SteadyOptions is an options trading forum where you can find solutions from top options traders. Join Us!

We’ve all been there… researching options strategies and unable to find the answers we’re looking for. SteadyOptions has your solution.

Leaderboard

Popular Content

Showing content with the highest reputation since 02/06/25 in all areas

-

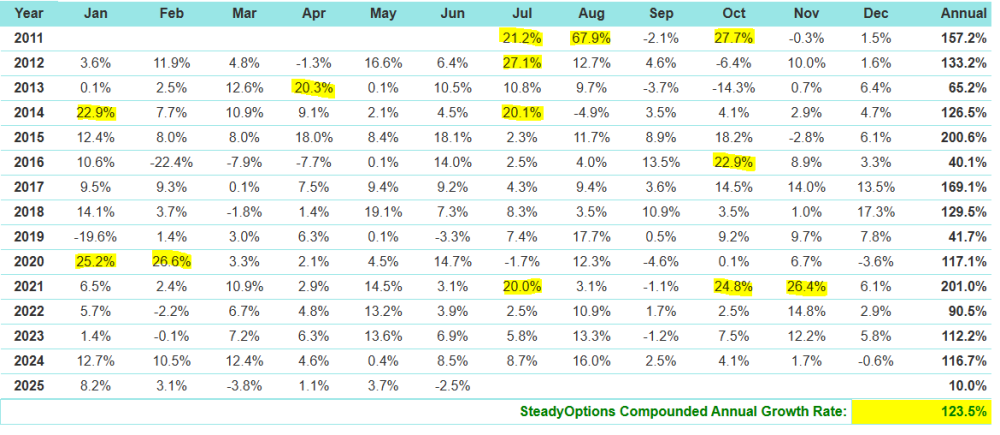

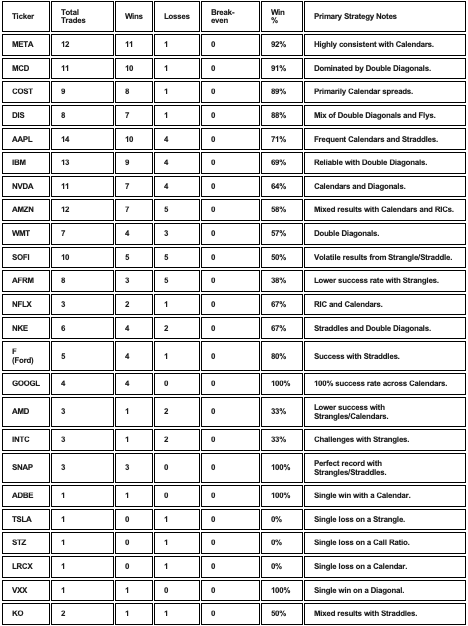

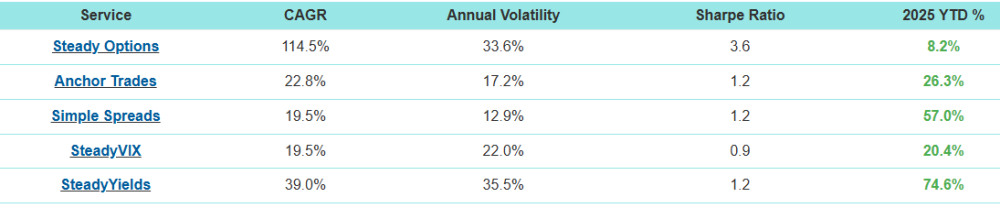

As I do at the end of each year, I’ve broken down the Steady Options 2025 trade performance by trade type. Numbers were taken directly from the data in the Performance screen (plus some recently closed trades). Here’s are this year’s stats along with some comments from my perspective. Where applicable, I added totals from prior years for comparison. Unfortunately, 2025 was Steady Options worst performing year. I’ll try to present what I believe to be the main reasons for this as they apply to each type of trade. From an overall perspective, here are some key points that I believe factored into the performance: Most SO trades are Vega positive trades leading up to earnings events, so volatility plays a key role in the outcome of our trades. Volatility rising helps trades and volatility declining hurts trades. 2025 saw 4 VIX spikes that occurred rather quickly (not a gradual rise), most spikes were relatively short in duration with declines starting shortly after the spikes. When you look at the year in total, the vast majority of the time we were in time periods where volatility was falling. Trades that were in place prior to the spike performed well, but other trades that did not encompass a spike commonly dealt with falling volatility and RV declines bigger than prior earnings cycles. This meant that trade that would have been small to moderate gains in prior years turned into small to moderate losses this year. Losses above 10% were also more common. There were some things that worked very well this year, although they were in some of the portfolios outside of SO. Steady Yields (SY) and Simple Spreads (SS) performed very well as many of their trades were helped by the same things that hurt the SO trades. Most trades in SY and SS tended to be Vega negative, meaning that they were helped by declining IV – so both time decay and declining IV helped these trades. Pre-Earnings Calendars 24 Trades – 21 win, 3 loss (88% win) – Average Gain +8.77% 2024: 65 trades (81% win) – Average Gain +12.13% 2023: 65 trades (85% win) – Average Gain +9.56% 2022: 11 trades (64% win) – Average Loss -9.55% 2021: 110 trades (79% win) – Average Gain +12.82% 2020: 33 trades (85% win) – Average Gain +21.97% 2019: 54 trades (65% win) – Average Gain +9.27% 2018: 40 trades (78% win) – Average Gain +9.61% 2017: 31 trades (84% win) – Average Gain +13.81% 2016: 44 trades (80% win) - Average Gain +15.07% 2015: 51 trades (80% win) – Average Gain +12.67% 2014: 48 trades (71% win) – Average Gain +13.80% 2013: 24 trades (88% win) – Average Gain +20.60% Comments: Overall winning percentage was at the high end compared to prior years, but average gain per trade was at the lower end. This year lacked some larger gains that we got in prior years (likely due to volatility declines). Number of trades was much lower than most prior years as this year saw the calendars for many stocks having their calendar RV significantly higher than prior cycles, and therefore trades were not opened in these cases. There was a learning here to take forward into next year. For calendar trades entry we look to enter at lower RV levels and/or on stocks that show a pattern of rising calendar RV heading into T-0. Many stocks show a tendency for calendar RV to rise regardless of current levels, but we didn’t open trades on these stocks if the current RV was elevated. While we wouldn’t want to enter if calendar RV was sky high, hindsight showed that opening trades when RV was slightly to moderately elevated wound up being winners. Earnings calendars continue to be a core SO strategy. Straddles/Strangles 42 Trades - 21 win, 20 loss, 1 break-even (51% win) – Average Loss -0.56% Breaking down further by hedged and non-hedged: Non-Hedged – 21 win, 17 loss, 1 break-even (55% win), average gain +0.24% Hedged – 0 win, 3 loss (0% win), average loss -10.97% 2024: 57 trades (73% win) – Average Gain +4.72% 2023: 166 trades (64% win) – Average Gain +1.65% 2022: 148 trades (71% win) – Average Gain +4.89% 2021: 129 trades (68% win) – Average Gain +3.27% 2020: 118 trades (67% win) – Average Gain +2.80% 2019: 106 trades (68% win) – Average Gain +3.58% 2018: 72 trades (83% win) – Average Gain +5.40% 2017: 77 trades (79% win) – Average Gain +5.02% 2016: 18 trades (72% win) – Average Gain +5.19% 2015: 44 trades (68% win) – Average Gain +2.61% 2014: 74 trades (62% win) – Average Gain +2.54% 2013: 104 trades (57% win) – Average Gain +1.35% Comments: Lower number of straddle/strangle trades compared to prior years, due primarily to double diagonal (DD) trades which have similar gain targets to straddles and strangles but can be kept open longer. Overall winning percentage and average gain per trade were at lows. This is primarily due to the decline volatility which saw straddle RV dropping by larger percentage compared to cycles in prior years. When the stock price did moves, gains were often muted when factoring in the larger RV declines. From a downside risk perspective, we saw more losses above 10% compared to prior years with 7 of the 20 losing trades having a loss greater than 10%. 12% of trades hit 10% gain target, which is lower compared to prior years. These trades remain low risk trades as it takes RV dropping much more than their prior cycle tendencies to be significant losers – unfortunately we saw more cases of the outsized RV drops this year. Double Diagonals DD trades have the goal of having performance similar to straddles/strangles – but have the ability for the trades to be open for much longer periods of time (up to 3 weeks prior to earnings) giving the stock more time to move but still have minimal downside risk. 48 Trades - 28 win, 19 loss (60% win) – Average Gain +0.79% 2024: 52 trades (73% win) – Average Gain +4.86% Comments: Winning percentage was down from last year and average gain per trade was only slightly positive. Again, a result of RV declines more than prior years. What were small winners last year because small losers this year. Last year, all losing trades were under 10% losses (majority of losses were under 5%). This year we saw 6 losses above 10%, but all losses were under 20%. The DD trade is a low risk trade type with minimal downside risk, but this year has shown that when RV declines are more than expected then losses in the 10%-15% range can occur if the stock price doesn’t move. 25% of trades hit 10% gain target (compared to 35% last year). This is not a huge difference, it means that when the stock price moves you can hit that 10% gain target regardless of what happens with RV. Pre-earnings Iron Condors In the 4th quarter we introduced the pre-earnings Iron Condor (IC) trade as a way to get a Vega negative trade type into the SO mix of trades. We targeted stocks that have a consistent and large straddle RV decline heading into earnings whose historical straddle performance show mostly losing trades (meaning the stock price doesn’t tend to move a lot prior to earnings). 10 Trades - 7 win, 3 loss (60% win) – Average Gain +0.07% Comments: Large percentage of winning trades, but one of the three losing trades was an oversized loss when stock price made a big move corresponding to a larger market downturn. Will continue with these trades in the future, trying to limit those bigger losing trades by keeping risk vs reward near equal and by selecting stocks whose straddle RV decline is both large/consistent and happens in a relatively short period of time. Other Trades Non-Earnings RICs: 2 win, 1 loss (67% win) – Average Gain +0.00%. These non-earnings trades have higher downside risk if stock price doesn’t move. In this case the 1 loss equaled the 2 wins. Hedged ratios and BWBs: 2 win, 3 loss (40% win) – Average Loss -10.90%. These were hedged directional trades, the losses were larger when the stock price didn’t move in the right direction. S&P500 addition date trade: 1 win, 2 loss (33% win) – Average Loss -14.50%. These trades play for stock price decline (or at least staying flat) after the S&P500 addition. The pattern of prior year additions was broken this year. Several of the additions this year had much less lead time compared to prior years, so this might be a factor. Summary 2025 was a very challenging year for the Steady Options model portfolio. We used the same types of trade setups and analysis that has worked for us year after year. However, the market behavior this year yielded underperforming trade results. Going forward, we will continue to try to optimize trades and limit losses – but one underperforming year does not mean we need to re-think every type of trade as they have performed consistently well in prior years As always, I’d like to highlight and thank the SO community. We continue to have a group of very smart people that seems to grow each year who share their ideas and knowledge – this is what makes SO great. Looking forward to a better 2026.17 points

