SteadyOptions is an options trading forum where you can find solutions from top options traders. Join Us!

We’ve all been there… researching options strategies and unable to find the answers we’re looking for. SteadyOptions has your solution.

-

Posts

473 -

Joined

-

Last visited

-

Days Won

17

Content Type

Profiles

SteadyOptions Trading Blog

Forums

Everything posted by luxmon

-

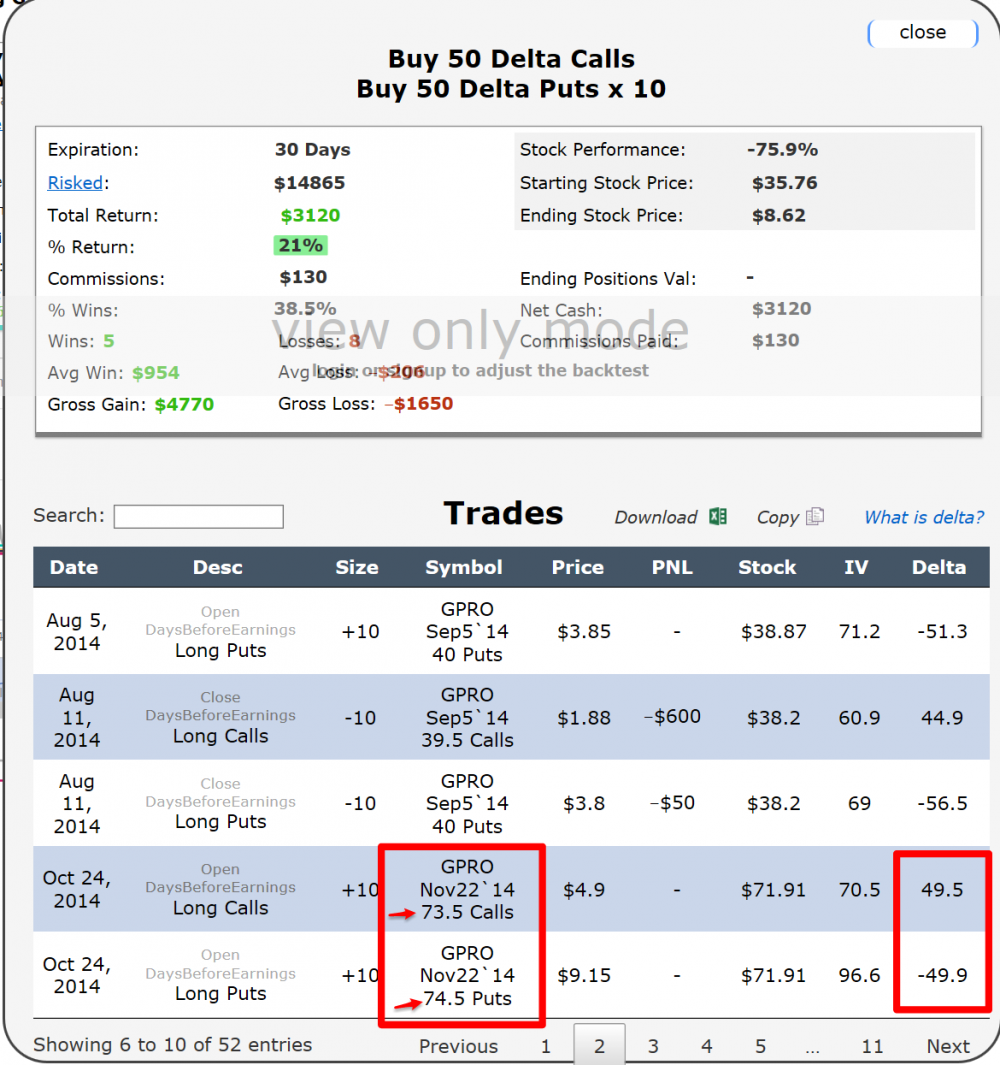

Thanks for sharing this finding, it is very interesting. I did notice when browsing the actual trades that backtester didn't always buy a straddle (which is understandable since sometimes the nearest call and put might be rounded to a nearby strike based on delta). However, there was one of the 12 instances where both the call and put were about +/49 delta yet it chose a call that was 1 point in the money (Oct 24, 2014). I attached a screenshot. There were also a few other instances where the call strike was less than the put strike of the spread. Probably not a big deal for the results but might be wise to look into in case someone wanted to enforce a straddle or OTM strangle be used consistently. Tim

