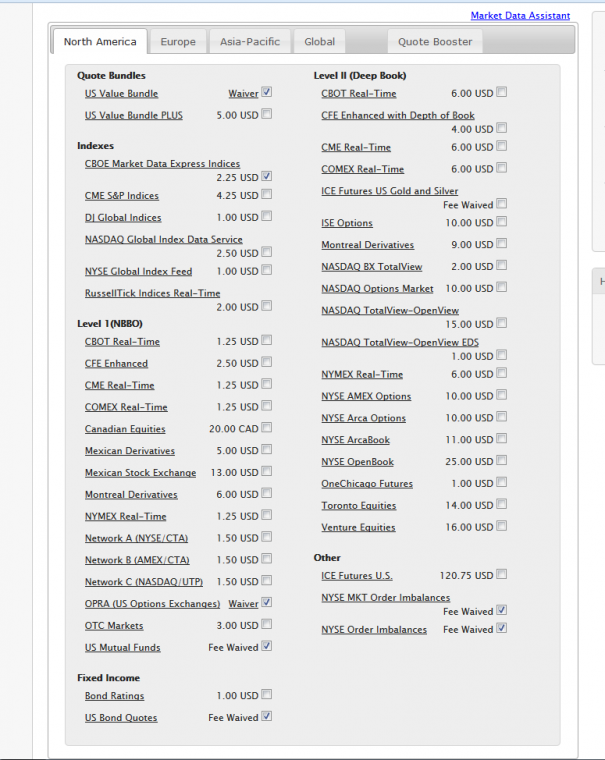

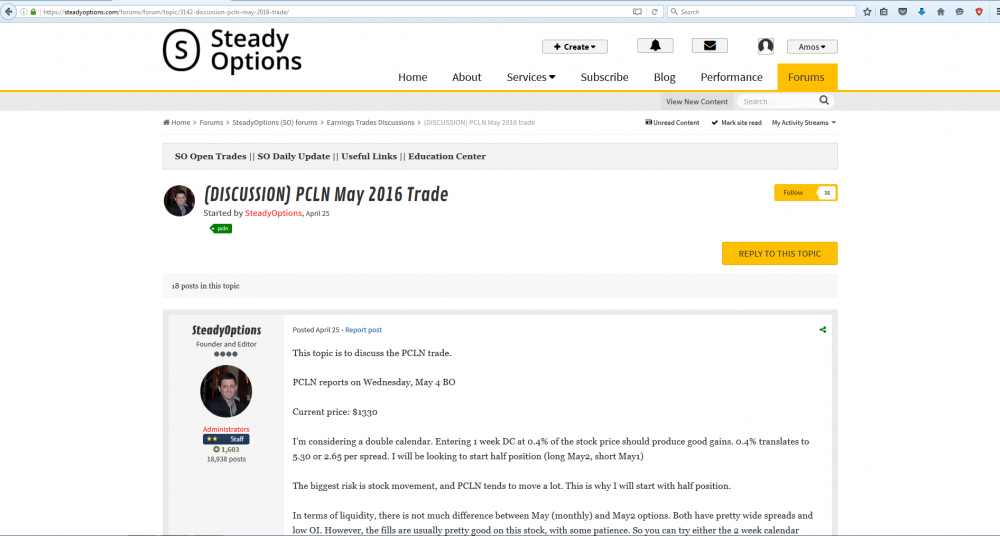

Anybody can hep it would be appreciated. Not sure what everyone is selecting here. I saw Kim had 2 data packages selected on the previous page besides the waived ones but wasn't able to find but one. Also the fixed or tier. Not sure what everyone is going with and if that has something to do with what I hear all of you doing with SMART routing.

-

And I do feel you have a legitimate complaint about what happend to you. You were extorted for more money and he banned you. That is terrible and one of the reasons I am hesitant about any paid service in this industry. And diet industry I swear I lost 3000 pounds total in my life but you couldn't tell lol. Again I like this service and have already got my money's worth. I did gain more knowledge and was able to meet good people. Maybe didn't meet some how I envisioned, but we all got to know each other a little better. IF you ever do mentoring program just be sure to allow potential clients to test the waters. Hell, maybe make them join the forum first for a few months then decide. We agree this world is too hard for others especially after they were promised castles made of gold by the many clowns of CNBC .

