SteadyOptions is an options trading forum where you can find solutions from top options traders. Join Us!

We’ve all been there… researching options strategies and unable to find the answers we’re looking for. SteadyOptions has your solution.

betaboy3000

Mem_C-

Posts

159 -

Joined

-

Last visited

-

Days Won

1

Content Type

Profiles

SteadyOptions Trading Blog

Forums

Everything posted by betaboy3000

-

Ya, real humans that talk are not IB's strong suit! I have puts and I can exercise them but there's no market to close the short I end up with if I do. Frustrating. I have a few months left on the position, so I'm hoping it gets sorted, but doesn't look good. Right now, the underlying has gone down a lot and the position has worked in my favour, but it's frozen. The stock (Mechel PAO) is still trading on the MCX exchange but that doesn't help me much.

-

Anyone have any idea what happens to the options of US-listed ADRs for Russian stocks? The OIC website has an FAQ that deals with a few scenarios, like bankruptcy, but not war.

-

@Wayne K. Can you give us any insight into how you are timing the mix? Are you using volatility triggers on the different assets? Economic indicators? Presumably it's something quantitative or you wouldn't be able to backtest it. Thanks for any insight.

-

TOS vs TWS discrepancy In P&L's between two platforms

betaboy3000 replied to ClearCut's topic in General Board

It doesn't. It will still base it on the current bid/ask. -

TOS vs TWS discrepancy In P&L's between two platforms

betaboy3000 replied to ClearCut's topic in General Board

I should also say that although the picture is more pessimistic, you'll probably get slightly a better price including commission with IB compared to TOS for a trade like this. -

TOS vs TWS discrepancy In P&L's between two platforms

betaboy3000 replied to ClearCut's topic in General Board

It doesn't actually consider what your order was, just the Bid/Ask. -

TOS vs TWS discrepancy In P&L's between two platforms

betaboy3000 replied to ClearCut's topic in General Board

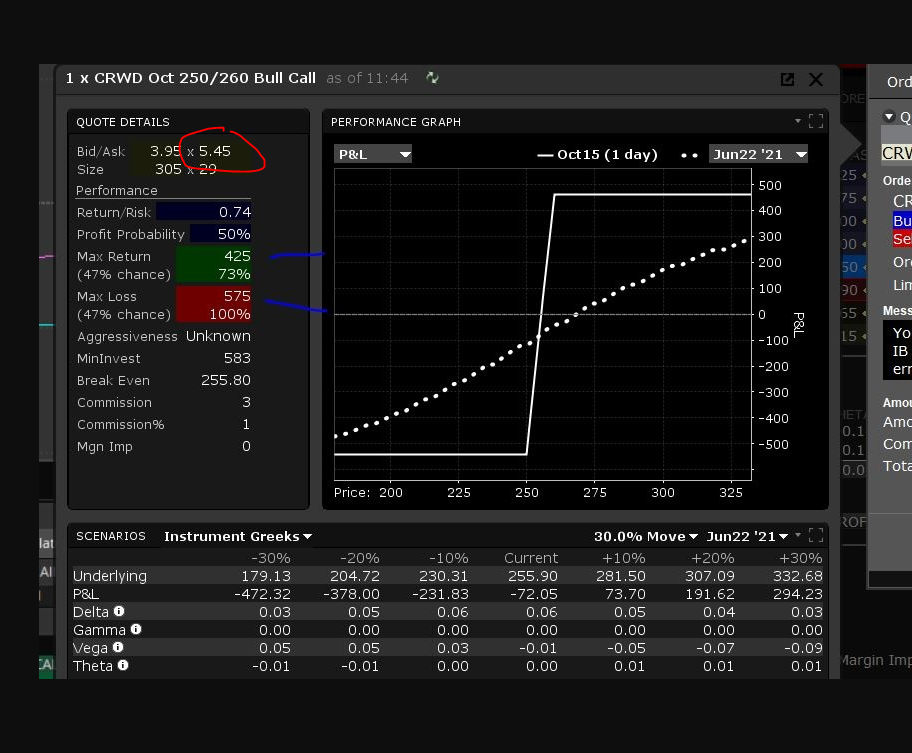

I'll take a stab.... In my experience TWS uses a pessimistic ASK price + a pessimistic commission to give you a pessimistic chart. It can't tell you the exact commissions at this point because it depends on the exchanges you get filled on. The higher the spreads the more it gets wonky. I always calculate my max profit and max loss AFTER the trade is done. The performance chart just gives you an idea of the shape of the curve. You should use it to make sure you got the buy/sell +/- right. In this case for a bull debit spread your max loss would be the price of the spread, say 4.55. Your max gain would be the spread width - the cost of the spread, or 10-4.55 = 5.45. -

Impressive performance through the March 2020 and 2008 corrections. The SWP site says it's an ETF-only portfolio. What are you using as hedges? Fair question I think as it's obvious what we use for hedging here!