-

As all our American friends are recovering from their dinners and drinks, a bit of light humour on this Monday. A friend of mine knew I was an active trader and asked whether I could share my portfolio with him and we could then discuss it. To be fair to him, he was a complete newbie and I restricted myself to sharing my shares portfolio explaining that the options bit is perhaps a bit complicated. The idea was that we would talk about it and how to build a balanced portfolio, again credit to him he took it seriously and researched the companies in my portfolio perhaps further than even I had. He therefore came prepared with his homework for our discussion this weekend and proudly laid out what he found, prefacing it with: "I researched all the companies in your portfolio, there is just one I had an issue with: ALPHABET, I googled it but can't find out which company it is."10 points

-

In the name of full transparency, I would like to address some issues regarding SteadyOptions recent performance. I will separate the analysis into several separate posts. Our performance in the recent months is not in line with our long term returns, as everyone can see on the performance page. The main reasons for the recent underperformance: We are struggling with a change in the fundamental behavior of volatility at the moment. Our trades rely on RV and therefore also IV and this has not been acting as expected. Periods of extended VIX decline have always been some of our worst performers. The main problem now is that we have been in a long period of VIX decline that’s been going for months - there have been a few spikes but in general VIX has gone from 30+ to the 20’s to the mid teens (and making things worse is many periods of minimal stock price movement during this timeframe). Our core trades do well when volatility is stable or rises. When volatility started to drop, it created some large percentage losers on a few trades that had an oversized negative impact on the portfolio performance. We had much less trades in 2025, which made the impact of those larger losses bigger. We had less trades because some options became very expensive, so it became difficult for many trades to fit into a $1K allocation, and for many stocks with moderate liquidity in normal times, now had less liquidity and very wide bid/ask spreads. This made them much more risky to use for options trades as slippage was a big concern. We used some directional trades, and the stocks did not follow historical patterns in those trades. When a directional trade goes against you, losses can grow very quickly. This is what happened with TTD, XYZ, KO, FL etc. Some of the non directional trades also experienced outsized losses. We will reduce the number of directional trades going forward. We used less calendars than usual because many of them were way too expensive compared to previous cycles. Now with VIX in the mid teens, we expect to trade more calendars, which is one of our best performing strategies. We are having extensive internal discussions on how to adapt to the current environment. Our strategies are designed to make money in any market. They are not guaranteed to make money, but our long term objectives are still in place. No strategy works all the time. There’s no room for ‘never’ or ‘always’ in the financial markets.8 points

-

Steady VIX 2025 Strategy Performance vs. SPY The Steady VIX 2025 strategy outperformed SPY in 2025 after closing out today’s trades. Performance Comparison: • SPY returned approximately 17.x% as of its latest level around 683. • Steady VIX 2025 finished with 20.4% total returns after including today’s closed trades. This outperformance is particularly noteworthy given that 2025 featured multiple significant VIX spikes — most notably during the April volatility surge that many market participants will remember for years. Despite these periods of elevated uncertainty, the strategy was often only half-allocated, yet still managed to outperform SPY. Trades like those executed in the Steady VIX 2025 strategy — in addition to a regular long-only portfolio — materially boosted overall returns. Also I wanted to mention, Allocation wise, we didn't over allocate, didn't take risky positions as much as possible. HALF allocation most of the time was highly conservative from our side. If someone had 1-2% better entry price as limit to enter the trade, I think most of the time there was BETTER PRICING for all the trades that we entered. So I won't be surprised folks getting 25% returns on SteadyVIX as well.6 points

