SteadyOptions is an options trading forum where you can find solutions from top options traders. Join Us!

We’ve all been there… researching options strategies and unable to find the answers we’re looking for. SteadyOptions has your solution.

All Activity

- Past hour

-

camillawalker110 joined the community

-

Question and apologies if this has been discussed. If someone is stuck using IB could you explore using options on /ZB futures instead? You’d likely have to pick different strikes based on deltas but you’d be able to reduce your contract size by 10x. Not to mention more favorable capital gains treatment in US.

- Today

-

Well, I wouldn't necessarily say that. The model portfolio is $10k, but I use a $20k portfolio so all my trades are double size. Since Yowster starting managing the strategy in July 2024, I've had total profits of ~$14,300 after paying ~$2735 in commissions. I just switched to using Tradier for this strategy in May, so most of the commissions are from IB. I'm pretty happy with it overall. Maybe I should have not overemphasized the commission difference in my prior post because if you can't use a cheaper brokerage, the results have still been pretty good with IB

-

This statement is completely inaccurate. Even with IB commissions you would still make outstanding returns.

-

bobbydcarr started following Yowster

-

The losses were with the previous manager who did a terrible job. Yowster has been managing it since the other guy was ousted, and there has been good returns. Read the postings on the Forum or follow Kim's email updates on Steady Yields. Sarang

-

With those commissions, and the payment of the service in IB, I don't think it will be profitable then.

-

I'm undecided whether to subscribe to that service, because I saw that it had many losses, have you been using it for a while?

-

I use IB for a lot of trading, but these TLT trades, in my opinion, are too expensive there so I use Tradier for them. However, I made these trades at IB before I switched to using Tradier so I can give you real numbers on the commission differences. Over several hundred contracts of TLT butterflies at both brokers, my average commission per contract at IB was $1.138 and my average at Tradier is $0.214. Tradier does charge a $10/month for Tradier Pro, which is spread across many other contracts for me. But even if you only traded these TLT trades at Tradier and you only did 15 butterflies per month, it would cost you around $25.68 commissions + $10 monthly fee = $35.68. Whereas at IB, the same trade would be roughly $136.56. Those are total costs to open + close just as a comparison of the difference

-

1. IBKR is a very low commission broker. I have used them for several years with both Steady Yields, and also better yet with Steady Collars strategies. Their commission structure as well as low Margin interest rates allow you to keep most of the profits for yourself. 2. You can read about it in the Forum Steady Yields Sarang

-

where Do I could read about this strategic?

-

I operate with IB, would commissions be a problem for this operation?

- Yesterday

-

Aspire Legal Solutions changed their profile photo

-

Aspire Legal Solutions joined the community

- Last week

-

I did not and I saw that it was not working so not sure what changed. Update: the previous error seems to be missing earning date from one of the source. Now it seems to be providing it.

- 1074 replies

-

- rv chart

- volatilityhq.com

-

(and 1 more)

Tagged with:

-

@Djtux not sure if you did anything, but it is working now.

- 1074 replies

-

- rv chart

- volatilityhq.com

-

(and 1 more)

Tagged with:

-

@Djtux trying to look at XYZ gives an error (as does looking up the old ticker of SQ).

- 1074 replies

-

- rv chart

- volatilityhq.com

-

(and 1 more)

Tagged with:

-

Shuttles and Needles changed their profile photo

-

Shuttles and Needles joined the community

-

Members who change their subscription from monthly to yearly, please don't forget to cancel the monthly to avoid double charge.

-

It is our policy to grandfather members at rates they originally subscribed as long as they maintain an active subscription. This applies to individual products and bundles. If you cancel a service or a bundle and wish to re subscribe, you will pay the price in effect at the time you re subscribe. So it will not be possible to change the term after the 15th and keep the current rate, but members can try the service now with monthly subscription and upgrade to yearly before the 15th at the current rate, and I will issue prorated refund of the monthly subscription.

-

Andy McCallum joined the community

-

Thanks for the heads up. The current rates until 15th October are: Monthly - $125 Quarterly - $300 Yearly - $1,000 If we subscribe by the 15th and get grandfathered in to these current rates, are we free to move between the current monthly/quarterly/yearly rates in the future? For example, if I subscribe to the quarterly at $300 now, can I switch to the yearly at $1000 some months down the line?

