SteadyOptions is an options trading forum where you can find solutions from top options traders. Join Us!

We’ve all been there… researching options strategies and unable to find the answers we’re looking for. SteadyOptions has your solution.

fieldydwb

Mem_C-

Posts

304 -

Joined

-

Last visited

-

Days Won

11

Content Type

Profiles

SteadyOptions Trading Blog

Forums

Everything posted by fieldydwb

-

I've always heard the sheridan program is good. I know a lot of the strategies I use came from there. I haven't pulled the trigger to join. and probably should. However, I've heard most of the value is in the forums/community (probably similar to here). Some members here have done it.

-

Hi Chris, Do you quickly know what you are up so far on this trade to date?

-

I took profits at 15%+ OR continuously rolled (which cost a lot of commissions). So if SPY straddle was at 165 and SPY hit 166.05 I'd roll the straddle to 166. Some weeks I rolled several times which may have killed the trade. Edit: I will run Aug to Nov and see how it does If you have specific parameters you'd wish me to include, let me know. PS I rolled the straddle when SPY was +1/-1 not at EOD.

-

i've ran some backtesting and can't get this strategy to produce a meaningful return between Jun and Aug. The first backtest I ran was: 1. Entering on Friday Morn and closing by Wednesday close Second backtest I ran was: 1. Entering the following week upon closing the first week (Closing Wednesday and opening a new one on Wednesday for following week) I was particularly interested in this as a partial hedge to the Steady Condor trades for a large 2008/2011 type movement. If a trade can maintain itself profit wise but also provide a complimentary delta/vega hedge then I am interested.

-

With SPY currently over our short strike. Do you have plans to roll up to protect the upside/further over-run? How do you generally deal with this? I would think to roll half up and out to Nov 15 178

-

Chris, Would you roll Mar 21 166's to Jun 20 176's for the diagonals? Much appreciate the time.

-

Yep, no I know. Just wondering what metric you like to use for rolling diagonals since we are more liberal with them. I am looking to roll my 164/165s at around 177

-

You are more liberal with diagonals as opposed to anchor. I have 164 and 165s. Would you roll those?

-

Hi Chris, What is your long put currently? 162 still? When do you like to do your long rolls in the diagonals?

-

A little over-run here as well. Rolling short today?

-

Large move in GLD today. You planning any adjustment ie rolling up the short as we've gone past the strike?

-

GLD skyrocketed in last hour, it was quite interesting to watch. Hopefully you rolled. I've been trying to time the rolls as well but I find now, 3 months in, that I just am not getting anywhere with timing either SPY or GLD. I did a combination of buying back the shorts intra-day with the aim of selling them for higher price as well as using combinations of OTM, ATM and DITM to represent my stance. I started off well during the summer when volume and volatility was low. Everything seemed quite easy with the right tools (I used HFTalerts service (market breadth and liquidity) and Cobrasmarketreport) but since late Aug I've found intra-day timing to be incredibly difficult. I think its naturally tempting to try and time the sale and buy backs of your short puts intraday. Has anyone else been tempted to buy back the shorts in hopes of re-selling for more when the market is see-sawing intraday? it's tempted me but it hasn't worked well lately and it's required too much time. I was ahead of the game until late Aug, but with the recent volatility and exogenous events (Syria, Taper, Debt Ceiling) I took a more bearish stance and have given back any timing gains. There is a lot of danger in missing a run-up as there is being delta positive on a down swing. I agree with Chris that the best bet is a ratio and always target DITM with the bulk of your short puts. So much of the movements since Jul have been afterhours and lately also in the last 5 minutes (look at today and yesterday with 1s to go). Thus, having tried it with a lot of effort, I would agree with Chris and suggest against it. Stick to the plan. Just some observations from my experience as of late. It's now equally tempting to try and keep a bearish stance in order to gain back some of the timing losses but I've convinced myself and continue to convince myself that this is no way to do it.

-

Thanks Chris. Appreciate the insight.

-

Hi Chris, Any chance you could answer that one question in regards to balancing deltas. Things like going OTM instead of DITM during certain periods and using a positive ratio of OTM (120%) at times rather than DITM. Love to hear your input.

-

Chris, would be interested to hear your thoughts on this as well, I've been playing with this a lot with my strategy posts in the anchor section. I've been striving for delta/vega neutrality while capitalizing on extrinsic/time decay in my testing

-

Hi Chris, Do you guys still do these trades?

