Charlie Bilello argued that I DON'T KNOW are The 3 Most Important Words in Investing. And rightfully so. This is what he wrote:

"The future and markets are unpredictable, and having the humility to admit that is very hard for us to do. We’re simply not wired that way and instead suffer from the behavioral bias of overconfidence. Which is to say we overestimate our own abilities when it comes to sports, trading, driving or anything else. While a little bit of confidence can be a good thing in many areas of life, overconfidence, particularly in the investment world, can be disastrous. With overconfidence comes the tendency to overtrade and make highly speculative, concentrated bets on the future."

Looking at CNBC as an example, here are some of the last week headlines:

- A 'perfect storm' correction is coming, and nothing can stop it

- One of street's most accurate forecasters calls for stock sell-off to deepen

- 'Halftime' trader Jon Najarian sells everything

- Don't worry—this is just a 'back-to-school' sale

One of the well known Seeking Alpha contributors (who is also a frequent speaker on CNBC) claims to "know" what the markets will do. His mantra is "Remember: I can only tell you what is going to happen in the markets and how you can make money trading it - the rest is up to you!"

My guess is that if anyone could really predict what the markets will do the next day, week or month, he would be retired by now and not fishing for subscribers on Seeking Alpha...

To see how reliable market forecasts are, lets take a look at cxoadvisory study. Those guys asked a simple question:

Can equity market experts, whether self-proclaimed or endorsed by others (such as publications), reliably provide stock market timing guidance? Do some experts clearly show better market timing intuition than others?

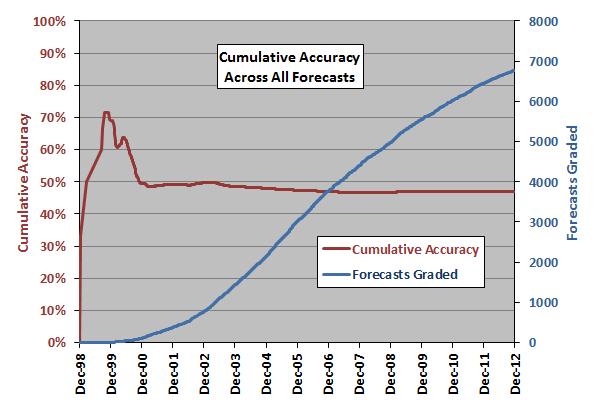

To answer that question, during 2005 through 2012 they collected 6,582 forecasts for the U.S. stock market offered publicly by 68 experts, bulls and bears employing technical, fundamental and sentiment indicators.

Are you ready for the answer?

Terminal accuracy is 46.9%, an aggregate value very steady since the end of 2006.

Did you get it? The average accuracy of the investment gurus is worse than a coin toss!!!

If you are not a member yet, you can join our forum discussions for answers to all your options questions.

As an example, Bob Prechter from ElliottWave made himself a pretty good name by correctly forecasting the 2008 market crash. What most people don't remember is the fact that Prechter's newsletter had been almost uninterruptedly bearish for the nearly two decades prior to 2008 -- and, as a result, according to the Hulbert Financial Digest, was near the bottom of the rankings for market timing performance over those two decades. A bearish stopped clock even gets to be right occasionally. cxoadvisory's research confirms this - Robert Prechterwas ranked the last out of 68 gurus, with only 20.8% accuracy.

Charlie Bilello suggests to practice the "I don't know" concept in response to some standard questions you hear on TV every day:

- Where will the S&P be at the end of the year? I don’t know.

- Where will the 10-year yield be at the end of the year? I don’t know.

- Where will Crude be a year from now? I don’t know.

- Is Gold a good investment here? I don’t know.

- Will the U.S. enter a recession this year? I don’t know.

- What will be the best performing stocks/sectors/asset classes over the next day/month/year? I don’t know.

- Will the Fed hike rates this year? I don’t know.

- Who will win the election and what impact will it have on the economy/markets? I don’t know.

The bottom line is that it might be very dangerous to rely on any market forecasts for your investment decisions.

Admitting you know nothing about the future is just about the best thing you can do. If you want to learn how to make money in the markets without the need to "know" the future, join our trading community.

Related articles:

Can you double your account every six months?

Can You Really Turn $12,415 Into $4M?

Performance Reporting: The Myths and The Reality

Why Retail Investors Lose Money In The Stock Market

Are You Ready For The Learning Curve?

Are You EMOTIONALLY Ready To Lose?

SteadyOptions offers the best options trading education for investors and traders. Our goal is to help you become a successful trader by providing you with the tools and knowledge you need to make informed decisions. Subscribe to SteadyOptions now and experience the full power of options trading at your fingertips. Click the button below to get started!

There are no comments to display.

Join the conversation

You can post now and register later. If you have an account, sign in now to post with your account.

Note: Your post will require moderator approval before it will be visible.