SteadyOptions is an options trading forum where you can find solutions from top options traders. Join Us!

We’ve all been there… researching options strategies and unable to find the answers we’re looking for. SteadyOptions has your solution.

-

Posts

178 -

Joined

-

Last visited

-

Days Won

6

Content Type

Profiles

SteadyOptions Trading Blog

Forums

Everything posted by Maxtodorov

-

Not sure if money or size is the primary driver for you. I just got the Microsoft Surface Pro 3. I am setting it up for IB and OptionNet... will tell you tomorrow how its working......

-

I am just wondering if any of you use Skype or other chats during the trading day? I know there is a chat feature that we have on the board, but folks do not seem to be very active on there..... Just wondering what folks use. I am often on Skype.... (maxtodorov).... reach out if you want I will accept request if you mention that you are from SO.....

-

Thank you for the comments Chris. My trade is slightly different than yours, and I been going closer to the money (on shorts), and rolling up my LONG (now 182 Dec 2014). I am also using it as a volatility hedge for my MIC positions...... Trade was much less profitable than yours, but I like being NET long VEGA in this environment.... I amy even considering making my ratio a bit more defensive for market drop....

-

Hi Chris, Just wandering if you can elaborate. Do you feel market does not know where it wants to go? Or do you expect a correction? Or Further run up?

-

Latest Thoughts on Sheridan Mentoring / OptionNET?

Maxtodorov replied to Gary's topic in General Board

post-1-0-96736300-1382914077.png The software pulls the pricing data from your broker. Trades you would have to double enter. As far as how you see the impacts to the position, look at the bottom of the image. It shows greeks at various prices. -

Latest Thoughts on Sheridan Mentoring / OptionNET?

Maxtodorov replied to Gary's topic in General Board

I have been using OptionNetExplorer for less then a month. While much of the information can be obtained in TOS Analyze tab, the ability to see impacts to a position from adjustments, as well as being able to see the Greeks of the position at various stock prices, is very cool. I most likely will be signing up for the software. -

One of the tools in TWS is spread builder.... try it...

-

Which tool in IB are you using? I found the spread builder to be the best tool for spread trading. Overall the price in IB is what you enter. Also, its important to know that you can accomplish the same transaction by both selling or buying. Assuming you want to by a spread of XYZ, entering -0.10 would accomplish nothing, as you are asking to sell for credit. In other words you are accepting 10 cents to also get the spread. I enter the price that I am willing to pay. Bottom lime, call IB and ask them to walk you through. They would do that....

-

I think my personal lesson on this..... I will probably roll my LONG up more often. My long is at 162 and I was about to ROLL it, but did not. Now I am not feeling so good.

-

Thank you, Chris! I closed the trade for 12.14% gain. (my strikes were slightly different due to timing). I will be entering NOV/AUG tomorrow.

-

Chris, did you do the above?

-

I just put in some orders, less aggressive then Chris, but I am in Moscow Airport, trading in a lounge. So I have to put the trades in before I hop the plane. Hopefully will execute.

-

Yes, but you would more exposed to gamma. (change in underlying impacts option more close to expiration). So if there is a big sudden move a day before expiration, you will get a delta close to .9 or something. The 2 week approach has lower delta.... so any big move is less impact full. As Chris mentioned before, and I agree, until your long is deep in the money the 2 week approach seems less risky. Also, the 2 week approach reduces assignment risk, as its much less likely for someone to exercise the option with a week worth of time value.

-

I do not think anything is expiring... remember we are using 2 weeks out.. So the shorts still have a week in them.

-

I am generally bad at trying to predict things. So, I am just going to ride the trade as is. With volatility of GLD, it could drop $7 tomorrow, or rise another $5. I will simply follow the plan.....

-

It depends. I think most likely for me[for this specific trade], if the rise continues, I will simply roll up and out and keep the trade going. But in general, I would either close or roll up/out at no later than 2 month before the expiration of the long. Exactly for the reason you are pointing out. Don't want theta decay to eat away at the long too much.

-

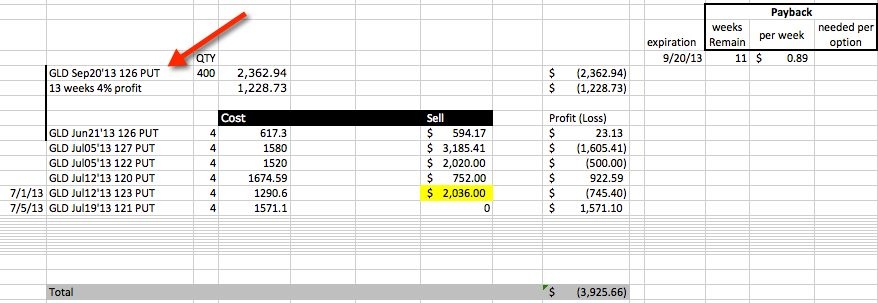

Chris, Am I correct to understand the above statement is $1.63 extrinsic at SALE, not actually captured. Or did you actually captured that much? I was in the ratio 4 to 5 for duration thus far, and only captured $0.96 on average per week per option.