-

This answer most certainly depends on how much confidence you desire, or "alpha level". Getting into this is beyond the scope of the thread and my expertise for sure. Just to throw out a broad brush answer, in the research studies I've done and if the sampling plan is unbiased (a huge assumption in this analysis since it's only the last 8 events, not 8 randomly sampled from all earnings events in the entire population), I've found to that in order to test significance of a single parameter (i.e., calculate a "p-value" in the vernacular), I've needed at least 20 samples for estimating each parameter in the model. And this is just to check the significance of the main effect of each parameter (not interactions between those parameters which add another level of complexity - say if entry date is set to one, does the significance and sensitivity of the optimum short delta change, etc). Again, my main point was to not read so much into the precise settings of these studies and slap that particular trade on blindly, but consider what's going on in IV, RV, and possibly technical analysis that's fundamentally leading to these undoubtedly strong trends that appear to have good edge. Tim

-

My 2 cents on this: I'm an engineer and armature user of statistics based models in my day to day work for using past data to predict future data (and yes, it is probabilistic as Kim mentioned). To me, this is most certainly "curve fitting" here, or if you don't like that term, he's come up with a model for prediction of profitably playing post-earnings events in TWTR by selling put spreads. The obvious parameters of the model are option expiration, short option delta, long option delta, entry date, and exit date- so 5 parameters. If he's training that 5-parameter model based on 8 data points (2 years of earnings events), that's n-1 degrees of freedom, or 7 (n-1 since it doesn't include the entire population of earnings events). In analysis of variance (stats 101) for regression modeling, and assuming your errors are normally distributed, you use up one degree of freedom for each parameter, and the rest are left over for calculating error (i.e., confidence intervals for each parameter and error in the overall model). So, with only 3 degrees of freedom left over for computing confidence intervals, it is very unlikely the interval would be very tight around any one parameter. Hence, that's why I'm very skeptical the confidence interval around entry date is less than +/- 1 day. So basically, in my opinion, it's wise not to focus too much on the specifics of any one setting CML is predicting based on such a small sample size (as a previous poster mentioned), and just focus on what's actually going on here: implied volatility in the options is in reversion to the mean after earnings announcement to a level that still provides edge over the realized volatility in this time frame, and there's a slight bullish tilt to price (again, for a very small sample size).

-

On the TWTR study, why pick entering 2 days after earnings? Sounds suspiciously like a curve fit parameter with limited robustness, especially if entering say 1 day or 3 days after earnings don't give similar results. But, the tool does look powerful for certain purposes as long as robustness of settings is verified.

-

I just point out those fees as some brokers eat the OCC fee themselves (in fact, Tradier did until a few months ago) so one can do a correct head to head cost comparison. I have contacted Tradier's trade desk (more often than I care to admit) and that's how I originally discovered the unfriendly margin treatment as the culprit for the large amount of missing buying power. They claimed the margin requirement was being imposed by their clearing firm, and they offered to restore the missing buying power for the day within their backend system. However, they claimed I needed to call them every morning thereafter as long as that position was on to have the buying power restored. Additionally, they did warn me that if my trading exceeded the buying power beyond what the clearing firm required, I would receive a margin call the next morning. I decided at that point not to do those types of trades there. As far a execution, I have not noticed any differences with other major brokerage accounts I have, although I did run into some strange incidents recently of having the exact same order stall at TOS but be filled at Tradier. I didn't follow up on this any further and don't have any hard data to prove Tradier is better. I hope this helps. Tim