-

I just received this email addressing some issues SO was facing in the past. I’m not a member anymore but I was and I’m familiar with the strategies. I’m a vol trader since over 20 years so here my 5 cents. There is no fundamental change in volatility. Volatility is behaving as it always does. Volatility reflects the future expectation of movement of an underlying during a certain time frame. One important driver of Volatility are events. The bread and butter of SO, earnings events. Since Trump took office, single stock volatility also incorporates a lot of Macro Event vol and there are a lot more than normal. Best example is the one you used: SOFI. Expiry is 1st of August. Thats Trump’s Tarif deadline and that’s something effecting all businesses. Hence to the normal earnings expectations you got additional macro risk that is specifically fixed on one date. But Trump started taking some expectations out of the deadline by announcing the sending out of letters with deals about two weeks ago and about one week ago announcement of a deal with Japan and on Monday the deal with EU. Hence 1st of August premium got priced out after several parts of the big event got communicated down the road. Thats like pre earning releases. There are a lot of these Macro Events around. Hence, if you trade volatility, you need to be aware of these (extra)events and what the additional premium for these events are on top of the normal micro events. It’s ok trading on backtesting but you need to be aware of the future, hence if the future has addition risk that isn’t replicate in past comparisons. I can clearly say, the SO edge isn’t lost, you just need to be aware what expiry vols you are buying/selling and what (additional) risk they incorporate.5 points

-

I always like to use the analogy of the whole stock market. The stock market indexes produce average return of 10-12%, but that included several drawdowns of 20-30%. Some of those drawdowns lasted months or even years. Nothing goes up in a straight line. So, if you joined the stock market based on a long time return of 10-12%, would you quit if you experienced a 30% drawdown? If the answer is yes, then the stock market is not for you. If the answer is no, then SO is no different. We all would like all our trades to be winners, but we know this is not possible. We know some of the trades will be losers. Many traders think that if a trade has lost money, it was a bad trade. They try to identify what errors they made that lead to losses. Why? "Because I lost money! So surely I have made a mistake somewhere?” Was it the right conclusion? Is any losing trade necessarily a bad trade? The answer is no. No matter how well he executed his trade, there will be losing trades because we are playing a probability game. Trading is a business based on probability. And probability means that sometimes we get what we want, sometimes we don't. And that's the nature of this business. The sooner we accept this, the better we can operate it as a business. To put things in perspective, our model portfolio was up 10% in the first half of 2025. We had few bad trades in July and those put us back few percentage points. While those returns are way lower than expected, they are not the end of the world. We will refine our strategies going forward and I encourage everyone to look at the big picture. It is important to note that consistency in trading is important rather than changing everything when you get an adverse movement. Adaptation rather than revolution over time is the right way to go. Have our strategies lost their edge? This question has been asked many times over the years, basically every time we have a period of dull returns, and the answer each time has been "no, they have not". I believe this time is no different. Profits come in bunches. The trick when going sideways between home runs is not to lose too much in between - Michael Covel Since inception we had 13 months that produced 20%+ returns, and over 30 months that produced 10-20% returns. To win you've got to stay in the game. Our strategies worked very well for us for over a decade, and we have full confidence that they will continue working in the future. Those who have the patience will be greatly rewarded, like in the last 13 years. Members who have been with us from the very beginning know it very well.5 points

-

A move that will likely help those of you with smaller accounts, it seems PDT minimum account value is about to be reduced to 2K rather than 25K. Timing remains uncertain however. https://www.tradingview.com/news/financemagnates:723d87023094b:0-the-25k-rule-that-s-blocking-millions-from-day-trading-is-about-to-change/5 points

-

My 2 cents worth. I've just been a tradesman all my life, not a professional. But I didn't really become the "go to guy" until I had almost 20 years working on the different kind of machines and control systems that went with them that I worked on, ultimately I ended up with 40 years in that field. I can't count the number of military and corporate "schools and/or classes" I've been to in that time. In periods between contracts I would trade, off and on, for about 20 years. I didn't make very much if any money, but I found it fascinating so I kept playing with it. But I didn't start consistently making profits trading until I finally sold my business and found myself with nothing to do, so I put full effort and full time into learning to trade and that was after 20 years of putzing around with it. Some mentoring classes and over 4 years now on SO and I still make expensive mistakes. It is easy to say "I'm smarter than the average guy so I should be able to do it a lot faster than that", but does that mean you could learn it in 5 years or 3 years or what. Don't quit your day job until you either A: already have your retirement and won't be risking that or B: you have been doing this long enough to be making a consistent profit. I think the stress of HAVING to make a profit from trading is the big filter for traders, when you aren't making any money or worse yet, losing money and you can't pay the rent, the psychology is going to make it that much harder to be successful at trading.5 points

