SteadyOptions is an options trading forum where you can find solutions from top options traders. Join Us!

We’ve all been there… researching options strategies and unable to find the answers we’re looking for. SteadyOptions has your solution.

-

Posts

5925 -

Joined

-

Last visited

-

Days Won

189

Content Type

Profiles

SteadyOptions Trading Blog

Forums

Everything posted by SBatch

-

The Apex (their custodian) website allows you to run P&L reports: https://public-apps.apexclearing.com/session/#/login

-

That completely depends on your account size. The model portfolio uses a 10% allocation per trade and averages about 10 trades a month. The contract amount will be dictated by your capital amount. A $10,000 account would allot $1,000 per trade and would trade a lot less contracts than a $100,000 account that is allotting $10,000 per trade.

-

Medved and Option Samurai are very basic offerings. I use TradeHawk and am very pleased. Thirty day free trial so no reason not to give it a shot. https://mytradehawk.com/

-

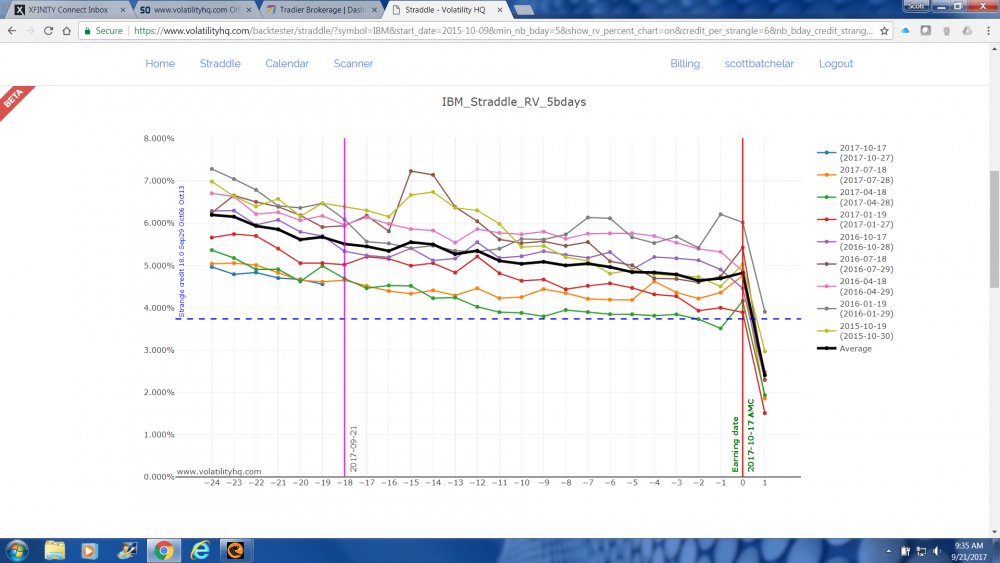

@Djtux This is an excellent addition, thanks to @Yowster for the suggestion. IBM looks extremely compelling utilizing the new function with the 6% default:

- 1061 replies

-

- rv chart

- volatilityhq.com

-

(and 1 more)

Tagged with:

-

More tools to analyze the earnings trades: www.art-of.trading

SBatch replied to Christof+'s topic in General Board

Very nice work. Intuitive and clean design. A great addition would be to add to the Upcoming Earnings Announcements page the percentage movement of the underlying in the session after the earnings release in the previous cycle. -

Thanks.

-

@RapperT There seems to be an issue with the SO stream and search functions currently which disallows me from accessing the ACN thread. Would you please post your ACN chart here? Thanks.

-

But can it hurt? I think a 30 day average using data taken from 60 days to 30 days prior to the earnings release over a two year period may prove valuable.

-

I believe he had mentioned previously that he uses an IV number that is approximately 25 days before earnings and holds it static.

-

Historically, yes.

-

Only down to about .8 if closed before the release.

