SteadyOptions is an options trading forum where you can find solutions from top options traders. Join Us!

We’ve all been there… researching options strategies and unable to find the answers we’re looking for. SteadyOptions has your solution.

equus

Mem_C-

Posts

302 -

Joined

-

Last visited

-

Days Won

3

Content Type

Profiles

SteadyOptions Trading Blog

Forums

Everything posted by equus

-

What is the best way to receive an alert to find out when a company has just announced its earnings date? Is there a tool in IB or TOS that can do this or perhaps another way? Have been manually visiting Yahoo but it's quite time consuming to check symbol by symbol each day. Thanks

-

Now I see what you see, Kim. Whatever switch your developer used, it is now working and also the double-spacing issue is resolved. Thanks, looks good!

-

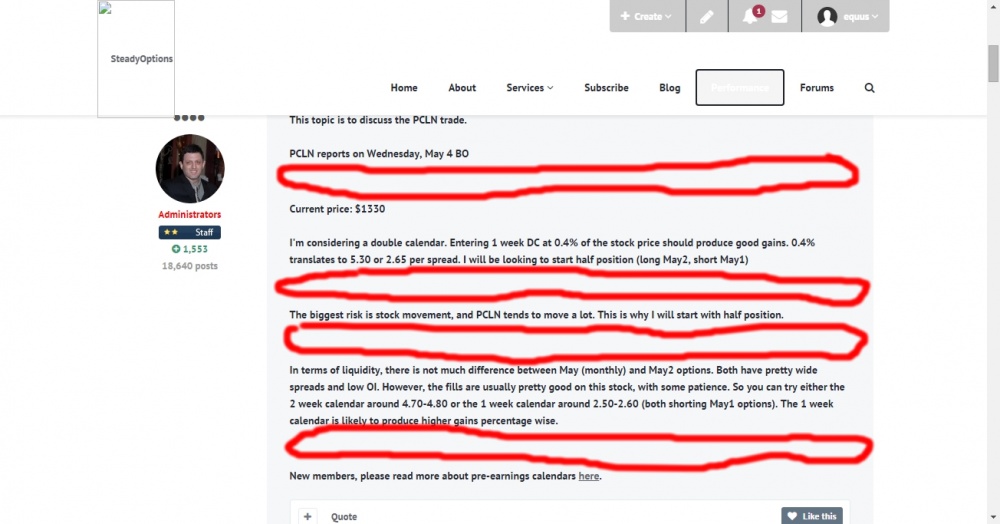

I'd love to be able to see what you see, your screenshot shows a much more attractive layout than my screenshot, both in terms of colours and use of space. I have tried different browsers (latest Mozilla, Chrome, Opera in Windows 7 both on my desktop & laptop PC) but result is always the same as my screenshot, somewhat unattractive & dysfunctional. How can I see what you see? I do agree you need to have spaces between the text. My point is that the formatting is showing an excessive amount of space, not just in the top banner but also in between paragraphs, which in my screenshot is double the normal space. Would be great if your designer could take a look at this.

