SteadyOptions is an options trading forum where you can find solutions from top options traders. Join Us!

We’ve all been there… researching options strategies and unable to find the answers we’re looking for. SteadyOptions has your solution.

JoeA

Mem_SO-

Posts

137 -

Joined

-

Last visited

Content Type

Profiles

SteadyOptions Trading Blog

Forums

Everything posted by JoeA

-

@Djtux I love your tools and use them every day. I notice that some of the tools are under a "Beta" heading. Does this mean there are further plans for them? If so, can you tell us what they are? Does "Beta" mean we should be wary of the results we receive for those tools? Thank you so much.

- 1061 replies

-

- rv chart

- volatilityhq.com

-

(and 1 more)

Tagged with:

-

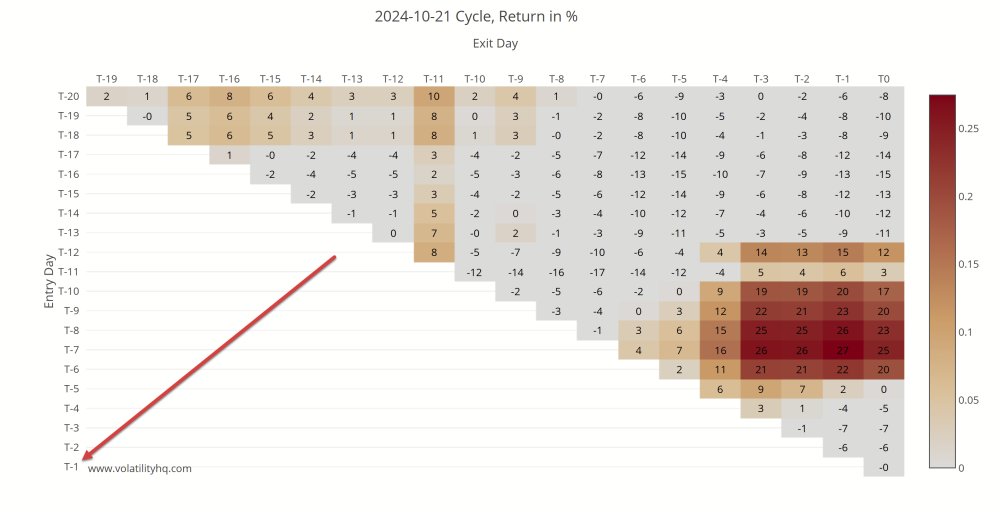

@Djtux @Yowster On the Return Matrix, when the vertical axis says "Entry Day", is the price used the price at the beginning of that day, or at the end of that day? I am doing some work on T-1 to T-0 Straddles, and the entry price on T-1 makes a big difference as to whether it is Start-of-Day or End-of-Day. Thank you.

- 1061 replies

-

- rv chart

- volatilityhq.com

-

(and 1 more)

Tagged with:

-

On the Earnings Feed, what is the difference between the two columns? Some stocks, like META, appear in both columns. Thank you.

- 1061 replies

-

- rv chart

- volatilityhq.com

-

(and 1 more)

Tagged with:

-

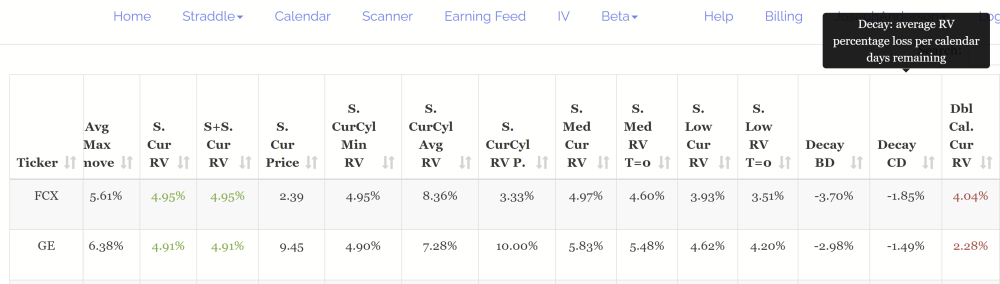

@Djtux Thank you. That helps a lot. Just to be clear, I mentioned the Straddle Current RV, 4.95%, in my question, but you replied with the Straddle Median Current RV, 4.97%. Not trying to split hairs here, but I want to make sure I am using the correct column. So the Decay CD column is *not* using the Current RV of the current cycle, but rather the Median Current RV, i.e., the black line Current RV. Is that correct? Thank you for your help.