-

4 points

-

Thank you @Yowster for an excellent summary as usual. Few comments. First, we are definitely working hard to make adjustments to our strategies in order to get back to the previous years performance. Specifically: We will do more calendars even if the RV is slightly elevated, as long as there is a pattern of rising calendar RV. We will be using our newly introduced strategy Pre-earnings Iron Condors, but use a better risk management to prevent larger losses. We will be more selective with Hedged ratios and BWBs to limit the losses. Straddles/Strangles: we will likely try to cut the loss before it reaches double digits. As a general note, no strategy can work 100% of the time. Our model portfolio was still up in 2025, just not as much as in the previous years. The market conditions have been very different in 2025, and it's unrealistic to expect any strategy to work all the time. That said, our other strategies performed very well. If you invested an equal amount of money between all our services, your portfolio would be up around 37%. As always, diversification is the key. I don't know what the future holds, but I am confident that the strategies we use are solid and are based on probabilities. Sometimes it just takes more time for the probabilities to play out. I'm also aware that some people join based on 13 years of triple digit returns but cancel after a few sideways months. This is similar to someone who entered the market at the beginning of Covid in 2020, based on ~10% yearly historical returns, and exited a few months later after 30% drawdown, just to watch the markets more than doubling in the next 5 years.4 points

-

A better strategy would be not to trade options that expire the same day. Extremely risky. A better strategy would be to understand what you are doing and asking questions before you place a trade. Learn first, trade later. And if you think education is expensive, try ignorance.4 points

-

think my response would have been, "i know a guaranteed way to have an account balance of 1.25 million your first year of trading.. start with 2.5 million and quit when you reach 1.25. many have done it, so can you." HA!4 points

-

If I had to select one thing that causes most traders to fail, it would be wrong expectations. I know I sound like a broken record, but consider this: when someone wants to become and engineer or an accountant, do they expect to achieve this in a few months? No, they fully expect spending at least 4 years and tends of thousands of dollars in University (not to mention becoming a doctor or a lawyer). And yet, many people read all the hype and expect becoming experts after a few months. When I just started SO, I got an email from one of my Seeking Alpha readers. He told me that he is a big fan of my articles and asked how he can learn more. He wanted to make it his new career. He asked me if I can recommend any books or internet sites to learn/practice the options strategies. Then he said that he is new to trading options, he set aside a small amount of money in hopes of doubling it at least yearly. Don't you find it amazing? The guy admits he is new to options, but wants to double the account "at least yearly". My reply was: "There is a lot of hype surrounding options trading. Some "gurus" out there will make you to believe that doubling your account every 6-12 months is an easy task. If it was, we all would be millionaires by now. My advice to you: if you just start options trading, preserving your capital during your first year of trading would be a great achievement" I didn't hear from him since then. He probably went to one of those charlatans who promise to double your account in one month and charge you few thousand dollars for a week of “one on one consulting”. Many people will tell you what you want to hear to get your hard earned money. Here is another email from one of our former members: "I'm new to options trading. I'm retired and am hoping to make $1.25 million per year by trading" This member cancelled after just 2 weeks. Why I'm not surprised? And honestly, I would be very interested to know the psychology behind people thinking they can have no experience with something, probably not even know how to place an order, and start making money with options right away. A 7 figure income in this case. But maybe it's the same psychology that makes people to believe that they can lose 50 pounds in 2 months without any effort..4 points

-

Hi everyone, As some of you already know, I’m not only a fellow Steady Options member but also a physicist who loves coding Python tools to help me make better trading decisions—always grounded in probabilities and statistics. I’m excited to share that I’ve put some of these tools online at math-trading.com. One of the main ones available right now is my Monte Carlo simulation tool. Pricing: $39/month or $359/year (before applying the coupon). Special for SO members: you get 15% off all subscriptions until December 31, 2025. And here’s the bonus—new tools I’m currently developing (including a Monte Carlo + Credit Put Spread combo) will be added over time without any price increase. Feel free to check them out, and if you have any questions or ideas, just reach out through the math-trading.com website. Happy trading—and thanks for your trust! Romuald3 points

-

@Yowster thank you very much for this summary ... it was a tough year and my SO account ended up slighlty in the red (-0.31% before comms, -1.2% with comms).... but I am not deterred going into 2026 as this strategy has a risk:reward profile that I can better manage .... I have been working on improving my knowledge of the put calendar trade strategy so that I can be more proactive with my trades instead of waiting for alerts in the forum ... I will keep in mind the observation that RV's with slightly higher than previous cycles may make good trades ... thanks again to all SO members and looking forward to a prosperous 20263 points

-

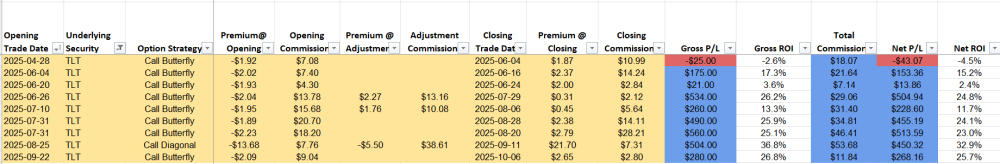

Well, I wouldn't necessarily say that. The model portfolio is $10k, but I use a $20k portfolio so all my trades are double size. Since Yowster starting managing the strategy in July 2024, I've had total profits of ~$14,300 after paying ~$2735 in commissions. I just switched to using Tradier for this strategy in May, so most of the commissions are from IB. I'm pretty happy with it overall. Maybe I should have not overemphasized the commission difference in my prior post because if you can't use a cheaper brokerage, the results have still been pretty good with IB3 points

-

I use IB for a lot of trading, but these TLT trades, in my opinion, are too expensive there so I use Tradier for them. However, I made these trades at IB before I switched to using Tradier so I can give you real numbers on the commission differences. Over several hundred contracts of TLT butterflies at both brokers, my average commission per contract at IB was (EDIT: $0.5041....not the $1.138 I posted originally) and my average at Tradier is (EDIT: $0.11925...not the $0.214 I mistakenly posted originally. Tradier does charge a $10/month for Tradier Pro, which is spread across many other contracts for me. But even if you only traded these TLT trades at Tradier and you only did 15 butterflies per month, it would cost you around (EDIT: $14.31 commission...not the 25.68 I originally posted) + $10 monthly fee = $24.31. Whereas at IB, the same trade would be roughly (EDIT: $60.49...not the $136.56 I originally posted). Those are total costs to open + close just as a comparison of the difference3 points

-

Hi everyone, I have added a new tool to my math-trading.com website. It is a table showing the results of a scanner that computes the Probability of Profit (POP) for Credit Put Spreads options trading strategies on some ETF's (the most liquid in options) using Monte Carlo Simulations. The Monte Carlo Simulation runs thousands of individual stock price simulations and uses the data from these simulations to average out a POP number, using the Black&Scholes formula. Unlike other calculators, this new tool lets you is a scanner and tries different target profits (as a percentage of maximum profit that will trigger the position to close when it's reached in the simulation. Here's how it works: The algorithm scans: ETF tickers For each ticker: DTEs between 30 and 60 days For each expiration, it tries different deltas combinations: (0.45, 0.40), # Short delta = 45, Long delta = 40 (0.45, 0.35), # Short delta = 45, Long delta = 35 (0.40, 0.35), # Short delta = 40, Long delta = 35 (0.40, 0.30), # Short delta = 40, Long delta = 35 (0.35, 0.30) # Short delta = 35, Long delta = 30 ] For each Credit Put Spread, for each day between today and the expiration date, it performs 5,000 simulations of Monte Carlo and, for each of the 5,000 prices obtained, applies the Black & Scholes formula to estimate the price of the initially opened Credit Put Spread. When the GTC of 30%, 40%, and 50% is reached, it looks at the number of days it took to reach it. If it is not reached, the Credit Put Spread is considered lost. It thus calculates, for all simulations, a profit probability and an average day to close. Note, of course, that the IV is considered constant and equal to the value when the Credit Put Spread was opened. The stock price volatility is equal to the implied volatility and remains constant. It makes the following assumptions for its simulations : Geometric Brownian Motion is used to model the stock price using Monte-Carlo simulations, Risk-free interest rates remain constant, The Black-Scholes Model is used to price options contracts, Dividend yield is not considered, Commissions are not considered, Assignment risks are not considered, Earnings date and stock splits are not considered, Of course, not all of these assumptions are true in real life and so there are limitations to this approach. For example, it's highly unlikely that the stock price volatility remains constant for several days. Thus, one should take these results with a grain of salt. Here are the results for yesterday 2025-08-20: On that image I have applied the filters : Gain/Loss min = 0.50, GTC/Loss min = 0.25 and Avg DTC (Day to Close) max = 10 : it means that I want the scanner to select the trades that have reached their GTC within the 10 days after the opening of the trade : this filter is because it is better to close these kind of trades once we get within a 2 weeks of expiration because gamma risk gets much higher closer to expiration. Of course you can click on each columns to sort by ascending / descending order. The computation process itself is very long, given that 5,000 Monte Carlo simulations must be carried out for every day over the 5 last years (for the history of Monte-Carlo simulations), for all tickers, for different combos of Deltas and different expiration dates. On my powerful PC, this takes about 3 hours, without running anything else. Therefore, it is only possible, on math-trading.com, to put the final results table every day. You can see in the image that I have put very interesting filters so that everyone can choose according to their wishes. I will put a complete user guide and deeper explanations in the coming days but, in the footer of the table, you already have a brief description of the different terms ("dictionary of terms"). I hope you all find this tool useful! In preparation : a new tool for calculating the Probability of Profit (POP) and the Average Day to Close for a lot of options trading strategies using Monte Carlo Simulations! Stay tuned! Romuald3 points

