SteadyOptions is an options trading forum where you can find solutions from top options traders. Join Us!

We’ve all been there… researching options strategies and unable to find the answers we’re looking for. SteadyOptions has your solution.

Search the Community

Showing results for tags 'vix'.

-

Hi, I was doing some research on VXX and if you pull up any charts for any long-term, it's obvious to casual observers that VXX does not track VIX at all, http://www.seeitmarket.com/exposing-the-vxx-understanding-volatility-contango-and-time-decay/ The issue is due to the fact that VXX doesn't track VIX, but rather tracks a 30-day rolling window of a near month VIX future and a back month VIX future, http://www.ipathetn.com/us/product/VXX/#/dollarweights In the case when VIX future's are trading in contango, e.g., the near month VIX future is less than back month VIX future, VXX fund manager everyday is selling his cheaper VIX future in exchange for more expensive VIX future for a loss, Right now VIX April futures is trading at 14.65 while VIX May futures is trading at 15.70, reflecting the market sentiment that VIX will always revert to mean of 15. In this scenario, given that VIX is in contango, VXX should be performing worse than VIX (and vice versa if VIX was trading in backwardation). I plan to make a test trade to trade out this idea: I'll sell VXX calls and buy VIX calls; because they are not perfectly-sized; VXX is trading at 20 while VIX is at 12 something. For the remaining unhedged delta on VXX, I'll hedge with VXX underlying, Has anyone done this before; or are knowledgable about VIX, please comment. I'll report back with performance, Best, PC

