SteadyOptions is an options trading forum where you can find solutions from top options traders. Join Us!

We’ve all been there… researching options strategies and unable to find the answers we’re looking for. SteadyOptions has your solution.

akito

Mem_C-

Posts

686 -

Joined

-

Last visited

-

Days Won

8

Content Type

Profiles

SteadyOptions Trading Blog

Forums

Everything posted by akito

-

closed MAR position for 3.05 credit. 22% gain.

- 1716 replies

-

- pre-earnings

- trade machine

-

(and 1 more)

Tagged with:

-

opened MAR 11/17, 121 call for 2.5 debit. Using a later expiry to be more conservative

- 1716 replies

-

- pre-earnings

- trade machine

-

(and 1 more)

Tagged with:

-

Sold for 0.55. 47% loss. Looks like it is going further down.

- 1716 replies

-

- pre-earnings

- trade machine

-

(and 1 more)

Tagged with:

-

I have no idea what the expected move is. I'm just going by Kim's rules with pre-earning straddles. So, a full allocation (10% of portfolio) and a profit target of ~10%. @Mary 's backtest screenshot does show an average of ~19% gain though (with 30 day expiry).

- 1716 replies

-

- pre-earnings

- trade machine

-

(and 1 more)

Tagged with:

-

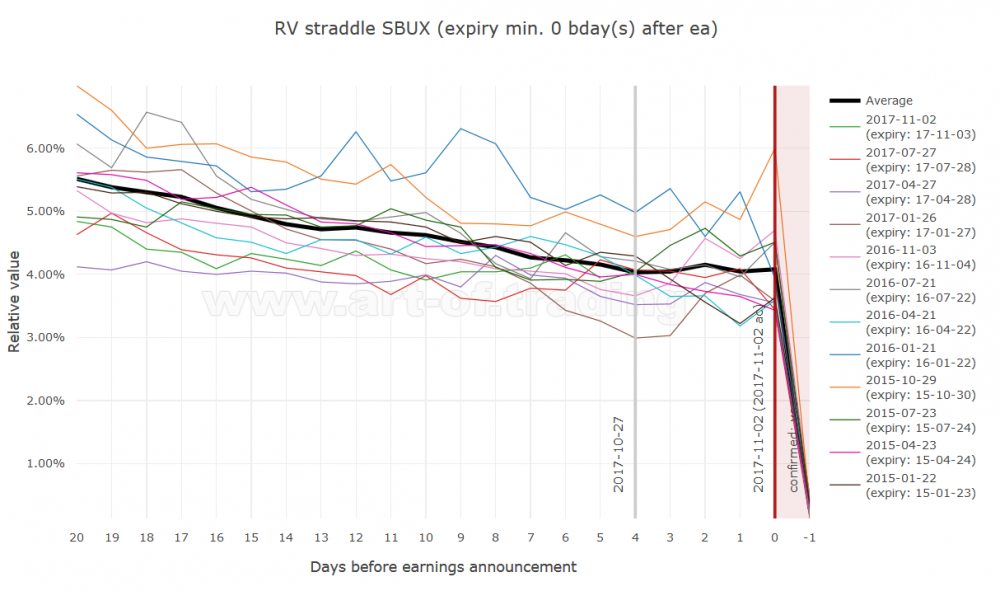

The RV being flat says that implied volatility (vega) keeps up and compensates for time decay (theta). So we can hold a position without worry about time decay and wait for potential delta/gamma gains from stock movement.

- 1716 replies

-

- pre-earnings

- trade machine

-

(and 1 more)

Tagged with:

-

This is with the closest expiration: FYI, I just got this from https://www.art-of.trading/graph-straddles/, which is still free at the moment. (courtesy of @Christof+ ) Playing around with some of the expiration mins, the 10 day expiration min looks even better. (thus why I opened some of the November monthly as well)

- 1716 replies

-

- pre-earnings

- trade machine

-

(and 1 more)

Tagged with:

-

That's just a typical pre-earning straddle. Your backtest results look good though. I also took a look at the RV charts for SBUX and they indicate a rising RV from today onwards too. Current RV is below average of last 4 ERs and last ER had an outsized move. Entered a few 11/3, 55 straddles for 2.14 debit and a few 11/17, 55 straddles for 2.6 debit.

- 1716 replies

-

- pre-earnings

- trade machine

-

(and 1 more)

Tagged with:

-

Ah, right. ER release looks to be on 11/7 AC, but earnings call is on 11/8 BO (I was looking at their website): https://investor.shareholder.com/MAR/events.cfm (regardless, same result though, closing on 11/7) Oh, you're only counting trading days? The backtests aren't based on calendar days? The CMLVIZ blog post also recommends entering on 10/31 though. http://www.cmlviz.com/cmld3b/index.php?number=11776&app=news&cml_article_id=20171026_the-one-week-pre-earnings-momentum-in-marriott-international (link from krisbee)

- 1716 replies

-

- pre-earnings

- trade machine

-

(and 1 more)

Tagged with:

-

Just curious. Any particular reason why you're entering now? Do the backtests show best results entering now? With earnings on 11/8 BO, 7 days before would be 8/31

- 1716 replies

-

- pre-earnings

- trade machine

-

(and 1 more)

Tagged with:

-

Bought a single 76.5, 11/3 YUM call for 1.05 debit as well.