-

And I would also encourage everyone to look at a year to year basis -- not a month to month, just because of how the strategy works. The hedges have to both kick in and be paid for. The "worst" case for the strategy is about a 7% SPY drawdown right after opening a new year strategy. At that point you've not paid for the hedge at all, plus you've lost some on the diagonal, and as the hedge doesn't really start until a 5% drawdown, then you haven't gotten the advantage of having it. On a 12 month rolling basis, it works great (except for one period due to an odd mix of market crash plus volatility dropping, but we did address that). Anchor ideally outperforms in up markets (those up over 10%) and in crashes (over 15% to 20%). In flat markets (5% to -5%) we EXPECT to underperform. In small down markets (-5% to -10%) it's a tossup depending on a lot of factors if we outperform or over perform. (Past performance does not always indicate future performance)3 points

-

As a side note, we encourage people to look at the big picture and not focus on the last few weeks. Anchor is has been CRASHING the S&P 500 since inception, up 223.3%, compared to S&P 500 return of 134.7% (as of 12/31/2024). We also recommend reading How Anchor Survived the 2020 Crash. On March 19 2020, SPY at 234 (down 30%), Anchor UP $5k (~3%).3 points

-

In addition to @InvestTrader, something else that dovetails into position size. Don't "day trade" your positions, and if you are, then ask the nice nurse for another shot and go back to your computer. Seriously, what I mean is, if I have a position open that is getting beat up, I try not to focus on the chart constantly, watching it's every move, this very often leads to me closing or altering the position, in other words, over trading. Sure, there are times I must focus on as specific trade/ticker, but I don't have the temperament to watch the screen, filled with angst like a day trader, finger hovering over the send button. And yet, I still often do it, so I have to constantly control that tendency. I think that one thing has cost me more money than any other.3 points

-

I came across an excellent article explain Why Most Traders Lose Money. Key facts: 95% of all traders fail. 80% of all day traders quit within the first two years. 60% of all day traders quit within the first month. Trading is a profession and requires skills that need to be developed over the years. Yes, there is a steep learning curve in trading, like in any area in life. It takes 4-7 years to become an engineer, a lawyer or a doctor. Why people expect it to be different with trading? Can you become a doctor by following a skillful group of doctors? 'If you are not willing to learn, no one can help you. If you are determined to learn, no one can stop you.' - Zig Ziglar3 points

-

I had to restrain my laughter so I won't wake up my wife!!!!! (punch line:"googled it" !! Sarang2 points

-

2 points

-

@greenspan76 your comment about your experiences with IB commissions on the TLT trades made me look at my commissions for every 15-lot TLT fly this year. As you know IB commissions vary, but my range across all of those trades was a low of ~$0.35 and a high of ~$1.05 per contract (with only two trades of paying $1.00+). The average across all those trades was ~$0.60 per contract, so much lower than what you have observed. At that $0.60 rate the total commission to both open and close the trade was $4.80 for each fly (4 legs on open and close) - and with each fly typically costing ~$200 that commission is 2.4%. Ideally, I'd like under 1% impact per trade, but these are 4 leg trades so while not ideal the commission impact is bearable. Of course if you can lower fees and the same fills with another broker then that is better. The question is why your IB commissions are so much higher than mine, I have nothing special or out of the ordinary tied to my IB account.2 points

-

Profits come in bunches. The trick when going sideways between home runs is not to lose too much in between - Michael Covel I keep repeating this quote again and again, just look at latest Simple Spreads performance. Every drawdown in S&P 500 was followed by a monster rally (it is now up over 30% from its April lows in just 3 months). Every time SO was "underperforming" for a few months, was following by a monster year.2 points

-

Great analysis, and with candor and transparency, too. Thank, Kim. The comment about directional trades did resonate with me, as I have been watching them from the sidelines, or had modified my own trade away from the official. Directional trades probably have their place in a basket of strategies. However when they deviate from the core thesis, it's a red flag for me. Many such trades started out delta positive right off the bat, with no (or not enough) room for error - just the hope that the stock would revert if it went south (pun intended). Somewhere in my basket of wisecracks is a saying that goes "Hope is not a strategy". In such cases I tended to stick with the original thesis, which worked better, or at least add a simple hedge - one that is understandable by the lay person - kind of like like we do with our Double Diagonals, where a calendar is added to mitigate the non-movement of the stock. Taking the loss on a bad trade and moving on is another thing that traders tend to postpone, and then find themselves in trouble. The persistent red values in the daily trade log that present themselves hour after hour and day after day tend to make traders obsess over recovering from them which takes away time from finding potentially successful new trades. Someone had mentioned a while ago, and I agree whole-heartedly, that there is a psychological cost to staring at ugly red losses on a continuous basis. I personally tried this "different" discipline earlier - that is, mostly sticking to the defined max loss and/or profit targets - and my trading became more fulfilling, the losses smaller in number and value, and profitable trades more numerous. Even the moments of depression were fleeting when the closed losing trades were put aside in the cumulative trade log, leaving the active log looking a whole lot healthier. The wonderful thing about SO is the thinking, back-testing, discussion and evolution that have formed all the core strategies, and this time is no exception, I'm sure.2 points