-

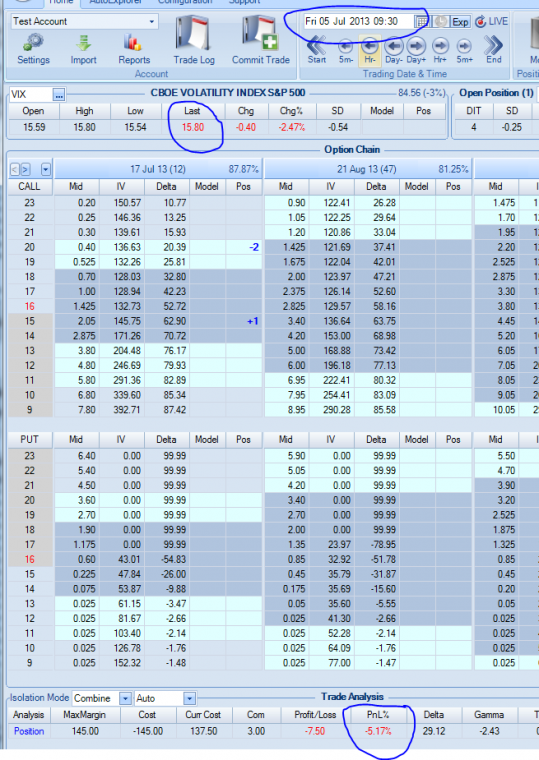

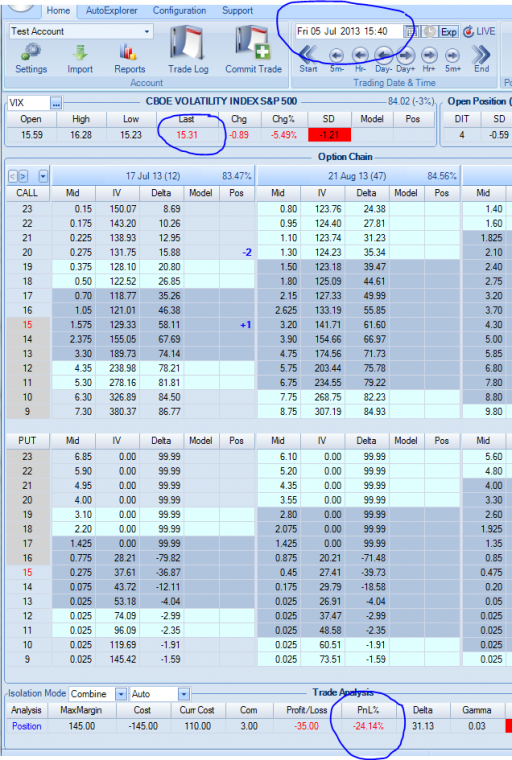

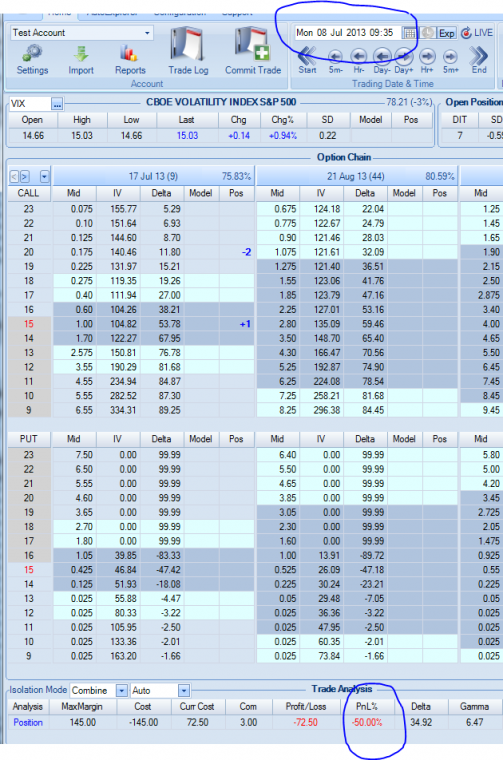

After 500+ trades we recorded today our first 100% loss. SteadyOptions members know that I place full transparency as one of the top priorities of the service. Unlike many other services that publish only the track record at the best, we list ALL our trades on the performance page, good and bad. So it is only natural that our first 100% loss would require a special topic to analyze what went wrong. The Trade Members can see the history of this trade here and all the discussions (over 230 posts!) here. Here is the history of the trade: On July 1st, VIX was trading at 16.20 and we purchased the VIX July butterfly at 1.46 debit: Buy to open 1 VIX July 16 15 call Sell to open 2 VIX July 16 20 call Buy to open 1 VIX July 16 25 call On July 16 we rolled the butterfly to August for 0.80 debit, and on August 19 we rolled to September 16/20/24 fly for 0.40 debit (less 0.30 credit). It expired worthless today. The thesis The idea behind the trade was to take advantage of any IV spike. Take a look at the VIX chart: The entry point is marked in blue. As you can see, VIX went down from 20+ to ~16 and I considered this area low enough. In addition, we also had some VXX puts at that time, and the VIX trade was supposed to partially hedge those puts. Any spike back to 19-20 area would cause the fly to widen to 2.00-2.50 and provide us with very nice gains. What went wrong Well, as we can see from the chart, VIX just kept falling like a rock. It did briefly spike back to the 17 area, but it was not enough. I had a mental stop loss around 30%, but VIX just continues to collapse very quickly and 30% turned to 50-60% loss very quickly and never recovered. The prices moved so quickly that I'm not sure we could get out at 30%. When the loss became 50%+, I didn't see a point to exit. To demonstrate the magnitude of the move, take a look how this trade developed in just one day: Morning July 5 (Friday): End of day July 5: Morning July 8 (Monday): Basically we didn't have a chance to get out at 30% stop loss. So, the first mistake was entering when VIX was around 16. This is just not low enough to give us any margin of safety. Second mistake was obviously not honoring the stop loss. When VIX went down like a rock, the right thing to do was just exiting for whatever we could get for the trade, but the window of opportunity to exit at 30% loss was very short (about last 15 minutes before the close on Friday, so not sure that all members would even get the alert on time). The reasoning for not exiting was experience of some of our previous VIX trades that were down and recovered nicely. However, the difference was that the VIX was much lower in the previous trades. In hindsight, exiting at 55-60% was the only right decision. Rolling was obviously a bad decision as well - but again, we did it few times in the previous trades and they recovered nicely. Lessons learned Obviously the main lesson is not to go long when VIX is above 15. In fact, to get a good margin of safety, I would even lower the minimum value to 13-14 area. Following this rule provided us some nice gains this year. Sticking to what was working in the past is usually the smart thing to do. Adding significant capital to a losing trade is also a bad call most of the time. Another lesson is that opening those trades only 2 weeks before expiration is not a good idea. You need to give the trade some time to work out. My advise to members: if you don't understand the trade or think it is too risky, don't take it. To reduce the risk, you can reduce the size or not add to a losing trade if you feel that you are throwing good money after bad. There is not doubt that this was a brutal trade. I feel your pain as I'm in the same shoes. Unlike other services, I trade EVERY single recommendation I send - in fact, all trades come with screenshots of fills from my broker. I also open a trade discussion before the trade is made and explain the thesis and the rationale behind the trade. Again, if you don't understand the rationale or don't agree with it, don't take the trade. To put things in perspective, we did 8 VIX trades before this trade and booked 8 winners. Average winner was around 30% - that's 240% cumulative gain. Another proof that you should stick with what is working.

-

for those who trade VIX - be it though futures, options or ETP's (VXX,XIV,ZIV and the like). I came across a paper that I found very interesting - well I only glanced over it for now and read a few things in more detail, but it looks very interesting so far. Trading VIX related strategies is slightly more complicated in my opinion that 'normal' option strategies, so if you are new to options and still get your head around delta,gamma,theta keep this for later and certainly venture into this area slowly and carefully. Having said this I think this is written not overly complicated and you don't need a degree in maths to understand it. It also offers a number (5 to be precise) of actual trading strategies and compares them - so it's not only about theory. At the first glance I particularly like these two (for simplicity and results): #3-Roll Yield: if the 10 day moving average of VXV/VIX > 1 go long XIV else go long VXX #4-VRP: (volatility risk premium) if the 5 day moving average of (VIX - 10 day historical volatility) > 0 go long XIV else go long VXX I have heard of the first one before here (note this guy has the ratio the other way around). The results looks pretty good however I would caution that these reverse ETN's havent been around for too long yet (~2.5-3 yrs - so after the 2008 financial crisis) and trend in VIX was down over that time frame so a simply buy and hold would have been a pretty good investment as well. So the backtesting has to be seen in that context. A quick backtest since 30-Nov-10 (when XIV was listed) and I start with a long position in XIV on both: roll yield: 7(!) trades since inception, total (non compounded return (just adding % returns so +12%, +13%, -5% = +20%) = 296% (the strategy is long XIV since 12-Oct-11 without any trades since) VRP: 23 trades since inception, total return 153% buy and hold XIV since inception (30-Nov-10) 146% NB: I'm counting a flip from one ETN into the other as one trade. Backtesting has been done with EOD prices. I urge you to understand how VXX and XIV work and the risks involved before you actually try and trade this. Also read the paper (they mark the bits about risk with a 'grim reaper' ) okay here the paper and the link to the back testing sheet (let me know if you come across any errors). Marco. 00R_Easy Volatility Investing + Abstract - Tony Cooper.pdf https://dl.dropboxusercontent.com/u/26062189/XIV_VXX_strategies.xlsx

-

I have been considering this trade for a while. Then I came across this article - http://seekingalpha....vix-for-dummies The thesis is: Rather than just selling naked PUTS on VIX, when VIX is somewhat higher and shows signs of contango, a calendar spread can be effective. The best way to notice this is if the premiums on PUTS are very close, even as the expiry increases. For instance, both the January 2013 and February 2013 16 strike PUT have a bid/ask of $1.05/$1.15. This equalization doesn't exist with normal options, but as I said, VIX options are "strange." When this occurs, I look to sell the January 16 strike PUT for a credit of $1.05, and buy the February 16 strike PUT for a debit of $1.15. Total cost is a debit of 10 cents. So if VIX rises above 16, the January 16 strike premium of $1.05 is fully earned. If the February strike is worth more than 10 cents, profit ensues. Unless VIX goes way, way, way up, gain is a very likely outcome. I did some backtesting and it shows excellent results. I would like to make few small adjustments 1. rather than 16 strike, I noticed that doing the 17 strikes produces better results 2. Instead of doing February/January, I want to do March/January, so I can roll the short options to February after one month. Currently the trade can be done for about 10 cents credit. Remember that VIX calendar has margin requirement. IB requires $150 per spread. So if you allocate 10% per trade, you will do ~6-7 spreads per 10k portfolio. We aim to make 15-20% return on margin within 3-4 weeks ($25-30 per spread) with fairly low risk.