SteadyOptions is an options trading forum where you can find solutions from top options traders. Join Us!

We’ve all been there… researching options strategies and unable to find the answers we’re looking for. SteadyOptions has your solution.

ixero@20

Mem_SO-

Posts

254 -

Joined

-

Last visited

-

Days Won

2

Content Type

Profiles

SteadyOptions Trading Blog

Forums

Everything posted by ixero@20

-

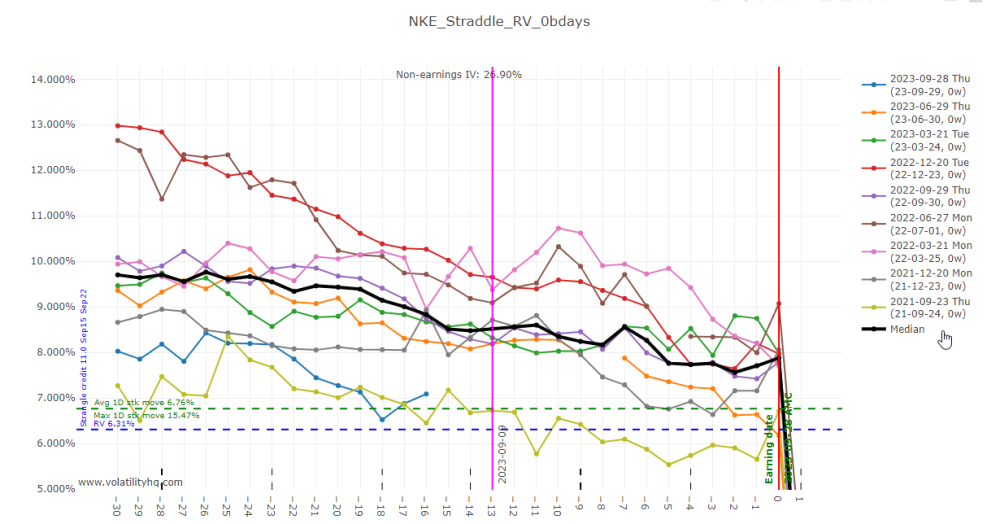

Hi @Djtux, it seems that current cycle RVs have not been calculated since Wednesday. Can you please take a look?

- 1061 replies

-

- rv chart

- volatilityhq.com

-

(and 1 more)

Tagged with:

-

For the record I didn't do thorough research on covered call ETFs, but a few big ones I checked were beat by the index in the long run. From that I draw a conclusion that if professional fund manager cannot beat the market selling calls, then I shouldn't try to do it either. Again, may be I was unlucky to choose wrong ETFs and there are some which are doing well. But that was my conclusion after quick research.

-

2030 seems like very distant future now. First we have to get through the crisis and martial law we have in Canada now. Can't believe we got that much down that fast... If the right side of the history wins, may be The Global Reset is not really a thing... P.S> Sorry for ranting about politics here but Canada really in uncharted waters right now

-

https://www.canada.ca/en/revenue-agency/services/tax/businesses/topics/gst-hst-businesses/digital-economy-gsthst/charge-collect/cross-border.html It seems government made some changes in July 2021. Based on these rules cross border sellers must collect HST if they sell digital products directly to Canadian consumers.

-

Exactly the same thing - no HST last year and 13% HST charge on Jan 28th 2022.

-

In my case it first starts as "Not working" version while page is loading. But once it is fully loaded (after 10-15 seconds) it switches to "Working" version. I am using Chrome too.