-

Bear in mind as I think this was already mentioned earlier in this thread, even though they state the commissions are only the flat fee, you will pay regulatory fees of about 0.09 to 0.11 per contract. For example, on a 20-lot calendar spread I traded yesterday on an equity, according to the trade confirmation statement I paid 3.86 in these fees on the 40 contracts transaction. You may or may not already be paying with these extra fees with your broker, and usually need to check the trade confirmation statements to see them as they don't always show up in the trading platform. Also, they are not margin friendly when it comes to unbalanced flies. As soon as you break a fly/condor or make the wings unbalanced, the margin relief for the credit spread side goes away (at least the last time I traded one, sometime earlier this year). And yes, no calendar spreads on cash-settled options. Just some surprises I've noticed. Tim

-

Just fyi, after inspecting some trade confirmation statements, Tradier subtly started passing through a 0.05 per contract "OCC clearing fee" yesterday. Here was their reply when I inquired about it: There is an OCC fee of $0.05/contract, with a max of $55, that Tradier Brokerage is now passing through to customers. We have been covering this fee since it was first introduced, but we are no longer doing so. Unfortunately, this is a fee that will apply going forward for option transactions. Please see the OCC link below for further information. https://www.theocc.com/membership/schedule-of-fees/

-

Good food for thought. This twist on your scenario could be even more gut wrenching - Say AMZN shoots up on Friday intraday and your spread is almost 0 and you're happy as a clam. The news from the CEO you mention comes out right after the close Friday and the stock trades lower after hours but you're out at the bar for happy hour with your buds and fail to realize the opportunity to exercise your 495 put. The buyer of your 500 put happens to see the news and calls his broker to exercise the option. I couldn't imagine the heartache on Monday. I let OTM put broken wing butterflies in the indices expire once in a while but haven't held vertical spreads in single name stocks through expiration in a long time (from now on, never).

-

They are not a charitable organization. Of course they make money off the thing; they freely admit in their FAQ that the "Bob the Trader" service that shares their trades in detail is the #1 grossing financial app (at $900 per year per subscriber). https://www.tastytrade.com/tt/faq I'm not saying their information isn't useful, just that there are sometimes inherent limitations/assumptions left out when they explain their study designs and new traders may take the conclusions too literally or apply them broad-brush.

-

It's amazing the flawed studies these guys assemble and promote. Every one seems to have a severe deficiency or two and is misleading in some way. Here is another one regarding the profitability of selling weekly credit spreads in SPX that was scrutinized very well by another options site: http://sjoptions.com/spx-bull-put-spreads-taught-by-tasty-trade/ I've learned to take everything they say with a rather large grain of salt and use it to learn to think for yourself.

-

Well, that makes sense then and is a great reward-risk setup. I didn't realize the IV of the Apr4 was so underpriced right now for earnings. Good luck.

-

Thanks for sharing your idea. I'm not sure about it, as the options you sold are about the cheapest ones on the board. What is your thesis, that Apr4 IV will pop if confirmed for that week? I don't see April monthly IV dropping much more if earnings are confirmed after based on the IV of the weeklies in front of it (similar). There could be a big risk if earnings are confirmed after Apr4 expiration (as I just noticed Kim had already mentioned).

-

This is a very risky strategy to depend on for income. You will win 90% of the time but the 10% of the time the trade will be challenged and impossible to manage. It will cause immense psychological challenge. You'll ask: do I buy the spread back for > $2, sweat it out hoping market retreats, adjust by buying a call (and triple the capital), etc. Trust me, the weekly options in the indexes are typically priced correctly and offer little edge to the trader for positive expectancy. There are exceptions when skew gets out of whack but you need to track it to identify when and use butterflies to get the edge.

-

Edwin, thank you for the reply. That's too bad, the last few ones I've caught from them have ALL started late and had technical difficulties. Last week's the host would be trying to speak to the guest and the guest couldn't hear him, having to disconnect/reconnect, etc, throughout the whole meeting. Seems pretty basic in this day and age to have those things ironed out ahead of time. I have noticed also some of their webinars have been glorified sales pitches from people that work for SMB. It sounded like this guy was too - caveat emptor. That being said, they have had independent presenters that have been really good and worth the time. Thanks again for the summary.

