We’ve all been there… researching options strategies and unable to find the answers we’re looking for. SteadyOptions has your solution.

-

Posts

120 -

Joined

-

Last visited

-

Days Won

2

Content Type

Profiles

SteadyOptions Trading Blog

Forums

Everything posted by RobertB

-

Good suggestions, Victor. I haven't tried it myself, but my guess would be that ONLIVE would provide performance similar to VNC-type programs (such as RealVNC and Windows Remote Desktop). ONLIVE's implementation would be very similar to those sorts of apps, although perhaps optimized in some fashion. Sharing your Windows Desktop to your tablet is very simple. On the Windows side run RealVNC or Windows Remote Desktop. On the tablet (or Smartphone, for that matter), run AndroidVNC, which you can download from Google Play Store. If your tablet runs iOS, the Apple store probably has a similar ap. I use AndroidVNC all the time on my Galaxy S4 smartphone (five-inch screen) to access and run Windows apps throughout the day on one of my home Windows machines. It works really well. I'm sure the user experience would be even better on a tablet with its larger screen.

-

Have you tried running IB's WebTrader browser-based program on your tablet's browser? Although nowhere near extensive as the full desktop TWS app, I believe you can still setup most combos within it. If when trying this your tablet's browser attempts to revert to mobile mode, which may present reduced functionality, there is usually a browser option to force it to seek the desktop version of a web site instead, regardless of the fact that you are coming in on a mobile device. I haven't tried this for a while, so I can't vouch for this at the moment. But it seems like it might help you.

-

Yes, a software update could very well be the cause. That's great that TOS says that ThinkBack should still go back beyond '08. Hopefully, they'll fix it for you soon. However, I have had mixed results with TOS's promises about data fixes.

-

Chris, I just tried to go back to 2007, and I cannot either. In fact, it returns a Java programming exception having to do with a null pointer. This probably means that the Java programming code expects to see the older data there, but cannot find it. So either TOS has removed the old data without updating its Java programming code, or the data is there but the Java code cannot find it. For the latter case, this could happen, for example, if the older data has been recently archived with the intention of its still being available, but the programming code isn't accessing it properly. These, of course, are just guesses by me (someone who has seen just about everything when it comes to software and data issues). You'll probably have to find out officially from TOS itself.

-

Hannes, About 20 minutes ago, my spread quotes disappeared too. I called IB. Tech Support said to enter Ctrl-Alt-F (if you're on Windows) to refresh, but that didn't work. So I restarted TWS, and then my spread quotes returned. I asked the tech support person how I would reset the quotes without restarting TWS, but he had no answer.

-

Red Option "newsletter" (part of Thinkorswim/TD Ameritrade)

