We’ve all been there… researching options strategies and unable to find the answers we’re looking for. SteadyOptions has your solution.

mks212

Mem_C-

Posts

88 -

Joined

-

Last visited

Content Type

Profiles

SteadyOptions Trading Blog

Forums

Everything posted by mks212

-

That's a good insight Kim. I will keep it in mind. What about the bid/ask spread on FOSL? The trade went from a small loss to a larger-than-I-would-like-loss because I got filled on both sides far from the mid.

- 10 replies

-

Regarding Gamma gains, in Dec I actually went through the most volatile stocks I could find and then looked for earnings related IV spikes. My thought was if I can rent the options for very little, let me raise the odds of gamma gains. That hasn't really panned out though in this earnings cycle. The move needs to be rather large for it to make it worthwhile to roll the straddle. Also, the market has been quiet the past few months. FOSL is a good example. I entered the 105 straddle, and the stock moved down to 101 I believe, and there was no money to be made by rolling. This stock is also affected by very wide bid/ask spreads on the options. I might avoid it going forward for this reason.

- 10 replies

-

Here are two whitepapers that I read in the past few weeks. http://www.kellogg.northwestern.edu/research/fimrc/papers/EPS%20ESTIMATE%20DISPERSION.pdf I can't seem to get a link for the other one without my computer downloading it. Put this into google and it will come up: Earnings Announcements in Options Expiration Weeks by H Ding.

-

Thanks Gary. The title is certainly dead on for what we do. Let us know what you think when you get through it. Mike

-

Good points Marco. I wonder if the "best" way is to make sure to compare the ATM straddle at the close of the position to the ATM straddle when the position was opened. For example, if XYZ was at $100 5 days before expiration, and was $105 right before the announcement, compare the price of the $100 straddle 5 days out to the price of the $105 straddle right before the announcement. That will give a sense of gains from volatility. Gamma is separate from that, and while welcome, can't be relied upon.

- 10 replies

-

I've been thinking about ways of refining our method for choosing trades. I know we look at IM and IV which makes perfect sense. However, there is a challenge because the same company doesn't always announce earnings at the same point in the expiration cycle. When they are the week of expiration, the IV spike is much larger due to a very short time to expiration. When they announce further out, the IV spike might not appear on the charts we look at on optionistics, but the IM is also misleading because there is a lot of time value remaining. Any ideas on how we can make an adjustment for this, so that we are always comparing apples to apples? I'm thinking this will require some sort of equation, so I am looking towards the more advanced mathematicians among us. Thank you. Mike

- 10 replies

-

Portfolio Management/Diversification applied to options trading

mks212 replied to mks212's topic in General Board

Good points Marco. Thanks. Yes, I use TOS and they display that very prominently. -

When investing a portfolio in stocks/bonds, you always hear the word "diversify." Simply put, you don't know which asset will perform best or worst, so buy a bunch that do not move in concert and you will always be protected. I wonder how we can apply that to options trading. For example, long straddles are facing headwinds due to low volatility across the board. However, calendars are doing pretty well. Are there any other trades that we can put on to help balance things out? One thing is that both long straddles and calendars are long vega. Would it make sense to do a short vega trade in case IV slips further? Another point is that calendars seem to be more sensitive to gamma than straddles. So a big move will hurt the calendars more than the straddles will benefit. Thanks, Mike

-

Using Calendars To Trade Earnings In A Low Volatility Environment

mks212 replied to mks212's topic in General Board

I traded another calendar this week, this time on APA. I used the weekly that expires tomorrow for the short leg and the monthly that expires next week for the long leg. The earnings call is next week. I wouldn't say that APA is an ideal candidate as the stock can certainly move, however, the pickings were slim. I needed a stock that has weekly options and an earnings announcement next week. Furthermore, the stock's options do not really display much of an IV spike prior to earnings which was a big thing I was trying to exploit with this trade. I opened the trade Mon AM and closed today AM for a profit of 11%. I would have held until the end of the day, however, I was not near a computer and have not yet become comfortable with trading on my phone. I did not want to hold until tomorrow since there is no time to adjust if the stock does make a sharp move. -

Using Calendars To Trade Earnings In A Low Volatility Environment

mks212 replied to mks212's topic in General Board

Nice one Marco. What it lacks in eloquence it more than makes up for in emphasis. Mike -

Using Calendars To Trade Earnings In A Low Volatility Environment

mks212 replied to mks212's topic in General Board

a -

Using Calendars To Trade Earnings In A Low Volatility Environment

mks212 replied to mks212's topic in General Board

I finally got my head around my issues with this trade and calendars in general. The main feature that attracts me to options trading, is that big moves in the underlying price don't really matter, and in many cases, help. When buying a stock, there is always that little voice right after you get filled that hopes for the price to go up and always says "don't go down, don't go down." With a calendar, it's even worse. Not only don't go down, don't move at all! Also, what made me get out of this trade early, even though I acknowledge that we are in a very low IV environment, which favors a calendar as the underlying prices are standing still, was Kim's example of AMZN above. It was a great trade until the very last day. It moved so sharply that the gains just disappeared. There was not much of a chance to adjust. That's a reality of calendars that needs to be acknowledged. They make money slowly, and can lose it very quickly. I'll keep all of this in mind on future calendar spreads. They are definitely a powerful tool. I wanted to do CLF, but the stock price is low, so the trade is too commissions consuming. -

Using Calendars To Trade Earnings In A Low Volatility Environment

mks212 replied to mks212's topic in General Board

I closed the calendar this morning for a gain of 23%. As prior people on this thread have said, BIDU is just not the right candidate for calendars, and between its value as well as the AMZN double fluctuating wildly today, I figured it is best to take the profit. I imagine I will have more thoughts on this, but it's been a long day trading wise and work wise. Mike -

Using Calendars To Trade Earnings In A Low Volatility Environment

mks212 replied to mks212's topic in General Board

Thanks for the education Kim. No doubt, BIDU came up on my screen for when looking for the most volatile stocks of 2012. Do you have any intention of adding it as a straddle candidate for next week? -

Using Calendars To Trade Earnings In A Low Volatility Environment

mks212 replied to mks212's topic in General Board

Thanks Marco. Part of the challenge with this trade is that backtesting isn't really "available." The volatility environment is so low now I don't know how realistic the backtesting is. BIDU was a good candidate for straddles/strangles in 2012 with some nice gamma gains. Those gamma gains would be a real kick in the pants if they happen on this trade (and most certainly illustrated on the spreadsheet you posted). This is why I opened only a single calendar and will open a double or triple should the stock start moving. I do feel like I am in no-man's-land a bit, but I have been gun shy to do the straddles since it has been a rough couple of months for them. I will of course defer to Kim, but would like to keep this discussion here. I am going to start talking about CLF shortly and would like to keep all talk of this particular trade in the same spot so we have it to come back to next time we are in a low IV environment. Mike -

Using Calendars To Trade Earnings In A Low Volatility Environment

mks212 replied to mks212's topic in General Board

So on Jan 17 you would short the Jan 25 and use the Feb Monthly for the long side? Thanks, Mike -

Using Calendars To Trade Earnings In A Low Volatility Environment

mks212 replied to mks212's topic in General Board

Thanks Kim. As this is a new trade for me, I did a whopping one contract on each side, so kept the risk as low as possible while still being in the trade. The trade I have been discussing in this post has been short options before earnings, long options right after earnings. The thought is that the long will experience increasing IV due to the impending earnings call whereas the short will not see nearly the same increase. BIDU is definitely not the ideal candidate for this due to volatility, however, it is tough to do on stocks that don't have 5 weekly calendars available. With just regular weeklies, we could only open on Thurs and then close the next day. And as it stands now, there aren't too many stocks with 5 weekly options CLF is on the radar for this trade as well as it announces on 2/13. My plan is to open it on Friday, 2/1. Short Feb 8 and long Feb 15. However, maybe it is better to open now due to the BIDU calendar doubling in one week! I will have a look at it now. Mike -

Using Calendars To Trade Earnings In A Low Volatility Environment

mks212 replied to mks212's topic in General Board

I entered the BIDU calendar today. They announce on 2/4 after the close. Please note, I had the incorrect date in my original post and have now corrected it. Trade is entered as follows: Buy To Open February 8 110 Call Sell To Open February 1 110 Call Price: $2.42 Debit Earnings Date: 2/4 After Close Stock Price $110,.38 I will close this trade on Fri. If the stock moves from the strike I will open a double calendar in the direction of the move. Let's see how it goes! Mike -

Using Calendars To Trade Earnings In A Low Volatility Environment

mks212 replied to mks212's topic in General Board

I agree. I wouldn't do the cheaper stocks. However, there are very few stocks that have options set up 5 weeks in advance, so for purposes of testing, I included them. Do you know of a good screen for this? I know we have optionistics.com and optionslam.com that help with identifying those stocks that are best suited for straddles. -

