SteadyOptions is an options trading forum where you can find solutions from top options traders. Join Us!

We’ve all been there… researching options strategies and unable to find the answers we’re looking for. SteadyOptions has your solution.

izzo70

Mem_C-

Posts

390 -

Joined

-

Last visited

-

Days Won

1

izzo70's Achievements

Hero Member (5/5)

22

Reputation

-

If i increase portfolio size from 10k - 50k can i continue using official SO strategies and just change the allocation to 5k. Do the official SO trades tolerate this easily? I'm curious how larger portfolio members trade and would welcome any advice on how and when to step up.

-

izzo70 started following Model portfolio size

-

Any advice or links to previously discussed guidelines for increasing portfolio size and allocation using official SO trades?

-

izzo70 started following Ophir Gottlieb

-

we have double put calendar and Maji was suggesting a put/call dbl calendar. But as Kim has shown, it makes little difference.

-

@Antoxa You would definitely want to take a look at Tradier Brokerage as well if in fact, as urfiend stated above, they are are now accepting non-US clients? With their $40 flate rate per month, think of how much you could save!!! Your CSX trade alone will cost you $125 round trip. That would cover 3 months of commissions with them!

-

The commission structure has to do with where the product is traded and not your physical location. Kim uses IB and as far as i know, lives in Canada! I doubt he would pay 1.25 per contract, but not 100% sure.

-

Interactive Brokers

-

Unfortunately it's only single leg. So your 20 contract spread would cost 20.00 in commissions (10.00 max on each leg) and 6.00 in fees. (40 X .15 = 6.00) Plus you pay for the fees when you close it so approximately another 6.00. Round trip cost = 32.00 Old price would have been 52.00.

-

On the technology side, tastyworks is releasing a new analysis tab, portfolio margin, options on futures, paper trading, an open API, a new scripting language and lots of new mobile features.