-

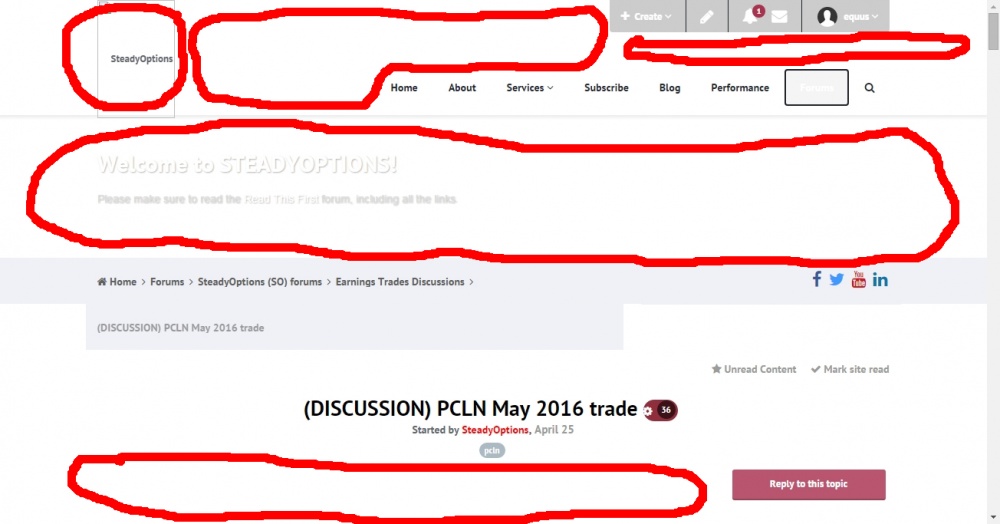

I've been away for a while but am now starting to spend more time on the new website. I'm observing that the website is difficult to use on my laptop because even before i start scrolling down 25% of my screen is wasted with a deep banner at the top (and one which remains ever present even when you scroll down). A question I have for the designers: what is the benefit is using up so much screen real estate with what is essentially white space? It might look good on a huge monitor but on a portable laptop with 800 or so vertical pixels as a user you end up scrolling, scrolling, scrolling all the time. I've taken a couple of screen shots and used red to try and illustrate the vast white space that seems to be inefficient use of space. As a user i am not so interested in how pretty the screen looks, much more important is readability and ability to access the information quickly and easily.

-

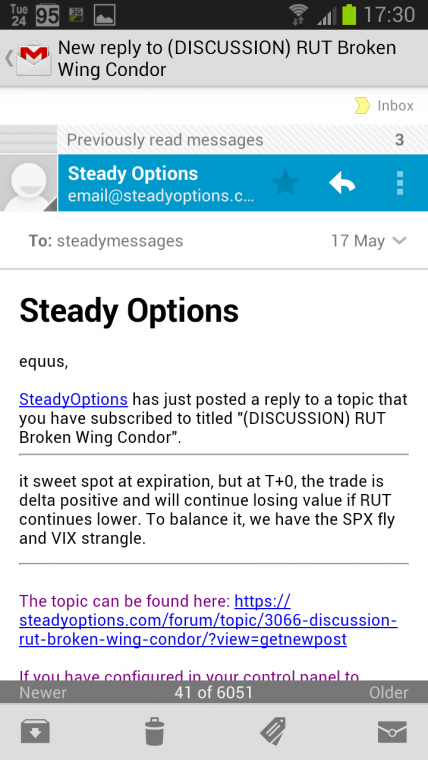

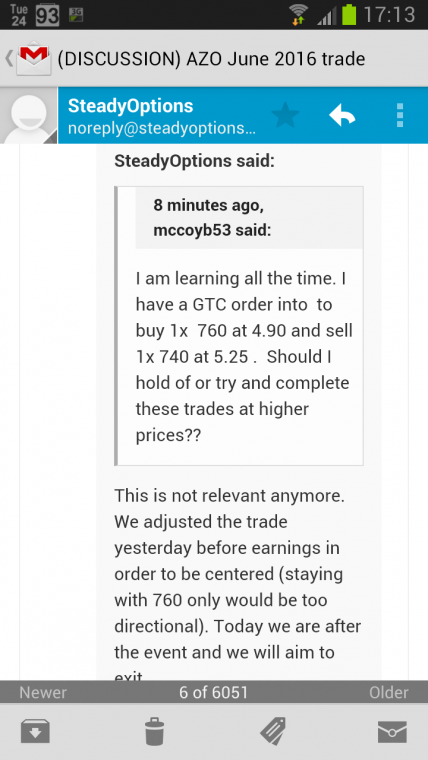

Writing at the airport with my Galaxy S3. Here's another comparison of old & new. Old emails were packed with information on the top page - meaning as soon as you opened the email you instantly saw most or all of the content. With new emails the actual content is not visible on the top page and you have to scroll down each time for the reveal. The new format has a Steady Options link in a grey box that takes up nearly a quarter of the screen. Since everyone already knows the Steady Options homepage, my feeling is that this is probably not needed. I loved the old emails for their simplicity and practicality, they were able to inform quickly and efficiently. Hope the new format can replicate all these good points.

