SteadyOptions is an options trading forum where you can find solutions from top options traders. Join Us!

We’ve all been there… researching options strategies and unable to find the answers we’re looking for. SteadyOptions has your solution.

PaulCao

Mem_C-

Posts

324 -

Joined

-

Last visited

-

Days Won

14

Content Type

Profiles

SteadyOptions Trading Blog

Forums

Everything posted by PaulCao

-

Volatility Products Strategies & Trades (VIX, VXX, XIV etc.)

PaulCao replied to Mikael's topic in General Board

Hi, Probably some people already know this, but actually VIX futures term structure is in backwardation 'till December - meaning instead of the usual VXX contango/decay, there is a VXX gain every day that VXX fund sells the more expensive October future and purchase more relatives shares of the cheaper November future. http://vixcentral.com/ That gain is 2x on UXVY and inverse on XIV. I'm still in my 17.5/16/15.5 VXX call BWB but expect VXX to breach the max loss pt. on my structure at 17.5 before it hopefully goes back down again, Best, PC -

Volatility Products Strategies & Trades (VIX, VXX, XIV etc.)

PaulCao replied to Mikael's topic in General Board

Hi, I'm thinking about doing a October 4 BWB: -1 Oct 4 VXX 17.5 call +2 Oct 4 VXX 16 call -1 Oct 4 VXX 15.5 call The thesis: US congress will resolve the debit ceiling issue and not risk default by Oct 17 deadline; VXX will fall below 16.65, the breaking even point of this trade by Oct 25. This trade has better theta decay than a straight-out VXX put. The link to the P&L structure (for some reason I can't do attachements anymore): http://imgur.com/8Cz4Tne Best, PC -

Hi Kim, Thanks for posting your monthly performance for the month of September. Not sure about for everyone else, it was also a down month for me given the Syria situation, FOMC surprise decision not to taper and then capped by the US gov't shutdown. So I think for anybody is a net option seller, it wasn't a good month. Can you give us an idea what trades you felt were bad or good that offset the losses? E.g., was it the calendar spread's on AAPL, IBM or RUT where we had to adjust several times or close as the realized vol turned out to be higher than expected. Or did the earning straddles of stocks with high beta ratio benefit a lot from the volatility spikes this month and offset the loss somewhat? Or the closing of the VIX calendar with 100% loss? Best, PC

-

Hi, Given that next week is FOMC meeting. Are you guys still in this trade or sitting in the sidelines until Wednesday next week after the FOMC Meeting Announcement? http://bloomberg.econoday.com/byweek.asp?day=17&month=9&year=2013&cust=bloomberg-us&lid=0 Best, PC

-

Hi, I want to ask everyone if they know if there's an equivalent GLD option series on the European markets that we can trade on during the Asian/European hours, Given the recent events involving Syria, it's been quite frustrating to see how gold prices swing wildly in after hours of US market and not being able to do anything to adjust the positions, I think having an alternative option-series to trade on during the European trading session would help a lot in preventing unexpected gaps in GLD open, Best, PC

-

Hi Yowster, You can try elastic ip on AWS. The problem is that if you turn your instance off after work, it still cost $0.005 for your elastic IP. So if you are going home for 16 hours and then coming back to work for 8, you are accruing $0.08/day or $2.4/month for the privilege of using it. Not a big deal I guess since we pay a great magnitude more for the subscription of this service. The issue is AWS is really designed for running web-sites or doing heavy scientific computing than our purpose of using it purely as a personal remote machine. If anyone tried other virtual machine services (e.g., Rackspace, Digital Ocean etc.), please feel free to let me know if you have an better alternative. Best, PC

-

Hi, I also use AWS to do trading at work. Amazon offers a free micro-instance with 450MB RAM where you can run Windows and get a web browser. However, if you want to try to run the full blown IB TWS trading platform or ToS, it's going to be very slow. So you need to upgrade to the medium instance. Overall, it's pretty reliable. Setting up is not the easiest thing as you need to always access the AWS web console to start your virtual machine and figure out the IP address of your assigned VM; but I find it useful as I do all of my P&L calculations graph on the ToS platform on my VM at home; then later at work, when the market is open, I can log onto my VM and see where I'm in the P&L graph's with all of my trades already set up, Best, PC

-

Hi, Can you access Windows Remote Desktop at work? You can leave your home computer on and set the Windows Remote Desktop Service on and you can remote into your home computer and use WebTrader that way, Best, PC

-

Trading and getting fills with Interactive Brokers

PaulCao replied to cwerdna's topic in General Board

Hi, Sometimes liquidity rebate takes a lot off your commission, e.g., http://cdn.batstrading.com/resources/regulation/rule_book/BZX_Fee_Schedule.pdf "Customers who provide liquidity are offered $0.30/contract rebate on BATS option exchange" - so original IB commission of 0.70 should be rebated to 0.40/contract under this case. Also, can someone confirm if Livevol does actually execute with IB platform. I checked their fine print and they said that they clear with either IB or Apex. http://www.livevolsecurities.com/stock-options-trading-pricing http://en.wikipedia.org/wiki/Clearing_(finance) http://www.onlinebrokerrev.com/other_articles/clearing-firms.php Clearing is different from execution. For example, my former employer Lime Brokerage cleared through Apex and Goldman Sachs which meant that the customer's account custodians was at these clearing firms (so our clients got access to the Goldman Sachs account management portal and margining) but the execution of the trades were routed not through clearing firms' trading platform but through Lime's trading servers co-located with the exchanges server-room in Jersey City and Kansas City.. (For anyone who's curious as to why people don't just get accounts directly through Goldman, the value-add was the co-location where most customers were algorithmic high frequency traders; customers upload their algo's onto the trading servers and respond in real time to quote streams and pipe out orders to exchange servers a few feet away in the exchange data centers). In other news, in the course of looking up Livevol, I realized that I just passed by their headquarter this afternoon sightseeing on vacation; they are located in the financial district in San Francisco, very close the TransAmerica Pyramid building. This just means nothing except that I check too much on this forum, Best, PC -

Hi, This is a really good question. I don't have a good answer for the time during the day; I think the general trend is VIX spikes at both the beginning of the day or end of the day. Although, it's not cut and dry depending on situations. http://finance.yahoo.com/q?s=%5EVIX I noticed that Kim likes to enter calendars on Thursday's, presumably to collecting the weekend theta; there's a theory on this forum coming from Jeff Augen that weekend theta is already baked in by Friday afternoon (you can search for the thread where people dive into this). In general, I find trading weekly options the best days to enter/adjust trades is on Thursday when the weeklies are just released, and also on Wednesday, two days before the weeklies expire. The latter because you benefit from the weekend theta, especially if Friday is a typical off-day, the former because it is the point I find at which theta decay accelerates and there is still some juice left on the OTM chain, Please add or correct any of my thinking as I'm not an expert on this, Best, PC

-

Volatility Products Strategies & Trades (VIX, VXX, XIV etc.)

PaulCao replied to Mikael's topic in General Board

Hi, Usually VXX is inversely correlated with SPY/RUT etc. So we'll see if the market will continue to slide later this week or will recover from this initial drop. If it does recover, VXX should fall drastically; if not, then it should stay at its current level or higher. VIX is currently at 16. The last spike due to Fed's initial announcement about stepping off QE peaked at 20, so we'll see what happens. Best, PC -

Volatility Products Strategies & Trades (VIX, VXX, XIV etc.)

PaulCao replied to Mikael's topic in General Board

Hi, Good luck to everyone. I decided not to enter my original trade as I'll be away from keyboard, on vacation for a week. So I can't adjust but should be an interesting time for VXX as it's spiking, Let me know how your BWB goes Saud; with the spike this morning to 16, should have plenty of room to breathe, Best, PC -

Volatility Products Strategies & Trades (VIX, VXX, XIV etc.)

PaulCao replied to Mikael's topic in General Board

Hi, I actually haven't tried with puts, Maybe you can come up with combo, it's just something I quickly pulled up at work. Best, PC -

Volatility Products Strategies & Trades (VIX, VXX, XIV etc.)

PaulCao replied to Mikael's topic in General Board

Hi Micahjw, The reason I chose the protection on the up side is because VXX has a tendency to spike up and slowly erode. This may not be true when VXX has spiked up a lot (e.g., Fed announcement in June/July about stepping off QE), it could also crash very quickly. But right now, my thesis is there is a floor on VIX at around 12-13 with VIX spot currently at 14.74. So it might spike up on any news but it can't go down as much. So I want to remain in the profit zone when VIX does spike like it just did from when I uploaded the P&L diagram from 14.80 to 15.29; but also leave plenty of room, have the current price at the other end of the tent of the BWB for VXX to decay; with the thinking that if VXX decays slowly, I always have room to adjust but I can't adjust if VXX gaps up 5% on close or open, Saud: I chose the 2nd week as it was closest week where that BWB can be profitable. You can play around with the simulated ToS trading tool or whatever analytics tool you use to see if there's a better alternative now that the price just spiked, Best, PC -

Volatility Products Strategies & Trades (VIX, VXX, XIV etc.)

PaulCao replied to Mikael's topic in General Board

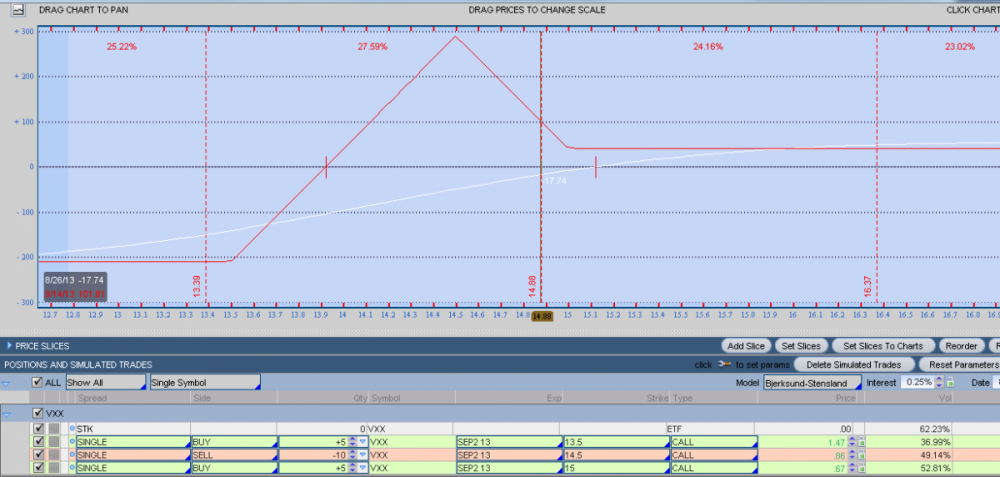

Hi, I'm thinking about doing a Sept 2 13.5/14.5/15 VXX BWB, The down-side is if VXX erodes more than 6% in 15 days which is definitely possible. Might have to do more adjustment if VXX erodes more, Best, PC -

Hi Mikael, Thanks for replying. You are a bigger man than I am. I reduced to half of contracts yesterday and I haven't adjusted and so overall unrealized + realized P&L is a 4-5% loss, Best, PC

-

Hi, I'm taking about 1/4 of short contracts before the meeting, Best, PC

-

Hi Saud, Looks like there's extensive instructions on how to set it up with IB, Why not set it up with your IB test account and let it rip with 1 million dollars and see where it goes in a month, Best, PC

-

Hi, Yes, be interesting to see how FOMC also would affect the GLD trades, Best, PC

-

Hi, NFLX rose 5.2% today on the news of an exclusive content licensing deal with Weinstein Company; I had to adjust today twice from my original 245-265 DC to 245-265-270 triple calendar, then finally to 255-275 calendar. I took a 6% realized loss on my margin including commission and so far 0% unrealized P&L. Needless to say, this trade has def. gone against my original position and I may lose even more. I reduced my margin on this trade by half as the I'm not sure where this stock is going now. My prerogative now is to get out of this trade by expiration breaking even or taking a small loss, Best, PC

-

Trading and getting fills with Interactive Brokers

PaulCao replied to cwerdna's topic in General Board

Hi, Yes. If you want to trade VIX or any commodity futures options (e.g., Gold, Natural Gas, Crude Oil). I think the only one that Kim trades is VIX though, Best, PC -

This is just a question for everyone who has ever sold options? Have you guys ever been assigned? Meaning your counter party to your short options have exercised and you have to deliver shares. In my experience, it has happened to me only once when I was testing out some dividend capture strategy, where I sold some options on a ticker that paid out 10% dividend after ex-dividend date; thinking there might be a chance my counter-party might not exercise and the short call will be worthless after the ticker pays the dividend. Sure enough, like clockwork, my counterparty exercised and my strategy failed. There was another time when I decided to be "smart" and sold a naked strangle against an expiring biotech ticker whose FDA approval decision was suppose to come out at 5:30pm on expiration date. I figured that I was being "smart" since IV was huge, like 150 and the stock was halted while FDA committee was convening. So there would be no movement and none of the strangle would be assigned automatically unless my counterparty wanted to make a bet by 4:00pm which way the committee was going to vote and exercise one of his/her put or call. Luckily, my counterparty decided to not to take the bet and I collected the premium. But I decided that I'd never do that again, as I was nervously following the FDA live meeting and not being able to do anything as everything was halted. Also, Mikael, isn't your NFLX example a good thing? I mean besides having to come up with 260K margin on a weekend, the guy is basically sacrificing his time-value on his option; so assuming NFLX stays flat from Friday to Monday (big assumption I know), you can basically just go to the open market buy NFLX at 250 and sell it to him at 260, making 4% in the process and get out of your position? I think you could call on your wealth friends/relatives and ask them if they'd like to lend out a high interest and extremely short-term loan. Micahjw, for my specific NFLX trade, here are my thoughts, - NFLX had just reported earnings; so on the volatility charts, its IV has been crushed while 30 day historical vol is also at a lull. If you read the explainations on Kim's threads on his IBM and GS trade. Basically he is working on the assumption that IBM and GS will be boring for the time period of his short calendar spread, not move around much; so you get to collect insurance premium. At the same time, he is hoping that his longer dated option which contains the next earnings report date for IBM will slowly rise during the course of the trade. - NFLX has no significant catalyst for next week, as far as I know. So I'm hoping that it'll be boring. At the same time, I'm hoping since IV on the options are at a low, that it'll slowly rise and my longer-dated option will rise. - I plotted out my P&L graph on Think or Swim Analyze tab; to see where my P&L will be on expiration day or several days before it, and how much it'll vary as the price of NFLX moved around. I always go to the edge of the P&L chart to see what my max. loss and set my position allocation to 10%. I highly recommend anyone to plot out their P&L graph on their options trade and play around with scenario, say next week on a Wednesday, what'd happen if NFLX is up 5% or down 10% from the current price, to my spread? It'd give you a feel for your trade in advance instead of playing Monday Quarterback the day of a big move. - I also make a note where my break-even point is, my peak point where my profit is, which is at the strike of my double calendar or the 'tent poles' of the double calendar tent, 245 and 265. - Now the most important thing IMO, is plan for adjustment. I work on the assumption that I'm not very smart and just entered a bad trade. So I need to have a plan in place to adjust to protect myself from myself. My plan for adjustment is when NFLX hits is about half-way or 2/3 way near my tent-poles, so say at 263-264 or 248-247. I have to move my tent-poles in such a way that the current NFLX price sits comfortably in the middle of my tent, - Example let's say NFLX spikes up on Monday/Tuesday to 263.5 or more, then I'll have to sell my half of my NFLX 245 put spread (since the price has moved so far out of that tent pole) and open the equivalent number of contracts at NFLX 270 contracts. I'll take a loss on that sell but I have also extended my breathing room. - Vice versa, NFLX spikes down on Tuesday to 248; I'll have to sell half of my NFLX 265 call spread and open up the equivalent size of NFLX 240 put spread. - You can play around with all of these scenario's with the ToS analytics or whatever other option analytics software to get a feel of how much your P&L will take a hit on an adjustment vs. how much more breathing room you get from it by adjusting the day step on the tool and also set a price slice. - Everytime I adjust I take a realized loss and have less potential max. profit; but I'd rather flee and live to fight another day. - Perhaps the visuals and scenario's presented in this video by Dan Sheridan would help instead of my text in how to adjust. https://www.tradeking.com/education/videos/adjusting-calendar-spreads; just skip the first half as he goes through some really basic stuff, Anyways these are my thoughts, others may and probably have better ideas than me. So please correct my incorrect thinking or feel free to add anything else, Best, PC

-

Hi, I've entered a 245/265 August 23-Sept 9 NFLX double calendar with BE at 242 and 268. Best, PC

-

Hi, What a spike on GLD; was doing an expiring 125/129 GLD calendar spread that was going swimmingly, was going to adjust as GLD spiked up to 129.5 but stepped out for lunch; and had to take a loss when came back to a screen of GLD at 132.20, closed the whole original GLD structure. Now in 130 put/132 call/134 call August 16-August 23 triple calendar. Will see how it goes and report with the performance of doing expiring calendar spreads after this week's expiration, Best, PC

-

Hi, http://www.ivolatility.com/options.j?ticker=NFLX:NASDAQ&R=1&period=12&chart=2&vct= Looks like there's a huge IV crush after earnings, combined with low HV after earnings. Would be similar to Kim's IBM and GS double calendar spread? Best, PC