RobertB replied to cwerdna's topic in General Board

So many people get very confused with probabilities. Those with no formal education in the subject can get definitely confused. But even those with a formal education in the subject easily can get off track. One area of confusion I see often is people thinking that processes, such as stock movement, follow probabilites, instead of probabilities describing processes. Probabilities are just mathematical descriptions based on past history and other considerations. The processes themselves know nothing about the probabilities. They don't know when you had started counting your sequence, for instance. They have no memory. How about the so-called gambler's paradox. A gambler is watching a roulette wheel and notices that it has landed on black ten times in a row. He knows that the odds are 50/50 (ignoring "0" and "00" for the moment) between landing on a black or a red for each individual spin. He also know that the probability of getting ten blacks in a row is 1/1024 (2 to the tenth power is 1024); that is, virtually zero. So he thinks that FOR SURE the next spin has to be a red since the chances of NOT getting a red in 11 spins is virtually zero. What the gambler has forgotten (or, more likely simply ignorant of) is that the roulette wheel has no memory. For each individual spin the chances are 50/50 between red and black regardless of the recent past. So even though it is true that BEFORE THE 11 SPINS there is an exact probability of 1/2048 that in 11 spins of a roulette wheel you would get 11 blacks in a row, once the first ten have occurred and you notice all blacks, you cannot say anything about the next spin other than that there's a 50/50 chance for either black or red--just like all the other spins. Again, the roulette wheel has no memory of what has occurred prior. The same is true with stock market probabilities. Even if they were exact like the roulette wheel (and stock market probabilites are surely not exact), you can use them only as guides into the future for a particular time range. But once the stock movement has started to occur, you need to at the very least recalculate the probabilities for whatever range of time is still of interest to you. If the stock hasn't moved as much as it was "supposed to" have during the initial part of the time range, you cannot assume it will "make it up" in the latter part. If you think this, you are falling victim to a version of the gambler's paradox. One more thing: Along the lines of what I just said, I've seen traders completely misuse probabilities and standard deviations when attempting to make correct market decisions. I once read a pseudo-scientific article written by someone whom I believe was sincere. But ... oh so how misguided! His system went something like this. Throughout the trading day he constructs a bell-shaped (normal) curve of a stock based on its intraday movements. If a majority of the bell curve seems to be being built on either the left or the right side of the bell, he says there is a great chance that the rest of the bell "has to be" built on the opposite side. Thus, he would use this "knowledge" to day trade the latter half of the trading day. The errors in his thinking are numerous. One of the errors, of course, is that the stock movement doesn't "know" its on someone's left- or right-side of a bell. Indeed, if he had instead constructed a bell in real time with a total time range of only the first half of the day (instead of the full day), he would have ended up with a completely different bell that is is "filled in" on both sides. Everything about his method is arbitrary including the time range. There are an infinite number of time ranges and an infinite number of possible histogram bin possibilities when constructing your histogram. Yet he swore by this "scientific" system. Lots of ignorance abounds.- 27 replies

-

- 2

-

-

- red option

- newsletter

- (and 6 more)

-

Red Option "newsletter" (part of Thinkorswim/TD Ameritrade)

RobertB replied to cwerdna's topic in General Board

Thanks for the further information. Looking at the trade excerpt you posted, I don't see that as a good trade at all. Perhaps there are other aspects to the trade that you didn't post, but assuming the probability analysis is based around expiration time, the numbers don't add up in your favor. Assume you did that trade 100 times. 64% of the time your short position expires worthless and you profit. 36% of the time it doesn't. That means that out of 100 trades your profit would be (64 * 0.51) = 32.64, while your losses would (36 * 1.49) = 53.64. The probabilities are definitely not in your favor. Not to mention the huge risk of a drawdown occurring. To answer your question, I never traded any of their recommendations after analyzing the trades they offered. It simply appeared that they find trades that have a high probability of success, while ignoring risk. For example (and I'm just making this up on the fly): Suppose I were to toss a fair coin six times. My offer to you is that I will pay you $1000 if at least one tail appears during the six tosses. But you have to pay me $75,000 if the six tosses all come up heads. That would be a bad bet for you take because if you were to take this bet 64 times (which is the number of combinations of heads and tails possible), you would expect to gain $63,000, but lose $75,000. Eventually, probabilites do catch up with you. And my experience three years ago with Red Option was that the kinds of trades they provide are really no different from that coin toss example. In the coin toss example, you have a 63/64 chance of winning the bet, but when you lose 1/64 of the time, you lose all your profits and more.- 27 replies

-

- red option

- newsletter

- (and 6 more)

-

Red Option "newsletter" (part of Thinkorswim/TD Ameritrade)

RobertB replied to cwerdna's topic in General Board

cwerdna, I once accepted TOS's trial of Red Options, and I was very unimpressed with their methodology. This was about three years ago. Perhaps it's different today. But they seem not to understand the nature of probabilities and options market pricing and risk. They made a lot of statements that were foolish and ignorant. (again, this was three years ago). For example, they would say things such as, "This trade has an 80% chance of being profitable" without accounting for the trade's risk and reward properly. Over time one would expect in aggregate either a wash or a loss if i recall from my tests. When I called them up to discuss any of this, they didn't really seem interested. If they are still making their picks in the same way, I would attribute your recent success with them as pure luck.- 27 replies

-

- red option

- newsletter

- (and 6 more)

-

mks212, If you search this site for words such as Interactive Brokers, IB, TOS, ThinkOrSwim, you'll find a lot of discussions about some of your questions. Perhaps someone will post a few links for you to some of these areas. TOS is much easier to learn than is IB, but IB has lower rates and (in my opinion) better fills. If you find TOS confusing, just play around with it some more in paper trading mode. Most people find that they have very few complaints about TOS's interface.

-

Free kindle book on Amazon: Systematic and Automated Option Trading

RobertB replied to Ken's topic in General Board

Are you sure you've downloaded the entire book? It appears to cost just under $90 for a Kindle edition, at least that's what my link says. There is a free sample, but not the entire book. Unless I'm looking at the wrong link. -

This may not be related, but I'll mention it anyway. Oracle pushed an updated version of Java to Windows machines in the past few days. TWS, and the charting feature in particular, is heavily dependent on Java. There may be an issue there. If your trading is really being hampered by the chart feature's not working, you might try a Windows system restore to restore your Windows system settings (which includes Java versions and Java settings) to an earlier time before the Java update. This just takes a few minutes, and you can easily undo it. Just go to Control Panel and search for "Restore your computer to an earlier time." Or, you can try uninstalling Java from Windows Control Panel. Then, go to the Oracle site to download the previous version of Java and install it. Of course, the problem you're encountering may have nothing to do with Java. But I've seen problems like this before immediately after the push of an updated Java.

-

I once grilled IB support for precise information about their data fees and minimum commission fees based on how much in commissions you had generated for them. Here are my notes: 1) These fees are billed during the first week of the following calendar month. 2) Data fees (possibly waived, see below) are applicable if at any time during the previous calendar month you were a data subscriber for any length of time. Unsubcribing and re-subscribing within a calendar month does NOT generate two possible charges. 3) IB has a per-calendar-month $10 minimum-required total commissions. If you are below $10 in total commissions for that month, you pay only the difference between your total and $10. For example, if your trading had generated $6 worth of commissions that month, you pay only $4 extra to meet this requirement. 4 To have the $10 data fee waived, you must generate $30 worth of commissions within the previous calendar month. If you do not meet this requirement, you pay the full $10, not the difference. Thus if you had generated $29 worth of commissions that month, you wouldn't just owe $1, but the full $10.

-

A Comment on Kim's Latest Performance Alter E-mail

RobertB replied to tjlocke99's topic in General Board

I completely agree with the sentiment of everyone who has written here. It is obvious to each of the members here that Kim really provides an A+ service. It's extremely rare to find a trading site such as SteadyOptions where the person running the site shares virtually everything he is doing with his subscribers. From beginners questions to advanced, Kim is willing to give his experienced answers and advice. And the fact that he provides his exact trades within minutes to his subscribers is indeed very rare. So many sites seem to be run by those who do not actually place the trade (they've become "writers" of the market instead of "traders" of the market). Kim always places his trade. The performance numbers he provides are real and tangible. There are no surprises here. Also, although Kim's options knowledge is clearly and demonstrably super-advanced, he is always willing to learn new techniques and hone up his current ones. In a dynamic trading world this characteristic is a must. And we all benefit from it. I don't see anything particularly worrisome about a few relatively bad weeks of trading. In the long run these are a blip on the graph. To be sure, it's comforting that Kim is always keeping his eyes on the total performance and worries about it, but a few bad weeks should not concern any subscriber here. SteadyOptions subscribers have learned that these trades are not guaranteed but do have a very high likelihood of success. This fact hasn't changed simply because of a few relatively under-performing weeks. Consider that even though the expectation one has when flipping a coin, say, 50 times is about half heads and half tails, there's nothing wrong with the coin if occasionally one were to get 35 heads and 15 tails. It happens. But the coin itself is fine. As is the methodology promulgated here. In the long run the techniques learned on this site have a very high expectation of success. Again, thanks Kim, for providing and maintaining a stellar site! -

