SteadyOptions is an options trading forum where you can find solutions from top options traders. Join Us!

We’ve all been there… researching options strategies and unable to find the answers we’re looking for. SteadyOptions has your solution.

mkingsley

Mem-

Posts

16 -

Joined

-

Last visited

Recent Profile Visitors

The recent visitors block is disabled and is not being shown to other users.

mkingsley's Achievements

Jr.Member (2/5)

0

Reputation

-

I guess I should of sold, since its now OTM again and back down to $.30 Oh well, live and learn I guess. Hopefully this helps others understand with a real world situation. If anyone has any opinions of what I should do (wait for stock to keep dropping|sell the puts), I'm all ears. Thanks in advance.

-

Good Morning. Thanks to everyone for the replies. I am letting this play out because I want to see what happens over the course of this week. As mentioned, the stock did drop yesterday, not to $0, but to $.60. The put options that I bought now have a bid of $.50. My assumption was incorrect in that I thought I would get maximum profit. I'm ITM, but not as much value as I initially thought. It's interesting to note that in premarket this morning, HTZ stock is trading up 50% at $.86 a share.

-

Thanks again...Looks like its halted for now, so I can't do anything.

-

Thanks for the reply. I am still confused and still have those questions above, but I'll post back as I watch the price this morning and also post what happens to the premium price, just for some notes for anyone this may help. It's an interesting situation that I've never been a party to, so it's a learning process and hopefully it helps others.

-

Good Morning Everyone: I am relatively new to stock options, and have an interesting situation. Last week, I purchase a put option on Hertz stock. I purchase 3 contracts for .18 with a strike price of $1, expiring on 19 JUN 20. They just declared bankruptcy (chapter 11) on Friday. I am a little confused what will happen now and what I should do. I have never watched closely what happens to the stock price based upon a filing of chapter 11, but in looking at some recent examples, JCP for example, is now trading on the OTC for $.18. Am I to assume that HTZ stock will be switched over to the OTC, and not go down to $0, but trade at 10-20 cents? I had read this on another site when researching this: If you own put options on stocks of a company that has just declared or filed for bankruptcy, you are in for your maximum potential reward. Whoever sold you that right to sell shares of that company at that higher price is obliged to fulfill that obligation, so your profit is guaranteed. A few questions I have, that maybe others might find useful in getting answered for the future if they are also in this situation: How would I get the maximum profit if the stock still trades at $0.10 - $0.20 on the OTC? Is it better to trade it now, or wait until the price drops even more? I had a strong hunch that this was going to happen and be announced over this weekend....would it of been more profitable to buy options closer to expiring...29 May 20 vs the 19 JUN 20? Thanks in advance for shedding light on how Bankruptcy affects options. -Michael

-

This is excellent information! I think in this one thread I have already learned more then all of the videos I've watched. It is much appreciated and hopefully be very useful to everyone that reads it.

-

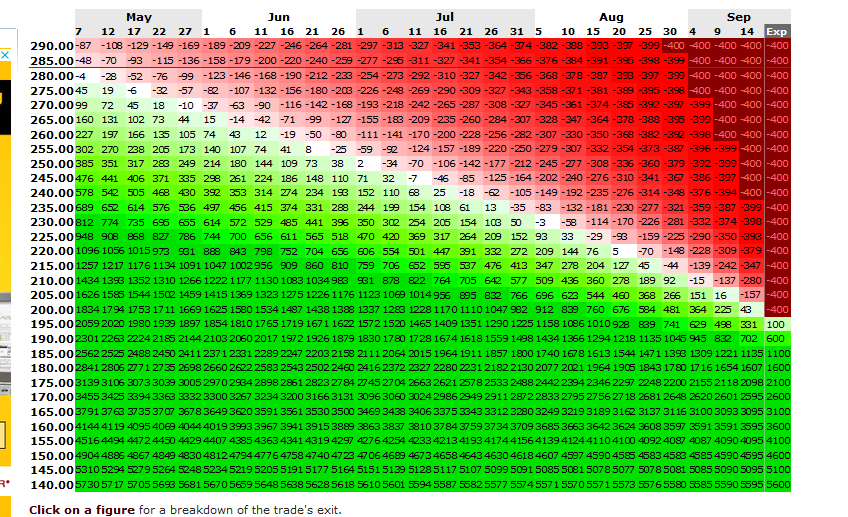

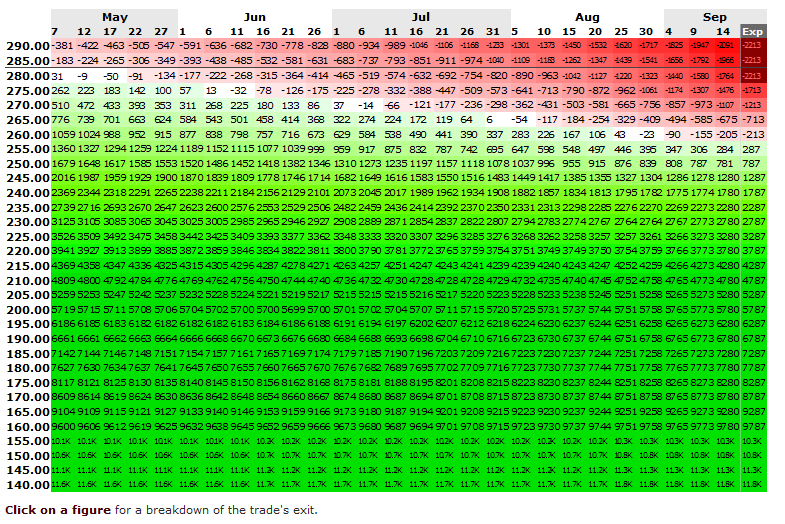

Thanks for this. I will check it out. Just so I understand correctly, right now its around 3x the IV as a normal market. During the dip on March 17th, it went to 7x. But that's over a short time and would only be really beneficial to a fantasy trade as discussed if the market crashed quickly again, right? One can argue that history shows market corrections usually do a quick drop, but then recover, and then if it is a recession or depression, the move down to a bottom usually takes a lot longer, 1 to 2 years. So what you are saying is that the fantasy trade mentioned would suffer because volatility would probably go down from here, seeing that historically the downtrends happen more slowly (2-3% a month lets say) So the price might be met, but the IV would cause the prices of the contracts to still go down in price? I guess that opens up other questions if my understanding is correct. If you know the current IV and want to project the price of a contract based on price movement and the affect IV will have based upon its ups and downs, can that be calculated? Meaning, lets say one does buy this: 18th Sep $200.00 Put (5 contracts) total cost: $2000 I'm not sure how to find the IV for that specific option contract, but lets say it's like the graph shows, at 32%. If the price target was met, but the IV goes down to the average of 10%, how would that be calculated? Thanks in advance.

-

I just read everything 3x so I could let in sink in. Your breakdown is great! To everyone, I really appreciate the analysis of this trade. Obviously, it would be a 1 in a million chance of happening, but as quoted in "Dumb & Dumber": Mary Swanson : I'd say more like one out of a million. Lloyd Christmas : [long pause while he processes what he's heard] So you're telling me there's a chance. YEAH!

-

How can I check the Implied Volatility levels over time? Is there a chart that can be produced within thinkorswim? Other sites I can investigate this more? Sounds like IV is important to understand so I want to make sure I fully understand this, so if you have any good resources to review, I would appreciate it. Thanks in advance.

-

Yeah, I was not comparing apples to apples, and looking at $ instead of percentages.

-

Ahhh...got it.. 18th Sep $280.00 Put total cost: $2,213 Value at expiration: $7,787 Net Profit: $5,574 ******************************** 18th Sep $200.00 Put total cost: $400 x 5 = $2000 Value at expiration: $1,600 x 5 = $8,000 Net Profit: $6,000

-

Thanks for the replies about the IV...that is definitely something to look at from my initial readings on options thus far. Like was stated, this is just a fantasy trade to try and understand how different prices and dates interact. It's interesting, when I used an online calculator, it looks like that you make much more money on this fantasy trade if you buy a put option that is closer to in the money. I'll post the screenshots of the breakdown, but here are the data points... 18th Sep $280.00 Put total cost: $2,213 Value at expiration: $7,787 Net Profit: $5,574 ******************************** 18th Sep $200.00 Put total cost: $400 Value at expiration: $1,600 Net Profit: $1,200 So, my assumption is incorrect then that you can make more money buying the contract closer to what you know it is going to drop to and should still buy an option cloder to in the money. Let me know if in my fantasy that would be correct. Thanks again!

-

Thank you for the reply. Since I am really new to this, how did you derive the percentage gain? I am trying an online calculator now to try to figure this out, but would be nice to know how to figure this out on my own. BTW, this is a great forum and glad I found it! Glad to see that people actively engage here and help out. I hope to return the favor in the future to another newby.

-

EdSeba... BTW what's that stock? My message box is open haha ...LOL I wish I had the ultimate crystal ball. The stock I used in the example is just the SPY, ETF that follows S&P 500. The car mentioned that goes in the future is just the The Delorean from "back to the future" I'll have to study your post in great detail to pick it apart, since I am a newby But thank you so much for all of the details.

-

Hi and thank you for the reply. I understand partially what you are saying about implied volatility, but if one still wants to make an investment anyways, because, like I said, that person went to the future and already knows that the SPY will drop to the example level given...180, what would be the straight forward idea to take full advantage? Thanks again for the insights.