-

Well I agree and disagree. A university or high school just does not die leaving the community. With those types of schools you are able to take your credentials with you and continue your education. In Options and in trading general, if a community dies you pissed away 7k in your case. So not only did you get screwed if you paid 7k, you got screwed by a snake-oil salesman and lost your credentials. Sure you may have gained some knowledge but the network is gone and no credentials to bring to another service besides knowledge gained. Then knowledge obtained is a stretch for a lot of these clowns in this service. I can point out 100's of pieces of shit, and yes I am saying that, who rob and steal from people trying to make a living in a world economy that is shrinking due to a massive bubble created by parasitic bankers. The trading world is one of the worse industries on the planet that thrives on individuals with "hope". They didn't coin the terms smart money and dumb money for nothing and throw in retail and institutions as other words. Now is it good value then that is up to you. You do a good deed here by allowing a free trial. That is plenty of time to see if this place is for you. I applaud you for it and which is a reason I am giving this service a fair shake. We will either agree or disagree. That is fine but I have my feelings towards these types of services and it is ok if you have yours. At the end of the day it is my money and it is your money. Some may find value with certain services while others do not. That is quite alright in my book.

-

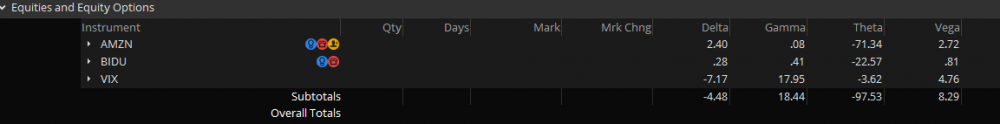

Well what gets me I think is the TOS platofrm. The example above is best way to explain. On TOS platform the Gamma shows .08. Now do you read it as .08 dollars or 8 dollars. And I am sure it is $8. So when I moved the decimal places over I saw theta at -71.34. So is it -71.34 dollars or -7134 dollars. See thats what gets me. Why move the decimal for some and not all.

-

I kind of got confused yesterday with this and was trying to understand the issue at hand. When you say percentage is only meaningful for theta it makes a lot of sense. I will read again the section of the greeks this weekend to see if I am missing something.

-

-

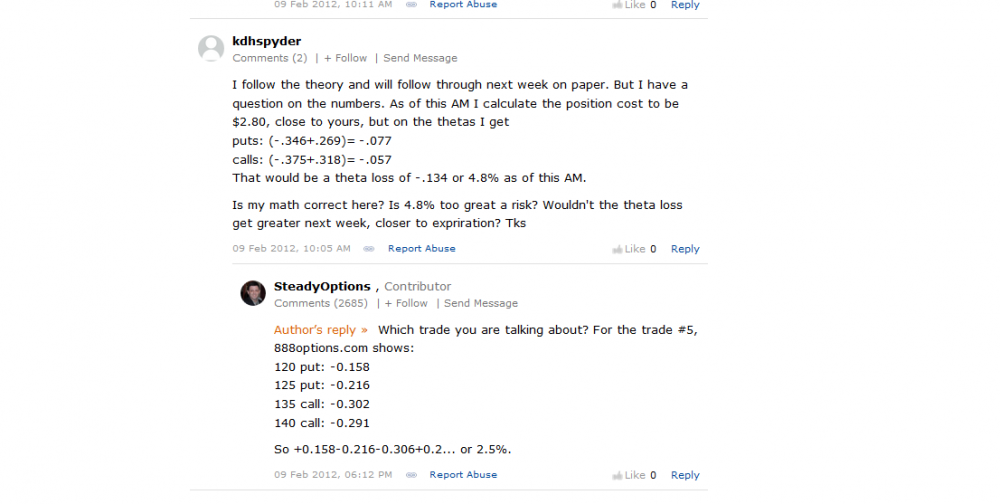

Another example in picture below. Where are you getting the 2.5% from? This is from article about BIDU http://seekingalpha.com/article/346961-5-ways-to-play-baidu-earnings