Trading and getting fills with Interactive Brokers

RobertB replied to cwerdna's topic in General Board

Yes, WebTrader is an extremely stripped down version of TWS. But at least it works behind a firewall. You can make TWS work behind a firewall, but you'd have to get your IT person to forward some ports to your work computer. This is usually in most companies both a security breach and also a red flag that you're trading options while you're supposed to be working. So perhaps it's not a good idea to request it. But, technically, it's a simple matter for IT to forward the ports if you have permission to do so. I haven't tried this, but this might work. Since people here have stated that the mobile apps for IB seem to have some nice features, perhaps you can get a mobile app to work on your computer. I believe I've seen programs you can download that will spoof an app into thinking it's running on an iPhone. Thus, you could then use the mobile app on your PC. Again, I haven't tried this. -

Marco, I'll be interested in hearing what IB has to say. Tell me what you think. But I interpret the following from IB's site as possibly allowing IB to do just that. Also, note the wording of the following, also from IB's site: Notice the phrase, "... at the time that IB routed the order." Well, IB has total control over when they route the order. This is not necessarily the same time that you submitted the order.

-

Marco, You're right. If that were always the case you would never get a liquidity rebate. But depending on your IB configuration settings for routing, if you don't have it set to bias for a rebate, you may find the Smart algorithm has decided to move your order to another exchange. Just last week I had that happen to me with Dell. My order when submitted was not marketable. By the time it was filled, however, it had been moved to the PCX exchange where I ended up paying $0.45 per contract "remove liquidity" fees. Had I set the configuration setting to bias for a rebate, this is not supposed to happen. Again, sometimes you'll want the order moved to a new exchange since you'd expect a quicker fill (but thus possibly pay liquidity fees); other times, no.

-

Listolyman, I've seen what you mentioned also. But my main point is that with Smart routing in its default configuration you are leaving it up to the algorithm to decide which exchange is most likely to get you a fill. This is a separate question from which exchange (or combination of exchanges) will get you the best overall price. Like everything, it's a tradeoff.

-

Marco, That hasn't been my experience. I have found IB holding my non-marketable limit order within IB's own servers, not sending to any exchange until marketable or nearly marketable. One of the reasons IB will hold an order is to reduce possible cancel/modify fees (for themselves). Their Smart algorithm tries to make educated guesses on which exchanges to send, with varying degrees of success. I have found, as I've said, that Smart routing gives me the quickest fills, but not necessarily the best when all fees are considered. And, in response to something you said, the Smart order routing will consider it a very low priority saving you exchanges fees. However, as I mentioned earlier, you can configure Smart routing to give priority to your getting rebates (in exchange for fewer and slower fills). Anyway, this has been my experience. And speaking to IB about it from time to time has confirmed it. However, I'm still a big user of IB's Smart algorithm because most of the time, for me, getting filled at my limit, possible exchange fees and all, is better than my not getting filled more often.

-

Augen is correct in many cases. Smart routing, in my experience, tends to get you filled faster, but not necessarily at the best overall price especially when you consider possible exchange fees. For this discussion remember that when you place a limit order to buy and your limit price is below the ask, this is considered a non-marketable order and thus ADDS to liquidity (possibly allowing you an exchange rebate). On the other hand, placing a limit order to buy at the ask (or higher) or placing a market order itself is considered a marketable order and thus SUBTRACTS from liquidity (incurring a possible exchange fee). For example, suppose you wish to purchase an ABC 50 call. The current bid/ask is 1.00(bid)/1.02(ask) with ABC at 51. If you place a limit order to buy at 1.01 (the midpoint), that is NOT a marketable order and you are ADDING liquidity. Your limit order at 1.01 is declaring to the world that you are willing to buy at 1.01 or better. What you'd like is for that fact to be presented to other traders as the currently highest bid. Ideally, you'd like for some other trader to lower his 1.02 ask price down to 1.01 to meet your bid even if the market itself isn't moving in that direction. In contrast, if instead of using Smart you were to direct your 1.01 limit order to a particular exchange, that is what should happen: another trader would meet your bid, or the market may tick down to meet your bid. Either way, you'd be filled at your limit of 1.01 or better, and on many exchanges you would be thus entitled to a rebate since you had added to liquidity when you placed your limit order. But with Smart and other intelligent routing systems, you are, in effect, saying that getting filled faster is the most important thing to you--not getting the lowest overall price. IB via Smart very often holds your order UNTIL it becomes marketable. That is, no one else even knows you have the best bid at that moment since IB holds your order in its servers until, in this example, the market itself comes to your bid on any one of a number of exchanges. At that point, IB submits your order and, significantly, an order that initially would have added liquidity (since your limit order to buy had been below the ask) is at submission time now marketable, and thus is subtracting from liquidity. You've just incurred an exchange fee of up to $0.45 a contract to which you would not have been subject had the Smart algorithm submitted your order when it was not marketable. Additionally, in return for these (possibly) faster Smart-induced fills, no one knew you initially had the best bid price (since IB held your order); thus, no trader was able to possibly meet it! (I suspect IB makes a lot of its profits through shifting these exchange fees in various manners to their own benefit. But that's another topic.) There is an option under IB's Smart Routing configuration settings (in Global Management) that allows you to drop a hint to the Smart algorithm to attempt to give you the best rebate instead of the fastest fill. Also, you can update this setting on a per order basis in one of the drop downs in the Order Ticket dialog. To be sure, sometimes it will be to your benefit to get faster fills; other times it's best to get the lowest overall price (exchange fees considered). It's very important to always know how these things work so you can make informed decisions on how you'd like your orders filled.

