We’ve all been there… researching options strategies and unable to find the answers we’re looking for. SteadyOptions has your solution.

All Activity

- Last week

-

Option Commander - Trading Terminal for Interactive Brokers

andrey748 replied to andrey748's topic in Promotions and Tools

Currently only for PC, maybe I'll add Mac in the future -

Option Commander - Trading Terminal for Interactive Brokers

NuclearMaple replied to andrey748's topic in Promotions and Tools

Does it work with Mac OS? -

Hey everyone! I've been using OptionVue and later ONE for a long time. They're decent tools, but I kept hitting the same issues - lagging interface, unreliable order submission, broken fill imports, clunky modeling, and no strategy templates. So I built my own terminal that solves these problems: - Speed. Everything is fast with no lag - quotes, order execution, loading fills. - Flexible modeling. More convenient position modeling with support for custom strategy templates. - Accurate calendar spread what-if analysis. Volatility changes are modeled independently across different expirations, so you get realistic projections. It also includes a number of other features: strategy builder with entry conditions, volatility cone analysis, Kelly criterion calculator, trade copy-paste, historical price distribution analysis, the ability to send orders to two TWS instances for mirroring trades to a second account, and futures-based SPX price tracking during off-hours. On the practical side - there's a convenient backup/restore to Google Drive so your data is safe and not tied to a specific machine. Everything runs locally, no data is sent to the cloud. And authorization is handled once, so you don't have to log in manually every time. I'd love to get any feedback. Happy to answer questions about setup or how it works. Download and start a free 14-day trial at https://optioncommander.com/

-

Joshbarr4 joined the community

-

bgricker joined the community

-

SO can be more than 50% invested during busy earnings periods, so you would need to reduce the position sizing. And your drawdowns might be higher as well, so it would be more risky. But overall, yes, it can be done, although generally speaking, I always recommend not to invest 100% of the account and have at least 20-30% in cash (or less risky assets).

-

SO has all trades listed because it's a lot of trades using different strategies. Services like SY and SV have only 2-3 trades every month, so it's very easy to track the P/L. For example, SY January return of 4% is based on 4 trades closed in January: If you sum the P/L of each trade (291+208+305-326), you will see how we report 4% ($400) return. SV is even simpler - it is typically a single trade per month.

-

Hi Kim, looks like a fantastic service with a bright future, especially with Yowster managing it, who i know from steady options is incredibly smart and reliable. I think i will likely end up purchasing this too in the future, my question is: given that this is only usually 50% invested, and so is steady options, would it be a silly idea to make that 100% of my portfolio? Could you share some more info on the types of trades and the greeks? Thanks!

-

Kim, New to service, and trying to understand the history of the services, in particular SteadyYields. SteadyOptions has a decent set of details, outlining the trades for (say) 2025. But I cannot find a corresponding set for any of the other services, only aggregates. SY appears to have a "bit of history", but it seems difficult to assemble a complete history of trades, PnL, DrawDown, Risk incurred, Position size in order to have a better understanding of what to expect. Any tables/data appreciated - Phil

- Earlier

-

Bens joined the community

-

Personal MBA Coach changed their profile photo

-

Personal MBA Coach joined the community

-

thetechguy joined the community

-

huynhchinhthuan91069 joined the community

-

philH joined the community

-

BillK joined the community

-

thanks for the information!

-

kennethwes joined the community

-

sensei614 joined the community

-

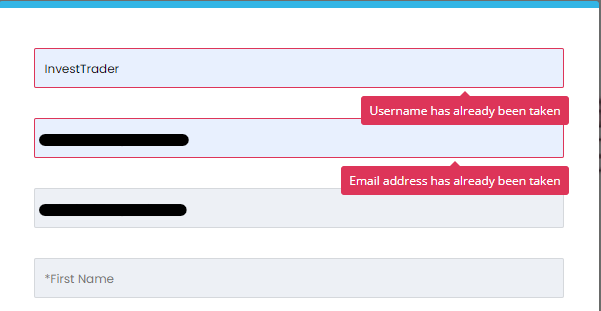

Hi, sorry to hear about that. I cannot find "InvestTrader" in the members. Can you please give me the email address in order for me to find you among all the subscribers? Thanks, Romuald

-

Hi @Romuald A few months ago I registred in your site (the free plan). Now I'm trying to activate a paid subscription. I login, go to the subscriptions page, click on the desired plan and nothing happens. There is no response. If I logout and go to the subscriptions page, then I can access the form to activate the subscription. However, when I start inserting my data, the site rejects it saying that they already exist (which is correct). How can I activate the paid subscription? Thanks In Advance!

-

It’s the friday before the earning. Each earning date is not always on the same day of the week (Monday, Tuesday, etc) so it’s not always the same T-X. Another thing is that the data does until the Thursday because on friday end of day there is no data for that option that is expired.

