SteadyOptions is an options trading forum where you can find solutions from top options traders. Join Us!

We’ve all been there… researching options strategies and unable to find the answers we’re looking for. SteadyOptions has your solution.

ChadK

Mem_C-

Posts

151 -

Joined

-

Last visited

-

Days Won

2

Content Type

Profiles

SteadyOptions Trading Blog

Forums

Everything posted by ChadK

-

@mglaezer Did you trade with Tradier in 2016, and if so, how did you do your taxes? Also, do you trade using their web interface, or one of their partner programs?

-

As another data point, I finally received my invite for TastyWorks. Their ACH is limited to $250,000 per day. Good point.

-

They have just emailed me with a follow-up: I'm still a little hesitant, as those aren't the best tools for serious amounts of option trades.

-

I was moment away from sending some funds to Tradier, but I'm now having cold feet. Here's why: I looked at my trading for the last year. My thought was to move all of my options trading to Tradier, and keep my big SPX and RUT trades at TOS/TDA. Looking at that, excluding RUT & SPX, I had 1100 multi-legged trades last year, totaling 2600 legs. As it's near tax-time again, I thought about tax accounting for all of the trades. I use TradeLog to import and match all of my TOS trades. I went to the TradeLog website to see if Tradier was supported. Tradier was not listed as a supported brokerage, but they did have CSV import supported from Apex Clearing, which is who Tradier clears trades through. Of course, if you're not using TradeLog, there's always TurboTax, etc., but using the brokerage supplied 1099-B alone is a recipe for failure. So, I contacted Tradier to confirm that customers would be able to download the CSV files from either them, or directly from Apex. They replied: I've followed up with some questions regarding downloading of trade data (for tax purposes) but they haven't responded yet. I can post an update as soon as I hear back. I did inform them that I am not manually typing 2600 trades into my tax tools, and considered this a no-go for me and that I'd close my account instead of funding it if they have no other methods of downloading the data. A couple other observations, without even doing any trading: I looked at their web interface. It is very clunky and minimalist. This is how they save money...they don't spend money on fancy coding development, but instead have many, many partners that can provide a front-end. In looking at how to enter an order through their web interface, I saw that it would take entering in 13 pieces of information in order to trade a two-legged trade (calendar, vertical, straddle, strangle, etc.) For a 4 legged trade, it would be 23 pieces of information that you'd need to enter manually. This is very laborious, and can be subject to errors. If you think you're going to trade through their free web-interface, this is something to consider. This wasn't going to be acceptable for me, so I was planning on using OptionNetExplorer, which I've used before and it great. There are several discounts available, such as the one from Tradier that is $55/month to have the ONE software. SteadyOptions also has a deal with ONE. One other observation that wasn't a deal-breaker, but was weird. Tradier limits ACH (bank cash transfers) to $25,000 maximum in or out in a day. If you want to fund your account with $100k, then you either need to spend the money on a wire transfer, or send four daily $25k transfers. Again, no biggie, but weird to have a limit.

-

Thanks for the confirmation. I'll be opening an account to see how it goes. I traded 1600 contracts in January, so even if I move a fraction of my trading over, it will be a sizable savings.

-

I've contacted Tradier and still find it hard to believe they can do this price structure. Can you please confirm the total fees you pay per contract? They claim: So that's about $0.045/contract for most of Kim's trades, $0.58/contract for SPX, and $0.23/contract for RUT. Seems far too good to be true. Much better than the excellent rate I have at TOS or even the new offering at TastyWorks (TastyTrade's new brokerage).

-

I'm an original TOS customer. It would be strange that if you were a TDA customer using the TOS app, that there'd be less functionality.

-

Yes you can. Single leg orders can be routed to one of 8 exchanges. 2-4 leg complex orders can be routed only to BEST, CBOE, ISE or PHLX. 3 exchanges are better than none.

-

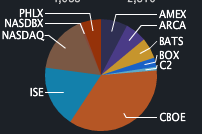

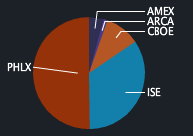

Joining the party late, but thought I'd throw in my thoughts/observations, especially with respect to TOS. TOS is paid for order flow, mostly PHLX. TOS has claimed that they cycle through exchanges, but maybe it's 8 to PHLX, 1 to ISE, 1 to CBOE, then the next 8 to PHLX. I don't know, but it would allow them to make such statements and still be true. TOS doesn't have a "SMART" feature per-se, but by defaults routes orders to the "BEST" exchange. Of course, is that best for TOS's order flow kickbacks, or best for getting my order filled at the best price...I don't know. Here's what I do. I'll try BEST briefly. If that doesn't get filled in a timely fashion, I'll cancel/replace and route to ISE. Many times an order that's been siting for minutes, gets filled instantly when switching the exchange. Sometimes it doesn't, so I'll cancel/replace and route to CBOE. And now sometimes I'll cxl/repl and send to PHLX, as they are getting a LOT more volume these days on RUT. And sometimes, I'll even split my order simultaneously to 2 or 3 exchanges. That is, if I want to trade a 10-lot, I'll send 4 to ISE, 3 to CBOE and 3 to PHLX. Whichever gets filled first, and the others are still unfilled, I'll move them over to the exchange that I did get filled on. Also, certain exchanges seem to have more volume than others, depending on the underlying. Attached are examples of AAPL (high CBOE slice of the pie) vs. RUT (high PHLX) for today's trading so far. AAPL: RUT:

-

Marco is right. Someone trading 10,000 contracts on a $0.10 option isn't quite the same as someone trading 10,000 contracts on a $10.00 option. While the volume is the same, some may argue they are not necessarily the same liquidity. Indirectly, the "DVO" also applies a heavier weighting to: 1) Higher priced options due to higher priced underlyings and 2) options traded near the money vs. far out of the money (technically, deep ITM options are weighted very heavy too, but the volume on DITM options is typically quite low). OptionVue does not have a screen purely on volume or OI. I did find this http://www.marketwatch.com/optionscenter/screener which appears to have a list of "Highest Option Volume Sum"

-

What are the most liquid options you ask? Using OptionVue's "Greatest dollar volume of options traded" scan: (DVO - multiply the number of option contracts traded times the price they traded at, and add all of them up for a ticker...across all strikes and months) (Volty = volatility. Pctl is the volatility percentile, based on the last 2 years.) I used a filter of minimum price $15/share.

-

I left IB years ago (2007? really? wow, time flies) when I got TOS to give me $1.00. Even happier when I got $0.80 then $0.75. The analytics and tools that TOS has was worth $1.00 back then, and I'd probably agree with dwilliams that I'd pay $1.00 now at TOS vs. so-called $0.75 at IB.

-

FYI, some people are getting $0.50/contract no ticket at Trade Monster with $25k account with group affiliation. But like IB, there are some exchange fees, as high as $0.60 per contract on SPX, but only like $0.025 on RUT. I don't know where their exchange fees are listed.

-

Well, some quick math says that you're averaging over 13,000 contracts per month. That's sizable as well. But you make a good point. Most of us mere mortals aren't going to get the claimed $0.50 per contract no ticket any time soon. It was a few years ago that I was >1000 contracts per month when I went from $1.00, to $0.80, to $0.75. Now I'm trading a bit smaller, averaging only about 500 contracts per month, but still enjoy the $0.75/contract no ticket.

-

Because he's been concentrating on earnings plays? Here's a question for you...well, a couple. 1) How do you know when to start back up again? (How do you know when the storm has passed? Sometimes it's not as obvious as a storm. 2) How do you know when to quit before the system breaks again? I can't speak for Kim, but sometimes, when getting burned by the stove, you stop touching it to see if it's still hot. (ie. you walk away from a trade and not consider doing it again. If it broke once, it can break again, especially when you least expect it.)

-

Getting a good deal on comms is now difficult at TOS since TDA bought them. Previously, with relatively high volume, you were able to get under $1. I know several people who have gotten $0.75 (and that includes the exchange fee, unlike IB, so $0.75 is really $0.75). I have one friend who has gotten less than $0.75, but he runs a multi-million dollar hedge fund and trades around 10,000 contracts per month. Since the TDA takeover, I think they'll only give you about $1.00 if you are trading >1000 contracts per month. They'll do $1.25 if you do a few hundred per month.

-

I was hoping you'd chime in. Just so people understand, you were doing this live. This wasn't a backtest. Personally, I don't like any trade that has an occasional 50% loss, or even, gasp, 70% loss.

