SteadyOptions is an options trading forum where you can find solutions from top options traders. Join Us!

We’ve all been there… researching options strategies and unable to find the answers we’re looking for. SteadyOptions has your solution.

Rob

Mem_C-

Posts

100 -

Joined

-

Last visited

-

Days Won

1

Content Type

Profiles

SteadyOptions Trading Blog

Forums

Everything posted by Rob

-

I like to listen to Gary Kaltbaum. He is a regular fox contributor and doesn't trade options. He's more from the William O' Neil camp, but he's very entertaining and has a great feel on the market. I don't know if there is a podcast available, but I listen to the condensed sped up version that is posted by Stoolander on Twitter. I can post more info if you're interested.

-

Thank you!

- 1061 replies

-

- rv chart

- volatilityhq.com

-

(and 1 more)

Tagged with:

-

Yes. But I believe that expires, so when the start up icon boots up, there is an area that says demo account, hit that link.

-

I believe you can use that charting software for spreads to track their price on their demo account. I was trying to get it to work and found it a bit clunky. I’m not sure if that had anything to do with the fact that it was a demo account, or operator error. Probably the latter. IB stated to me I could use the demo account for as long as I wanted and it doesn’t expire.

-

I'd like to get some feedback if possible from members who are using the return matrix in their own trading. I see a potential for "edge" in our trading if we are able to execute our trades at times that coincide with numbers that look really good on the return matrix. For example, entering the hedged straddle at a time period where the return matrix is showing positive returns at a certain T-X. Or entering a straddle at a point in time that coincides with great numbers on the return matrix. Is anyone using this as an extra filter when planning out their trades? Thank you.

- 1061 replies

-

- rv chart

- volatilityhq.com

-

(and 1 more)

Tagged with:

-

Hi Craig, take a look at my experience with TOS today regarding not getting filled on ULTA after Kim got filled 5c below an order I had sitting there since the open:

-

Thanks for your comments @Yowster. Let me add that depending on how you generate this, it will be much easier with actual dates rather than T-x points. This goes back to my earlier request on showing the dates which I posted earlier.

- 1061 replies

-

- rv chart

- volatilityhq.com

-

(and 1 more)

Tagged with:

-

Maybe @Yowster can chime in on this idea since the hedged straddle is his baby, but perhaps some kind of formula where once earnings is announced, the software can pick 2 points on the chart where it slopes the least and have a certain amount of days in between so that you can opt to hedge it with a strangle and have the time to collect the 6% suggested average.

- 1061 replies

-

- rv chart

- volatilityhq.com

-

(and 1 more)

Tagged with:

-

Clicking 2 points on the chart would be optimal (if the capability is available), if not, any manual entry would be fine. Thanks.

- 1061 replies

-

- rv chart

- volatilityhq.com

-

(and 1 more)

Tagged with:

-

Hello DJTUX, I'd like to make a request: I'd like to be able to measure the degree of slope between 2 T-N points on the chart. That will help me choose some points along the graph where I may want to create a hedged straddle where the degree of slope is less in comparison to other points on the chart. Thank you, Rob.

- 1061 replies

-

- rv chart

- volatilityhq.com

-

(and 1 more)

Tagged with:

-

Exactly what Yowster said.

- 1061 replies

-

- rv chart

- volatilityhq.com

-

(and 1 more)

Tagged with:

-

I would like to see the date for whichever T-x my mouse hovers over. Thank you.

- 1061 replies

-

- rv chart

- volatilityhq.com

-

(and 1 more)

Tagged with:

-

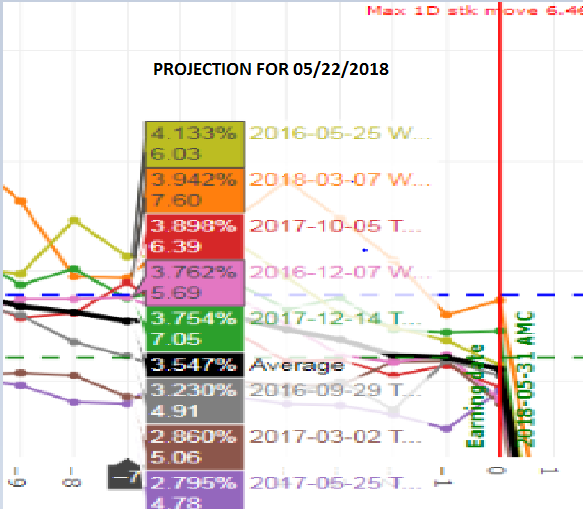

Hello, I'd like to make a request. When you hover your mouse over a T-X plot you get all the RVs for that particular spot in time over a number of cycles as we all know. I am respectfully requesting that at the top of the averages you display a date for that particular corresponding T-X. I didn't calculate the dates for the example, just using it as a visual of what I would like to see. Thanks.

- 1061 replies

-

- rv chart

- volatilityhq.com

-

(and 1 more)

Tagged with:

-

@mglaezer Hello, Just wondering how you made out with your taxes while using Tradier? Any other issues you encountered? Have you continued to compare executions and do you feel they can compete with fills members are receiving with IB? Thanks for your feedback. Rob.

-

Thank you for your response.

-

Is the current rate on IB of .70/contract with $1.00 minimum what you all are referring to regarding your accounts? I got a little confused when I read earlier posts about 70 cents, then 75 cents, and now I see that it looks like 70 cents on their website with a dollar min? I called them to clarify and I got a semi rude agent who said they haven't had 70 cent flat fees in over a decade.