- 1061 replies

-

- rv chart

- volatilityhq.com

-

(and 1 more)

Tagged with:

-

@Djtux Can you please tell me how the Decay CD is calculated here? It says "Average RV percentage loss per calendar days remaining". The current Straddle RV is 4.95% The Straddle Median RV, T = 0, is 4.60% . So I don't understand how the Scanner is calculating Decay CD as -1.85%. Thank you.

- 1061 replies

-

- rv chart

- volatilityhq.com

-

(and 1 more)

Tagged with:

-

@Djtux For the double calendars, what are the Deltas of the two calendars that are being used, and are they puts or calls? Thank you so much.

- 1061 replies

-

- rv chart

- volatilityhq.com

-

(and 1 more)

Tagged with:

-

@Djtux Is there a way to preserve the choices I make in the Advanced Options? I always want to set " Show stock price change" to "Relative Stock change", but it seems I have to reset that each time I return to the VolHQ website. I believe it defaults to "Hidden". Thank you.

- 1061 replies

-

- rv chart

- volatilityhq.com

-

(and 1 more)

Tagged with:

-

@Djtux Is it possible learn the identities behind Source #1, #2, #3, etc? I prefer to follow the guidance given by OptionSlam and it would be helpful to which one it is.

- 1061 replies

-

- rv chart

- volatilityhq.com

-

(and 1 more)

Tagged with:

-

I do that but it does not "stick". I have to redo the selection for every chart I run. Does it "stick" for you?

- 1061 replies

-

- rv chart

- volatilityhq.com

-

(and 1 more)

Tagged with:

-

When clicking on a Straddle link for a stock in the Scanner, is it possible to change the default setting for the charts that appear from "Median" to "Average"? I prefer "Average" and can't find a way to make that the normal way of displaying chart information. Thank you.

- 1061 replies

-

- rv chart

- volatilityhq.com

-

(and 1 more)

Tagged with:

-

The Scanner for the VolatilityHQ tool gives RVs for double calendars in its results. What are the deltas that are used for placing the two calendars on each side of the ATM strike? @Djtux @Yowster Note: I meant to put this in the VolatilityHQ thread and not as a new topic. Sorry.

-

cwelsh, One of things I am unsure about with Kim's approach is the low number of contracts traded.I know Kim is only doing 3-5 contracts, in order to stay within the 10% allocation of a $10K portfolio. I need more than that to make SO a meaningful portion of the portfolio I am responsible for. So I was surprised and interested in your volumes. Are you typically trading 300+ contracts in many of the SO straddle trades? Thank you.

- 92 replies

-

- tastytrade

- tastyworks

-

(and 1 more)

Tagged with:

-

Thank you, djtux and Yowster. The matter is much clearer to me now.

- 1061 replies

-

- rv chart

- volatilityhq.com

-

(and 1 more)

Tagged with:

-

In previous discussions by Kim, I thought a double calendar was two different strikes near each other, e.g., 100 and 105 for IBM. Each could be either a put or a call calendar depending on how expensive they are. But your answer implies a double calendar is both puts and calls at the same strike. Am I misunderstanding something? Thanks.

- 1061 replies

-

- rv chart

- volatilityhq.com

-

(and 1 more)

Tagged with:

-

Given the SO methodology, is it important to consider the RV of a double-calendar? I don't know if your site provides RVs for double calendars, but reading through a lot of the past trade discussions, it seems like Kim puts a lot of value on pricing a double, as opposed to a single, calendar. Thank you.

- 1061 replies

-

- rv chart

- volatilityhq.com

-

(and 1 more)

Tagged with: