SteadyOptions is an options trading forum where you can find solutions from top options traders. Join Us!

We’ve all been there… researching options strategies and unable to find the answers we’re looking for. SteadyOptions has your solution.

pboongird

Mem_C-

Posts

144 -

Joined

-

Last visited

-

Days Won

2

Content Type

Profiles

SteadyOptions Trading Blog

Forums

Everything posted by pboongird

-

@craigsmith I have found this dated thread and it would be great if you could share your current tracking spreadsheet? What works and what doesn't over the years? Do you still have 25 columns in your spreadsheet? What additional parameters that really gives you the "edge" and how do you get to use them?

-

PureVolatility's Tradier/Tradehawk Bundle Package

pboongird replied to SBatch's topic in General Board

Can you please confirm how much CA annual subscriptions fee would be for those that have already subscribed (a $57 per month) and wish to convert to the annual plan? -

Hi ablanco - Would you mind sharing how you modify/organize the risk section? I am also wondering if you could share your google sheet trading journal so I can track the SO trade better. I have a hard time tracking profit/loss on a trade that needs to calculate it based on margin. For example, our current BWB CAT trade cannot be tracked p/l accurately in tradehawk as it only shows p/l based on the cost, not the margin used. Any advice you or anyone can share on this matter would be appreciated.

-

More tools to analyze the earnings trades: www.art-of.trading

pboongird replied to Christof+'s topic in General Board

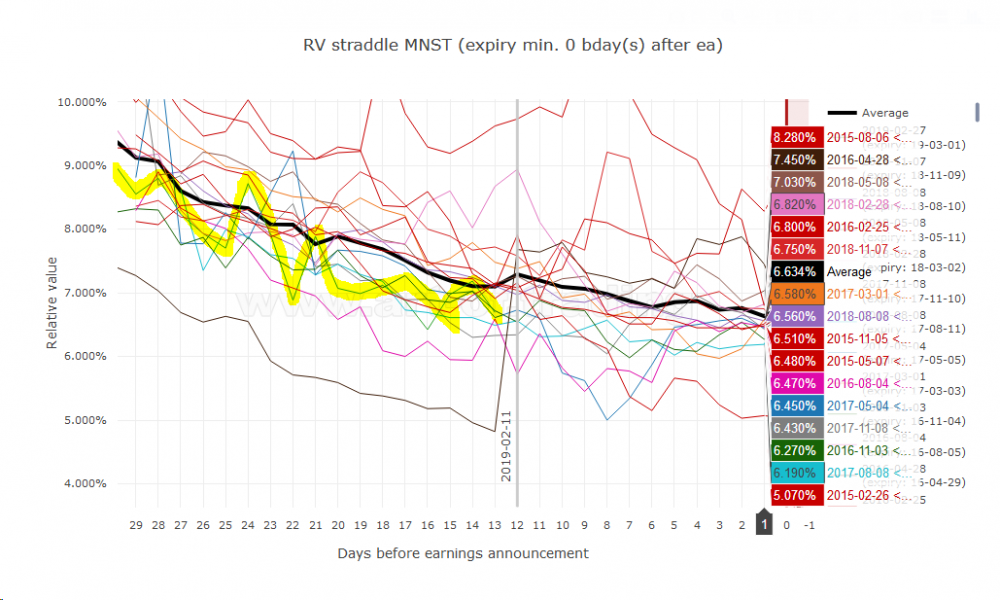

@Christof+ - I have one request on your RV graph... I am wondering if it would be possible for you to help adjust the size of the line graph of the next expiry cycle to be a bit bigger/thicker? For example, it would be similar to the one highlighted in yellow below. Currently, only the Average RV line get all the attention (bold) but the cycle that should get our attention the most is very difficult to see. It doesn't need to be as thick as the Average line but should be a bit thinker or highlighted so we don't have to strain our eyes? It would be even better if you could have a big dot at its tail as a current time mark so we can easily see where the price is currently. It would be a great help to someone like myself that already have to wear a prescription glass all my life. Thank you for your consideration. B-) PS. could you please add MDB to your database as well? -

@KimIs there a middle-ground alternative where you would enable "Our Picks" during the weekend/holidays only? I don't know how much work is involved to enable and disable it. IMO, there are few benefits to do so. reducing noises for the active members enhancing the effectiveness of the message promoting the "our picks" interesting articles to less-active members In this information-overloaded era, I personally think attaching it to every email is overkill and it becomes less effective. After a while, one would mentally filter it so they are no longer "see" them. Just my 2 cents.

-

PureVolatility's Tradier/Tradehawk Bundle Package

pboongird replied to SBatch's topic in General Board

@anand331Just email support@tradierbrokerage.com and state what you need. I think using the email you registered with Tradier will make thing simpler. You will receive a reply shortly with further instruction (you will need to esign a document similar to what you did when you first open the account). I put "Creating Alpha (CA) promo $109" in the subject. Hope this helps. -

PureVolatility's Tradier/Tradehawk Bundle Package

pboongird replied to SBatch's topic in General Board

Just to clarify. What does the "No separate SO/CA/Tradier fee" mean? Is it a typo on the current subscriber rate above? It should be $99 instead of $109 as anand331 mentioned? Also, if I'm not mistaken, the previous $99 offer is only for unlimited options trading? So, please correct me if I'm wrong... the benefits of converting to this CA deal would be two folds 1. getting the unlimited stock trading for $10 extra and 2. get in for the 3,000 discount deal to waive the fee altogether -