-

Reddit user who helped inspire GameStop mania lost $13 million on Tuesday

betaboy3000 replied to Kim's topic in General Board

Definitely an historic week with lots of interesting outcomes. One thing that will definitely change is that activist hedge funds will no longer be activist. -

IB sent this out, this week: Customers with Short Option Positions If you are short the options, you may be assigned until 5:30 pm based on the decisions to exercise by other market participants. These traders will have the ability to see the current market price after the close of options trading, at a time when you will not be able to close your option position. Again, these stocks may move significantly the after the close of regular trading at 4pm. This may mean that a position that was well out of the money at 4 pm may be in the money, perhaps significantly, by the time it is exercised against you. There is no way to predict whether the long holder of the option will exercise based on the 4:00 pm (16:00 price) or some later price up to 5:30 pm (17:30). The only way to avoid this volatility is to close out your short option position before 4 pm. To repeat, the only way to mitigate the uncertainty of your post-expiration stock position is to close out short positions prior to the end of the trading session. Interactive Brokers Client Services

-

IMHO you should leverage the Steady « brand », not avoid it. SteadyOptions Basic or SteadyBasic SteadyOptions Foundation or SteadyFoundations SteadyBasis or SteadyBase SteadyPrimary SteadyCornerstone EasyHedge

-

A great free resource detailing the risks involved in different asset allocation strategies (based on backtesting) is this site: https://portfoliocharts.com/portfolios/ The "ulcer index" concept is particularly useful. https://portfoliocharts.com/2017/11/01/the-ulcer-index-is-a-helpful-way-to-quantify-portfolio-pain/

-

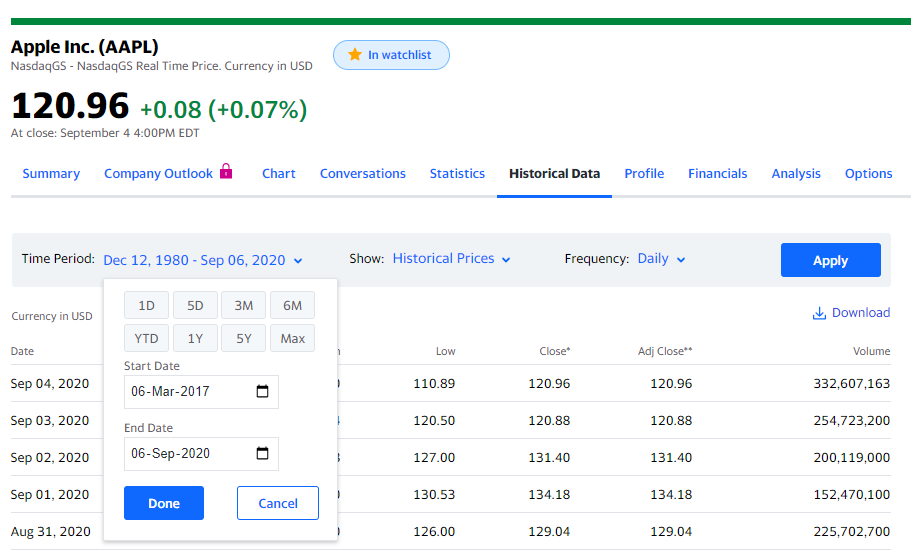

It is available in Yahoo. You just have to change the date range before downloading. Otherwise it defaults to 2 years. For instance, AAPL data is available back to 1980.

- 1 reply

-

- 1

-

-

If I may post a contrasting experience to @yalgaar's... I am the newest newbie when it comes to options trading. After being a long stock investor for decades, I decided this year, after the crash, to figure out what options could do for me to provide a hedge. I did some free online courses, listened to a lot of podcasts, and then managed to lose thousands of dollars buying puts on a stock in an industry I am intimately familiar with, learning the valuable lesson (again, but with options this time) that the market doesn't care what a fair valuation is, and that it could stay irrational much longer than my options' expiration. I now realize this is a fairly typical entry for many a new options trader. I then sampled a few trade advisory services and then ended up here, intrigued of course by the returns, but also by @Kim's articles here and on Seeking Alpha. I joined SO in July. Since then I've done 7 trades: 6 official (BYND, UBER1, UBER2, LOW, BBY, BILI) and one unofficial (XLNX). Only one has been a loser (UBER2) My tips, all of which have been gleaned from advice from members here: 1) As everyone here seems to repeat Ad Nauseum, "Don't chase the entry!" For me, this means that if I can't get in within 2-3% of margin on official, I let it sit. From a post here I learned how to plot the strategy price so I can see it move during the day. I might place a day order for the first day, or even 1-2 days after the official notice, at the official price (or within 3% of margin if it looks like it will not go down), and then I just wait. If it doesn't get filled, I just walk away from the trade. As Kim has pointed out, the prices do sometimes go well below the official. 2) Once I get a fill, I immediately set a GTC close order because I'm on the other side of the world, and I can't be bothered to sit in front of the computer all night. For an earnings trade, if it doesn't get filled prior to the earnings announcement, I would plan on walking up before market close to close it, but I have not had to do that yet. My average GTC target has been around 10% return on risk, but I'm not stuck on that. Apart from SO, I'm playing with both VolHQ and ChartAffair, and I realize now that I'm going to need OptionNet to visualize potential trades better. I use IB but their option "Performance" visuals are lacking. But that is all I plan on getting. I am now reading books by Wolfinger and Augen, and I'm fully aware that this journey is going to take years. The more I learn, the more I realize how little I know. My results thus far: for the 6 winning trades I have averaged around 10% (unsurprising I guess given my target, but very surprising to me given that the average time in market was around 3 days per trade), and I lost 0.5% on the one loser. I'm glad to report that my first 2 months have more than paid for my subs! More importantly, I've learned A LOT in just a few weeks, and the curve remains very steep, but here I feel there's a culture of mentorship, something I'm going to need.

-

Anyone have any idea how I can do a Funari-type order on US options using IB? It's a limit order, with any remaining unfilled quantity resubmitted as a Market-On-Close order at the end of trading. https://www.interactivebrokers.com.hk/en/software/tws/usersguidebook/ordertypes/funari.htm Might be useful if I have a set target, that isn't reached, and I'm happy to close it pre-earnings close time.