-

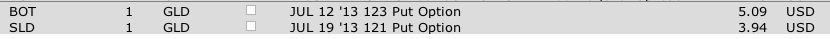

I rolled yesterday, I would probably go around 125 today.... based on your extrinsic need. Chris did roll yesterday as well. See post 108 above.

-

Yes it was a typo. So at expiration if GLD stayed at $118, we would collect $3200 on the long. (its at $119.50) as I write this.... making us a decent profit on the short.

-

Will simply add another row, put the value of the sold long in "sale column". I would only roll up, so it would imply a loss on that LONG, which would require raising needed premium. Yes, you could probably get into similar position last Friday. I think one of the things that many folks need to learn to live with, is that calendar trades, do not behave like any other trades. You can't graph the P&L of calendar trade for the entire duration. Sure, you can graph the current short, and current long, but not the entire duration. When I say the trade is doing great, what do I mean? I mean the following: 1. I am getting my extrinsic collected. 2. I do not have to roll my LONG 3. The whip sawing action have not crossed the short strike. Bottom line as long as I collect the extrinsic needed, I am on track to generate my profit. I do not mind short term losses on the short, as long as the whip saw action is limited to amount I have intrinsic in my sold shorts. As far as you being able to buy DITM Long, yes you could. But that requires higher capital to get in, vs. getting in at the money. So your returns on capital will be lower. (I had to drop in capital to maintain the trade). I do not see a reason, of using the capital until I have to, like I needed in this case. When initiating the trade, we certainly hope that we will not need to infuse additional funds into it. But you SHOULD NOT get into any of these trades, without either having plenty of margin room, or free capital available, to be able to cover your short positions on a strong down move. Remember its a TEMPORARY loss, as your DITM LONG will pay those losses back at expiration. So overall, we are on track to make the expected profit. Hence the trade is doing great.

-

Yes, I was 1 to 1 right away. In this trade we WANT GLD to stay below 126. Lets assume GLD will NEVER go up and stay at $118 till end of the trade. At expiration my LONG 126 will gain all the DELTA. So it will be 126-118 = 6 , times 400, would be $2400. In the mean time there are many weeks left, and we can continue get weekly premium. As long as I get $.89 per week extrinsic, I still would capture 4% profit. At this point, the long is worth $4K or so. So if I liquidate today, I would be about broken even. If GLD goes up, I will immediately collect intrinsic, but long will loose..... which is OK, as loss (on LONG) will be slower as gain (on short). [due to Delta being higher on short] If GLD goes further down, the shorts will loose, the long will gain... the further it drops, the DELTA would get closer to 1(on LONG), so losses will be smaller the further down it goes. However, every dollar lost on a down move today, is only a CURRENT CASH loss, every dollar lost today, will be gained back at expiration if the GLD does not rebound, or captured via intrinsic on the way UP. (In other words, our shorts would be very profitable if there is a rebound) There are 2 key risks to this trade: 1. GLD goes up TOO fast, for example if it suddenly goes to 124 overnight, my short will only gain $1571 at most, yet the LONG may loose more than that. 2. Long term (next 2 month) GLD going above 126, as that will quickly eat away at our long. Above $126, we would have to roll up, or have margin coverage.

-

DITM (GLD - 126 PUT Sep), has a Delta closer to 1 (.69). ATM would have a delta .5. So any further drop, would give you a bigger paper loss, if you were to roll. Plus you would be paying more extrinsic for ATM. If market goes up, you would have to roll up. Bottom line, unless you are done with the trade, an ATM that became DITM should be left alone.

-

I would not TOUCH the LONG. The trade is doing excellent. Remember we sold ATM, now its DITM. So as of today.... with GLD being $118, my PUT is $8 in the money. I do not have P&L complete, as I have not sold the LONG... but here is my trade status. But this sheet has three key points: 1. The future sale price of LONG GLD is excluded. 2. Profit, while is a NON cash expense is included as a cost. 3. if i get $.89 (extrinsic) per week, i achieve 4% per week profit, even if the Long expires worthless.

-

-

Chris, I think having our LONG being very DITM, it may be time to switch to 1 week expiration roll. I perceive the risk of loosing intrinsic on the way up as my primary concern. If I roll out now, with Delta on the current week short being so close to 1, and at the same time, in order to capture meaningful extrinsic, we have to drop our strikes. Sudden RUN up could leave money on the table... with 1 week expiration our delta would be closer to 1 and we will capture all the intrinsic. I do understand that same applies on the way down, but another couple of $$ down and our long will have a Delta close to 1 as well.