SteadyOptions is an options trading forum where you can find solutions from top options traders. Join Us!

We’ve all been there… researching options strategies and unable to find the answers we’re looking for. SteadyOptions has your solution.

-

Posts

178 -

Joined

-

Last visited

-

Days Won

6

Content Type

Profiles

SteadyOptions Trading Blog

Forums

Everything posted by Maxtodorov

-

I think you meant to say, your longs have GAINED more than your shorts LOST.

-

We get less than 1/2 due to Theta effect. [where theta is higher closer to expiration]. I am thinking that Chris, rolled the way he did, due to significant drop in price. At this point if we roll to low on the price, the potential rebound would cause us to loose on the intrinsic. By keeping it DITM, we are protecting ourselves from rebound risk.

-

-

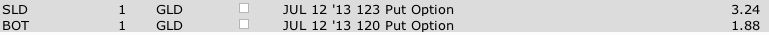

Hal, Look at the table below. If I capture $1.04 extrinsic in the next 12 weeks, I have achieved 4% weekly profit. You ask, how do we make money when GLD is going down, when we pay out every week. Well, the answer is shown with the green arrow. If today was expiration, the difference in strikes between my long (126 PUT) and short (120PUT), is $6. So if gold closed below $120, I would still collect $6 profit per contract share ($600). [in this case it would be $2400. So our goal is for GLD to just stabilize at any price point below $126, then we simply collect the extrinsic.....

-

121 has more protection if GLD was to pop UP. remember you are long as well, so if the GLD pops up, you need to capture all the intrinsic you can.

-

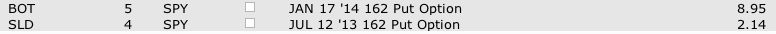

On many positions that are low volume I may have to leg in. In this case, BID/ASK is bad on the far out option Jan 14 LONG PUT. So I put in an order slightly above the bid, and essentially become the BID. I continue to sit and wait for execution or change my order, to continuously remain the highest BID. IB does charge cancellation/order change fees, but they are minimal when you compare BID and ASK Spread. At some point the order executes. At that point, I immediately go and put in an order for the leg that is high volume, and I put limit at MID or even above the MID. [but remember high volume items have small BID/ASK spread]. Bottom line, get the hard to fill LEG first, follow with easy to fill leg. This is the strategy you could/should also employ on RUT trades. Those almost always have to be filled that way to get best possible fill.

-

Remember these are PUTs not CALLs. I start looking at my longs when they go OTM. If my LONG is 126, but GLD goes to 128, I would have to go short above 128.... that would create a big margin requirements... So if GLD goes up to say 128, I would probably roll up my long to 128 and go another 1-3 month out. (the pricing would be the guide).

-

That has been Chris's most resent approach. But that may change.

-

Do not touch it, until GLD price is above your long PUT. Example: I have Sep 126 PUT Long. I am not doing anything, until GLD goes above 126. If GLD goes above 126, I will start rolling it up and out at that point.

-

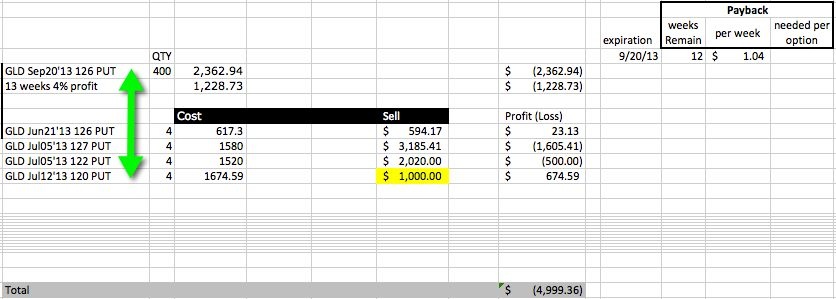

Chris, Are we rolling Jul 5th (122 put) today or waiting till next week? it still has about .45 of extrinsic....

-

I looked into getting one. However decided against it. I think you need to ask yourself a question: Why do you want it? If you are looking to get a job in the industry, then yes its a good certificate. If you are interesting in learning, I say its ineffective use of time. I have meat many CFAs, who passed the exams (3 of them), and after a year forgot most of the theory. Then they do not use the knowledge, and end up not having practical experience either. I often have conversations with my CFA friends, and concepts like implied volatility, implied move (based on price of straddle), option greeks, are concepts that they are familiar with, but they do not have practical understanding on how to utilize it. I have become a much better options trader, just learning and reading on my own. In fact doing most of SO and Achor trades, as I evaluate them, prompt the right questions, that I research and try to understand. If you understand how a Gamma of option behaves near expiration vs. a Gamma of further out option and how that relationship is impacting your profit or loss, you are probably a better trader than an AVERAGE CFA who is NOT a professional trader.

-

In this context it mean 4 PUTs not 4 July. Its July 12th PUT, which is 2 weeks out.

-

75% is NOT a hard requirement. if you want to take on 5 PUTs Long, you only could sell 3,4,5. Neither is 75%. So, I picked 4.... Chris did the same in his second trade....

-

-

We should probably talk this in another forum, as this for STZ trade. But in short, exchange fees are not DATA fees. Data fees are $10 per month (that you really need), if you do not hit $30 in commissions. I have no problems with reaching $30 per month. There is $1.30 per month in fees for options data... But in the end, 2 TOS trades cost about that much.

-

.70 is the official number (listed on the website) plus there are exchange fees and those vary. However the actual costs vary. I still cant fully figure out why, but my commissions seem to be different on every order. However on average, I pay less than $1 per contract. That is very useful for orders of my size, as I can chose to only follow 2 or 5 contracts on some trades. At TOS I was paying 7.95 plus .65 or .75 per contract. So if you wanted to do a small allocation, the commissions would eat the profit. Also, at TOS its almost impossible to get a RUT IC or RIC filled as one transaction at mid price. You pretty much have to either pay the BID/ASK or leg in. In fact the move to IB was caused by my recent burn in RUT IC. I bought a CALL LEG, then market suddenly jumped up, and the PUT credit pretty much left me in the dust. So I ended up getting out with a loss. I seem to get much faster fills at IB. STZ is a good example.... got in right after KIM at the same price. I see folks had to leg in at TOS.

-

Got to keep emotion out of it..... Trust me there are many times, when I get out and take profit, only to see it go another 15%. This is just another lesson about proper allocation per trade. There always will be losers....

-

Followed your Roll. I was at 127. Now same as you..... I am only worried about a big spike up, where we will lose the intrinsic above 122.

-

Hi Everyone, I was just wandering if anyone ever used IB Stock Yield Enhancement Program. I read the disclosure, and do not see any big risks. Seems taxation of Dividends at regular rate is the primary disadvantage. In my case it could generat about $120 per year on $50K portfolio. Any feedback?

-

Per Chris's original post if we get 40 cent per week we should be able to pay for the LONG PUT. So we are targeting above 40 cent. But you do not want to be too greedy either. Rule of thumb --- the more you are in the money, the less extrinsic you typically get.

-

Hal, the fist thing to understand is what extrinsic means..... in other words, we continuously hunt for extrinsic (aka Time Value) in most of the Anchor type of trades. In your trade, the option that you sold 128 PUT (due to timing) has very little extrinsic value by the time you sold it. So you only stand to make any money from it, if GLD bounces up tomorrow. Extrinsic is something that you get to keep no matter what. You need to make sure that you configure the software that you use to continuously display the extrinsic value.

-

Yes you are correct. What I meant to say, is if there is a big move UP in GLD tomorrow to say 128, I will get to keep the entire 1.54, but my 126 LONG will drop in value. So overall I would keep less than 1.54. On the other hand if it goes to say 125.80, I will get to keep 1.34, and my long will retain most of the value.

-

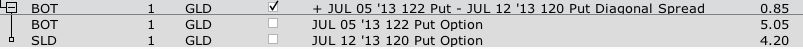

I just entered a calendar. Sold jun 21 126 PUT for 1.54. Bought Sept 20 126 PUT for 5.90. By the time i got there... the extrinsic on 127 was .36 cents. I will probably realign tomorrow to follow your trade. I am just greedy... hopefully gold stays under 126 and I can keep most of 1.54. Gold was at 125.04 or so

-

I got greedy and closed today at 6.10.