SteadyOptions is an options trading forum where you can find solutions from top options traders. Join Us!

We’ve all been there… researching options strategies and unable to find the answers we’re looking for. SteadyOptions has your solution.

Crazy ayzo

Mem_C-

Posts

65 -

Joined

-

Last visited

Content Type

Profiles

SteadyOptions Trading Blog

Forums

Everything posted by Crazy ayzo

-

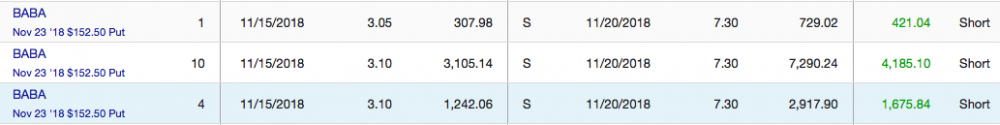

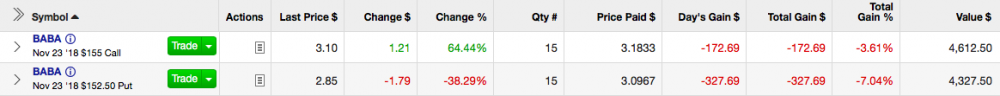

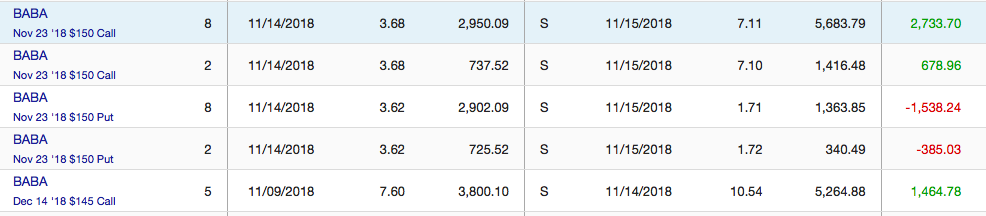

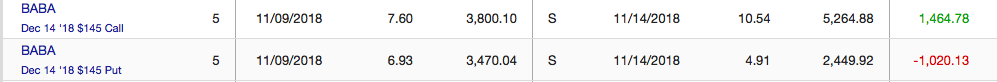

@Kim Closed my 3rd BABA trade. $1,676 profit on $9,420 bet = $17.8% profit in 5 days. The call leg is still open, counting it as worthless in the calculation. Still a change of a bounce to further increase the profit.

-

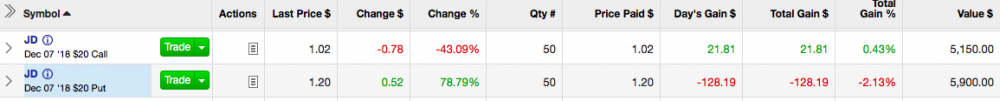

@Kim Closed my second JD G20 Trade. 73% Profit on a 4 day trade!! $6,451 profit on $8,772 bet. I'm starting to like politics. ** This is the closing trade of the narrow strangle above. The call leg is still open, but counting it as worthless for the calculation. Still an outside chance of a bounce to further increase the profit.

-

Thanks @krisbeefor the recommendation of Tradervue. I think I'll try it out.

-

@Kim et al, Is there a good tool that I can load my trades into that calculates profit and Loss? I see the totals in a spreadsheet, but I'd like something can can show annualized % based on time held, slice and dice for YTD, monthly, etc.

-

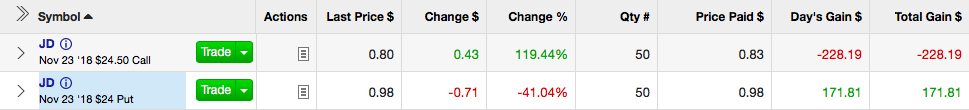

Closed out the JD Trade @ 10% profit. One day trade. Opening another JD for next week. Unfortunately my 3rd BABA trade is at a loss. Does anyone have an option about holding these type of options over the weekend into the final week?

-

I opened a JD trade on the G20 thesis. This one also has earnings next week. ... and I opened a 3rd BABA trade

-

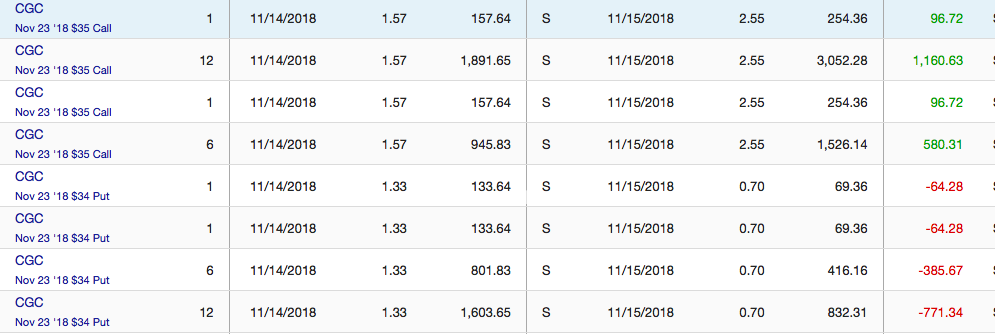

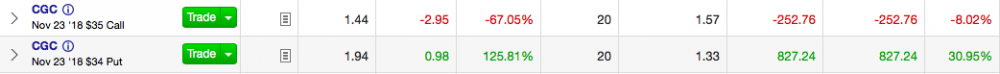

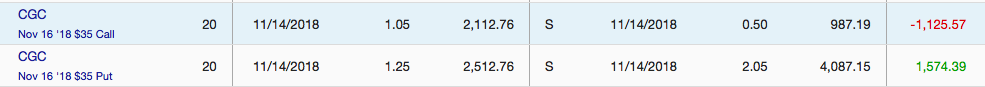

Closed my second cannabis CGC straddle. 12% profit. 1 day trade. Opened a third. Sorry, but I couldn't figure out column labels... $1.57 is the opening price price for the calls, 1.33 for the puts, $2.55 closing for the calls, $.70 for the puts. Total of 20 contracts. Opened a third trade for Nov 23rd

-

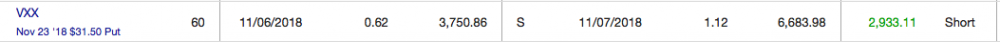

@akito I should label the columns, it's all there. 20 is the number of contracts. Second box is the opening date and opening prices. Third box is the closing date and closing prices. Last column is the closing total gain/loss.

-

@cuegis, I greatly appreciate your feedback. Despite having been a voracious reader of the SteadyOptions content for the past 6 weeks your feedback is mostly greek to me! Would you mind elaborating on... * How do you determine the liquidity level? Open interest? Bid/ask spreads? Other? To a beginner, these felt liquid in the fill process. The prices jump around so much within a few minutes that I had no problem getting a fill for the straddle by selecting mid bid. * The gamma totally escapes me... although I think that's what was happening on my longer term BABA trade. I understand that a longer expiry is more expensive than a shorter term. Here's my beginner reasoning; I thought that was because it has more Theta (time?) built into the price. Therefore the same amount of Delta in the stock price would have a smaller % impact to the option prices. Would you mind elaborating on the gamma? and/or correcting my reasoning? * I'm trying a variety of trades, so far most of them have gone well but I'm also trying to learn where I was just plain lucky vs. reasonable calculated risk. In my enthusiasm for winning my first cannabis trade, I immediately opened a second. I would have closed this one out today as well for a 16.5% return but time got away from me. Hopefully the price holds tomorrow. Ps. The first was 100% beginners luck. I wasn't paying close enough attention and I accidentally bought Nov 16, thinking I was buying the 23rd. I would have immediately sold them for a slight loss but I had to run out for a doctors appointment! Thanks in advance.

-

I had some success today on a one-day trade straddle on CGC. 10.8% profit.... feel free to check my math. I'm new to calculating option margins.

-

I closed out the first G20 BABA trade. I lowered my net credit, should have done it from the beginning. I was expecting too much of a swing for options 5 weeks out. 6.33% isn't too bad for a 5 day trade. I opened a new BABA straddle for next Friday. I have a tentative sell order for 20% profit target.

-

NO, but I just read the link now. The link and backtest seems to contradict my one-off success.

-

@againstallodds Thanks for your input. I couldn't agree more! While I'm bullish on China long-term, for the G20 trades I'm trying to remind myself to be directionally neutral and profit from short term volatility regardless of direction.

-

I'm looking for someone that is a power user of some of the following... Tradehawk with Tradier, Interactive Brokers, Optionnetexplorer ONE, CMLviz TradeMachine... and any other tools that you find particularly useful. My schedule is fairly flexible. I'm in the pacific time zone. If this is something that interests you either post here or PM me with an hourly rate. It's ok if you only know some of the tools, I don't expect anyone to know them all. I can pay via paypal. After I get a better handle on the tools, I'd also be interest in working with someone on strategy of non-directional trades. P.S. I did get Kim's approval before making such an off-topic post.

-

- ib

- interactive brokers

-

(and 3 more)

Tagged with:

-

Fortunately the feeling of going BIG only hits me after closing a winning trade! The caution always creeps back in when opening a new one. Thanks for the advice.

-

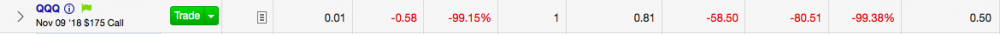

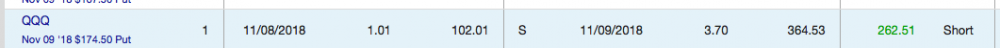

It was QQQ straddle opened late yesterday afternoon with today's expiration. Actually, a tight strangle $174.5/$175 Purchased a Nov9 175 call for .81 and a Nov9 174.5 put for $1.01. Total cost $1.82. Sold it for $3.64. One day trade. My logic was that it has been very rare that the QQQ has moved less than 1.81 in a day of late. I posted the graphic of the Put buy/sell. The corresponding Call is still in my portfolio, about to expire worthless.

-

I wanted to share yesterday's trade... especially for other newbies looking to try a few low value trades. I've been buying Thursday straddles for the following day expiration. I also bought an HD yesterday. I think recent options are underpricing how much this crazy market has been moving on many Fridays. If you want to try it, I suggest you buy a tight straddle. I've lost on most of my thursday directional bets. FYI. The corresponding call is about to expire worthless, a loss of about $80. It's approximately 100% return on a one day trade. I should have gone big!

-

@Azov... you are right about the volume on BABA. it's very sporadic. Surprisingly, the bid-ask spreads are tight. The options are expensive, but the stock is so volatile that I think it's worth the premium. I'm taking a beginner's guess that BABA is so volatile that the volatility portion of it's option price is somewhat insulated from a decline in VXX. Long story short, I opened a BABA trade a few minutes ago. My plan will likely be to leg out if it moves as dramatically as I expect in the coming days. I was tempted just to go long, but then I thought the same thing @$150 yesterday!

-

Thanks @Azov. I'll definitely take a look at that.

-

No, I don't mind you asking. I'm a beginner. I've had a handful of speculative trades on QQQ in the last few weeks where I legged out as each was profitable based on the expectation of the market being volatile that were very profitable. I'm up about $40K on pure play options for the last 6 weeks... call it beginners luck. I joined SO in mid September. The midterms trade was really the first one that was based on a good thesis. I'll back test it for the last few elections before our next big election in 2020, share the trade, and go big if it fits as well as I think it does. I think the G20 is a good thesis as well, but I don't have the experience to back it up. There's also no real data set to backtest since we've never been in this position before. I think we're likely to see Trump and China send out discouraging signals between now and the meeting... there's little reason to tip their hand in the negotiations. Trump's encouraging tweet last Friday was I believe an attempt to rescue the markets for the election. What makes this trade a little more unpredictable is that there's not a certain date/time for their meeting like there is for a major earnings call. Also, a public company would never intentionally send out an incorrect pre-earnings communication. This is just the opposite, I would expect that both parties want a deal, neither party wants the other party to know how badly they want it.

-

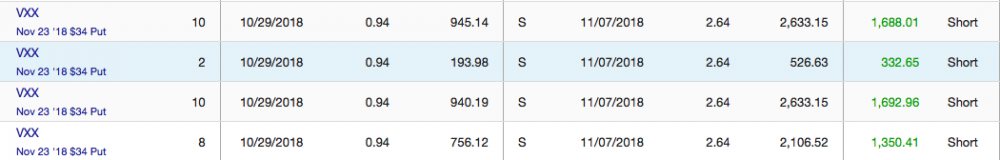

@Kim, @akito, @Paul, @NJ_KenRob I did pretty well on trading the midterms... 87% for a one day trade, 187% for an 8 day trade by buying VXX puts. I'm going to try some trades on the G20. Would love to have some more experienced company to discuss it with. My thesis... * The China Trade war is one of the most influential effects on the current market... especially the Chinese, but even QQQ. * As an example, look at what the market did last friday (Nov 2nd) when Trump tweeted that he wanted his staff to put a China trade deal on paper to consider... many of the china stocks jumped 10%. A couple hour later the white house clarified that the tweet was optimistic. All gains plus some were immediately given up. * Expectations for the Trump/XI meeting at the G20 (Nov 30-Dec 1) are all over the place. * I think the G20 will meeting will function like an earnings call as if all of china were reporting in the same 3 days... volatility and options related to QQQ, BABA, BIDU will go up substantially in the days leading up to the meeting. * I'm planning to do small straddles, strangles and a couple long call positions on BIDU, BABA, QQQ 7 days out and 3 days out (Nov 23rd and 27th). All of these are extremely efficient in terms of bid/ask as well as volume. I'll also likely try a VXX trade. * I haven't decided if I will sell on Thurs Nov 29th, Friday Nov 30th, or hold through the weekend. * I really don't have much of an opinion on whether to use expiration dates of Dec 7, 14 or 21. I may try small trades in all three just to watch. * While no one can predict the direction of Trump, the market reaction should be pretty extreme. If there great progress, the market will soar. If there's no progress or a step back, the market is going to take a big hit... especially China. * If you have ideas, I'd greatly appreciate you sharing them. Even if you don't want to do the trade or have an opinion, let me know if you'd like to see the results.

-

@Kim, Well, I didn't get any response on how to play the election, so I took a beginner's guess and went long... I bought VXX puts yesterday and 8 days ago. Here's how it played out! 187% on the 8 day trade, and 86% on a one day trade! Just shy of $8,000 in gains. I can't thank you enough for the SO site. What I learned on volatility trading has been very profitable. 86% on a one day trade! @akito ... I'm getting closer to the century mark!

- 1 reply

-

- 1

-

-

Kim, I watched my VXX Puts give up 80% of the gains over the weekend. I'm still optimistic, but I'd like to model the price of the PUT aging. Do you have a recommendation of what tool to use to do this?