-

Yes, sometimes trading option spreads triggers the pattern day trading rule (PDT) even when you are not logically thinking of your trades this way. For instance, if all within one day you open a vertical spread and roll it up a few strikes, and some of the new rolled-up strikes are identical to the old strikes, you will, in effect, have done a day trade on the identical strikes. The rules do not make exceptions for spreads; the rules see only the legs. This is something to consider when rolling a position that you opened that same day. I believe that if your account is above $25,000, the rule doesn't apply.

-

Trading and getting fills with Interactive Brokers

RobertB replied to cwerdna's topic in General Board

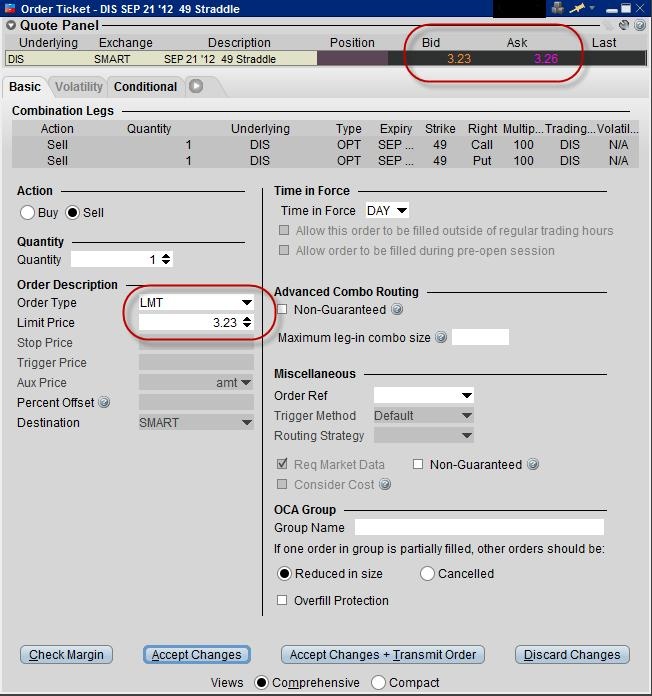

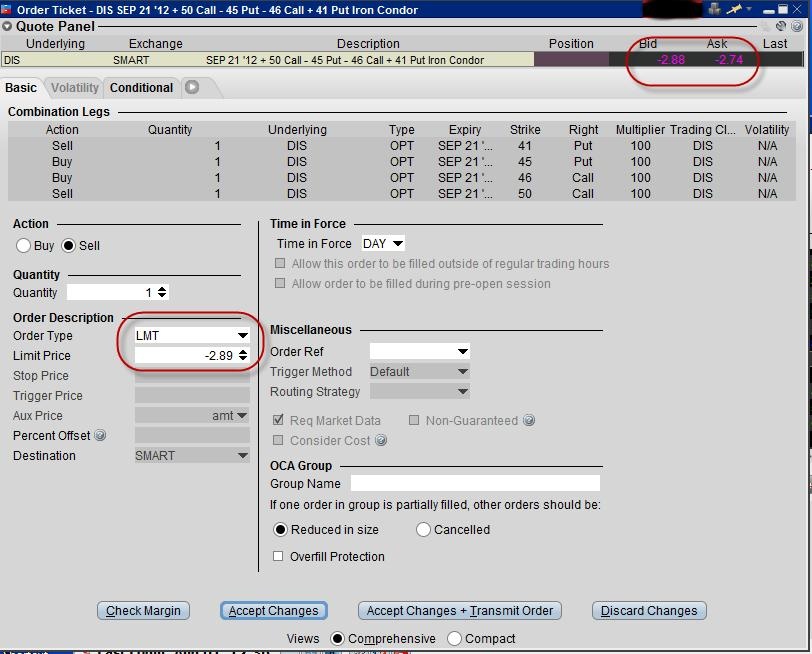

Xpresstalk, I see the screenshot you posted. I usually do not use that particular screen. It appears to me that IB is in this case using the negative price as a redundant indicator that you are initiating a credit trade. Kind of what you'd see on a spreadsheet tally of your bank account: positive values are deposits; negative values are withdrawals (or vice-versa). This screen is different from the order entry screen, which is the screen I've been referring to when discussing negative values. I've attached two screenshots. One shows a sample IB order entry window for selling a DIS straddle. Notice there are no negative values for this credit trade. The other screenshot shows a sample IB order entry for selling (using IB's terminology) an iron condor (what we refer to here as a RIC). In normal conversation, since a RIC is a debit trade, I would refer to it as a "buy". However, IB refers to it as a "sell," presumably based on the formal definition of an iron condor. The IB negative values I've been referring to are of these sort. As I've said elsewhere, when IB refers to a debit trade as a "sell," such as for a RIC, you will see negative values (in the order entry window). -

Trading and getting fills with Interactive Brokers

RobertB replied to cwerdna's topic in General Board