- 1061 replies

-

- rv chart

- volatilityhq.com

-

(and 1 more)

Tagged with:

-

Using IBKR's TWS after using TOS, trades not filling

ixero@20 replied to ClearCut's topic in General Board

I would say that TOS paper trading doesn't give you real life experience. I tried paper trading in both TOS and TWS before and I think TWS was much closer to the reality. So yes, it will take some time and patience to practice the trading skills. Options market is not as efficient as stock markets and getting a fill can cause frustration sometimes. -

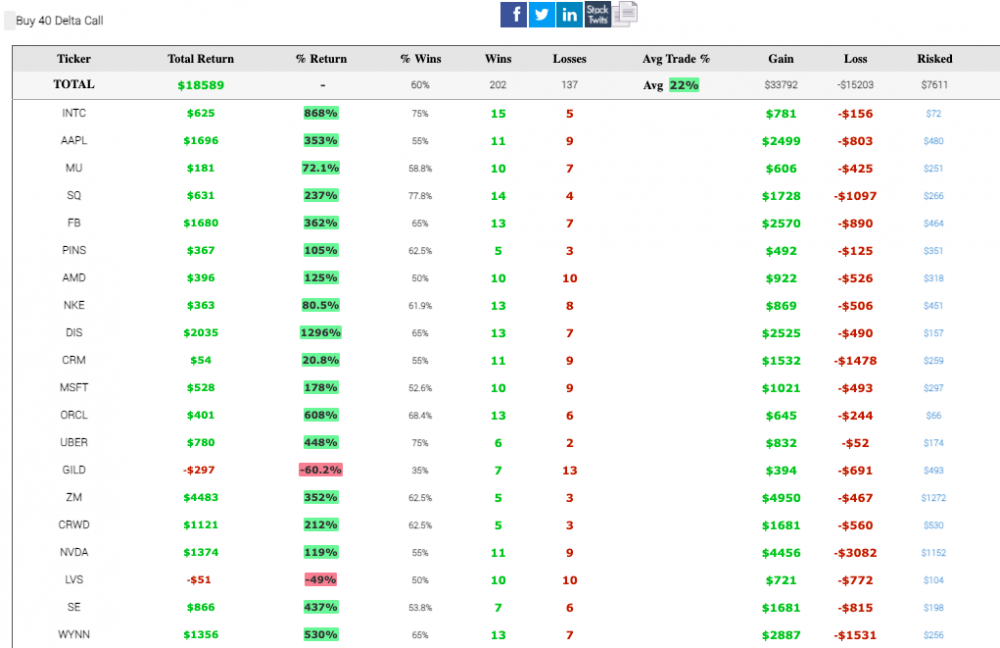

I didn't graduate to the ratios yet and personally I still have challenges understanding the benefits of this strategy. I know that downside is capped and even in case of large downside movement it can make money. Similar to straddle it will benefit from the rise in IV and sometimes @Yowster is using it as an alternative to a straddle if stock has upside tendency approaching the earnings. But if I run the backtest for the same list of stocks as you have but for a simple Delta 40 call instead of a ratio, the results look much more appealing. I am using the similar setup as your backtest - open the trade 6 days prior to earnings and close at 0 days, 40 Delta calls with 14 DTE. The simple calls will be much more of a rollercoaster but in the long term it should deliver much higher returns (if implemented properly). So while ER Calls and Diagonals are not SO style trades because of larger loss potential, I am not that convinced that personally I should prefer ratios instead.