-

In the example below we have current stock price of Amazon at 752.61 and Bidu at 165.63 My question is for each greek how does this look like in dollars and when I see a theta loss in percentage people use? Example: Amazon stock price 752.61 Delta 2.40 Gamma .08 Theta -71.34 Vega 2.72 Would Delta read $2.40 and would the percentage be calculated 2.40/752.61=.003 or .3% ? Another example is Theta loss. Theta is -71.34. Would it read in dollars -71.34 and theta loss percentage be calculated -71.34/752.61=.09 or 9% ?

-

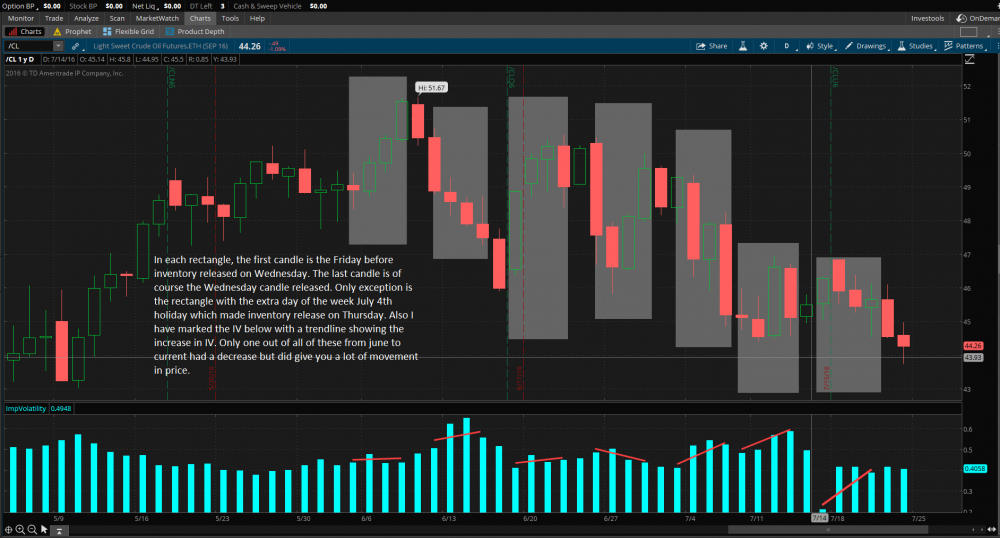

@SteadyOptions I think USO will work. I noticed a RIC could work because you can keep the bounce under the roof. Now will it be profitable as I am not sure. I just don;t have the experience in options to tweak back and forth. I am trying to figure it out as I go but I may be missing key details due to experience. Thank you too for helping me and looking into the idea. Here is a link for anyone who wants to just check the inventory release time. Just click on the little calendar to customize the past dates and if you want to look at something else you can likely find in this calendar. FOMC meetings is another idea that comes to mind as we see a lot of movement when Yellen and company speak. http://www.investing.com/economic-calendar/

-

Looked at USO and it does move at the economic weekly event. I figured out how to back-test some of this, but I believe TOS does not show the Greeks. Well I have not figured out how to show the Greeks when i click on-demand. Anyway I checked some of the straddles and they do work and some do not. I don't have enough Options experience to suggest any idea's which is why I am hoping someone can say here is an idea or this is the most retarded idea in the existence of Options trading. Either way I will likely learn a thing or 2. I just entered the straddle 1 hour before the event as I saw IV is different than CL. I also used the current weekly in USO. Again I have no idea if this is a waste of time or not but wanted to share what I have known for a long time is crude oil moves violently during inventory release at 930am central every Wednesday unless holiday.