- 1716 replies

-

- pre-earnings

- trade machine

-

(and 1 more)

Tagged with:

-

Looks good, going to give this one a shot next Tuesday.

- 1716 replies

-

- pre-earnings

- trade machine

-

(and 1 more)

Tagged with:

-

Do you mind sharing the links to the backtests or the CMLVIZ blog posts?

- 1716 replies

-

- pre-earnings

- trade machine

-

(and 1 more)

Tagged with:

-

I haven't closed any of my positions yet on Tradier (so I don't know how accurate the total account values are after completing a trade), but I did see that the total values up top are calculated with the option mid prices and the values of each leg are calculated on last prices. (As opposed to mid) Super confusing as the last prices are sometimes better or worse than mid. I asked Tradier about this and here is what they said: ----------------- Hi, You are exactly correct on which calculation is used in each section. The position page uses the last price while the total account value uses the mid-price. We do plan to use the mid for the position page at some point, but we do not have an ETA of when that will be changed. Sincerely, Chris Lepore Director of Operations

-

FYI, tastyworks just released another update today that fixes the closing positions bug. Finally, it looks like the tastyworks team is focusing more of their efforts on the android app.

-

Tastyworks has also released an update for their android app (technically unreleased beta, but can be found on google play) today which fixes some crashes on the grid page. (not that I ever use that though) However, the new update has now broken the mechanism for closing positions. Previously, if you selected some legs and tapped "close", it would navigate to the trade page and prefill the settings to close the legs. All you had to do was choose a price and hit confirm. Now, it just goes to the trade page without prefilling out anything. If anyone else is using the android Tastyworks app, I would highly recommend against updating until another update comes to fix this issue.

-

Had just signed up for Tradier last week and made my first trade today. Definitely will need to get used to their interface, but it's not too bad. Has anyone thought (or even tried) to write up a userscript to customize their default web interface? (for example, using greasemonkey/violentmonkey browser extensions to then load the userscript, which is basically just javascript. so just injecting some javascript into the page) I'm going to spend some time writing one up. I really need to see the position legs grouped up. It's just so much easier to see how the overall position is doing. Probably going to add in some buttons to make it easier and quicker to enter/close orders as well. All this data entry is going to get real tedious real quick. Sure tradehawk looks awesome, but I really need to be able to easily manage positions and make trades on my mobile device. I'm planning on using the firefox android app since you can install browser addons/extensions in it. (for loading userscripts, greasemonkey doesn't work in firefox android, but one extension called "usi" does and it works very well)

-

My thought is that not everyone is with or knows about SteadyOptions, so the SteadyOptions+Tradier deal would not be available to them. In that case, the Elite version would be right for them.

-

Wow, that is awesome that you can combine the offers! On a side note, for $.35 per contract, would they still have their $5 and $7 minimums? (for single and multi leg orders, respectively) on their $49 tradehawk pro deal.

-

Really? Strange. I'll have to follow up on this then. This is what they had said in their email: "Hi, If you have a multi leg trade fill, it will show as one line and you will have a button to the left of the trade where you can expand it to see the individual legs. Let me know if you have any other questions. Sincerely, Chris Lepore Director of Operations "

-

Do they group multi-leg option positions into a single row now on the portfolio page? (as opposed to listing all the legs separately) I see that many responses here say that they previously did not. However, I've emailed them about this and they say that they do. (they also said there is a button on the row that you can click to then view the individual legs) Can anyone confirm? If so, does it also group them up if you order the legs in separate orders? (as opposed to one multi-leg order)

-

More tools to analyze the earnings trades: www.art-of.trading

akito replied to Christof+'s topic in General Board

Also, the filter on your "confirmed" column does not seem to work. I tried to type in "yes" and it couldn't find any results even though many of the rows do indeed have a "yes" in them. (I also tried "no" and had the same results) -

More tools to analyze the earnings trades: www.art-of.trading

akito replied to Christof+'s topic in General Board

Can't you accept a comma separated string, parse the symbols within, and then filter out the results on the page? Not sure what tool/framework/extension/library you are using, but I can't imagine it to be too difficult. (unless you have some strange formatting/structuring on that page) Yahoo does something similar (this is what I am using currently for upcoming earning dates as it allows searching/filtering for multiple symbols): (unfortunately, it does not say if each earnings is confirmed, which your sites does) https://finance.yahoo.com/calendar/earnings?symbol=aapl%2Cfdx&offset=0&sf=startdatetime&st=asc -

More tools to analyze the earnings trades: www.art-of.trading

akito replied to Christof+'s topic in General Board

Very nice! I love the upcoming earnings page and that it shows whether the earnings are confirmed or not. -Could you add in a way to filter the upcoming earnings page with multiple symbols? It seems like only one can be searched for at a time. -The price, at around 20-25 usd, seems much more reasonable when compared to other sites. Nice. -Is there a way to disable the smooth scrolling? (perhaps a setting?) The biggest issue with it is that it seems to scroll way too much with one notch of the scroll wheel on the mouse. -

I don't know about everyone else, but the charts make a lot of sense to me and look like a great resource. Hopefully, more examples and test runs will validate exactly how useful they are. Please continue posting these! Your work is very much appreciated.

-

Does anyone have any screenshots of the default web-based interface for tradier? Does it have different pages for making a trade, watching your portfolio of positions, and viewing existing/past orders activity? Curious to see exactly how bare-bones it is.