SteadyOptions is an options trading forum where you can find solutions from top options traders. Join Us!

We’ve all been there… researching options strategies and unable to find the answers we’re looking for. SteadyOptions has your solution.

-

Posts

473 -

Joined

-

Last visited

-

Days Won

17

Content Type

Profiles

SteadyOptions Trading Blog

Forums

Everything posted by luxmon

-

Good job, nice to hear real life examples of people who profit from taking the other side of Sosnoff's trades.

-

I have accounts at IB (via LiveVol) and Tradestation. I have negotiated rate structures with both brokers, but Tradestation is much better for trades like this (~0.30 per contract on this trade but varies depending on number of lots since there's a ticket).

-

I entered the 77.5 and 80 put 1-week calendars for 0.16 on Monday 8/3. After the funkiness seen in calendar behavior this cycle, decided to exit the 77.5 put calendars today for 0.25 yielding 56% gain before commissions, 50% after. The 80's didn't fill yet but marking 0.25 also.

-

Favoring Calendars over Straddles in Current Market?

luxmon replied to PaulCao's topic in General Board

Good straddle candidates have been tough to find lately. I did open MSFT July4 46 straddle on June 24th for 2.46 since it has moved a lot leading to earnings the last few cycles. The position is down to 1/5th the original size as I peeled off options on the winning side to stay delta neutral rather than rolling. I'm currently break even on the trade so it's been a tough road to hoe but it has provided some hedge protection along the way. -

Just added more at 2.90. IV is up 5 points in the July4 options and only 0.5 pts in the Aug. Let's hope things normalize next week.

-

Very true, but much less $$$ loss than if he shorted 100 shares of stock ($45 loss on his spread vs $400 loss on the short stock). This is a great use case for options.

-

You're right, it was. It is 0.03 more this quarter so that explains part of the lower price. Nice find, Vancouver! Update - the dividend was 0.03 more last quarter (0.36), this quarter's doesn't appear to be out yet.

-

There is a dividend in play making the June19 cheap, not sure if that was the case last time. I'll see if I can dig it up.

-

The earnings trade didn't work out as the odds makers predicted (~1:20), but I did end up taking some of Karen's money this morning as I unloaded the 7 May15 calls for 0.06. On a 20 lot, the trade netted $78 after commissions, or 390% - one for the record books percentage-wise for me :-)

-

There is some pretty decent open interest on that strike for both expirations (~10k contracts), but you probably couldn't get that much done (I did a 20 lot). I find it odd I even got filled on this spread and who would want to take the other side of it. Maybe Karen the Supertrader read your blog and thought it wise to add some long gamma to her portfolio as a hedge.

-

In keeping with the recent chatter of cheap calendar spreads: With GRPN trading at $6.80, I picked up the 7 May8/May15 call calendar for $0.01 before the close to hold through earnings (yes, $0.01, small position). I estimate it could be worth 0.18-0.20 if the stock sticks around $7 in the next few days and the money could be spent at the bar this weekend. If not, I'll be staying home.

-

Paper is buying the 1-week 80 put calendar today - Tradestation claims 9,945 spreads traded today, that's 90% of the volume on the 80 May8 put. Wow.

-

I closed my 85 put and call calendars for 0.30 and 0.31 respectively as I was over allocated in BABA and the stock was moving. I am also in the official trade with 3-week calendars. It has potential to go a lot higher especially if the stock moves back to the strike. Seems like this one week performs well as the official spreads haven't really widened yet. Here are my stats: May8/May15 85 put: Entered for 0.23 on 4/27, exit for 0.30 on 5/4 (26% profit after commissions) May8/May15 85 call: Entered for 0.22 on 4/28, exit for 0.31 on 5/4 (36% profit after commissions)

-

Bought a 40 lot of the 1-week 60 call calendars yesterday for 0.20 (I saw them marking for 0.15 at times after my fill so might have been able to get them for less). I set a GTC order to close at 0.28 this morning and it filled a few minutes ago. Wasn't all IV shifts that made it work as stock moved closer to strike this AM so luck involved also. 34% gain after commissions.

-

Official announcement made: https://investor.twitterinc.com/releasedetail.cfm?ReleaseID=909177

-

Earnings leaked via a tweet, how fitting lol.

