SteadyOptions is an options trading forum where you can find solutions from top options traders. Join Us!

We’ve all been there… researching options strategies and unable to find the answers we’re looking for. SteadyOptions has your solution.

Search the Community

Showing results for tags 'spy'.

-

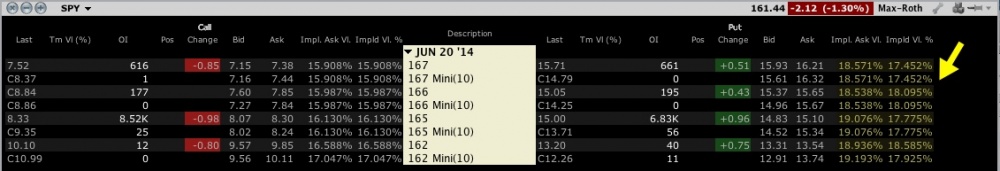

Hi Everyone, I have found something that I can not figure out. I am looking at bid and ask prices for SPY mini vs. regular options. I would think that considering that mini is simply 1/10 of a regular option contract, that the bid/ask prices would be same. However it seems that the prices are different. At the same time, the implied bid/ask volatility seems to be identical. Two questions come to mind: 1. Is there potential arbitrage opportunity. (getting 10 mini, shorting 1 regular)? 2. Why implied bid/ask volatility is listed same, but the prices are different?

-

Hello. I haven't seen the next SPY ex-dividend date posted. Has anyone seen this? I think the last one was Dec '21. Maybe they won't have 4 dividends this year due to loading up in 2012 for tax reasons. Thanks.

-

I'm going to take advantage of the falling IV - VIX is down 10%, below $18 and open a July 135 SPY straddle. It is delta positive to hedge the RUT IC and the 135 calendar. If the rally continues, it should make some nice gains. If SPY pulls back, the IV will increase helping to limit the losses.