More tools to analyze the earnings trades: www.art-of.trading

pboongird replied to Christof+'s topic in General Board

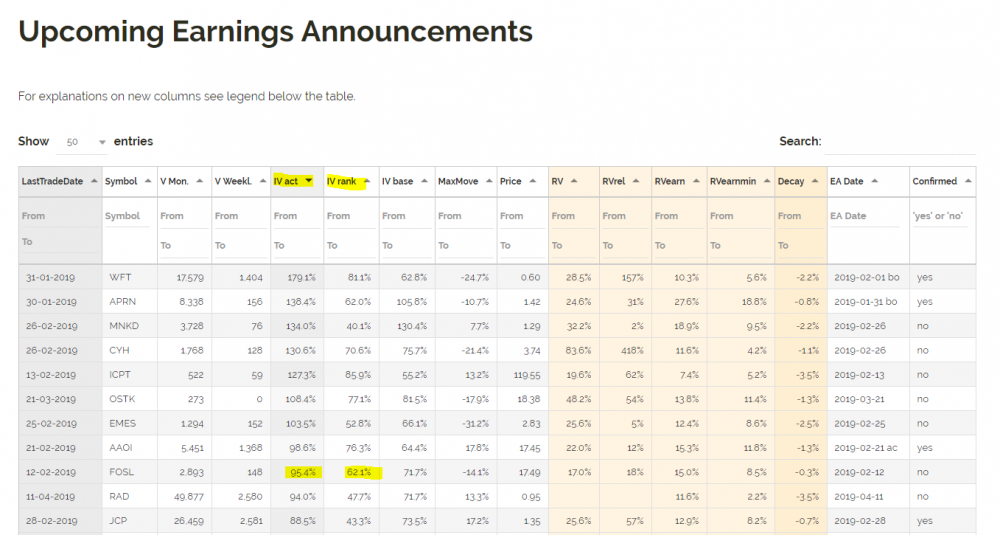

Please let me ask a follow-up question to clarify my understanding. For the FOSL case highlighted in the table, you would use the actual IV of its options (12-02-2019 expiry) and the minimum IV for the duration dated back 1 year (or from 12-02-2019 to 12-02-2018 period) plugged into the formula given to come up with the IV rank percentage? -

More tools to analyze the earnings trades: www.art-of.trading

pboongird replied to Christof+'s topic in General Board

@Christof+ Thank you for the great tool! I have a quick question about the IV rank in your table as the definition is not at the bottom of the chart yet. What is it being ranked against and at what time period? -

To clarify, I just got a reply from TradeHawk this morning that the $90/month or to be exact $89 per month ($40 So offer + $49 Tradehawk offer) promotion that SBatch got is no longer available. Now they (TradeHawk) only have the $59 per month Pro options for options trader. If that is combined with the SO offer ($40), it will be $99 per month for the unlimited commission-free option trading with Tradier Brokerage using TradeHawk platform. When I asked TradeHawk about the refund if trading more than 300 commissioned contracts (posted on the Tradier website), the guy referred me to Tradier as he didn't really have a clue on that. So, it clears to me that the refund is offered by the Tradier brokerage and has nothing to do with TradeHawk. Anyway, in sum, there is no more $89 per month. The current deal is $99 per month if one decides to go with Tradier + TradeHawk. Oh and you should just ignore the refund stated on the Tradier website as you would have to choose to trade 300 commissioned contracts in order to get that $59 refunded which makes no sense when you could trade the unlimited number of contracts commission free with the SO offer. In the beginning, this is really confusing to me. So, I hope this explanation helps someone down the road...

-

Thank you Bull3t007 for your reply. I don't have IB. I am planning to create a new Tradier account and trying to decide whether to go with TradeHawk or ONE (both with Tradier). Tradier customer service just got back to me saying since I am a SO customer, I can get TradeHawk for $99/month while ONE platform it will cost me $95/month. To my understanding, if I decide to go with the TradeHawk and happen to trade more than 300 contracts, I will also get the $59 refund. So, I probably would go with TradeHawk if they can confirm back to me on that. Regarding the platform, I already have been using TOS for years and I still have my account active there. So, I probably will just continue to use TOS for analysis and use Tradier + TradeHawk to entry order just to minimize the commission and fee. Unfortunately, the TD commission is still much higher even I tried to negotiate them down. Cheers, Luke

-

Hello all - I am new here and trying to set up a new option trading account so I can reduce the commission and fee which seems to be crucial to maximize your gain when trading with the SO strategy. Currently, after reading a few posts, I'm looking at either Tradier + ONE or + tradehawk. Now, I would be grateful if someone can share with me what would be the average number of contracts do you get to really transact on average (per month) for a 100k portfolio size so I can sign up with the right plan. Tradehawk has a current plan that if I trade more than 300 contracts per month, it would refund the $59 fee. Hence, I am wondering if I would be able to reach this threshold. I saw that the official SO trade are about 10-12 trades per months but the number of contracts is a big variable depending on the stock price and fill rate. I am also aware that bigger lot size could have a hard time getting order filled if blindly following the official trade. Can anyone share his/her experience? It would be great if you can give me a rough ratio of how much do you actually follow the official trades as well i.e. 500 contracts/month and about 50% of the time...