Xpresstalk, I urge you to setup an IB paper trading account to safely try out a lot of these orders. IB is complicated, but it is, nevertheless, totally learnable. As far as I know, selling for a credit should not display negative numbers. I don't understand why you'd see negative numbers for selling a DIS straddle. Concerning cancellation/modify fees, two things to keep in mind: 1) There are no cancellation/modify fees for multi-legged orders--thus spreads are immune from these fees; 2) Orders that have not been sent to an exchange yet, such as orders that are outside the current bid/ask range, do not incur these fees because they just sit in IB's servers waiting for the market to move. Only when sent to an exchange, which usually occurs only when the order has a chance of being filled, does it possibly incur these cancellation/modify fees. -

Cwerdna, No, the IB $1 minimum is per order, not per leg. A four-legged position would cost $0.70 * 4 = $2.80 (plus/minus fees). If you're only doing small orders, you might as well stick with TOS if you're getting $1.25/contract and are happy with their service. However, IB's Smart algorithm should give you better fills since it can intelligently fill a spread on separate exchanges. And, as Kim has pointed out, there are no cancel/modify fees for spreads on IB.

-

Trading and getting fills with Interactive Brokers

RobertB replied to cwerdna's topic in General Board

Thaze, Browse this entire topic. Less than a week ago we discussed this issue. Check out posts dated around July 27th. It really is unconscionable for IB to make users deal with negative prices. But that is the reality. This issue arises only when IB considers a credit trade as a buy and a debit trade as a sell, such as for iron condors and reverse iron condors, respectively. Apparently, it was too much trouble for IB's software designers to create software that handles this anomaly for you! -

Trading and getting fills with Interactive Brokers

RobertB replied to cwerdna's topic in General Board

Listolyman, Thanks. Just to be clear, I wasn't directly responding to what Kim wrote. I was making general comments regarding fees versus fixed costs. IB's technical support leaves much to be desired. I believe that was the point Kim was making. I totally agree.