SteadyOptions is an options trading forum where you can find solutions from top options traders. Join Us!

We’ve all been there… researching options strategies and unable to find the answers we’re looking for. SteadyOptions has your solution.

falkor

Mem_SVIX-

Posts

313 -

Joined

-

Last visited

-

Days Won

4

falkor last won the day on November 3 2024

falkor had the most liked content!

Recent Profile Visitors

The recent visitors block is disabled and is not being shown to other users.

falkor's Achievements

Hero Member (5/5)

257

Reputation

-

falkor started following Why, seriously, do most traders lose? and Selling Puts: The Good, The Bad And The Ugly

-

Hi June, It really depends on the strategy you pick. The Kelly Criterion provides a nice framework for thinking about things - in this model your edge is a combination of win rate (the ratio of winning to losing trades) and risk/reward ratio (the ratio of how much you win for every winning trade, vs how much you lose for every losing trade). The product of both of these had better be more than 1, or you will not have a profitable strategy. Said another way, if you don't have that many winning trades, then those trades you win had better knock it out of the ballpark. It is certainly possible to build such a "tail risk" strategy, eg relying on convexity from being positive gamma / long options. On the other hand, you could also build a high win rate strategy, earning from small wins most of the time. Without knowing the specifics of the strategies you've tried though, it's hard to be more specific. Hope these vague generalities help!

-

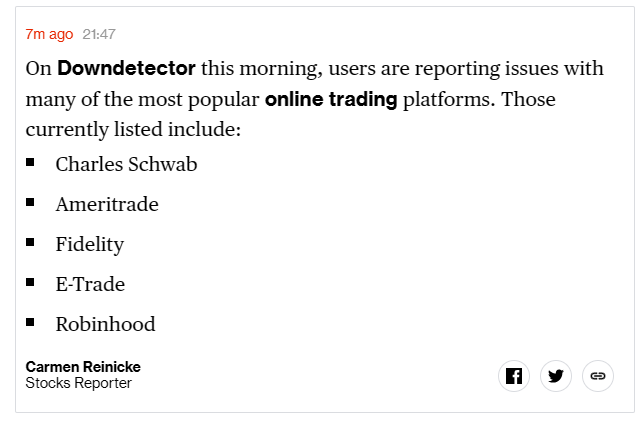

Hi guys, Been watching this thread for a while and would like to make a few clarifying points. Yes it has happened now and then. The most famous incident is Robinhood in 2020. @Skylimit and @ex3y7s are correct in that the terms of service are usually very carefully drafted such that any exemption clause would render it very unlikely that any affected user would have recourse under contract or tort (except for very few exceptions, such as if you can prove fraud, or death or physical injury was caused - which doesn't seem to be applicable here). By all means consult your lawyer, but imho it is unlikely you'll be successful in suing them directly. However, having said that, because Tradier is a member of FINRA/SIPC they are subject to regulation, and FINRA will indeed impose penalties for serious outages (as they did for Robinhood in 2021). Be prepared that the wheels of justice turn slowly, and any such restitution is likely to take years to come into your hands. If you are an affected user and you wish to take things forward with this, please file a tip with FINRA. If you act fast and can provide lots of detail, you may also (at their discretion) be eligible for whistleblower incentives, which may include a percentage of any penalty imposed.

-

On a related topic, how do exchanges which liberally pay out rebates make their money? I notice in IBKR there are certain brokers that seem to consistently yield negative comms (i.e., credit rebates) even when hitting the bid/offer (taking liquidity). Why would any exchange do this?

-

You can see the volume traded for puts and calls, but it doesn't make sense to distinguish long from short. Every trade has 2 sides - one side will be long and one side will be short. If your intent is to figure out what the non-market-maker is trading, then you may be able to look at the traded price relative to the bid/ask spread.

-

-

Dan Sheridan is still running webinars for IBKR. I attended one a few months back, where someone asked a question about gamma scalping and he gave a completely incorrect explanation. Just entirely off base. Since then I have assiduously avoided any of his content. If you are the kind to watch IBKR webinars, I would also advise caution if it is a session hosted by Dan.

-

@Jocomail78 as @TrustyJules noted it's expected that the theoretical model yields exactly 0 profit. But all theoretical models (particularly those commonly used by trading platforms eg Black-Scholes and its derivatives) of necessity only consider limited variables. The models don't know about things like earnings, macroeconomic events, etc. Therein lies your edge. Without such an edge it would indeed be a random walk, or worse, after considering slippage and transaction costs.

- 4 replies

-

- 1

-

-

- general question

- math

-

(and 1 more)

Tagged with:

-

@Kim Unless IB steps in to save the day! https://finance.yahoo.com/news/interactive-brokers-trading-notice-123600386.html "That evening, the Company determined to take over a substantial portion of these trades as a customer accommodation. " Now we know where our IB commissions are going...

-

Yes that's true! I have had many issues with IB API, especially for options. Sometimes market data fields just refuse to return values, and will only work after significant delay and multiple retries. I also find their delta values very unstable. In fairness, I have also experienced catastrophic market data returned by Bloomberg Desktop API (blpapi / bbcomm), which has also caused our trading desk much angst. Regardless of your market data provider, the key, as always, is having a robust risk management framework. Easier said than done, of course, and our risk team has perhaps the best job security

-

For options alone on IB, "OPRA NP L1" is sufficient ($1.50 / month, rebated with sufficient trading volume). But would you not also want to see pricing of the underlying on the same screen?

-

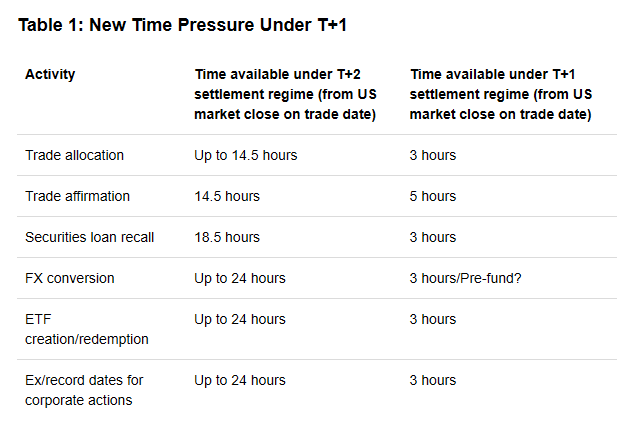

This table shows the dramatic improvement in trade settlement times now in effect. Brokers now need to work much faster to settle trades!

-

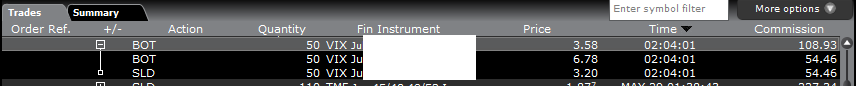

My experience is that trading VIX spreads in IB is slightly cheaper than trading individual legs in isolation. This is a recent fill from yesterday. The per-contract cost turned out to be $1.08. But even at these levels it's true that IB comms will eat into this strategy's profits, as J10 said.

-

I'm not sure if you're referring specifically to the SteadyOptions service, or to any of the services within the SteadyOptions collection. If the latter, there are some services which are more scalable - these include Collar, Vol, and Yields (as @zxcv64 mentioned). Collar in fact requires 110k and up as it relies on portfolio margin.

-

This discussion is very insightful. Thank you.

-

What if one creates 2 accounts in IBKR, sold a box in one, then transferred the cash into the other? Presumably the second account would have a clean slate for the 30x rule?