-

I sometimes catch the free weekly Option Tribe webinars that occur on Tuesdays at 5PM ET. This one looks interesting to SO members who trade earnings: SMBU's Options Tribe Webinar: SMBU’s Derek Vanderpool: The Use of Multiple Time Frame Weekly Options around Earnings December 8, 2015 Most weekly options strategies do not maximize capital potential due to the risky nature of trading within 7 days of expiration. Derek Vanderpool returns to the Options Tribe to present the system that he has developed which minimizes risk by using multiple time frames and several other edges that are available when using weekly options correctly. I'll see you tomorrow at 5:00pm ET. Seth Freudberg SMB Team

-

In my experience with news the IV goes up for good reason and not a good time to sell it. Wait for realized volatility to decrease and IV to start coming down, then find a risk controlled way to sell it (like a wide IC).

-

According to my platform, the VIX oct future was down 5.5% today while XIV was up 5.5%. Do you expect different leverage than that on a day to day basis from that product?

-

If the term structure is favorable, index bear calendar spreads are a good option for grinding declines, but don't work as well for crash scenarios like Monday. Owning some OTM puts are your best option. You can finance them by selling nearer term put spreads.

-

Need HELP with NFLX options that I started recklessly and am stuck in now

luxmon replied to Fugu628's topic in General Board

Hi Fugu628, I've been in similar situations, being buried by a trade that went poorly and trying to dig your way out. It's a mental tug of war inside, you want to make your money back and make the loss sting less but at the same time if you sit back and look at it as a fresh trade, would you put it on now? Most of the time I answer no to that. If you take it off, you will breath a sigh of relief and a big weight will be off your shoulder. You can then focus your energy on new opportunities. Tim -

Does anyone have any experience with Tradier? They seem to be a low cost brokerage integrated with a lot of platforms, including OptionNET Explorer (https://brokerage.tradier.com/platforms/optionnet-explorer). The pricing page seems to indicate that ONE costs $55 per month for brokerage clients, and is further discounted with increasing trading activity. The last thing I need is another brokerage platform / account to deal with, but might be a cheapskate way to access the ONE software and get good commission rates on smaller cost spreads. Just checking to see if anyone has used them and might provide some feedback on execution and customer service. Thanks, Tim

-

Exited the 80 put 1-week calendar for 0.21, kinda disappointed since I think I could have got more but work prevented me from watching it. (31% before / 26% after commissions). What did others that traded it manage to get for the 80 put calendars (or others for that matter)?

-

Their brokerage arm is a separate entity but an account there entitles you to use the LVX platform. The brokerage website is http://www.livevolsecurities.combut unsure if anything has changed with the recent acquisition by Lightspeed.

-

I like LVX but it took some time. It comes with little guidance on how to use it. Coming from TOS you will miss some of the features of the Analyze tab if you use it to test strategies and adjustments over time by locking the price on spreads. In LVX there is no "memory" of the intraday spread price so you'll have to jot it down or use another software package (even TOS if you still have it). You can get EOD prices on all options for backtesting however. There is a pseudo-ticket charge that comes about as a minimum charge of $1.50 per leg which is annoying for single contract orders. I'm agnostic on brokerage platforms, but here are my opinions: Main benefits of LiveVol is: 1) Lower commissions than IB with all the benefits of IB (you can even use TWS if you like), even better pricing available if you belong to certain education services. 2) Very lean and fast interface built on Adobe Air (compared to TOS, TWS, or Tradestation) 3) Charting of realized and implied volatility across multiple timeframes is second to none. 4) Near limitless search capabilities for order flow, IV, RV, term structure, etc, 5) Very good support through live chat right in the application (like TOS). Drawbacks I can think of: 1) need minimum of $35k to fund an account, 2) Can't chart option prices over time, very annoying (need to use other software) 3) The software side was just bought by the CBOE and the brokerage side went to Lightspeed (so far no change besides letterhead but not sure what the ramifications of this will be in the long run), 4) might not be able available in all countries as IB, 5) No mobile app, need to use TWS mobile for trading on your phone/tablet. Cheers, Tim