-

Am interested in this as well. Been away for a few months but am back now.

-

Hi Chris, Did you make any more headway with this? I've been running some backtesting with optionvue. I'll post some stuff ASAP.

-

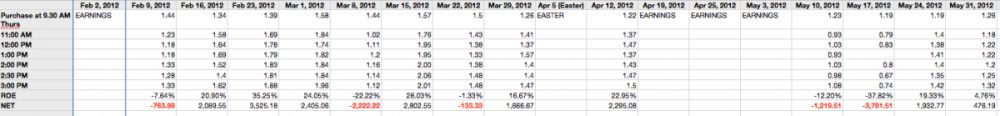

I did the same thing for NFLX from Feb 2 to Sep 06. Rules: -I did not play the three weeks around earnings. -I cashed out as soon as I hit 17.5% ROE -I did not trade when the price of the butterfly was 20% of the preceding 5 weeks The results were again good. -An average ROE of 11.02% with a net of $27,553 assuming 10k a play. -I entered 25 weeks of 31 possible. -Of the 6 non entered, 5 were around earnings and 1 didn't have the available strikes needed. -There was one anomaly on Mar 1 where we purchased a butterfly for 1.71 and it could be sold for 3.78 3pm on Friday. I don't know if this is some sort of mistake in the data or not. -The last 15 plays only produced 3.1% average return or $310 per 10k before commissions. However, the last 6 plays returned 6.36% or 636 on $10k.

-

I did the same thing for AAPL from Feb 2 to Aug 30. Rules: -I did not play the three weeks around earnings. -I cashed out as soon as I hit 17.5% ROE -I did not trade when the price of the butterfly was 20% of the preceding 5 weeks The results were good. -An average ROE of 8.14% with a net of $17,095 assuming 10k a play. -I entered 21 weeks of 30 possible. -Of the 9 non entered, 7 were around earnings and 2 were to highly priced Generally the best time to exit was at 15:30 on Friday.

-

Yeah, that's what AMZN shows since Feb. Going to do the same test for AAPL, GOOG and a few others.

-

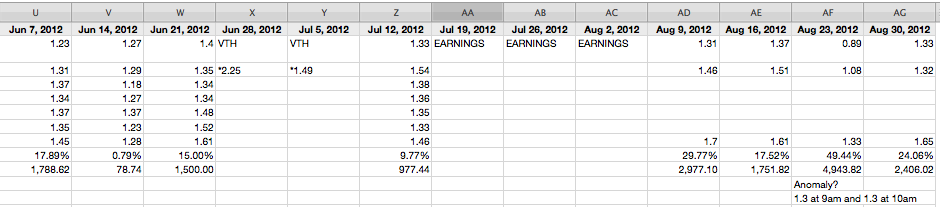

I tested AMZN since Feb until present using the long butterfly strategy. I used Option Vue backtesting to get prices every half hour. It showed that the most profitable was to enter at 930 on Thurs and exit at 3:00-3:30 pm on Friday. I omitted earnings week as well as the week prior and the week after. I also removed any week where the price of the butterfly/volatility was significantly higher than normal. The outcome to date was 12.14% and $25k profit assuming $10k played each week. I attached a screen shot of the results. Perhaps Chad or someone that has Option Vue can verify a few of my prices. I used market pricing so that takes care of slippage but this does not include commissions.

-

Honestly, I look for big dippy days and buy mostly then. For any that I hold up to ex-dividend, I'll usually purchase the same amount on Ex-div day and add it to it throughout. This is where I put a lot of my passive money. I'd love to know what you guys do with your non-options investment funds. I also do a lot of mechanical investing though I sat out most of the summer re the whole sell in may thing. I found/find mechanical investing to be quite fascinating. Look at the CAGR of this set of screens for instance: www.backtest.org/8911SWsp(STtb)(SS(Screamers)(PIH_CSO_safe)3m5l10)16p3c-2

-

That's right. I don't want to collect the dividend as it would be taxed at the broker. Since i live in a tax free jurisdiction I'd prefer to capture it as a capital gain. The drop is equivalent to the dividend.

-

I've got a bit in MREITs like NLY, AGNC etc I am offshore so I prefer not to get taxed on my dividends. What I'll do is sell day before Ex-Div and buy again on Ex-div for the dropped price. I love the yields on these guys 11-14%. I am currently in these ones: AMTG AGNC NLY CYS MTGE HTS NRF TWO