Our 50k model portfolio trades options on various futures contracts. We add and remove contracts periodically depending on liquidity and other factors. We are always reviewing additional contracts for viability in our trading system to provide added diversification. Signals are posted each week on Friday and the trades can be taken any time that day. It is not important to try to match the fills we post. Those following the system only need to get the direction right (long or short) and enter the trade at delta indicated by the system. These are not time or price sensitive trades. Members can take the trades at any time on the day the signals are updated.

In 2021, Steady Futures returned 21% versus 6.28% for our benchmark. We consider this to be an exceptional year for the system, especially when we consider that we typically only have around 20% of our trading capital at risk at any given time. Our system automatically adjusts the size of our trades for specific contracts based on the volatility of the underlying futures contract.

The system is very low maintenance and very easy to follow.

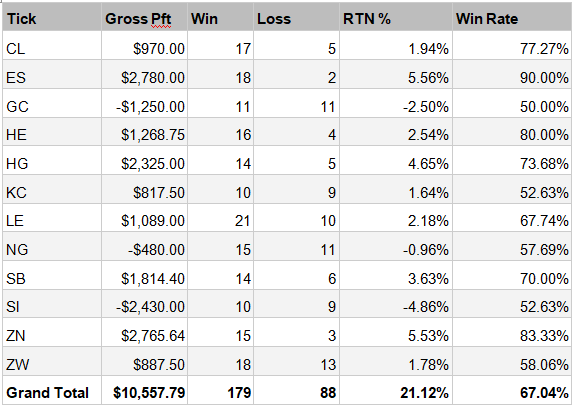

Here are the returns and win rate for the year by contract:

A note on win rate: 67% win rate may not seem impressive to some but this is very high for trend following systems. Our win rate and overall performance were impacted by changes to system we made early in 2021. At the beginning of the year, we added a long term trend filter against the signal indicated by our system for a given contract. If the long term filter signaled a trend in our system's direction we expressed that signal with a long spread. If the long term filter signaled a longer term trend against our signal or a neutral market we began using a short spread instead to allow us to benefit from decay in choppy markets. We estimated this change would have improved 2020’s results somewhere in the range of 10%-15% and its impact was obvious in 2021.

Adjustments for 2022:

Beginning in 2022, we be increasing the size of the model portfolio to 100k. There are fixed costs associated with trading futures options and this change will reduce those fixed costs as a percentage of overall trading costs for those using the system.

Conclusion:

The Steady Futures trend following system had an exceptionally strong year. The system continues to produce high signal accuracy and get us into big moves in the underlying futures contracts. The changes made to take advantage of decay in choppy markets improved the system’s win rate but more importantly significantly reduced the number of outsized losses we experienced in 2020. The system displays no (or even negative at times) correlation to equity markets and our recommendation is that any trader have some exposure to trend following in their portfolio. The increase in portfolio size will allow us to gain more from large moves in the underlying contracts and should facilitate continued strong performance from the system.

Steady Futures is offered as a standalone subscription or part of various bundles.

Read More:

Welcome to Steady Futures

Join the conversation

You can post now and register later. If you have an account, sign in now to post with your account.

Note: Your post will require moderator approval before it will be visible.