- 1093 replies

-

- volatilityhq.com

- volatilityhq

-

(and 1 more)

Tagged with:

-

@Djtux Looking at the double calendar RV charts with short leg before earnings, 1 week between calendar legs, weekly options, the black median line ends on different days before earnings date. Sometimes it is on Thursday Friday or Monday. It can be -2 -3 -4 trading days. What is the rule here? I would expect it always to be on a Friday since the calendar's front leg expires

- 1093 replies

-

- volatilityhq.com

- volatilityhq

-

(and 1 more)

Tagged with:

-

Spreadable Mobile Trading App created for Steady Options

mabueh replied to Bull3t007's topic in Promotions and Tools

The app works really well and is quite intuitive - I use it on a daily basis. If I am not mistaken, it is however available only on Apple products and also not accessible in browsers. -

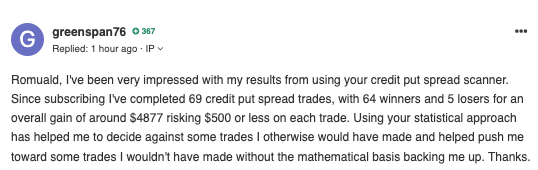

Here's a message I received today that's always a pleasure! I'm delighted that greenspan76 was able to earn this money thanks to my website math-trading.com!

-

Spreadable Mobile Trading App created for Steady Options

Bull3t007 replied to Bull3t007's topic in Promotions and Tools

I have built it and have been using it for three years now. It’s great;) -

Spreadable Mobile Trading App created for Steady Options

MikeMike replied to Bull3t007's topic in Promotions and Tools

I anyone using this app? I have been looking to switch to Tradier, but need to trade via mobile much of the time. If this app works well it would solve that issue for me. Thanks. -

Chartaffair.com - RV Charts & Backtesting for Steady Options

ocr008 replied to Christof+'s topic in Promotions and Tools

I want to cancel my subscription chartaffair please help -

Spreadable Mobile Trading App created for Steady Options

lisamontgom replied to Bull3t007's topic in Promotions and Tools

thanks for the information! -

Hi @Djtux, I came across an article by Newfound Research. In the article, they argue that using a volatility based timing strategy can reduce the hedging cost substantially. https://blog.thinknewfound.com/2020/07/heads-i-win-tails-i-hedge/ Since the timing strategy is about some "simple" manipulations of SPY IV and RV, I wonder if you are willing to included in volatilityhq? Thank you.

- 1093 replies

-

- volatilityhq.com

- volatilityhq

-

(and 1 more)

Tagged with:

-

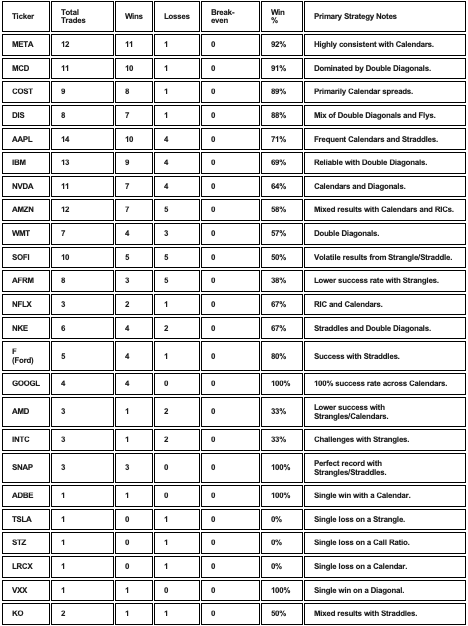

Aggregated Win Analysis by Stock (2022–2025) for SO Trades

Optrader replied to SlayTrader's topic in General Board

SOFI straddle has 50% chance. But RV is very low. So hopefully we will be in positive 50% side. -

Aggregated Win Analysis by Stock (2022–2025) for SO Trades

Optrader replied to SlayTrader's topic in General Board

This is nice and spot ON. The top of list is meta. The day meta calendar was bought. It has kept going up and turned out to be best trade of this year. All others look correct too. So Good Analysis. Thanks -

Yes, there is a coupon in the first post of this thread.

- 1093 replies

-

- volatilityhq.com

- volatilityhq

-

(and 1 more)

Tagged with:

-

Hi, do SO members still get a 50% for the volatilityhq subscription? Thanks.

- 1093 replies

-

- volatilityhq.com

- volatilityhq

-

(and 1 more)

Tagged with:

-

Performance Dissected Check out the Performance page to see the full results. Please note that those results are based on real fills, not hypothetical performance, and exclude commissions. Our contributor @Yowster did an excellent analysis in his 2025 Year End Performance By Trade Type post. Most SO trades are Vega positive trades leading up to earnings events, so volatility plays a key role in the outcome of our trades. 2025 saw 4 VIX spikes that occurred rather quickly (not a gradual rise), most spikes were relatively short in duration with declines starting shortly after the spikes. Trades that were in place prior to the spike performed well, but other trades that did not encompass a spike commonly dealt with falling volatility and RV declines bigger than prior earnings cycles. This meant that trade that would have been small to moderate gains in prior years turned into small to moderate losses this year. Losses above 10% were also more common. As usually, we are very transparent about our performance even when things don't work as expected. No strategy can outperform all the time, and SteadyOptions is no exception. There were some things that worked very well this year, although they were in some of the portfolios outside of SO. Steady Yields (SY) and Simple Spreads (SS) performed very well as many of their trades were helped by the same things that hurt the SO trades. Most trades in SY and SS tended to be Vega negative, meaning that they were helped by declining IV – so both time decay and declining IV helped these trades. Members who subscribed to our all services bundle did very well in 2025: If you allocated an equal amount of capital to each one of our services, your portfolio would be up 36.2% in 2025. In terms of average return of all our services, this was in fact one of our best years. Congratulations to our bundle members, and huge thank you to our contributors: @Yowster @krisbee @cwelsh @TrustyJules and @Romuald for their commitment and dedication! As I mentioned in one of the discussion topics, our performance reporting is very conservative. We rarely have more than 5 trades open at the same time, but with 5 trades open, you are basically only 50% invested. If you made 10% on the invested capital, we would report as 5% return on the total account. No service is doing it, but this is the only correct way to do it. But it also means that members can invest more than 10% per trade on trades that are more conservative and more liquid. Also there are tons of unofficial trades that don't make it to the official portfolio due to their size.being too large for 10k portfolio. If we reported performance like most other services do (return on investment and not on the whole portfolio), our reported performance would be 300%+. More details: How We Calculate Returns? After 14 years in business, SteadyOptions maintains its position as the most stable and consistent options trading service, with 114.5% Compounded Annual Growth Rate. Our strategies SteadyOptions uses a mix of non-directional strategies: earnings plays, Long Straddle, Long Strangle, Calendar Spread, Butterfly, Iron Condor, etc. We constantly adding new strategies to our arsenal, based on different market conditions. SO model portfolio is not designed for speculative trades although we might do some in the speculative forum. SO is not a get-rich-quick-without-efforts kind of newsletter. I'm a big fan of the "slow and steady" approach. We aim for many singles instead of a few homeruns. My first goal is capital preservation instead of doubling your account. Think about the risk first. If you take care of the risk, the profits will come. What makes SO different? We use a total portfolio approach for performance reporting. This approach reflects the growth of the entire account, not just what was at risk. We balance the portfolio in terms of options Greeks. SteadyOptions provides a complete portfolio solution. We trade a variety of non-directional strategies balancing each other. You can allocate 60-70% of your options account to our strategies and still sleep well at night. Our performance is based on real fills. Each trade alert comes with a screenshot of our broker fills. We put our money where our mouth is. Our performance reporting is completely transparent. All trades are listed on the performance page, with the exact entry/exit dates and P/L percentage. It is not a coincidence that SteadyOptions is ranked #1 out of 723 Newsletters on Investimonials, a financial product review site. We also get a very high 4.6 score on trustpilot, the most trusted reviews site. The reviewers especially mention our honesty and transparency, and also tremendous value of our trading community. We place a lot of emphasis on options education. There is a dedicated forum where every trade is discussed before the trade is placed. We discuss different strategies and potential trades. Unlike most other services that just send the trade alerts, our members understand the rationale behind the trades and not just blindly follow the alerts. SO actually helps members to become better traders. Other services In addition to SteadyOptions, we offer the following services: Anchor Trades - Stocks/ETFs hedged with options for conservative long term investors. Simple Spreads - simple spread strategies like diagonal spreads and vertical spreads. SteadyVIX - Volatility based trades. SteadyYields - Treasures trading We offer all services bundle at $3,000 per year. This represents up to 68% discount compared to individual services rates and you will be grandfathered at this rate as long as you keep your subscription active. Details on the subscription page. More bundles are available - click here for details. You can also get the yearly bundle with one month trial at $100 (one trial per member). Subscribing to all services provides excellent diversification since those services have low correlation. We also offer Managed Accounts for Anchor Trades. Summary 2025 was a challenging year for SO, but a very solid year for the rest of our services. SteadyOptions is now 14 years old. We’ve come a long way since we started. We are now recognized as: #1 Ranked Newsletter on Investimonials Top rated service on trustpilot Top Rated Newsletter on Stockgumshoe Steady Options Review: In-Depth Analysis Top 10 Option Trading Blogs by Options Trading IQ Top 6 Options Newsletters by Benzinga Top 40 Options Trading Blogs by Feedspot Top 15 Trading Forums by Feedspot Top 20 Trading Forums by Robust Trader Top Twitter Accounts to Follow by Options Trading IQ I see the community as the best part of our service. We have the best and most engaged options trading community in the world. We now have over 10,000 registered members from over 50 counties. Our members posted over 190,000 posts in the last 13 years. Those facts show you the tremendous added value of our trading community. I want to thank each of you who’ve joined us and supported us. We continue to strive to be the best community of options traders and continuously improve and enhance our services. Let me finish with my favorite quote from Michael Covel: "Profits come in bunches. The trick when going sideways between home runs is not to lose too much in between." If you are not a member and interested to join, you can click here to join our winning team. When you join SteadyOptions, we will share with you all we know about options. We will never try to sell you any additional "proprietary systems", training, webinars etc. All our "secrets" are included in your monthly fee.

.thumb.jpg.3ed143eeb45acb89ba43287757ccbd6b.jpg)