-

Mike O Flynn joined the community

-

Please be advised that Simple Spreads subscription rates will be adjusted on October 15 as following: Monthly - $150 Quarterly - $375 (save 17%) Yearly - $1,200 (save 33%) Please note that the increase will only apply to new subscribers. Existing subscribers will be grandfathered at the rate that they signed up for originally, as long as they maintain an active subscription. We hold rates for our existing subscribers as a reward to them for their loyalty to us, which we very much appreciate. As long as you join before October 15th, you will continue to pay the current rates. Bundle prices will remain the same for now, but are expected to increase soon. If you wish to join before the price increase, please use one of the links on the Subscription page. Please make sure to read the Frequently Asked Questions to make sure the service is a good fit for you.

-

Please be advised that Steady Yields subscription rates will be adjusted on October 15 as following: Monthly - $150 Quarterly - $375 (save 17%) Yearly - $1,200 (save 33%) Please note that the increase will only apply to new subscribers. Existing subscribers will be grandfathered at the rate that they signed up for originally, as long as they maintain an active subscription. We hold rates for our existing subscribers as a reward to them for their loyalty to us, which we very much appreciate. As long as you join before October 15th, you will continue to pay the current rates. Bundle prices will remain the same for now, but are expected to increase soon. If you wish to join before the price increase, please use one of the links on the Subscription page. Please make sure to read the Frequently Asked Questions to make sure the service is a good fit for you.

-

Please be advised that Anchor subscription rates will be adjusted on October 15 as following: Monthly - $150 Quarterly - $375 (save 17%) Yearly - $1,200 (save 33%) Please note that the increase will only apply to new subscribers. Existing subscribers will be grandfathered at the rate that they signed up for originally, as long as they maintain an active subscription. We hold rates for our existing subscribers as a reward to them for their loyalty to us, which we very much appreciate. As long as you join before October 15th, you will continue to pay the current rates. Bundle prices will remain the same for now, but are expected to increase soon. If you wish to join before the price increase, please use one of the links on the Subscription page. Please make sure to read the Frequently Asked Questions to make sure the service is a good fit for you. If you currently have a monthly or a quarterly subscription and wish to upgrade to yearly and be grandfathered at the current price of $1,000/year, you can cancel the monthly or the quarterly and subscribe to the yearly before October 15 and we will provide a pro rated refund of the unused portion of the current monthly or quarterly subscription.

-

koorosh joined the community

- Earlier

-

I think ONE just uses the spot price of the options at the end of each 5 minute window, I don't think its an average over that timespan. For stocks whose options are less liquid its common to see this type of thing as the width of the bid/ask spreads widen and narrow throughout the day.

-

Makes sense. Does it mean these mid points are within that 5 min window, since we are looking at moment in time?

-

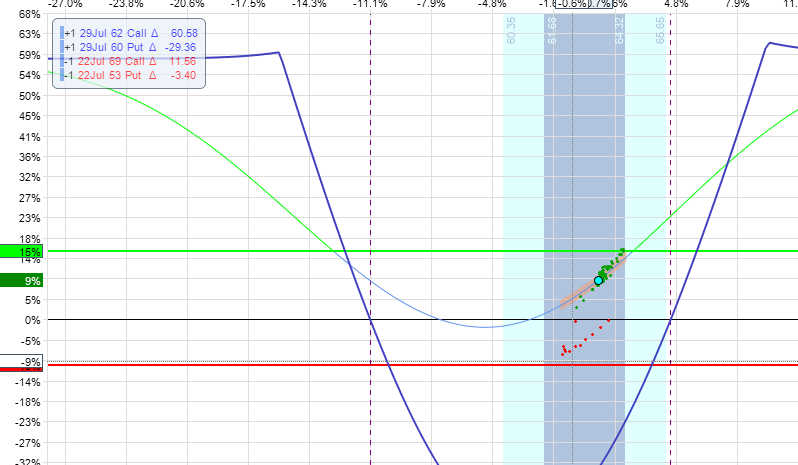

As you probably know, each dot represents the midpoint price of the position at different points in time throughout the day. When you see bigger variations like this with the dots when the stock price stays around the same level its likely that the bid/ask spreads are wider so the midpoint price is jumping around a lot. It can also be a bigger change in RV but that is less likely.

-

@Yowster I was backtesting a DD and am getting these dots (Green and Red) all over the place. What can we possibly conclude from this?

-

richfischer joined the community

-

Got it. Thanks!

- 1074 replies

-

- rv chart

- volatilityhq.com

-

(and 1 more)

Tagged with:

.thumb.jpg.e85549ef6caaf3774c118b152603561f.jpg)

.thumb.png.d3af2a144edba4dc1681db00e44b0897.png)