-

-

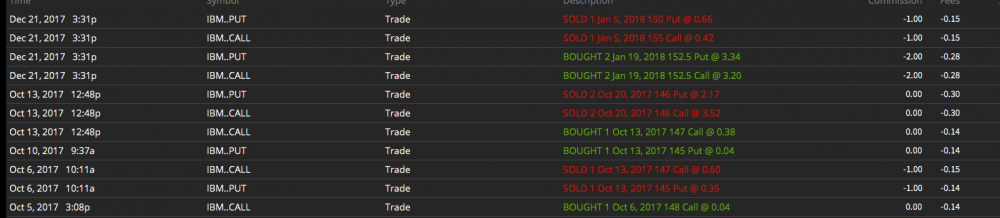

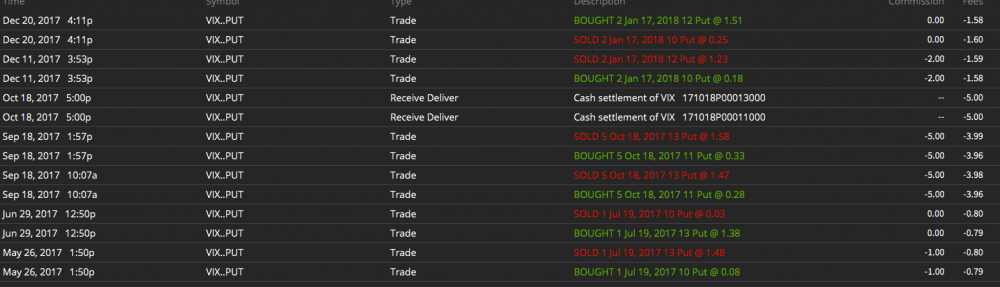

Fees are usually .14 or .15 cents per contract on open and close. (I have been using them since Feb and have yet to see a .10 cent fee. They may charge less for larger accounts but not sure) VIX is .79/.80 on open and close. IBM 1 contract For example: If you bought/sold to open a put in IBM it would be 1.00 commission + .15 fee = 1.15 To close it you would just be charged the fee of .14 cents Round trip cost would = 1.29 IBM 20 contracts If you bought/sold 20 puts to open in IBM it would be 13.00 (10.00 max commission + (.15 cents X 20 contracts = 3.00) To close it would be 2.80 (.14 cents fee X 20 contracts = 2.80) Round trip cost would = 15.80 VIX 20 contracts If you bought/sold to open 20 VIX puts it would be 26.00 (10 max commision + (.80 cents X 20 contracts = 16.00) To close 20 VIX it would be just the fees 15.80 ( Zero Commissions + (.79 cents X 20 contracts = 15.80) Round trip cost = 41.80 This is how i understand it at present. Hope this helps!

-

@zxcv64 They just sent it to me in an email as they are my broker, so i thought i'd share with everybody. It will probably be posted tomorrow when the offer becomes official. On the technology side they are suppose to unveil an analyze tab that i hope exceeds TOS. Here is the full email for those who are interested: Hello, tastynation! To start off 2018 just right, we want to thank you for your show of unconditional support and irreplaceable loyalty for tastytrade and tastyworks. You are the reason we’re driving change to the financial industry. We’ve not only planned more of what you love, like more live tastytrade shows in 25 cities, more trading tools, more mind-blowing content, more new daily shows – but also stuff that will leave you thinking, “How’d they do THAT?” tastyworks introduced zero commissions to close trades on Jan 3rd, 2017. Starting tomorrow, on Jan 2nd, 2018, tastyworks is introducing capped commissions for large option trades. This means the most commission you will pay for any single leg option trade is $10* (plus clearing fees). That’s right, just $10* per leg! Eighteen years ago, when we built thinkorswim, 100 option contracts to open and close was $300+. At the time, we thought $1.50 per contract was cheap. Today, the industry average per contract is about $.70 plus a small ticket charge. So, 100 option contracts today is approximately $150 to open and close at most firms. With tastyworks’ new rate schedule, the same trade will cost $10 in commissions to open, zero in commissions to close and a $20 clearing fee for a total of $30. Compare that rate to any other firm on the planet and remember how good our technology and content is as well. Fees for small options trades (10 contracts or less) stay the same. But we’re not done. As an added bonus, tastyworks will have twelve monthly drawings for funded accounts (minimum of $2,000) and each month, one customer will win free commissions for 5 years. And no, we haven’t lost our minds. We simply want to do something special and this is just the start. On the technology side, tastyworks is releasing a new analysis tab, portfolio margin, options on futures, paper trading, an open API, a new scripting language and lots of new mobile features.

-

A quote from Tastyworks: Starting tomorrow, on Jan 2nd, 2018, tastyworks is introducing capped commissions for large option trades. This means the most commission you will pay for any single leg option trade is $10* (plus clearing fees). That’s right, just $10* per leg! Eighteen years ago, when we built thinkorswim, 100 option contracts to open and close was $300+. At the time, we thought $1.50 per contract was cheap. Today, the industry average per contract is about $.70 plus a small ticket charge. So, 100 option contracts today is approximately $150 to open and close at most firms. With tastyworks’ new rate schedule, the same trade will cost $10 in commissions to open, zero in commissions to close and a $20 clearing fee for a total of $30. Compare that rate to any other firm on the planet and remember how good our technology and content is as well. Fees for small options trades (10 contracts or less) stay the same.

-

I just wanted to say thank you and Happy New Year to @Kim and all the mentors and other SO members who have given so much of their time answering my questions and guiding me. It really is appreciated and i look forward to an even greater 2018 with Steady Options!

-

As far as i know dough is shut down (although the corp is still under the dough name) you can try and log into the tastyworks platform on the web with your dough user id and password and see if that will get you in, but probably not. Here is a link https://trade.tastyworks.com/tw/login If that doesn't work you will have to open an account and fund it with a couple bucks in order to gain access as they don't have paper trading/ trial accounts as of yet.

- 1716 replies

-

- pre-earnings

- trade machine

-

(and 1 more)

Tagged with: