SteadyOptions is an options trading forum where you can find solutions from top options traders. Join Us!

We’ve all been there… researching options strategies and unable to find the answers we’re looking for. SteadyOptions has your solution.

Search the Community

Showing results for tags 'commission'.

-

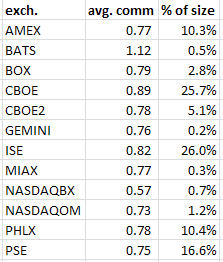

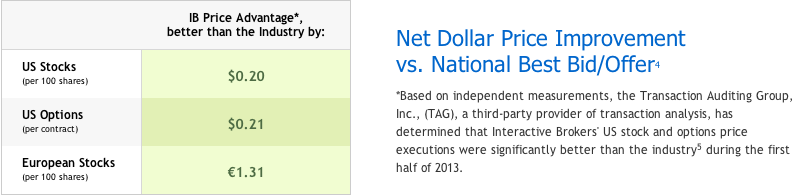

Hi and happy new year, Interactive Brokers (IB) commissions were the subject of various discussions here already and the general complaint is that you never know exactly how much you pay as IB passes on any 'exchange fees' on top of their 0.70$/lot commission. Exchanges charge or credit fees for adding or removing liquidity. Following example: the bid/offer spread for an option is 1.00 / 1.10. If you place a 1.05 bid you are adding liquidity and should that bid get hit you will get a credit for adding liquidity. If you lift the 1.10 offer you are removing liquidity and you will be charged extra exchange fees. These fees and credits vary from exchange to exchange. However if you are entering your orders via SMART order routing and you put in that 1.05 bid the SMART order routing algo might rest your order in the order book of exchange A and if it gets hit there you will get the credit again but if the order doesn't get executed on exchange A but after a while becomes executable on exchange B because someone is showing a 1.05 offer there the algo will move your order to exchange B. However that means you are now lifting that 1.05 offer and all of a sudden are removing liquidity hence getting charged the extra fees again. SMART order routing at IB will take the extra exchange fees into account and only move your order if you get a better fill at exchange B INCLUDING the higher fees. I tend to place orders at or below mid and either wait for a while or work my way slowly up to the offer. Usually I get filled without having to lift the offer in rare cases I end up lifting the offer. I ran a statistic over 300+ orders across 45 different US stocks and ETF's (like SPY) all executed in 2013 with a decent number of lots (5 figures) so that should be a big enough sample size. I always execute more that 1 lot so that doesn't include any 1$ minimum fees. The highest per lot fee I was charged was 1.89$ (just one order) an there were a number of 1.59/lot orders. The lowest fee was -0.28$ (a credit!) all very high or very low comms were on PSE so I take it these guys have the highest charges and rebates for removing / adding liquidity. The average comm/lot (without VIX and RUT order - I get to these later) was 0.79$/lot. The average fee for VIX was 1.22$/lot. CBOE charges an extra fee for trading VIX options (0.40$ for retail customers I believe - plus/minus liquidity fees/rebates) making that more expensive to trade. The average fee for RUT was 0.84$/lot. I'm not sure if there is an extra fee for RUT actually or whether I just managed to get charged more here than my overall average. Many people (including me) moaned about fees from one exchange being always much higher - I can't remember now but I think it was PHLX. So I was wondering whether any exchange was particularly expensive or cheap. Here the average fee per exchange with the respective 'market share' (in % of my total lots traded) in the right column. so no massive outlier from the average! (CBOE is a bit higher due to the VIX trades and BATS is only a very small market share so I would't say that is a big enough sample size to conclude that their fees are always that high) So in conclusion the average of 0.79$/lot with no per order fee (unless you only execute 1 lot than you have a 1$ minimum) is below what you get at most brokers. You get that comm even if you trade small size and infrequently (10k$ minimum deposit required though to open an account). IB is not the cheapest however some brokers charge a very low per lot fee 0.10 combined with a something like a 7-10$ fee per order making it cheaper to trade larger orders. However fees are not the only criteria you should look at when choosing a broker. Besides - platform (I would rate IB's platform as very powerful but especially people new to (options) trading find it complicated) and - service (I'm not sure how it compares to other brokers but especially on the phone you get some pretty useless answers from IB - I find If I speak to European advisors or if I ask a question per email that improves quite a bit but it sometimes takes very long to get a response via email) - execution is probably the most important factor for me. An execution of just 1 cent better or worse basically equates to 1$ per lot (assuming 100 multiplier). In my opinion IB has one of the best (if not THE best) SMART order routing on the street. Some like TOS probably come close but to my knowledge even TOS doesn't execute legs of a multi leg spread across various exchanges for example which might lead to better fills for combo orders. I think the difference in option execution to some smaller brokers (like option house) or brokers who mainly execute stock or ETF orders (like fidelity or schwaab) is significant. I have no own data to support that claim but IB claims a average 0.21$/lot better execution than industry average (see below) - thats massive! (in fact I find it hard to believe) If I had traded the size that I used for above statistic at an average 0.21$/lot extra cost that would wiped out ~70% of my portfolio! However I'm a fairly active trader and I'm not sure whether that 0.21$/lot difference is for single leg option trades (likely) and I trade plenty of 2 and 4 leg combos. I just looked at the average option price (per leg) across these 300+ trades and get to 6.10$ - not sure how representative that is for the 'industry average' sample that IB used but based on that they have a 3.4% better execution. more detail here: https://www.interactivebrokers.com/en/index.php?f=1340 Have a look at the impact of commisions and slippage on your trading and check whether it might make sense to move to a different broker. Despite all the above praise for IB I am not affiliated with them in any way