SteadyOptions is an options trading forum where you can find solutions from top options traders. Join Us!

We’ve all been there… researching options strategies and unable to find the answers we’re looking for. SteadyOptions has your solution.

Crazy ayzo

Mem_C-

Posts

65 -

Joined

-

Last visited

Content Type

Profiles

SteadyOptions Trading Blog

Forums

Everything posted by Crazy ayzo

-

@Kim, I just switched my monthly subscription to the yearly bundle for free ONE access... that's too good to pass up. I just signed up for a new IB account. I'm also very interested in CMLviz Trade Machine... and Optionslam, and... I'm more than a little overwhelmed! Do you (or any of the other Senior members) have a recommendation for how to ingest these various services and tools in a systematic fashion? To a beginner, it appears many have at least some over-lapping functionality. Is there one to start and get comfortable with first, or is there a symbiotic combination that you recommend?

-

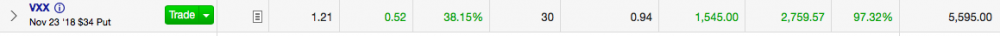

Kim, I was half way through reading all the VXX material on the site last week when the market went crazy. I bought 30 OTM put contracts last week when Volatility spiked. It's only been a few days and I'm up nearly 100%... killer return for a few days. My thesis when I was making the purchase was that the common wisdom expects the markets to stabilize after the midterm elections. Following the template of your earnings call trades, I picked the expiration for two weeks plus a few days beyond the event. If I'm right, and VXX returns to the high 20's... I make a fortune. This trade seemed too easy. I've read and re-read all the training this weekend. Is there something about VXX options that I'm not grasping that's radically different than stock options?

-

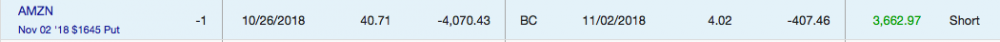

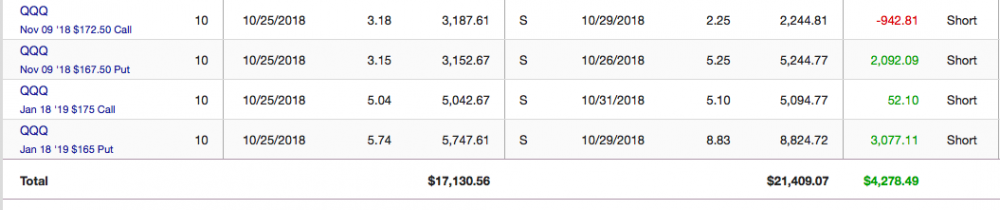

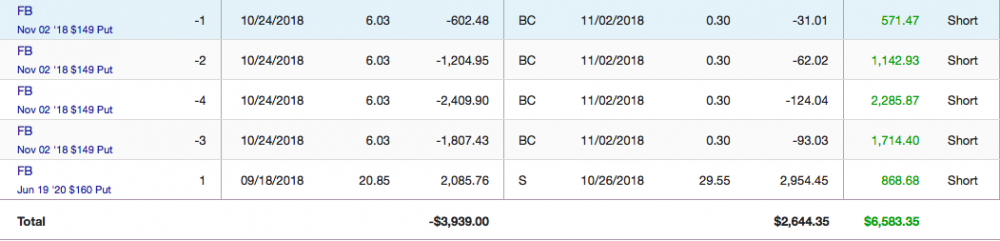

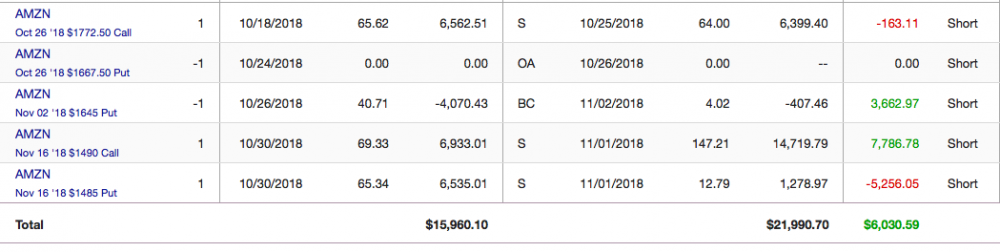

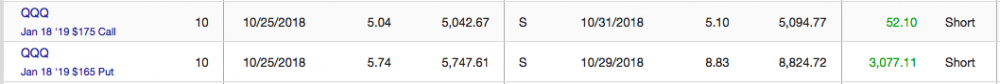

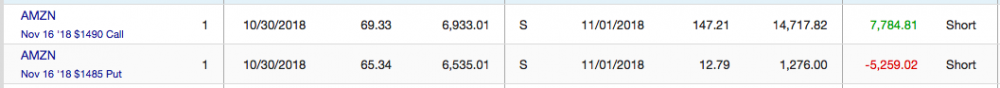

@gowtham, On the QQQs, I kept hearing in the market news the market is going to be volatile at least through the election. I expected it to oscillate, so I took the straddles. On opening the trade, I planned to sell both legs at a profit. I should have stuck to my original strategy a little longer. On netflix, I bought 500 shares at about the same time. I sold a straddle. My logic was that I wouldn't mind buying more NFLX at that price, or getting called out at the higher. My June 19 '20 FB put was bought on the same day I bought 100 shares as downside protection on a long position, not an options gamble. Sold it when I thought the market was down enough. I bought the FB Nov 2 puts thinking I'd either be happy to own more FB at that price, or get paid the Put price. AMZN Nov 2 put was the same logic as FB. AMZN Nov 16 strangle seemed like a no brainer that the following days would bring more volatility after such a big drop. I also bought puts on VXX mid last week that are doing nicely but still open.