-

The issue is not with font size, which was fine in both old & new formats, but with the wide margins on the left & right. This makes it harder to read because it shoehorns the text into a narrow funnel. Keep the current font but it would be good if webmaster could remove the excessive margins. I attach old format as an example where text uses the whole real estate of the screen. It's a non-trivial issue when you read dozens of posts each day this way!

-

Mobile. But not just for trade alerts, also the discussions. Attaching an example screenshot from gmail app in Android.

-

One thing I'd like to request: please can we have the old formatting back on emails? The new format is quite hard to read with only about 5-6 words per line. The old format was easier to read with 11-12 words per line.

-

I just received an instant notification of your last post - very cool!

-

Yes, i like the look too. Very clean and spartan. Hopefully fast loading too.

-

nice to now be able to follow a topic directly in the mobile version without having to switch to desktop. :-) is it possible now to follow an entire section such as earnings trades discussion (and not have to manually subscribe to each new topic, which can often cause the user to miss the first few posts if they are not quick to subscribe), like some members wanted?

-

As a pointer, I wonder what is a good minimum and maximum range for number of quarters to backtest?

- 8 replies

-

- backtesting

- strategy

-

(and 1 more)

Tagged with:

-

For backtesting earnings calendars, how many quarters back is it helpful to go?

- 8 replies

-

- backtesting

- strategy

-

(and 1 more)

Tagged with:

-

Exited TWTR 51P for 0.37 (entry was 0.30). Not much left after commissions I suspect!

-

Got it, thanks. Are there any other metrics it would be good to record during the backtesting process, such as IV or IM of the long/short legs?

- 8 replies

-

- backtesting

- strategy

-

(and 1 more)

Tagged with:

-

TWTR around 0.38 mid, GPRO around 0.60 mid at the moment.

-

Kim, I had a look at the historical ATM spread values for the recent GOOG April 15 calendar we did using ThinkBack's End of Day data. Across the days I looked up running up to earnings, the average ATM value was 1.52, with a minimum of 1.43 and maximum 1.73. In other words, the granularity of the EOD data is not fine enough to show the 1.15 entry that some folks achieved on 20 April. Is it necessary to be looking at the intraday spread prices to establish the range for the day or is EOD good enough?

- 8 replies

-

- backtesting

- strategy

-

(and 1 more)

Tagged with:

-

Kim, when backtesting the pre-earnings calendars, is the idea to track the price of the ATM spread each day in the runup to the historical earning date, whatever the ATM strike price happens to be on a particular day? For example, FSLR calendar: the underlying might be 60.00 on Monday, 62.50 the next day and 65.00 the next day etc -- do you look at the price of the 60 calendar on Monday, the 62.5 calendar on Tuesday and the 65 calendar on Wednesday?

- 8 replies

-

- backtesting

- strategy

-

(and 1 more)

Tagged with:

-

Interesting, don't think we've ever done EXPE as an official Steady Options calendar trade.

-

Might be mistaken but I was quite surprised to get in about 0.15 below the mid.

-

Prices dropped a bit, in at 2.38 and 2.40 on 1190P and 1200P, thank you Vancouver.

-

Waived if you meet the minimum trading volume requirement, which I believe remains unchanged.

-

Spent some time with customer services and the US Value Bundle looks like it will be sufficient for what we trade at Steady Options, during regular market hours - I asked about symbols like SPX, SPY, TLT, VIX and equity options such as GOOG, NFLX etc.