Last week I came across the following Tweet:

I see an excellent risk/reward trade right now:

— The C O N T R A R I A N (@ZeContrarian7) April 16, 2020

Buy 1 S&P500 (ES Mini), Strike 2,840

Funded by:

Sell 2 S&P500 (ES Mini), Strike 2,870

Expiering tomorrow,

max gain is $31 at S&P 2870

You start loosing above S&P 2,900

Open for credit of +$1

Close tomorrow based on mkt moves pic.twitter.com/w7LwJcIMNM

And the following followup the next day:

Closing position for a 1,300% return https://t.co/zXDDKquTIW

— The C O N T R A R I A N (@ZeContrarian7) April 17, 2020

1,300% return in one day??

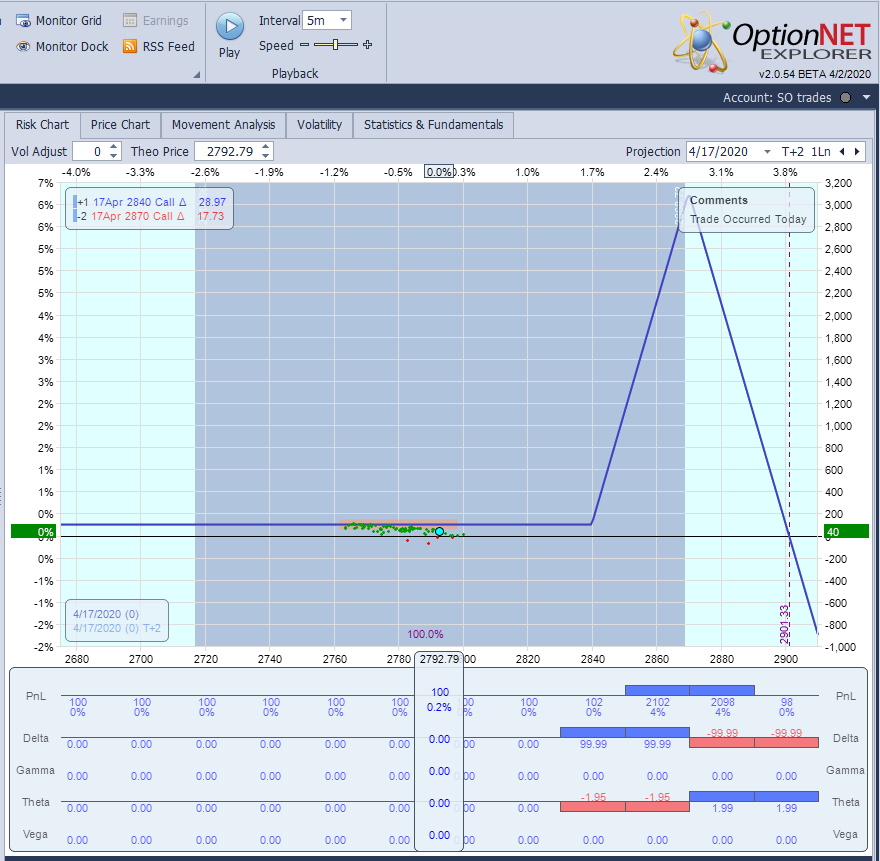

This is how the trade looks in ONE software at the time of the opening:

ONE shows a maximum return of only ~7%. What is going on here?

This trade is long one call and short 2 calls. Which means one of the calls is naked and requires huge margin requirement.

If you are not a member yet, you can join our forum discussions for answers to all your options questions.

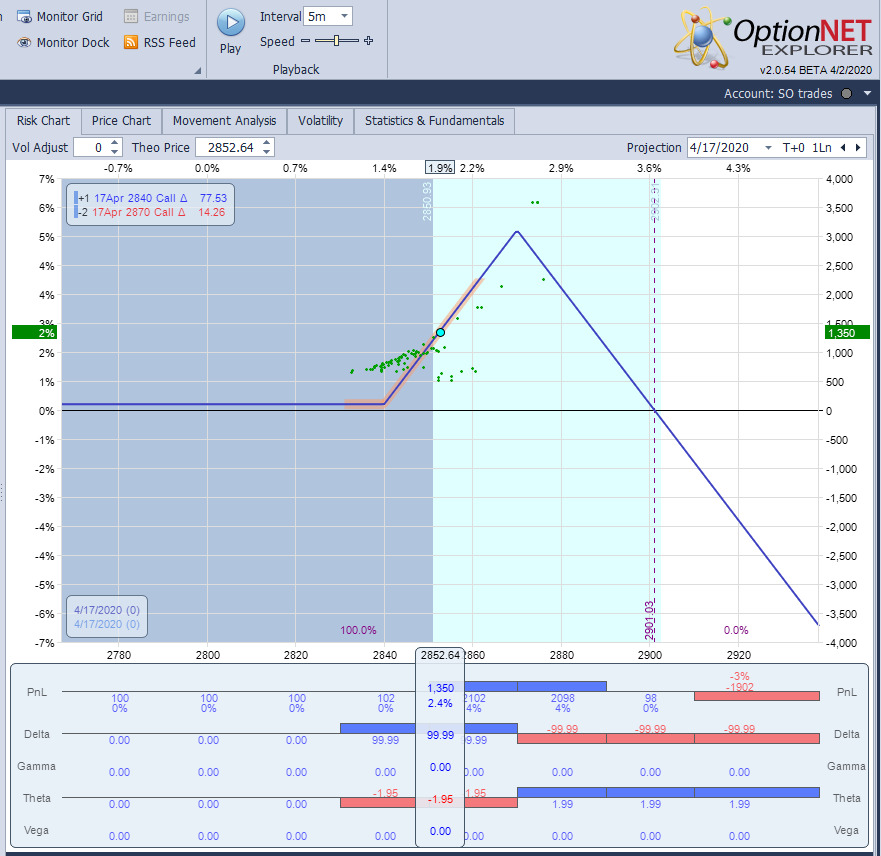

When the trade was closed on Apr.17, this is how it looked:

Explanation for "1,300% gain"?

This calculation ignores the margin requirement on the short options. When a trade requires a margin (like credit spreads or naked options), the return cannot be calculated on cash outcome - it has to account for margin requirement.

As a side note, it was a good trade. No downside risk, and upside risk starts at 2,900 (over 100 points move in one day). But the gain was nowhere near 1,300%.

Related articles:

There are no comments to display.

Join the conversation

You can post now and register later. If you have an account, sign in now to post with your account.

Note: Your post will require moderator approval before it will be visible.