-

Very sounds advice Chris. And it should apply to all strategies, not just Anchor. Unfortunately, some "investors" think in terms of weeks and months instead of years and decades. Some of them cancelled in 2022, and kept watching the Anchor portfolio doubling since then. BIG MISTAKE, HUGE. No wonder that 90% of investors lose money in the stock market. P.S. Anchor was up 4.1% in April vs. SPY down 0.91%. Anchor is down 4.6% as of April 30, matching SPY performance more or less. But in 2024 Anchor was up 37.8% compared to SPY up 23.3%.2 points

-

On the "liberation day" crash, we just barely missed what I would have considered to be our roll point for the hedges. On that day, S&P was down about 17% and my portfolio was down about 10%. We didn't quite hit the roll point, so now we've sort of inverted with the S&P being down about 6% while my portfolio is down about 11%. But if we continue to recover, portfolio should recover faster here. If we retest lows, we should be able to roll this time and lock in being ahead. If we just float right here, we should be able to make pretty good premium on our diagonals, but I would assume we would lag the market a bit. Had the price of SPY dropped about another $10, we likely would have rolled our hedges and been up. Sometimes we just don't quite hit the break point though.2 points

-

All well said! A couple of things based on experience: - Trade style should match your trade personality and trade character. (Are you are day trader or swing trader/position trader?) - Options Education (Do you understand your max risk or exposure before a trade is placed?) - Volatility response (Matches rule 1, but you have to experience it to know how much volatility you can handle.) No paper trades - Profitability Goal (Yes, options/trade education is important. However, if it doesn't transform to profitability then it's a total hype and/or waste of time) - Options trading is not the holy grain of stock trading/investing. (Options trading should be one of the tools used as part of a multiple-faceted approach to investment profitability) - Less is more (Overtrading is a real thing and it has the potential of diminishing profitability in the long run) - Compementary trading systems help smoothen the curve. (Find two complementary systems that help smoothen the volatility curve and work out a combination or ratio that suits your investment goal) - It's ok to pivot when necessary (Options trading isn't for everyone. It's ok to give it a try and admit if it's your thing or not.) Pivoting to a profitable system is great. Whether that's an options based system, combination of both, or not is ok. - Stick with what works (Keep it simple. Stick to what works for you and make it the bread and butter of your system. Everyone gets that hunch to experiment, keep it nimble and in a separate account)2 points

-

That reminds me of the Irish farmer who won the lotto. When asked what he would do with the money. He said I'll keep farming until it is all gone.😀2 points

-

Hi June I see you joined yesterday. You have plenty of posts to learn. There is wealth of knowledge here. Three years is not enough to be profitable trader. It takes 10+ years to be a really profitable trader in most market conditions. Take your time and be prepared for long haul. I have been through 3-4 liquidation events in my career and still trading and going strong even in todays challenging times. You need passion . With passion and perseverance and guidance and hope and discipline and hard work and courage and tiny amount of luck , you can join the elite club of consistently profitable traders who depend on trading for their day to day living.2 points

-

Non-directional, volatility-based trades will not drive you crazy. In retrospect on my trading journey, I should have just done what I knew would bring profit from square one as opposed to chasing larger gains. Then just watch the markets until you fully grasp how they move and wait for opportunities. If you can't afford to lose, don't trade it. More conservative trading is better, and take profits when you can. There's so much noise out there with trading that if you find something that works, stick with it because often those are few and far between. I have some 59-day SPY spreads right now and am using SteadyOptions trades as a hedge. I will tell you that it is downright uncomfortable holding through this volatility and uncertainty. It will make you just not want to trade independently. I'm just barely profitable at this point, but much more competent than most, well educated, and exceptionally aware of macroeconomic conditions... most of my losses are attributable to not watching the market for long enough and following bad alerts. Just follow SteadyOptions from square one is the best advice I have for you, and then continue learning from there.2 points

-

90% if success of failure in trading/investing is related to psychology, human emotions and discipline. Even investors who simply buy an index fund or a mutual fund will have very different results, depending on how they do it. Here are some articles that might help: Probability Vs. Certainty Trap Are You EMOTIONALLY Ready To Lose? Are You Ready For The Learning Curve? Why Retail Investors Lose Money In The Stock Market Why Simple Isn’t Easy Thinking In Terms Of Decades Can you double your account every six months? Is Timeframe Your Biggest Mistake? Are You Following "Tharp Think" Rules? Top 10 Mistakes New Option Traders Make Price Of Options Trading Education How To Become A More Profitable Trader 5 Stages Traders Go Through 10 Fatal Mistakes Traders Make Learning To Win By Learning To Lose How To Avoid Emotional Mistakes In Trading 10,000 Hours Of Trading Bitcoin: The Greater Fool Theory? Investor Discipline Is The Key To Success Buy High, Sell Low: Why Investors Fail How To Control Losses And Protect Profits 10 Tips: Trade Options Like A Pro And Keep Your Day Job2 points

-

2 points

This leaderboard is set to New York/GMT-05:00