-

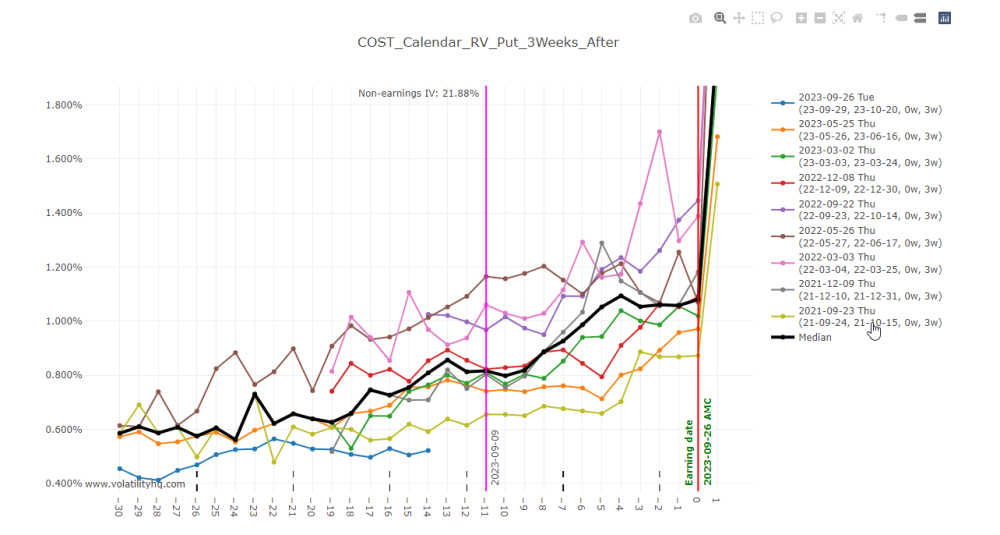

Thank you @FrankTheTank! This is very interesting setup indeed. You enter the trade very early on 21st day before earnings with 14 days roll for the short and 28 days for the long. Which means you start the trade 3 weeks before the earnings date with the short leg expiring 1 week before and the long expiring 1 week after the earnings. In this way the short leg is not protected by the earnings and will decay quicker. And on top of that you close the trade very quickly, just in 1 week to avoid any gamma risk. Based on other TM ER strategies it seems that pre-earning stock price movement begins to materialize after T-10 (14 calendar days) and you get out of a calendar trade just right before that. Smart! I am very excited to see how these trades will play during the next ER cycle. We just need to hope that these companies will announce the ER at least 3 week before the date. And a question if you don't mind - why did you setup this strategy with Calls and not Puts calendars. I re-run this strategy for Puts calendars and return was much worse. Do you know why?

-

As an update - I spoke with my accountant. In my particular situation she advised to report profits as capital gain. It was primary based on the fact that I have a full time job and profits from trading were very small comparing to my overall income. However, if I become very successful (which I truly hope will happen one day) or switch trading full time I should call back to reassess the situation. As a general comment, she noted that there is no strict CRA guidelines (as we have discussed above) and all "regular" guys doing trading on a side fall in a grey area. This means that either way I decide to report my gains or losses I should be prepared if CRA comes and re-assesses them differently. And on a very special note, she was very surprised that I didn't blow up my account in my first year and even have profits to report. For that I would like to send kudos to @Kim and @Yowster for creating such a wonderful community for us.

-

@FrankTheTank, can you please share the link to this backtest? I am very curious to see how you set it up. Also, why are you calling them pre-pre calendars? I was thanking that pre-pre calendars are when both short and long legs expire before earnings.

-

@Kim, do you know if SS can be implemented within Canadian Registered Accounts (TFSA or RRSP)? I tried to place "Sell to Open Covered" order in my TFSA account which has a long call position (but no stock) and iTrade didn't allow it. My account is approved for Level 2 Options trading (the highest we can get for registered accounts - long put, long call, sell covered call). I am not sure if this is a CRA rule or brokerage restriction. P.S. Sorry for bothering you with tax related questions lately.

-

@kyrojin, thank you very much for sharing the links. They are really eye opening and provide better understanding how the rules are applied by the court. I quickly scanned through the hearings transcripts. It seems that the court was very strict with a licensed investment professional despite the fact he held his positions over 50 days and made only 30% return while the broad market made 40%. And at the same time the court was willing to offer 50/50 split between capital and income for a "casual" investor even he held some positions for less than a week and couldn't explain how he came up with these companies names. Other than telling the court he looked them up in internet chats. These cases clearly demonstrate what you and @Kim meant by "personal situation". I just find it a little frustrating that we have to refer to court rulings to understand how tax law is applied. I believe CRA should have provided more clear guidance rather than IT479 publication which was last updated in 1984. Having said that, this brings us to very interesting dilemma. Personally I believe that SO trades we do here should be reported as business income. They just check off much more boxes that they don't. If CRA will ever challenge the business income choice, we can build a really strong case to support it. However being an ordinary guy who has full time technology consulting job with some extra trading on a side, I don't specifically see an issue with reporting gain as capital. Especially accounting for all the uncertainty around the rules. CRA indeed doesn't provide any thresholds to the duration of a trade, number of transactions per annum or any other metric. In my opinion the worst case scenario will be that in case of an audit, CRA will reassess the gains as income and will ask for more taxes plus interest. I just don't see with these rules how can they impose any sort of tax evasion charge which could lead to a fine. Again, I will speak with a tax professional before making a decision. All these may sound like a rant, but being an incorporated consultant in Canada I am getting a little bit tired that every time I have to deal with CRA I find myself in a grey area. I think I am starting to admire US tax system. While it is more strict, they seems to have more clear guidelines to follow.

