SteadyOptions is an options trading forum where you can find solutions from top options traders. Join Us!

We’ve all been there… researching options strategies and unable to find the answers we’re looking for. SteadyOptions has your solution.

Nevermind

Mem_C-

Posts

184 -

Joined

-

Last visited

-

Days Won

3

Content Type

Profiles

SteadyOptions Trading Blog

Forums

Everything posted by Nevermind

-

Thank you for your comment

-

Hi guys, when I look at my SO and SC portfolio we are more or less at good levels for most of our positions but we are heavily short volatility and the market keeps moving. With China situation and rate hikes ahead it's maybe a good idea to hedge our portfolio a little more with a spy straddle. I am considering open a spy October straddle today. Sure volatility is high but we might be able to get some nice gamma gains if market keeps moving like crazy. What do you think?

-

Nevermind Performance vs. SteadyOptions Performance

Nevermind replied to Nevermind's topic in General Board

Hi guys, here my update. June was a tough month for me as I had to study a lot for an exam but overall I find I improved and I getting better understanding of the whole process. What I believe I learned I try now to enter roll limits for earning straddles before I receive trade notification from SO try to analyze earnings candidates on my own to get in earlier than SO personally I like non earining trades more because of greate liquidity and htey are easier to follow Keep you guys updated about my improvements Cheers -

Hi I use it sometimes for trading because it's faster for trading spreads or butterfly. The only problem is that sometimes the link between ONE and IB - TWS does not work properly but their customer service is really good and they improve quite fast.

-

Hi guys, I am looking for a mentor which helps to master option trading even better. I learn so much here but I feel I need to learn a little bit more and need some coaching. Can you guys recommend someone? What's your experience with mentors? Thank you guys for your help

-

Nevermind Performance vs. SteadyOptions Performance

Nevermind replied to Nevermind's topic in General Board

Hi this is real performance but without commissions. I use Interactive Brokers. -