-

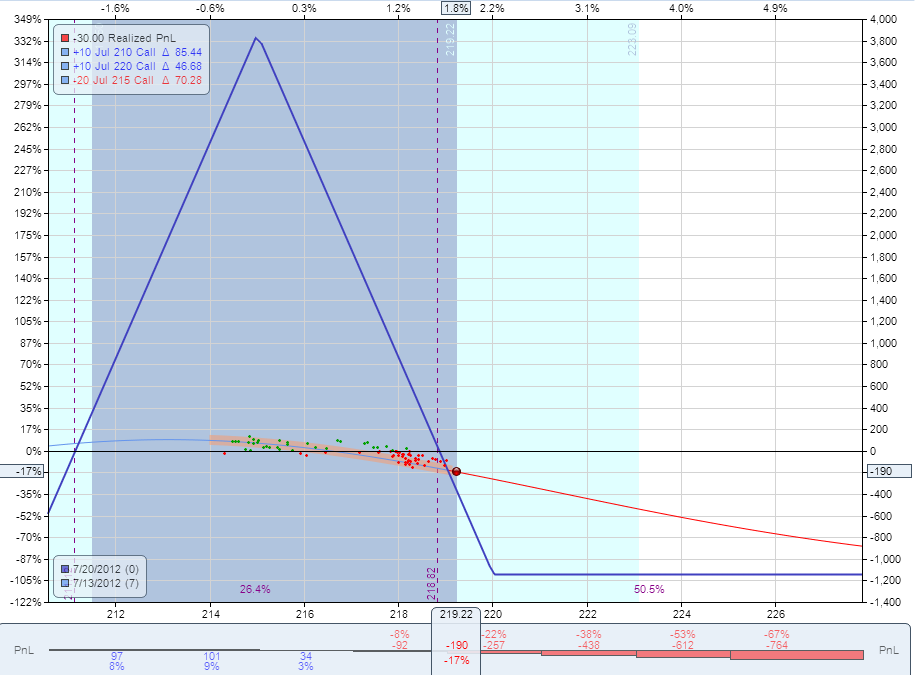

The backtesting I provided here was not using OptionVue data, but rather another program has data for every 5 minutes. See the picture I provided earlier. It's neat to see what the P&L was for every 5 minutes through the course of the day.

-

That's EOD data only. Two issues with that. 1) Last price posted can be out of whack with the prices for the prior 5, 10, 15, or 30 minutes. ie. the last print can be an outlier. 2) The strategy says enter no later than 10am (I assumed that was ET, so I used 9am CT). Again, mine was based on entering at 9am CT, and therefore we may have 1) different strikes and 2) different prices, or both. I stopped where I did due to unfavorable (IMO) results.

-

Starting at 9am CT, and using 5 point wings like you did: Aug 9th, 235 center, $1.15 enter, 0% EOD Thursday, +17% EOD Friday after comms Aug 2nd, 230 center, $1.165, -26% EOD Thursday, -18% EOD Friday (-39% at 11:50am CT) Jul 26, 220 center, $0.325, -67% EOD Thursday, -9% EOD Friday (-60% at 13:40 CT) (earnings after market close Thursday, not a good trade) Jul 19, 225 center, $0.425, -7% EOD Thursday, -12% EOD Friday Jul 12, 215 center, $1.085, 0% EOD Thursday, -3% EOD Friday (-17% at 14:00 CT) It would appear that using intraday data is not matching up with your results very well. I've added a picture of P&L plotted for every FIVE minutes on Friday July 13th for the July 12th trade. The cursor is at the -17%, 2pm CT price. You can see the string of dots representing price of the spread through the day. In this example, AMZN opened at $216 and the position was -3%. AMZN went as low as $214.30 at 8:50am CT, where the position was -2%. At 10am CT, AMZN was at $215 and the position was up 9% (after comms). AMZN ran up to $219.22 for the high of the day at 2pm CT, then retraced to $218.50 at the EOD, with the position finishing up at -3%.

-

Okay, last post on this until I get some feedback/direction/suggestions. AAPL, Aug 9th, 9am CT @ 620 615-620-625 5 point wings Thursday EOD 10% Friday open -12%, 9:30 10%, 10:30 6%, 11:30 14%, 12:30 14%, 13:30 25%, 14:30 10%, EOD 22% Monday open 0%, high of 14%-ish, EOD -24% 610-620-630 10 point wings Thursday EOD 11% Friday open 8%, then hourly: 15%, 18%, 23%, 25%, 27%, 22% EOD 28% Monday open 10%, high of 20%-ish, EOD -4%

-

Sorry to be a serial poster, but this same trade (GOOG, Aug 9th) with a 10 point wing width, was >15% return most of Friday, and at times over 20%, with EOD at 19%. Monday morning was painful at -7%, progressing to -64% at EOD.

-

I have access to several tools with intraday option pricing (OptionVue included). (But I don't have a lot of time to invest.) Let's start with strategy #1. You said ATM, but what strike spacing? Last week, 9am CT, GOOG=642.55, a 635-640-645 call butterfly is only $0.65 and has $0.03 in comms (assuming $0.75/contract). That's 4.6% in, and 4.6% out. You need to make 9.2% just to cover comms. Then let's talk about slippage. The market is closed right now, so I can't see how wide the market is, but assuming it's somewhat tight, but you have to cave in a nickel to get filled to get in. Well, that nickel is another 7.7%. Now you need to make 16.9% just to break even, assuming no slippage to get out. Taking this GOOG example from Aug 9th, in one hour (after 9am CT), this trade is down 25%. End of day -11%. Friday: 8:30am CT: -18% 9:30 +9% 10:30 -14% 11:30 0% 12:30 13% 13:30 2% 14:30 9% EOD 9% You don't even want to know about Monday. Started -17%, and proceeded to -93% at EOD, without adjustments.

-

I can understand the first strategy: Buy an ATM fly, wait for a bunch of time decay to kick in and hope for no price movement, and exit. I don't get the second strategy: Sell at ATM fly, 2 hours before expiration, in hopes that it moves enough to make money to overcome negative theta? Can you please tell us about the webinar location anyway? Is this the one from SMB's OptionTribe this week, or something else?