-

I am not sure exactly how liquid crude oil options are. I know the futures market is very liquid as you can imagine but on the options side I just do not know for sure. I have looked at USO out of curiosity, but never compared it to the weekly crude oil inventory release. So I need to look if USO moves like CL on this news event.

-

I tired backtesting this strategy but TOS kept giving me N/A on date in options ,and I may be doing it wrong as I am still learning the platform.. I am not even sure it can work. I was just wanting to share this with all of you who may know if this is a good or bad idea in the option world and if a possibility exists to capitalize upon a weekly event that will always occur.

-

Had an idea since I been trying to absorb all this option jargon and strategy. So thinking of my strengths which is chart analysis and knowing when to stay on the sidelines, Options have changed that approach from what I have gathered. Instead of running from a fire, options traders run towards it because it is where the most money can be made like earnings or some significant event like Brexit. With that said I traded futures for a long time and my main instrument was crude oil(CL). I know every week crude oil inventories are released and that was considered my off day due to so much volatility. As you can imagine the word volatility made the light bulb flicker just a tad. Has anyone looked at crude oil(CL or /CL) as a possible trade. I quickly glanced at inventory release for a few weeks just looking at IV on the charts. I was thinking a straddle would be profitable. The setup I noticed without any back-testing but just looking back at the past 6 weeks is enter the prior Friday and close shortly after inventory release. I have seen inventories shoot all over the place a 100 ticks in mere seconds. Plus as I stated the IV starts to climb on Friday evening it seems and tends to peak by Inventory trading day close which is mostly on Wednesday. So to clarify with the recent example on when to enter and exit please see below: Crude oil Inventory release date this past Wednesday was on july 20th Enter trade by pit close on Friday July 15th.(straddle) Now wait for the July 20th Inventory release which is at exactly 930am central time. Then after it happens look for a nice gain and close. Not Sure how this trade would pan out which is why I am asking all of you, what is your opinion and has any one looked into it. This news impact happens every Wednesday unless holiday occurs during the week which usually puts the event on a Thursday. If no holiday it is always on Wednesday at 930am central time no matter what. Again nothing is set in stone with the above possible trading setup. Just curious if anyone has tried to figure a method around this economic event that triggers massive moves and IV increase.

-

I believe you need to be in live trading and not paper account.

-

If I am reading this correctly, this is my summary I gather from the initial post: For a Straddle, we want the price of the underlying to be $20 or less. For a Strangle , we want the price of the underlying to be between $20.01 and $99.99. For a RIC, we want the price of the underlying to be above $100. Would this be a correct assumption?

-

Are you looking for a certain IV or any other variables to consider selling options for the premium? The reason I ask is when IV is low options are cheap and when high they are expensive.

-

That makes me feel better knowing my simple math skills were ok. Yeah my next debacle is understanding software as I am using TOS but have used Ninjatrader forever. I thought I was smart using automated trade management in Ninja when I figured it out. Now its back into the frying pan. Thanks again Mr. Kim for the fast response.

-

This is my first post and I am trying to wrap my head around a lot of the math involved with what everyone is doing around here. Mr. Kim I do have a question. In the above example, we have this shown " However, we should reduce it by two days of negative theta ($14*2=$28), so the next result should be increase of $224. " In the bold text above where did you get the negative theta number of $14. I can't figure it out. The only way i have got close is using the above example supplied negative theta of -$23 . I just took the -23 and multiplied by 2 days =$46. Took $46 and subtracted it from $252 = $206 for the final result. Am I doing something wrong getting this number because I can not figure out where 14 is coming from for negative theta. Not sure if I am missing some formula. If anyone can chime in that would be great. One last thing, does anyone have a pdf or some cheat sheet with all the math formula's used with examples. I appreciate in advice and help from the community and really look forward staying here as in my 2nd day of trial, I find the info valuable although overwhelming. This is coming from someone who traded futures and forex for a decade. That was actually simple compared to options but the attraction towards numbers instead of candlesticks just feels right and the true meaning of reading the tape. Thanks again everyone for posts I am able to learn from and hopefully one day I can contribute to the community.