-

@Kim Do you intend to increase your maximum total number of trades outstanding? For example, if you intend to keep that number at 6 and one of them exceeds the 10% size on the $10,000 portfolio, those with small accounts will be further alienated as they will see the number of official outstanding trades that they can participate in drop below 6 even though the model may have 6 open.

-

There are several. Their What If scenario risk simulation is excellent. The Risk Portfolio layout and contents are also great. The Spread Ticket is extremely intuitive once one learns how to use it. Also, what they call the Wisp, which is their Options Montage is the best I've used. There is also an intra-day Historical Volatility charting module which is very solid. In addition to what I mentioned yesterday regarding the Strategy Builder for tracking spreads they will also be releasing a Volatility Workshop to analyze skew. Couple all of this with the fact that they have accepted every one of my requests and have either already implemented them or have put them into the pipeline and it's a win all around.

- 57 replies

-

- portfolio tracking

- broker

-

(and 1 more)

Tagged with:

-

I concur with this. Initially it was my understanding that we would be opening a new discussion each cycle. However, opening one thread for each symbol in perpetuity makes sense and would not be any more onerous than what we are currently doing (but would be far more useful into the future).

-

Option #3 poses potential pitfalls when Unofficial trades become Official. Also, what happens when they are Official one cycle and only Unofficial the next cycle?

-

@Kim Regarding #2, I and several others do not discuss a trade before opening it. I just post my fill once I execute a trade. Under the two threads, I would be able to post my fill to the Trade thread and simply copy that post to the Discussion thread where collaboration could take place. This process would keep the Trade thread very clean. Others could choose to post in the Discussion thread first if they were looking for feedback, but if and when the trade is executed they would post the detail to the Trade thread. It is likely many members would simply subscribe only to the Trade thread which would give them all ideas as they become active unofficial trades.

-

@Kim I understand that the concept of going by majority is typically best. However, in this instance it may be insightful to take a more granular look. If those voting against the new topic for each trade idea are those that are also contributing the majority of the trade ideas, I believe this merits discussion. The notion here is that those that are already spending their time contributing most, may not also wish to spend the additional time to create a new thread for each of their trade ideas. This is just something to keep in mind as the more laborious it becomes the less some may contribute.

-

That is still a net of .50 round trip, that's no bargain today. If someone is trading over 1,000 contracts a month it makes a lot more sense to choose and pay for a platform with Tradier and save on the commissions. Savings increase exponentially with contracts traded.

- 57 replies

-

- portfolio tracking

- broker

-

(and 1 more)

Tagged with:

-

Understood, that was not the implication. However, there are many others here that find the sophisticated modeling and tracking features important (as I do), so I just want to make the forum aware they are not included with the basic platform.

- 57 replies

-

- portfolio tracking

- broker

-

(and 1 more)

Tagged with:

-

Yes, but their Platinum package (which includes the sophisticated features) is $245 a month. We need to be careful comparing the basic version against TradeHawk.

- 57 replies

-

- portfolio tracking

- broker

-

(and 1 more)

Tagged with:

-

If one is looking for option free trading, isn't Dynamic Trend $245 per month?

- 57 replies

-

- portfolio tracking

- broker

-

(and 1 more)

Tagged with:

-

TradeHawk already groups trades together and is adding P&L based upon margin. In addition, they are also adding spread P&L for trade life to include adjustments. This is clearly a great addition for the Straddle/Strangle strategy but also for many other non-SO strategies such as Broken Wing Butterflies, MICs, etc. Also, TradeHawk is fully integrated with Tradier whereas I don't believe any other platform is.

- 57 replies

-

- portfolio tracking

- broker

-

(and 1 more)

Tagged with:

-

Their web platform is mobile compliant so you can just use the website to trade mobile.

-

Tradier only offers equities and equity and index options (no futures) and TradeHawk only integrates with Tradier at this time.

-

FB seems to have a very defined pattern of sideways action for 60 days after the release and then a sharp move higher 20-30 days before the release. The IC trade backtest confirms the sideways action and Ophir's previous post (pasted below) confirms the pre-earnings move higher. This IC/Long Call dual strategy looks very interesting as a long term play.