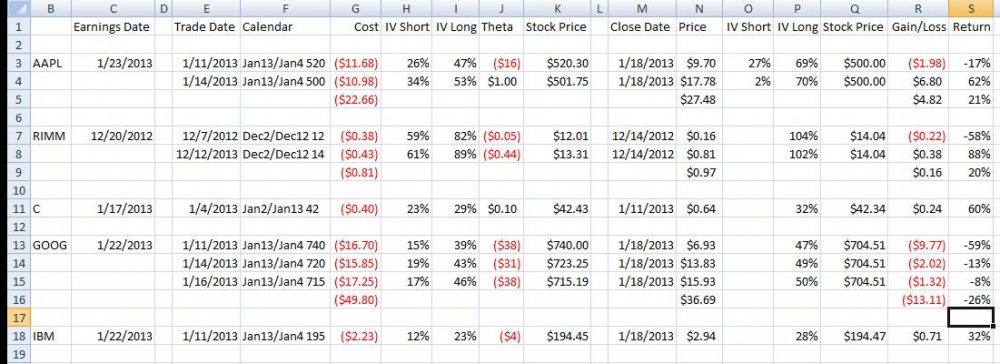

One trade that is on my mind with stocks that have 5 weekly options available is the following: Open a calendar spread that goes long the option that expires after earnings and short the option that expires the week before. This way your long option will benefit from rising IV from the upcoming announcement. The trade was opened two weeks before the long option expired and was closed just prior to earnings. I think this trade was mentioned in a few other posts, possibly IBM, I wanted to further investigate. The results of the backtest are attached. I used ATM options and opened another calendar if the stock moved. I know results can be improved, or at the very least, risk reduced by using double calendars and the like. I did it this way since it is simpler to understand and faster to backtest. As illustrated with the failure of GOOG on this chart, large moves are bad for this strategy. However, even in that case, the total loss was 26% with the gains on the winners much higher. Another point to note, theta was negative on many of these trades, unfortunately. The remaining stocks that have 5 options available in this earnings cycle are: F - 1/29/2013 FB - 1/30/2013 BIDU - 2/4/2013 S - 2/7/2013 CLF - 2/13/2013 Mike

-

I've been thinking quite a bit about what makes certain stocks good candidates for an earnings straddle/strangle trade, and what makes others bad. In that vein, I researched the 768 stocks priced between $40-$120 since that is kind of a sweet spot for options prices that are trade-able.* What I found is that some stocks have absolutely no relationship between IV and earnings announcements. What was more interesting, is that some stocks used to have a nice IV spike and no longer do. And also true, some stocks did not spike, but now they do. I think we would all agree that we would be better off if we could better predict which stocks are more likely to experience an earnings related IV spike, and which are not. Some of my initial hunches are to look at stocks that are more volatile (i.e. NFLX, EBAY) and also stocks that have had large earnings surprises in recent quarters. It does appear that the more volatile stocks tend to have more earnings related IV spikes. I am not really able to test the second hunch since any list I find of stocks that have had earnings surprises has mainly lower priced stocks, many below $10. However, my reasoning is along these lines: "Stock XYZ had a huge earnings surprise in the 4th Quarter, so now, going into earnings seasons in the 1st quarter, we would expect the IV of XYZ's options to spike." I would love to hear (read) input from other members and ideally be able to better set ourselves up for earnings season with higher probability trades. Thanks, Mike *These stocks have options priced to accommodate a portfolio of $10,000 or $20,000 allocating 10% to each trade. For the stocks less than $40, you have to buy so many contracts that the commissions start to really eat into your profits, and for stocks more than $120, even doing a straddle with 1 contract may be more than 10% of the portfolio.

-

Thanks Kim. Jeff Augen, in his book, Day Trading Options, discusses an example or two of straddles that lost a good amount of time value prior to easter weekend due to the market being closed on good friday. It was not a thorough enough discussion, however, so I am unsure. I read the post you referenced on Option Pit and it makes sense. I actually have a straddle open now and am watching the IV decrease starting yesterday afternoon into today for no apparent reason. The stock has moved down actually, so if anything IV should be up. Lowering vol is the first option the author mentioned that market makers have so maybe that is what is happening. I will hold until Tues as planned and see what happens. Mike

-

Thanks Kim. I will continue the discussion on the original post.

-

Since the markets are closed Monday, can we expect extra theta decay today to account for the long weekend? I have read conflicting opinions in various places. Both SNDK and FFIV look like good candidates for a straddle, but 3 days of theta might change the picture. Thank you. Mike

-

So, in this case, would it make sense to open the trade with TOS anyway? The reason I ask is because I have the capital available since my only open trade is the MOS straddle. I know that normally, we look at margin requirement as the true cost, which I agree with, but in this instance the requirement on the part of TOS seems to be erroneous.