-

I too did a smaller position in the 1-week 85 put calendar for 0.23 (after seeing Vancouver's note) because of that SINA trade and the benefit of having the long leg in the monthly. I also entered the official one so we'll see how it goes.

-

I fail to see the point of this comment - TSLA has moved much more than this on a percentage basis since the official trade was opened.

-

I've looked at them too but Musk has a surprise announcement coming out the end of April that may move the stock

-

Mukundaa, If you have a good feel for timing, you should look at a long call diagonal on those stocks to emulate the covered call trade. Sell the call you would if you held the stock and buy an ITM call further out with ~ 0.75-0.8 delta. You can do it for much less capital (i.e., if the falling knife keeps going down you're out of the way at your long strike). Tim

-

PC hit the nail on the head with problem #2 he mentioned. They have no (or random) risk management and always content with being in the market. This is bound to fail when picking up nickels in front of the proverbial steam roller and these market corrections happen. For the 2055/2060 call spread they sold the day of the fed meeting last week (2 days before expiration), that was a pure spec play IMO, not an income trade. They would have been much better off with an OTM butterfly with better risk/reward. It seems their service can't decide what it wants to be when it grows up.

-

I check their performance periodically for comedy relief, and "5 percent per week" just became -1.3% per week for 2014. Last week they let a $5-wide credit spread they sold for $0.25 expire completely in the money, wiping out a lot of hard work lol: http://www.5percentperweek.com/customer/customerMain.php?section=tradePage&step=viewClosedTrades This is a scary way to trade.

-

Check that - on the last scenario above I didn't move down the upper strike to be equidistant from the short as the lower strike is. When I do that the credit is still reasonable and gives the trade more breathing room to the downside. Will have to consider this in the future.

-

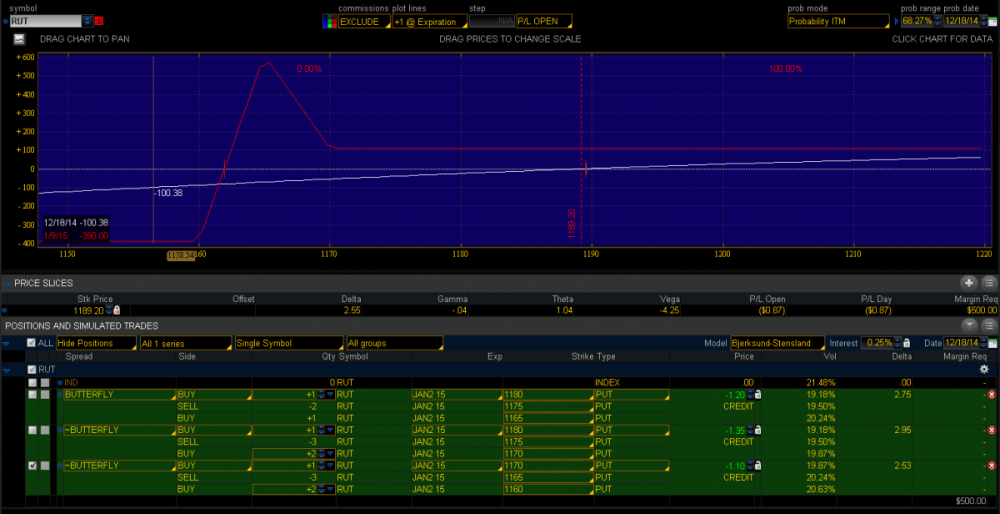

Yowster, That is an interesting tweak. I compared them using RUT spread Jan week 2 expiry so I had $5 wide strikes to play with. It looks like with your method you can get slightly larger credit for the same risk when using the same short strike (1st and 2nd trades below). However, when I pushed the credit spreads out further (3rd trade in the list) the credit diminishes rapidly, even if doubling the width. I might try this in the future if it gives a larger credit for the same level of risk.

-

I usually do them slightly OTM such that the initial credit is about 10% of the downside wing (for example, $1 credit on a $10 wide wing). I put it on indexes and high dollar stocks like GOOG. For risk management I exit at a max loss of 15% of capital at risk, and scale out at different profit targets (5, 10, 15%, etc). I don't mind leaving a fraction of my original spreads closer to expiration if I've already taken some profit. There are free webex videos at Sheridan Mentoring with more on the strategy. Tim