-

CXMelga, I started 6 weeks ago and went through the same confusion on terms and technique. Yes, on your trading screen if you click the " trade" link it should auto populate. You want to select (Buy to Close). I highly recommend using a limit price vs. Market. Many of the options have wide spreads between "ask" price and "bid" price. I've traded about 40 options in my first month. I've found that if I set a limit price in the middle of the spread it gets filled almost immediately every time. When I'm even more conservative and specify the far end of the buy/ask spread, I've gotten filled more than half the time before the price shifts. However, couple of times it did get away from me. When you really want out, Price=market is a beautiful thing. I needed to buy to close NFLX, AMZN and FB this morning and I had 10 minutes between market open and being knocked out for a surgery. I literally entered the order from the operating table! Keep in mind, if you're in a loss position on an option, you can be buying it back at an amount considerably HIGHER than the delta in the underlying stock price. Selling a naked call means selling a call without owning the underlying stock or call spread. It's very high risk. Selling a naked put (what you described above) is also very high risk. I learned by selling naked puts on AMZN week before the market cratered. Simply don't sell naked options until you're highly experienced... and then you won't do it because you know better! If your considering selling a naked put or call, check out the incredibly reckless trade I made this week. (you should be able to look up the historical price chart for the week I owned it.) When AMZN went to 1490 in matter of days, I was down MANY multiples of the $4070 I collected when I sold it. A further caution to selling a naked options, it will lock up a lot of cash as reserve.

-

I had a pretty amazing outcome to a terrifying week. One way to learn the value of non-directional trades is to try the opposite. All's well that ends well, but I almost had wear adult diapers on Wednesday. I made about $24K, but selling naked puts nearly gave me a heart attack.

-

Here's another nice QQQ Straddle from this week... 30% in less than a week. It's not exactly a "steady trade" since I staggered the sale dates.

-

No, I was on the sidelines with a lot of cash for the last two years since selling my company. I finally said FK it, I can't wait for ever and put $2.5 million in the market at the end of September in high beta stocks.... as you know October was the worst month for the Nasdaq since 2011. I ended the month even. Most of my gains were in selling calls against my long positions, buying long term puts to hedge my long term positions. I also got into about half my positions by selling puts vs. buying the shares directly. W/O doing any options trading and protection I would have been down massively. The biggest value I've gotten from the education is the idea that I no longer have to guess the direction of the market. My current thesis is that I'm going to buy straddles or strangles on QQQ and high beta stocks when ever there is an extreme movement unrelated to the underlying symbol. I'm also going to go long with 1yr plus calls when a stock tanks. I did this with AT&T this week, it's up 33% in a couple of days. PS> I sold my AMZN straddle at open for a pretty nice return in only 2 days

-

Kim, Question: I bought an AMZN Nov 16 1485/1490 strangle when the stock cratered on Tuesday. It's up considerably in only a day. Can you help me look at the exit of this trade more analytically? I'm torn between selling at open, setting a modest gain credit from here, or swinging for the fences and holding it close to close. PS. I stumbled onto Steady Options looking for options training only about a month ago... I was totally new to options. The idea of trading volatility was new to me. I made a small fortune trading QQQ strangles this month! I also protected my long positions with puts, sold calls on several of me long positions... all in, I've covered the cost of Steady Options for the next century in my first month.

-

I read one of Kim's old 2014 posts where he tears apart an article from tastytrade: "We Put The Nail In The Coffin On "Buying Premium Prior To Earnings. One of the points in Kim's rebuttal is that TastyTrade picked the worst possible companies for trading earnings calendars. I've noticed that Steady Options has a handful of go-to companies. However, I'm wondering, "What makes a company a good candidate to trade earnings?" and the reciprocal, "what makes a company a bad choice?" Can someone enlighten me?

-

I would like to trade either straddles or strangles on QQQ (or other candidate) based on the Mid term elections (Tues, Nov 6th). My thesis is; * It seems like political events are effecting the market in a major way (Fed, Midterms, trade war)... maybe more so than fundamentals at this point. * The market believes that an election causes uncertainty and volatility leading up to it. The market generally goes up after the election is over, regardless of who wins. * Volatility is likely to stay high, or even increase, leading up to Nov 6th, and fall after that. * Therefore, it seems like buying straddles or strangles this week and selling them on Monday or Tuesday Nov 5/6 would be a good bet. *** Does any one have any specific opinions on this, or on trading big political events in general?

-

Ouch. I just joined to learn about options. I've been using my Etrade account. My A-hole hurts after comparing this to how much I pay for an options trade.

-

I have a newbie question... My goal is to continually populate my LONG positions by waiting for dips in highly traded stocks like google, Facebook, Tesla, HSBC, etc. Since I'm willing/waiting for a price drop to get into a volatile stock... rather than just placing a simple limit order and getting the stock at the price I want if it goes down; * Would it be more profitable to either ** Sell a Naked Put at my desired strike price (that way I get the sale price of the put in addition to getting the stock at the price I wanted)j ** Sell a naked put at my desired strike price + the value of the put; thereby increasing my chances of getting the stock I want at the same net cost.