Nevermind Performance vs. SteadyOptions Performance

Nevermind replied to Nevermind's topic in General Board

Thank you for your comment -

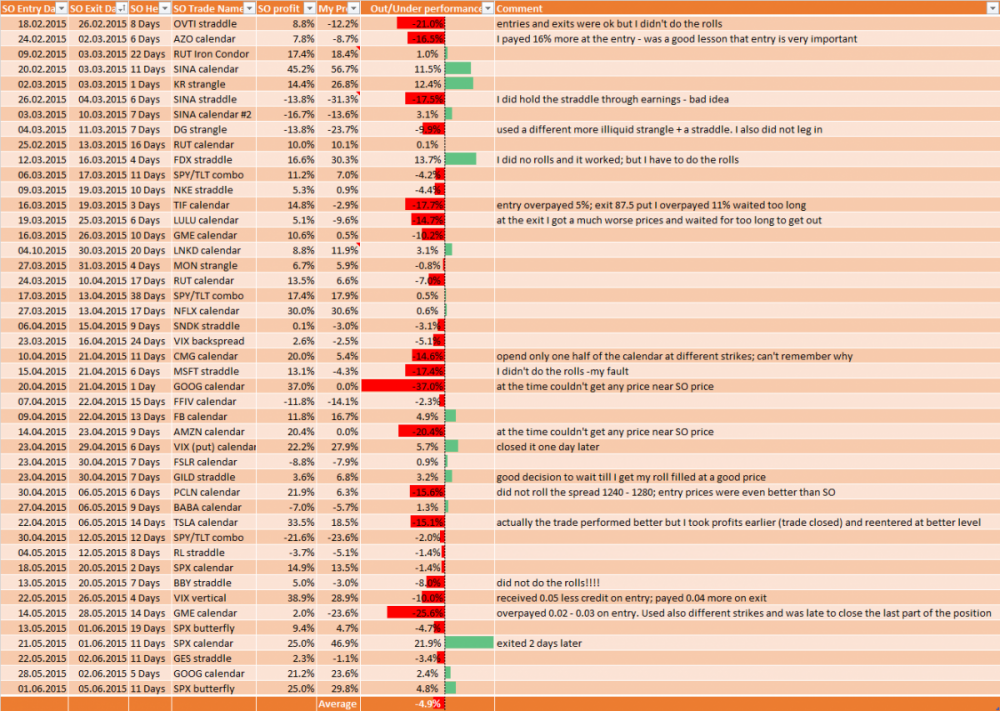

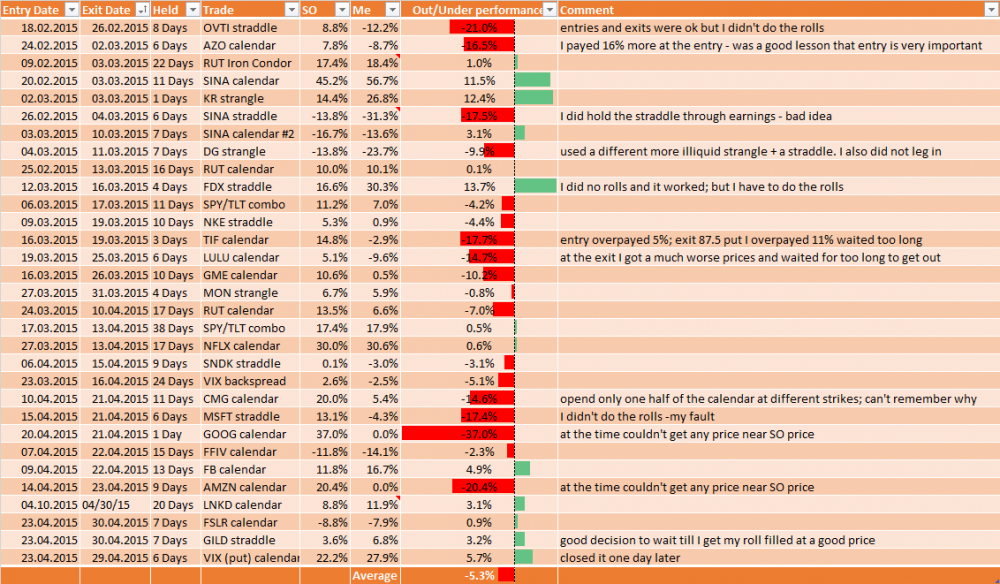

Hi guys, I am now a SO member since February 2015. What you need to know is that I am still a newbie at options trading. I finally went through all my trades and compared them against the performance posted I jused the exact same calculation as Kim. My results though are far away from Kims but I made money with his newsletter and thats after deducting the fees of his service. I enjoyed the time so far and I still have to learn a lot to master everything. I will keep updating my results so you guys get also a feeling of possible mistake one can make. I probably covered quite some mistakes Please note it's mainly my fault that I don't have the performance as good as SO. I already sent a comparison for March which was incomplete and not all trades were included. Here are my honest final results. Whats your expirience? How do you master the steep learning curve?

-

Hi Guys, I am using TradingDiaryPro + ONE. Works ok for me.

-

Thats what I found about the latest stable version of TWS https://www.interactivebrokers.com/en/?f=%2Fen%2Fsoftware%2FreleaseNotes%2FTWS_Notes_947.php#947_smartOptions

-

Thank you Kim

-

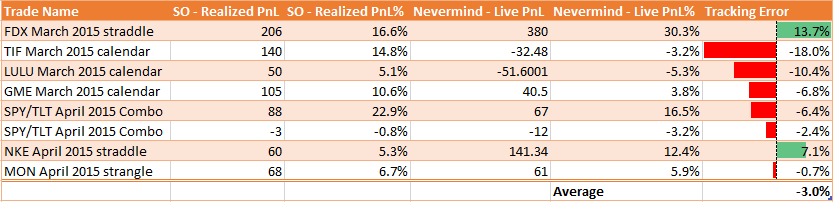

Hi Kim, absolutely right. I have to learn how to get better fills. I am responsible for my own results. I don't include commissions. SPY/TLT are showing as individual positions. I did not aggregate them after exporting from ONE. I believe SPY made loss whereas TLT wins. I used all the trades you were posting on your performance site 7 in total.

-

Hi guys, there is always a discussion about if its possible to replicate the Steady Options results. I am a quite new member about 1.5 month or so. I already made some bad mistakes and had to learn. I thought it could be helpful to show my results against SteadyOption results. Just to make it clear. The big tracking errors were mostly my fault. For instance TIF I payed 1.467 total whereas Kim only payed 1.35. I payed almost 9% more. So I need to be more careful not to chase the trade to much or to find cheaper alternatives. All in all I will try to do better going forward. Most tracking error were my faults where I tried to chase the price. I keep you guys updated.

-

Great work Kim! Could you kindly explain how you derive the portfolio values and the monthly returns? Portfolio Values So for instance if we take our latest trade: Do you take 10% of latest balance times trade pnl + previous account value? So in this case 10% * 13009 * 6.7% + 13009 = 13096? This number is slightly different than 13090 you posted? What do I do wrong? Or is it just the rounding? SteadyOptions Service - Recent Trades Entry Date Exit Date Holding Period Trade P/L Portfolio Value Entry Date: 03/27/15 MON strangle 6.7% Portfolio Value = 13,090Entry Date: 03/16/15 GME calendar 10.6% Portfolio Value = 13,009 Monthly Returns If I just compound the March returns assuming a 10% allocation I get following results 1.0166 * 1.0112 * 1.0053 * 1.0148 * 1.0051 * 1.0106 * 1.0067 - 1 = 7.24% If I take portfolio values for return calculation I get following: (13090-12237)/12237 = 6.97% but you are posting 10.7% https://steadyoptions.com/performance Thank you

-

Thank you for your nice explaination. BTW have you tried in IB instead of using LMT using REL+LMT? Not really sure what it does but I'll give it a try.

-

Thank you very much Kim for the nice explanation. I just recognized that my fills aren't as bad as I thought. I usually looked at them including commissions in IB and therefore the price for calendars was typically much higher but you are posting them without commissions which makes sense. Could you may try to describe how do you execute? Like if you do an earnings calendar. Do you have a target price in mind and wait for the midquote to get close to the target price and then enter a limit or do you stick with a limit order and try to get this price. I know it can be hard to explain the process because typically lots of considerations can influence the way of execution like liquidity bid ask spread underlying move ... but I believe it would be helpful to the whole community. Maybe when we do a trade next time you could explain it in more details. Thank you very much

-

Hi, I am still trying to learn and can't get my head around a couple of question. I would appreciate any help. does anyone know of a good source on how option orders are matched? Is there a spread order book? Does option order matching works the same as for stocks? How comes different brokers have different fills? For SO execution seems critical and I want to understand more about market makers and how the match our orders. Thank you

-

Has anyone a screenshot of an excel or is willing to provide a excel sheet to see how to track trades? Thank you