-

Thank you everyone! I think I got better understanding of taxation implications to have more constructive discussion with my accountant now. I will post an update here once I speak with her again.

-

@Kim, what is your opinion on the item (b) highlighted below? This is IT-479R, section 11. It seems that CRA actually does list short holding period as an indication of business activity.

-

@kyrojin, did you you see any references what these guidelines are? How can I determine if I should be considered a trader or not? I was referring to the strategies in my original post because I saw the same criteria as you posted, and SO trades checks off most of these boxes.

-

Thank you everyone! I will spend some time reading the links posted here and I will speak again with my accountant. This statement fully represents my overall impression of our taxation system. There are never set of definitive rules with a reference to tax payer individual situation. Which probably means that if you have a full time job making let's say $100k/year and you also trade stock and options part-time making another $10-20k, you'll be fine reporting them as a capital gain. But if your income from trading will increase significantly or becomes your sole source of income in this case you may need to report it as a business income. But what does it mean for us? Not too much honestly, in my experience most accountant hesitate to give any advice in advance. Most of the time the answer is "do what you think is the best for you today and if CRA will come back with an audit we will try to deal with it". It's probably because most people don't get audited often and even if they do it is only limited to verification of supportive documentation. As a separate note regarding T5008. In overall, I think CRA should mostly ignore them. While IB did a great job calculating all my transactions and converting them to CAD using proper exchange rates, other banks and brokerages don't do it the same way. I happened to make a few trades in my Scotia iTrade account at the beginning of the year and T5008 I got from them is mostly useless. For example, I sold a call for 2.20 and then bought it back for 0.35. T5008 shows this contract in USD with both cost (Box 20) and Proceeds (Box 21) equal to $220. So all CRA could get from this form are my maximum proceeds they can tax if I fail to provide activity statement to justify my cost basis.

-

@Kim and other Canadian members, can you please share your experience how trades we are doing using SO strategies should be reported to CRA? Are they income or capital gains? My accountant didn't have much experience with active options trading and said she would need to get back to me. I also read IT479 CRA publication myself and while I will need to read it again, I am now leaning towards it should be reported as income. But I still need to wait for my accountant to do her research or try to find another one who has more experience with options. I am not asking for a legal advise, but merely looking to hear your opinion and experience. If anyone can share it, it will be greatly appreciated.

-

@Yowster, thank you for your response, but I also have the similar question. Is there a link or document we can read how options are assigned at expiry? Let's say I sold a 100 call. Friday session on the expiry date closed at $99.90. During after hour session the price first spiked to $101.00 and then went down to $99.00. What will happen in this case? Will I need to sell the stock or keep the premium I collected?

-

Hmm.. I can see Dec31 date now. Last night I was looking at return matrices and I believe I didn't see Dec-31 entry/exit days, Dec-30 was followed by Jan-4. So I thought OK, this explains why RV charts have a blank day. And yes, my bad. I agree now that yesterday's data is missing. I cross-checked RV chart vs gf58's real time tool and can see the missing day.

- 1061 replies

-

- rv chart

- volatilityhq.com

-

(and 1 more)

Tagged with:

-

I noticed this problem as well, but I think yesterday's data is actually there. It seems that Dec-31 is marked as a holiday, therefore all charts show pink today's vertical line one day later then it should be (if it shows that today is T-4, actually it means that today is T-5).

- 1061 replies

-

- rv chart

- volatilityhq.com

-

(and 1 more)

Tagged with: